Relationship of Zakat and Waqf to Poverty and Inequality: Bibliometrics Analysis

DOI:

https://doi.org/10.23917/suhuf.v37i1.9938Keywords:

Bibliometrics, Zakat, Waqf, Content Analysis, Islamic financeAbstract

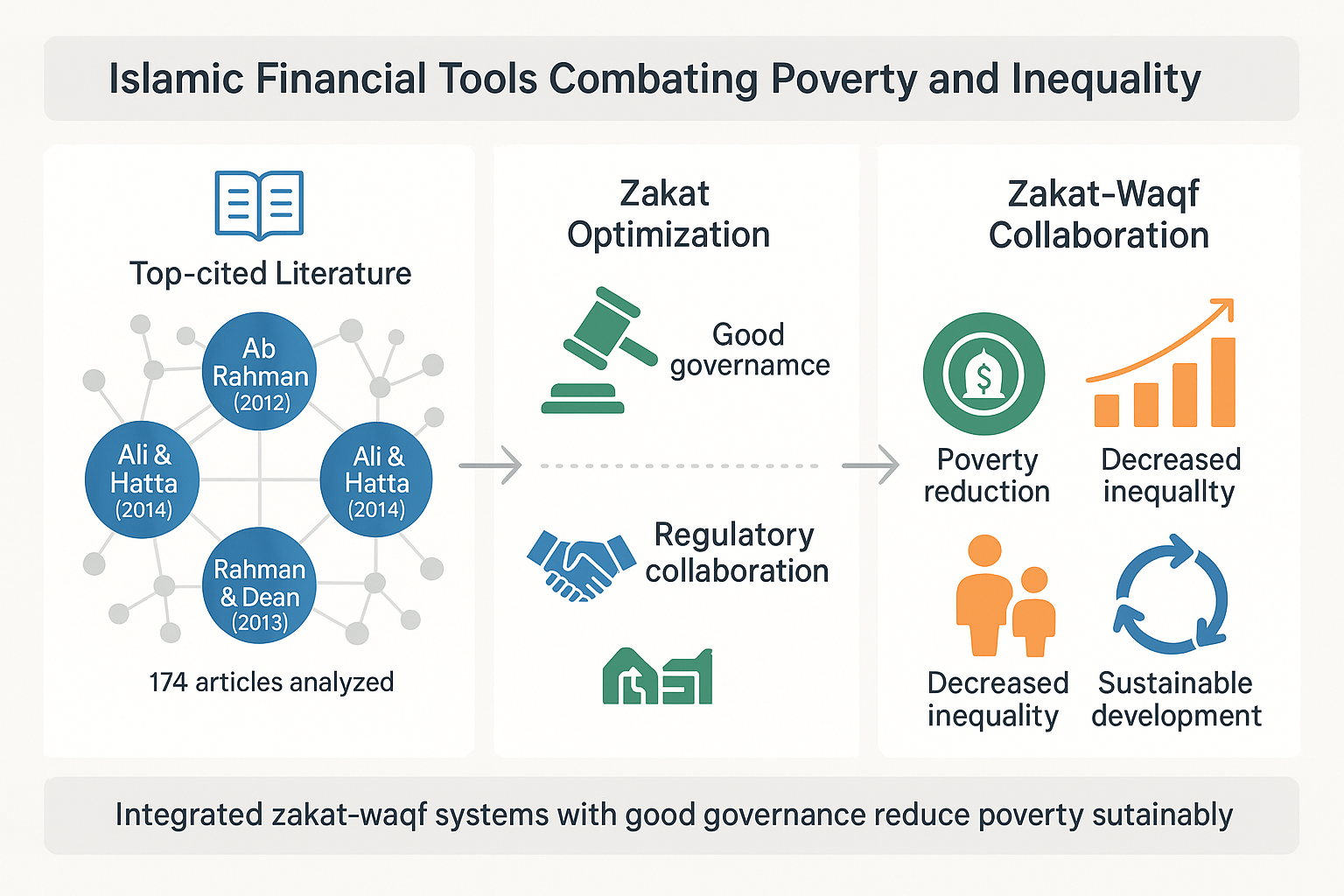

This paper explore the research of the role of zakat and waqf on poverty and inequality by using bibliometric analysis as content analysis. Based on bibliometric analysis, from 174 articles, Sadeq (2002), Ab Rahman et al., (2012); Ali & Hatta (2014), Haneef et al., (2015), and Rahman & Dean (2013) are the top 5 journals with the most citations of and are considered as supporters of the creation of other journals that research on zakat and waqf which effect on poverty and social inequality. In addition, this study also uses content analysis using top 20 articles. Several points of content analysis results show that poverty alleviation through zakat can be maximized through good zakat governance and regulator collaboration. On the other hand, the role of waqf can be maximized through the use of technology. And finally, the collaboration of zakat and waqf plays a role in poverty alleviation, inequality and sustainable development.

Downloads

References

[1] N. A. Zauro, R. A. J. Saad, A. Ahmi, and M. Y. Mohd Hussin, “Integration of Waqf towards enhancing financial inclusion and socio-economic justice in Nigeria,” Int. J. Ethics Syst., vol. 36, no. 4, pp. 491–505, 2020, doi: https://doi.org/10.1108/IJOES-04-2020-0054.

[2] I. Ali and Z. A. Hatta, “Zakat as a Poverty Reduction Mechanism Among the M uslim Community: Case Study of B angladesh, M alaysia, and I ndonesia,” Asian Soc. Work Policy Rev., vol. 8, no. 1, pp. 59–70, 2014, doi: https://doi.org/10.1111/aswp.12025.

[3] K. Ben Jedidia and K. Guerbouj, “Effects of zakat on the economic growth in selected Islamic countries: empirical evidence,” Int. J. Dev. Issues, vol. 20, no. 1, pp. 126–142, 2020, doi: https://doi.org/10.1108/IJDI-05-2020-0100.

[4] A. Abashah, I. H. A. Samah, U. N. Saraih, I. M. A. Rashid, S. N. Ramlan, and W. Radzi, “The impact of attitude and subjective norms towards zakat compliance behavior in Malaysia,” Int. J. Eng. Technol., vol. 7, no. 3, pp. 171–174, 2018, [Online]. Available: www.sciencepubco.com/index.php/IJET

[5] A. C. Andam and A. Z. Osman, “Determinants of intention to give zakat on employment income: Experience from Marawi City, Philippines,” J. Islam. Account. Bus. Res., vol. 10, no. 4, pp. 528–545, 2019, doi: https://doi.org/10.1108/JIABR-08-2016-0097.

[6] I. Supriani, S. Iswati, and F. I. Bella, “A bibliometric analysis of zakat literature from 1964 to 2021,” J. Islam. Econ. Laws, vol. 5, no. 2, pp. 263–296, 2022, doi: https://doi.org/10.23917/jisel.v5i2.18511.

[7] T. Widiastuti, I. Auwalin, L. N. Rani, and M. Ubaidillah Al Mustofa, “A mediating effect of business growth on zakat empowerment program and mustahiq’s welfare,” Cogent Bus. Manag., vol. 8, no. 1, p. 1882039, 2021, doi: https://doi.org/10.1080/23311975.2021.1882039.

[8] M. A. Mohd Thas Thaker, M. F. Amin, H. Mohd Thas Thaker, A. Khaliq, and A. Allah Pitchay, “Cash waqf model for micro enterprises’ human capital development,” ISRA Int. J. Islam. Financ., vol. 13, no. 1, pp. 66–83, 2021, doi: https://doi.org/10.1108/ijif-08-2018-0091.

[9] N. H. N. Azman, T. A. Masron, and H. Ibrahim, “The significance of Islamic social finance in stabilising income for micro-entrepreneurs during the Covid-19 outbreak,” J. Islam. Monet. Econ. Financ., vol. 7, pp. 115–136, 2021, doi: https://doi.org/10.21098/jimf.v7i0.1307.

[10] M. R. Rabbani, M. A. M. Ali, H. U. Rahiman, M. Atif, Z. Zulfikar, and Y. Naseem, “The response of Islamic financial service to the COVID-19 pandemic: The open social innovation of the financial system,” J. Open Innov. Technol. Mark. Complex., vol. 7, no. 1, p. 85, 2021, doi: https://doi.org/10.3390/joitmc.

[11] S. H. A. Razak, “and as instrument of Islamic wealth in poverty alleviation and redistribution,” Int. J. Sociol. Soc. Policy, vol. 40, no. 3/4, pp. 249–266, Jan. 2020, doi: 10.1108/IJSSP-11-2018-0208.

[12] S. N. A. C. Hassan and A. Ab Rahman, “The potential of cash waqf in the socio-economic development of society in kelantan,” in New Developments in Islamic Economics, Emerald Publishing Limited, 2018, pp. 67–82. doi: https://doi.org/10.1108/978-1-78756-283-720181005.

[13] M. R. Embong, R. Taha, and M. N. M. Nor, “Role of zakat to eradicate poverty in Malaysia.,” J. Pengur., vol. 39, 2013, [Online]. Available: https://www.scopus.com/inward/record.uri?eid=2-s2.0-84893929391&partnerID=40&md5=a92df03e3c5f4f4057a455e2e0fecaac

[14] K. Retsikas, “Reconceptualising zakat in Indonesia: Worship, philanthropy and rights,” Indones. Malay World, vol. 42, no. 124, pp. 337–357, 2014, doi: https://doi.org/10.1080/13639811.2014.951519.

[15] A. M. Sadeq, “Waqf, perpetual charity and poverty alleviation,” Int. J. Soc. Econ., vol. 29, no. 1/2, pp. 135–151, 2002, doi: https://doi.org/10.1108/03068290210413038.

[16] A. F. M. Ali, Z. A. Rashid, F. Johari, and M. R. A. Aziz, “The effectiveness of Zakat in reducing poverty incident: An analysis in Kelantan, Malaysia,” Asian Soc. Sci., vol. 11, no. 21, pp. 355–367, 2015, doi: https://doi.org/10.5539/ass.v11n21p355.

[17] I. N. Muhammad, “Scholars, merchants and civil society: Imperative for waqf-based participatory poverty alleviation initiatives in Kano, Nigeria,” Humanomics, vol. 26, no. 2, pp. 139–157, 2010, doi: https://doi.org/10.1108/08288661011074936.

[18] M. Wahyudi, A. Ahmi, and S. Herianingrum, “Examining trends, themes and social structure of zakat literature: a bibliometric analysis,” Glob. J. Al-Thaqafah, vol. 12, no. 1, pp. 40–67, 2022, [Online]. Available: www.gjat.my

[19] M. S. Apriantoro, E. R. Puspa, D. I. Yafi, D. A. Putri, and R. I. Rosyadi, “Beyond Mortgages: Islamic Law and the Ethics of Credit Financing for Public Housing,” Profetika J. Stud. Islam, vol. 24, no. 02, pp. 196–206, 2023, doi: https://doi.org/10.23917/profetika.v24i02.1795.

[20] N. Van Eck and L. Waltman, “Software survey: VOSviewer, a computer program for bibliometric mapping,” Scientometrics, vol. 84, no. 2, pp. 523–538, 2009, doi: https://doi.org/10.1007/s11192-009-0146-3.

[21] M. Aria and C. Cuccurullo, “bibliometrix: An R-tool for comprehensive science mapping analysis,” J. Informetr., vol. 11, no. 4, pp. 959–975, 2017, doi: https://doi.org/10.1016/j.joi.2017.08.007.

[22] E. Supriyadi, S. Inayah, J. A. Dahlan, and D. Darhim, “Bibliometric review: elementary and mathematics education from Indonesian authors,” Profesi Pendidik. Dasar, vol. 9, no. 2, pp. 176–190, 2022, doi: https://doi.org/10.23917/ppd.v9i2.19481.

[23] F. A. Hudaefi, “How does Islamic fintech promote the SDGs? Qualitative evidence from Indonesia,” Qual. Res. Financ. Mark., vol. 12, no. 4, pp. 353–366, 2020, doi: https://doi.org/10.1108/QRFM-05-2019-0058.

[24] R. A. J. Saad, A. U. Farouk, and D. Abdul Kadir, “Business zakat compliance behavioral intention in a developing country,” J. Islam. Account. Bus. Res., vol. 11, no. 2, pp. 511–530, 2020, doi: https://doi.org/10.1108/JIABR-03-2018-0036.

[25] M. Abdullah, “Waqf, Sustainable Development Goals (SDGs) and Maqasid al-Shariah,” Int. J. Soc. Econ., vol. 45, no. 1, pp. 158–172, 2018, doi: https://doi.org/10.1108/IJSE-10-2016-0295.

[26] N. Majeed and S. Jamshed, “Heightening Citizenship Behaviours of Academicians Through Transformational Leadership: Evidence Based Interventions,” Qual. Quant., vol. 57, no. Suppl 4, pp. 575–606, 2023, doi: https://doi.org/10.1007/s11135-021-01146-2.

[27] O. A. Kachkar, “Towards the establishment of cash waqf microfinance fund for refugees,” ISRA Int. J. Islam. Financ., vol. 9, no. 1, pp. 81–86, 2017, doi: https://doi.org/10.1108/IJIF-07-2017-007.

[28] A. Ab Rahman, M. H. Alias, and S. M. N. S. Omar, “Zakat institution in Malaysia: Problems and issues,” Glob. J. Al-Thaqafah, vol. 2, no. 1, pp. 35–41, 2012, [Online]. Available: https://www.scopus.com/inward/record.uri?eid=2-s2.0-84893985043&partnerID=40&md5=7db93cd1021c775c56835ae5885d482d

[29] R. Abdul Rahman and F. Dean, “Challenges and solutions in Islamic microfinance,” Humanomics, vol. 29, no. 4, pp. 293–306, 2013, doi: https://doi.org/10.1108/H-06-2012-0013.

[30] K. Tanvir Mahmud, M. Kabir Hassan, M. Ferdous Alam, K. Sohag, and F. Rafiq, “Opinion of the zakat recipients on their food security: A case study on Bangladesh,” Int. J. Islam. Middle East. Financ. Manag., vol. 7, no. 3, pp. 333–345, 2014, doi: https://doi.org/10.1108/IMEFM-08-2012-0079.

[31] A. Maisyarah and M. Z. Hamzah, “Zakat Distribution Management: A Systematic Literature Review,” Suhuf Int. J. Islam. Stud., vol. 36, no. 1, pp. 95–108, 2024, doi: https://doi.org/10.23917/suhuf.v36i1.4357.

[32] K. Sohag, K. T. Mahmud, F. Alam, and N. Samargandi, “Can zakat system alleviate rural poverty in Bangladesh? A propensity score matching approach,” J. Poverty, vol. 19, no. 3, pp. 261–277, 2015, doi: https://doi.org/10.1080/10875549.2014.999974.

[33] M. A. Haneef, A. H. Pramanik, M. O. Mohammed, M. F. Bin Amin, and A. D. Muhammad, “Integration of waqf-Islamic microfinance model for poverty reduction: The case of Bangladesh,” Int. J. Islam. Middle East. Financ. Manag., vol. 8, no. 2, pp. 246–270, 2015, doi: https://doi.org/10.1108/IMEFM-03-2014-0029.

[34] A. A. Farah, M. A. Mohamed, M. Ali Farah, I. A. Yusuf, and M. S. Abdulle, “Impact of Islamic banking on economic growth: a systematic review of SCOPUS-indexed studies (2009–2024),” Cogent Econ. Financ., vol. 13, no. 1, p. 2490819, 2025, doi: https://doi.org/10.1080/23322039.2025.2490819.

[35] H. Ahmed and A. M. H. A. P. M. Salleh, “Inclusive Islamic financial planning: a conceptual framework,” Int. J. Islam. Middle East. Financ. Manag., vol. 9, no. 2, pp. 170–189, 2016, doi: https://doi.org/10.1108/IMEFM-01-2015-0006.

[36] G. A. Jehle, “Zakat and inequality: Some evidence from Pakistan,” Rev. Income Wealth, vol. 40, no. 2, pp. 205–216, 1994, doi: https://doi.org/10.1111/j.1475-4991.1994.tb00059.x.

[37] U. Ahmed, A. Maruf, S. Alam, and L. Azizah, “The Role of Islamic Finance in Sustainable and Green Transition,” Suhuf Int. J. Islam. Stud., vol. 36, no. 2, pp. 118–139, 2024, doi: https://doi.org/10.23917/suhuf.v36i2.6314.

[38] H. Latief, “Health provision for the poor Islamic aid and the rise of charitable clinics in Indonesia,” South East Asia Res., vol. 18, no. 3, pp. 503–553, 2010, doi: https://doi.org/10.5367/sear.2010.0004.

[39] A. B. B. Abul Bashar Bhuiyan, C. S. Chamhuri Siwar, A. G. I. Abdul Ghafar Ismail, and M. A. Islam, “Microfinance and sustainable livelihood: a conceptual linkage of microfinancing approaches towards sustainable livelihood.,” Am. J. Environ. Sci., vol. 8, no. 3, pp. 328–333, 2012, doi: https://www.cabidigitallibrary.org/doi/full/10.5555/20123268641.

[40] S. A. Bin-Nashwan, H. Abdul-Jabbar, S. F. Dziegielewski, and S. A. Aziz, “Moderating effect of perceived behavioral control on Islamic tax (zakah) compliance behavior among businessmen in Yemen,” J. Soc. Serv. Res., vol. 47, no. 2, pp. 292–302, 2021, doi: https://doi.org/10.1080/01488376.2020.1767260.

[41] R. A. Hamidah, T. Widiastuti, A. Alam, and E. F. Cahyono, “Impact of ZIS (Zakah, Infaq and Sadaqa) Distribution and Islamic Financial Institutions to MSMEs (Micro, Small, and Medium Enterprises) and Gross Regional Product Growth in East Java (2011-2014 Periods),” J. Islam. Financ. Stud., vol. 3, no. 1, pp. 1–15, 2017, doi: 10.12785/jifs/030101.

Downloads

Submitted

Accepted

Published

How to Cite

Issue

Section

License

Copyright (c) 2025 Afief El Ashfahany, Muhammad Qodrat Multazam, Shahumeel Ahmed, Muhamad Radzuan Ab Rahman, Muhamad Subhi Apriantoro

This work is licensed under a Creative Commons Attribution 4.0 International License.