How Has Islamic Banking Windows Research Evolved? A Bibliometric Analysis of Trends, Influencers, and Sustainability Linkages

DOI:

https://doi.org/10.23917/suhuf.v37i1.9935Keywords:

Islamic banking windows, Sustainable finance, Bibliometric analysis, Shariah compliance, ESGAbstract

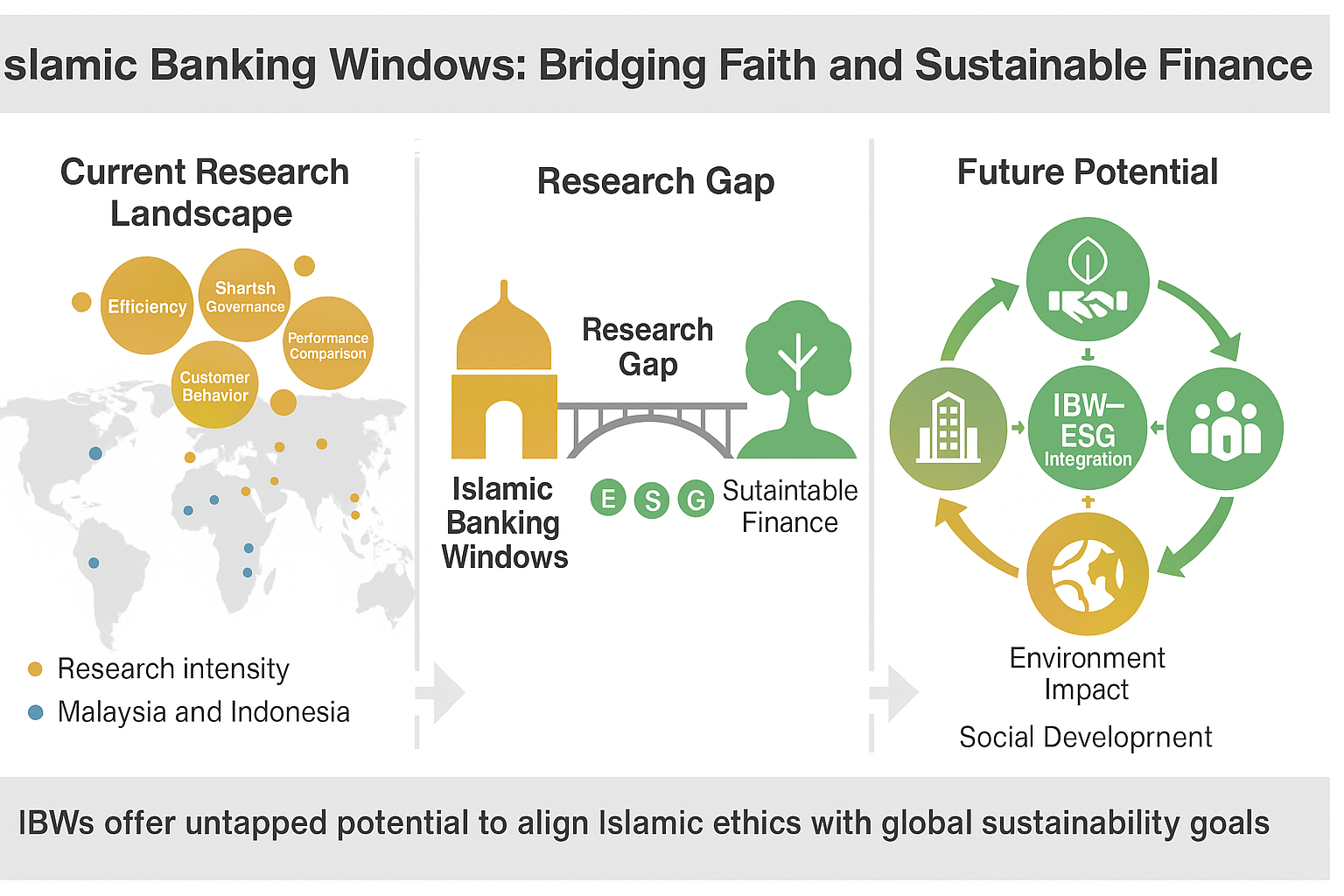

This study aims to provide a comprehensive bibliometric analysis of Islamic Banking Windows (IBWs) and their potential role in advancing sustainable finance. By examining publication trends, influential contributors, and research themes, the study seeks to bridge the gap in understanding how IBWs align with environmental, social, and governance (ESG) principles and contribute to global sustainability goals. A bibliometric analysis was conducted using data extracted from the Scopus database, focusing on publications related to Islamic Banking Windows. The study employed co-occurrence network analysis, citation metrics, and productivity indicators to map research trends, identify key contributors, and analyze prevalent themes. The analysis reveals a growing interest in IBWs, particularly in Muslim-majority countries like Malaysia and Indonesia, as well as emerging contributions from Western nations. Key themes include efficiency, customer behavior, Shariah governance, and comparative performance between Islamic and conventional banks. However, the integration of sustainable finance principles remains underexplored, highlighting a critical research gap. The study identifies influential journals and authors, with findings suggesting that IBWs have significant potential to promote ethical and sustainable financial practices. This study is among the first to systematically examine the intersection of IBWs and sustainable finance using bibliometric methods. It provides a structured overview of the field’s evolution, influential works, and emerging trends, offering valuable insights for researchers, policymakers, and practitioners seeking to align Islamic finance with global sustainability agendas.

Downloads

References

[1] U. Shahzad, D. Ferraz, H.-H. Nguyen, and L. Cui, “Investigating the spill overs and connectedness between financial globalization, high-tech industries and environmental footprints: Fresh evidence in context of China,” Technol. Forecast. Soc. Change, vol. 174, no. January, p. 121205, 2022, doi: https://doi.org/10.1016/j.techfore.2021.121205.

[2] P. Abedifar, I. Hasan, and A. Tarazi, “Finance-growth nexus and dual-banking systems: Relative importance of Islamic banks,” J. Econ. Behav. Organ., vol. 132, no. December, pp. 198–215, 2016, doi: https://doi.org/10.1016/j.jebo.2016.03.005.

[3] Y. Li and C. Zhu, “Regional digitalization and corporate ESG performance,” J. Clean. Prod., vol. 473, no. October, p. 143503, 2024, doi: https://doi.org/10.1016/j.jclepro.2024.143503.

[4] C. Song and M. T. Majeed, “Digital inclusion to enhance energy sustainability: public participation and environmental governance in the new media era to achieve energy sustainable goals,” Environ. Sci. Pollut. Res., vol. 30, no. 59, pp. 123633–123642, 2023, doi: https://doi.org/10.1007/s11356-023-30837-6.

[5] F. Chen, X. Zeng, and X. Guo, “Green finance, climate change, and green innovation: Evidence from China,” Financ. Res. Lett., vol. 63, no. May, p. 105283, 2024, doi: https://doi.org/10.1016/j.frl.2024.105283.

[6] M. S. Anker, S. Hadzibegovic, A. Lena, and W. Haverkamp, “The difference in referencing in Web of Science, Scopus, and Google Scholar,” ESC Hear. Fail., vol. 6, no. 6, pp. 1291–1312, 2019, doi: https://doi.org/10.1002/ehf2.12583.

[7] Y. Feng, Q. Zhu, and K. H. Lai, “Corporate social responsibility for supply chain management: A literature review and bibliometric analysis,” J. Clean. Prod., vol. 158, pp. 296–307, 2017, doi: 10.1016/j.jclepro.2017.05.018.

[8] M. S. Apriantoro, S. Faradilla, A. El Ashfahany, A. Maruf, and N. A. Aziza, “Quantifying Intellectual Terrain: Islamic Jurisprudence, Ethical Discourse, and Scholarly Impact,” Suhuf Int. J. Islam. Stud., vol. 36, no. 1, pp. 78–85, 2024, doi: https://doi.org/10.23917/suhuf.v36i1.4367.

[9] M. S. Apriantoro, J. Herviana, Y. Yayuli, and S. Suratno, “Sharia Financial Literacy: Research Trends and Directions for Future Inquiry,” J. Islam. Econ. Laws, vol. 6, no. 2, pp. 19–40, 2023, doi: https://doi.org/10.23917/jisel.v6i2.22396.

[10] M. W. Shohib, M. Z. Azani, N. L. Inayati, D. Dartim, and A. Nubail, “Islamic Perspective on Organizational Citizenship Behavior Among Academic Staff in Indonesian State Islamic Higher Education: Is It Effective?,” Suhuf Int. J. Islam. Stud., vol. 36, no. 2, pp. 155–169, 2024, doi: https://doi.org/10.23917/suhuf.v36i2.4702.

[11] M. S. Apriantoro and N. R. Wijayanti, “Bibliometric Analysis of Research Directions In Islamic Bank In The Pandemic Period,” NISBAH J. Perbanka Syariah, vol. 8, no. 2, pp. 127–137, 2022, doi: https://doi.org/10.30997/jn.v8i2.6408.

[12] M. Abdul-Majid and M. K. Hassan, “The impact of foreign-owned Islamic banks and Islamic bank subsidiaries on the efficiency and productivity change of Malaysian banks,” J. King Abdulaziz Univ. Islam. Econ., vol. 24, no. 2, pp. 147–174, 2011, doi: https://doi.org/10.4197/Islec.24-2.5.

[13] H. A. Alahmadi, A. F. S. Hassan, Y. Karbhari, and H. S. Nahar, “Unravelling shariah audit practice in Saudi Islamic Banks,” Int. J. Econ. Res., vol. 14, no. 15, pp. 255–269, 2017, [Online]. Available: https://www.scopus.com/inward/record.uri?eid=2-s2.0-85035795256&partnerID=40&md5=ade1d257a0cb595f57e549ec90335cf7

[14] A. Maulidar and M. S. A. Majid, “Do good corporate governance and financing risk management matter for Islamic banks’ performance in Indonesia?,” Etikonomi, vol. 19, no. 2, pp. 169–184, 2020, doi: https://doi.org/10.15408/etk.v19i2.15080.

[15] E. Aslam and R. Haron, “Does corporate governance affect the performance of Islamic banks? New insight into Islamic countries,” Corp. Gov. Int. J. Bus. Soc., vol. 20, no. 6, pp. 1073–1090, 2020, doi: https://doi.org/10.1108/cg-11-2019-0350.

[16] E. Akkas and H. Al Samman, “Are Islamic financial institutions more resilient against the COVID-19 pandemic in the GCC countries?,” Int. J. Islam. Middle East. Financ. Manag., vol. 15, no. 2, pp. 331–358, 2022, doi: https://doi.org/10.1108/IMEFM-07-2020-0378.

[17] M. R. Haque and M. N. I. Sohel, “Are Islamic banks less efficient than other banks? Evidence from Bangladesh,” Asian Econ. Financ. Rev., vol. 9, no. 10, p. 1136, 2019, doi: https://doi.org/10.18488/journal.aefr.2019.910.1136.1146.

[18] P. Abedifar, P. Giudici, and S. Q. Hashem, “Heterogeneous market structure and systemic risk: Evidence from dual banking systems,” J. Financ. Stab., vol. 33, no. December, pp. 96–119, 2017, doi: https://doi.org/10.1016/j.jfs.2017.11.002.

[19] N. L. Ab Ghani, N. Mohd Ariffin, and A. R. Abdul Rahman, “The extent of mandatory and voluntary Shariah compliance disclosure: evidence from Malaysian Islamic financial institutions,” J. Islam. Account. Bus. Res., vol. 15, no. 3, pp. 443–465, 2024, doi: https://doi.org/10.1108/JIABR-10-2021-0282.

[20] S. Ghosh, “The behavior of Islamic and conventional banks around the pandemic: cross-country evidence,” Islam. Econ. Stud., vol. 31, no. 1/2, pp. 108–129, 2023, doi: https://doi.org/10.1108/ies-02-2022-0016.

[21] M. Sanusi and S. Zulaikha, “The impact of bank-specific and macroeconomic variables on profitability of Islamic rural bank in Indonesia,” J. Ilm. Ekon. Islam, vol. 5, no. 03, pp. 317–325, 2019, doi: https://doi.org/10.29040/jiei.v5i3.635.

[22] O. I. Tawfik and Z. O. Bilal, “The impact of sharīʿah auditing requirements on the service quality of Islamic banks in the sultanate of Oman,” J. King Abdulaziz Univ. Islam. Econ., vol. 33, no. 1, pp. 101–116, 2020, doi: https://doi.org/10.4197/Islec.33-1.8.

[23] A. A. M. Olayemi, M. Noureldin, and S. Siddiqui, “Investigating the Disclosure of Fatwa and Shariah Resolutions on the UAE Islamic Banks Web Portals,” J. Islam. Econ. Bank. Financ., vol. 14, no. 1, pp. 71–82, 2018, doi: https://doi.org/10.12816/0051168.

[24] U. Hayat and A. Malik, Islamic Finance: Ethics, Concepts, Practice. CFA Institute Research Foundation, 2014. [Online]. Available: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2616257

[25] M. Indriastuti and A. Chariri, “The Effect of The Carbon and Environmental Performance on Sustainability Report,” Ris. Akunt. dan Keuang. Indones., vol. 6, no. 1, pp. 101–112, 2021, [Online]. Available: http://journals.ums.ac.id/index.php/reaksi/index

[26] Y. Suzuki, S. M. S. Uddin, and A. K. M. R. Islam, “Incentives for conventional banks for the conversion into Islamic banks: evidence from Bangladesh,” J. Islam. Account. Bus. Res., vol. 11, no. 2, pp. 273–287, 2020, doi: https://doi.org/10.1108/JIABR-03-2017-0031.

[27] I. Trinugroho, W. Santoso, R. Irawanto, and P. Pamungkas, “Is spin-off policy an effective way to improve performance of Islamic banks? Evidence from Indonesia,” Res. Int. Bus. Financ., vol. 56, no. April, p. 101352, 2021, doi: https://doi.org/10.1016/j.ribaf.2020.101352.

[28] A. S. Salim and R. Hassan, “The Legal Framework of Conversion from Development Financial Institution to Islamic Development Financial Institution in Malaysia under Development Financial Institutions Act 2002,” in International Conference on Business and Technology, Springer, 2021, pp. 195–209. doi: Salim, A. S., & Hassan, R. (2023). The Legal Framework of Conversion from Development Financial Institution to Islamic Development Financial Institution in Malaysia Under Development Financial Institutions Act 2002. Lecture Notes in Networks and Systems, 488, 195–209. https://doi.org/10.1007/978-3-031-08090-6_11.

[29] K. M. Jamshed and B. Uluyol, “What drives to adopt Islamic banking products and services: is it shariah compliance or convenience?,” J. Islam. Mark., vol. 15, no. 11, pp. 2891–2915, 2024, doi: https://doi.org/10.1108/JIMA-08-2023-0243.

[30] R. Belwal and A. Al Maqbali, “A study of customers’ perception of Islamic banking in Oman,” J. Islam. Mark., vol. 10, no. 1, pp. 150–167, 2019, doi: https://doi.org/10.1108/JIMA-02-2016-0008.

[31] S. Khandelwal and K. Aljifri, “Risk sharing vs risk shifting: a comparative study of Islamic banks,” J. Islam. Account. Bus. Res., vol. 12, no. 8, pp. 1105–1123, 2021, doi: https://doi.org/10.1108/JIABR-08-2018-0121.

[32] W. Chairunesia, “Performance of Islamic Banks Using the Islamicity Performance Index Approach on Islamic Banks in Indonesia and Malaysia,” Asian J. Econ. Bus. Account., vol. 23, no. 7, pp. 1–15, 2023, doi: https://doi.org/10.9734/ajeba/2023/v23i7941.

[33] A. I. Hasan and T. Risfandy, “Islamic banks’ stability: Full-fledged vs Islamic windows,” J. Account. Invest., vol. 22, no. 1, pp. 192–205, 2021, doi: https://doi.org/10.18196/jai.v22i1.10287.

Downloads

Submitted

Accepted

Published

How to Cite

Issue

Section

License

Copyright (c) 2025 Muhamad Subhi Apriantoro, Afief El Ashfahany , Nasya Tanasya , Fina Nusa Puspa

This work is licensed under a Creative Commons Attribution 4.0 International License.