Transfer of Ownership in State Retail Sukuk: Shariah Review Based on DSN-MUI Fatwa and AAOIFI Sharia Standards

DOI:

https://doi.org/10.23917/suhuf.v37i1.8114Keywords:

AAOIFI , al-Wafa’ , DSN-MUI Opinion , Retail state sukuk , Underlying assetAbstract

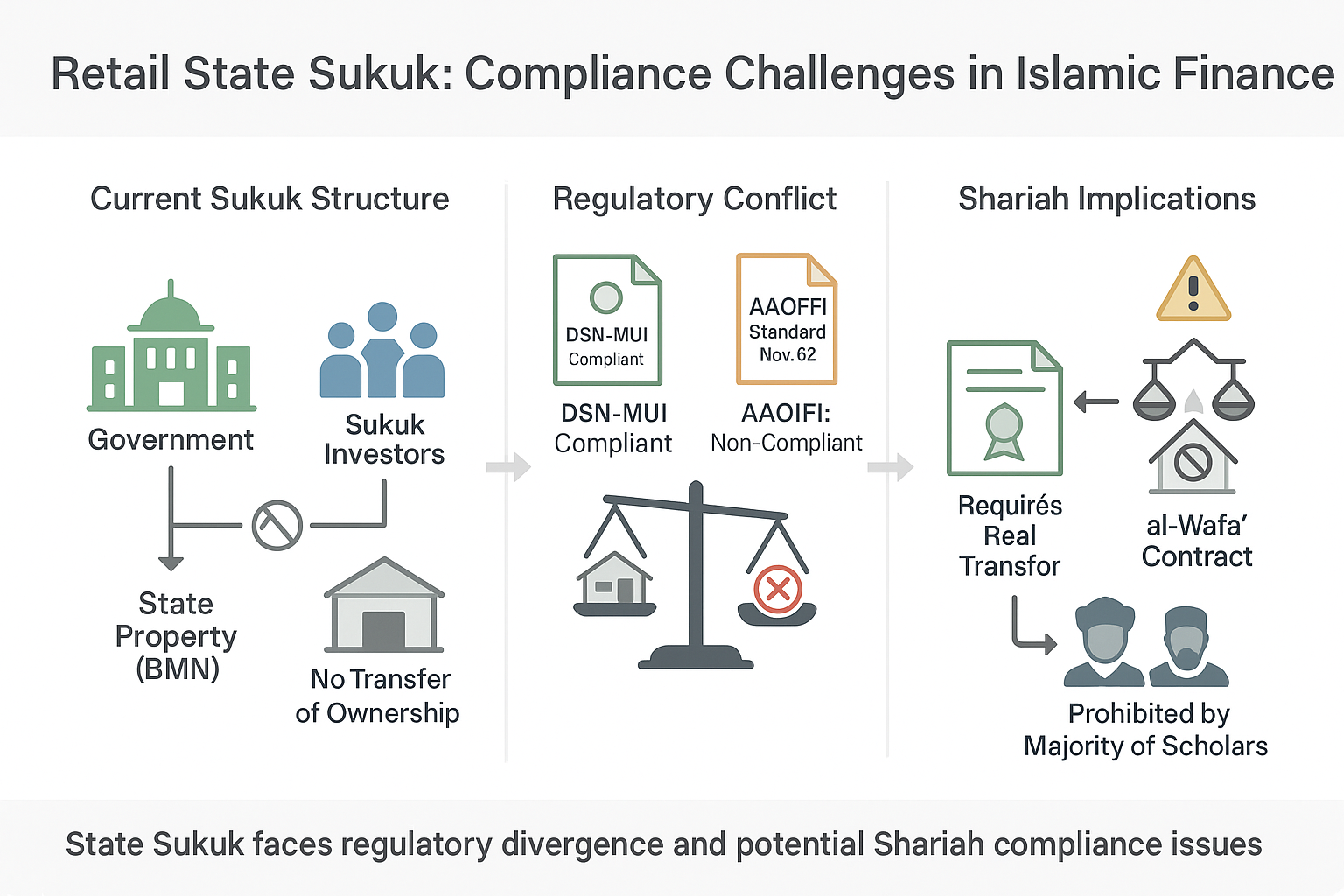

Underlying Assets of Retail State Sukuk are State Property which in reality cannot be easily transferred. Although the DSN-MUI has given an opinion on the suitability of the Retail State Sukuk contract with Islamic law, the DSN-MUI fatwas do not broadly regulate the Underlying Assets of Sukuk. The issuance of the Exposure Draft of Shari'ah Standard No. 62 on Sukuk by the Accounting and Auditing Organization for Islamic Financial Institutions (AAOIFI) on November 6, 2023 will have an impact on the sukuk industry that is given asset collateral because it requires a real transfer of ownership of the Underlying Asset to investors. This study will complement the discussion regarding the suitability of sharia for the Underlying Assets of Retail State Sukuk from the perspective of the DSN-MUI fatwa, AAOIFI Sharia Standards, and the similarity of sale and purchase approaches. This study uses a qualitative research method. Primary data is taken directly from the official publication of sukuk from the Government. The results of this study can be summarized as follows. Underlying Assets of Retail State Sukuk are State Property (BMN) that do not experience a transfer of ownership. Based on DSN-MUI fatwas, Retail State Sukuk does not conflict with sharia. The provisions of Underlying Assets of Retail State Sukuk do not meet AAOIFI Standards because there is no transfer of ownership from the Government to investors. The Underlying Asset Contract of Retail State Sukuk has several similarities with the al-Wafa' contract which is prohibited by the majority of scholars because it is not free from usury.

Downloads

References

[1] R. B. Trisilo, “Penerapan Akad Pada Obligasi Syariah dan Sukuk Negara (Surat Berharga Syariah Negara/SBSN) [The Implementation of Islamic Contracts in Sukuk and Sovereign Sharia Securities (SBSN)],” Econ. J. Ekon. dan Huk. Islam, vol. 4, no. 1, p. (in Indonesia), 2014, [Online]. Available: https://d1wqtxts1xzle7.cloudfront.net/40895009/782-2357-3-PB-libre.pdf?1451368285=&response-content-disposition=inline%3B+filename%3DPENERAPAN_AKAD_PADA_OBLIGASI_SYARIAH_DAN.pdf&Expires=1748433571&Signature=Qkh-WLS7K78CJq959~snIPWC~PmJWJ2hf7ps9EXaBhQe2P6uWIhW7FnFWp5N~pbjpULF15sm8SODnDXuBJYX1KI3KUYNoHoPXiApju4eUGYkL06gESe7e686tD0n0vvT301B9RB3GumX-kbuNLvlgXb3-RAx64355u6ZuCCIcEvzTSL7-v17AxuChfiWP2GAUqbrb6IEPNn7oBXVhjjXBFLZRVSVXVsBaPQxpq9IsDo-9mfOOLc-xdODlyMBGcMNS2JZGJ2zukjwOnVgDceV6kfDtHA1ZqBObCTDD1RQgwPApm4L5aamgT4O5xSYoTim8asv~pSPFKEcYoB8BnJJiQ__&Key-Pair-Id=APKAJLOHF5GGSLRBV4ZA

[2] DSN-MUI, “Pernyataan Kesesuaian Syariah Sukuk Negara Ritel Seri SR018 dan SR019 Tahun 2023,” Jakarta, 2023.

[3] A. H. and C. Gupta, “United Arab Emirates: Shariah Standard 62 - Much ado about nothing?,” Global Complisnce News.

[4] AAOIFI, “Deadline extension for industry feedback on exposure draft of Shari’ah Standard No. 62 “Sukuk’”,” AAOIFI. Accessed: Nov. 18, 2024. [Online]. Available: https://aaoifi.com/announcement/deadline-extension-for-industry-feedback-on-exposure-draft-of-shariah-standard-no-62-sukuk-2/?lang=en

[5] S. Global, “Sukuk Market: The Calm Before The Storm?,” Spglobal. Accessed: Nov. 18, 2024. [Online]. Available: https://www.spglobal.com/ratings/en/research/articles/240715-sukuk-market-the-calm-before-the-storm-13174532

[6] I. Ad-Duwaisy, “Jual Beli ‘Inah, Jual Beli Dengan Najasy,” Almanhaj. Accessed: Nov. 18, 2024. [Online]. Available: https://almanhaj.or.id/4035-jual-beli-inah-jual-beli-dengan-najasy.html

[7] W. al-A. wa al-Syuun, al-Islamiyah, al-Mausuah al-Fiqhiyah. Kuwait: Dzat as-Salaasil, 2008.

[8] A. N. Baits, Pengantar Fiqh Jual Beli & Harta Haram. Bekasi: Muamalah Publishing, 2016.

[9] N. K. Khanifa, “Tinjauan Hukum Islam Terhadap Transaksi Jual Beli Sukuk Ritel Menggunakan Sistem Akad Ijarah Serta Relevansinya Dengan Perlindungan Investor,” UIN Walisongo, 2012. [Online]. Available: https://eprints.walisongo.ac.id/id/eprint/1448/

[10] R. R. Djayusman, “Islamic bonds: Tinjauan fikih dan keuangan,” Addin, vol. 8, no. 1, p. (in Indonesia), 2015, doi: https://journal.iainkudus.ac.id/index.php/Addin/article/view/594.

[11] H. Hulwati, “Investasi Sukuk: Perspektif Ekonomi Syari’ah [An Economic Analysis of Sukuk Investment from the Perspective of Islamic Economics],” JEBI (Jurnal Ekon. Dan Bisnis Islam., vol. 2, no. 1, pp. 85–96, (in Indonesia), 2017, [Online]. Available: https://ejournal.uinib.ac.id/febi/index.php/jebi/article/view/70

[12] A. Oktariatas, “Obligasi Syariah (Sukuk) dengan Akad Ijarah Ditinjau dari Hukum Islam [Sharia Bonds (Sukuk) Based on the Ijarah Contract: A Review from the Perspective of Islamic Law],” FAKULTAS HUKUM, 2017.

[13] H. Hanapi, “Penerapan Sukuk Dan Obligasi Syariah Di Indonesia [The Implementation of Sukuk and Sharia-Compliant Bonds in Indonesia],” J. Ilmu Akunt. Dan Bisnis Syariah, vol. 1, no. 2, pp. 145–162, (in Indonesia), 2019, [Online]. Available: https://jurnal.staihas.ac.id/wp-content/uploads/2020/04/Hapil-Hanapi-Musyarokah-okt-2019.pdf

[14] M. Misissaifi and E. Erlindawati, “Investasi Syariah Melalui Surat Berharga Syariah Negara [Islamic Investment Through Sovereign Sharia Securities],” JAS (Jurnal Akunt. Syariah), vol. 3, no. 2, pp. 226–237, (in Indonesia), 2019, doi: https://doi.org/10.46367/jas.v3i2.186.

[15] M. Ridho, Sukuk, Akad Ijarah Sale and Lease Back, dan Pemindahtanganan sukuk. Yogyakarta, 2018. [Online]. Available: https://www.researchgate.net/publication/332633775_Sukuk_Akad_Ijarah_Sale_and_Lease_Back_dan_Pemindahtanganan_sukuk

[16] P. N. Sekarsari and M. H. Harun, “Tinjauan Hukum Islam Terhadap Konsep Sukuk Negara Ritel Seri SR-006 Tahun 2014-2017 Di Indonesia,” Universitas Muhammadiyah Surakarta, Surakarta, 2019. [Online]. Available: https://eprints.ums.ac.id/72910/

[17] L. Sakti and N. W. Adityarani, “Tinjauan hukum penerapan akad ijarah dan inovasi dari akad ijarah dalam perkembangan ekonomi syariah di Indonesia [A Legal Review of the Application of the Ijarah Contract and Its Innovations in the Development of Islamic Economics in Indonesia],” J. Fundam. Justice, vol. 1, no. 2, pp. 39–50, (in Indonesia), 2020, [Online]. Available: https://journal.universitasbumigora.ac.id/index.php/fundamental/navigationMenu/view/Beranda

[18] A. Hafidzi, S. Sa’adah, and F. Luthfi, “Telaah Obligasi Dalam Tinjauan Hukum Ekonomi Syariah [An Analysis of Bonds in the Perspective of Islamic Economic Law],” CBJIS Cross-Border J. Islam. Stud., vol. 3, no. 1, pp. 15–22, (in Indonesia), 2021, doi: https://doi.org/10.37567/cbjis.v3i1.708.

[19] S. Hartanto and D. F. A. Sup, “Konsep Sukuk Wakaf dalam Perspektif Fatwa DSN-MUI,” Muslim Herit., vol. 6, no. 1, pp. 201–218, 2021, doi: https://doi.org/10.21154/muslimheritage.v6i1.2767.

[20] M. R. Kadir, “Shariah Compliance Pada Investasi Sukuk Dalam Securities Crowdfunding Di Indonesia [Shariah Compliance in Sukuk Investment in Securities Crowdfunding in Indonesia],” J. Ilmu Perbank. Dan Keuang. Syariah, vol. 3, no. 1, pp. 16–29, (in Indonesia), 2021, doi: https://doi.org/10.24239/jipsya.v3i1.36.15-29.

[21] Y. A. Nufus and R. R. Kurniawan, “Penerapan Akad Bai Ad-Dayn Pada Obligasi Syariah Dan Sukuk Negara (Surat Berharga Syariah Negara/SBSN),” Center for Open Science, 2022. doi: https://doi.org/10.31219/osf.io/pt4hs.

[22] I. Fitriyansyah, “Implementasi Hukum Ekonomi Syariah Pada Surat Berharga Syariah Negara (Sukuk) di Indonesia [The Implementation of Sharia Economic Law in State Sharia Securities (Sukuk) in Indonesia],” Sahmiyya J. Ekon. dan Bisnis, vol. 3, no. 2, pp. 191–195, (in Indonesia), 2024, [Online]. Available: https://e-journal.uingusdur.ac.id/sahmiyya/article/view/7630

[23] M. Rizali, “Konstruksi Hukum Sukuk Berdasarkan Fiqih Muamalah [Legal Construction of Sukuk Based on Fiqh Muamalah],” UNIVERSITAS ISLAM INDONESIA, 2010. [Online]. Available: https://dspace.uii.ac.id/handle/123456789/8993

[24] M. Anjaswati, R. Rohimah, T. Suryani, and R. Amalia, “Tinjauan Fiqih Terhadap Pelaksanaan Sukuk Negara Ijarah Sale and Lease Back di Pasar Modal Syariah Indonesia [A Fiqh Perspective on the Implementation of State Sukuk Ijarah Sale and Leaseback in Indonesia’s Sharia Capital Market],” J. Fiqih Transaksi Keuang. Kontemporer, vol. 1, no. 1, pp. 1–29, (in Indonesia), 2016, [Online]. Available: https://d1wqtxts1xzle7.cloudfront.net/52696542/Jurnal_Sukuk_Riska_Amalia_dkk_STEI_SEBI-libre.pdf?1492618220=&response-content-disposition=inline%3B+filename%3DTINJAUAN_FIQIH_TERHADAP_PELAKSANAAN_SUKU.pdf&Expires=1748331263&Signature=JU3ZssDd9Ra0P6sOw9Wsxm

[25] A. Fauzi, “Sukuk negara dalam perspektif akuntansi syariah (Analisis komparatif indonesia dan malaysia),” Sekolah Pascasarjana UIN Syarif Hidayatullah Jakarta, 2021. [Online]. Available: A. Fauzi, %22Sukuk Negara Dalam Perspektif Akuntansi Syariah,%22 Disertasi UIN Syarif Hidayatullah Jakarta, 2021.

[26] T. Trimulato, “Analysis produk keuangan syariah sukuk [Analysis of Sharia-Compliant Financial Products: Sukuk],” Kunuz J. Islam. Bank. Financ., vol. 1, no. 2, pp. 120–137, (in Indonesia), 2021, doi: https://doi.org/10.30984/kunuz.v1i2.72.

[27] T. B. Sembiring, Irmawati, M. Sabir, and I. Tjahyadi, Buku Ajar Metodologi Penelitian (Teori dan Praktik). Karawang: Saba Jaya Publisher, 2024.

[28] M. B. Miles, A. M. Huberman, and J. Saldana, Qualitative Data Analysis: A Methods Sourcebook., vol. 11, no. 1. 2019. [Online]. Available: http://scioteca.caf.com/bitstream/handle/123456789/1091/RED2017-Eng-8ene.pdf?sequence=12&isAllowed=y%0Ahttp://dx.doi.org/10.1016/j.regsciurbeco.2008.06.005%0Ahttps://www.researchgate.net/publication/305320484_SISTEM_PEMBETUNGAN_TERPUSAT_STRATEGI_MELESTARI

[29] K. K. R. Indonesia, “Memorandum Informasi Sukuk Negara Ritel Seri SR021T5," Kementerian Keuangan Republik Indonesia,” Jakarta, 2024.

[30] K. K. R. Indonesia, “Memorandum Informasi Sukuk Negara Ritel Seri SR021T3,” Jakarta, 2024.

[31] P. R. Indonesia, “Undang-Undang Republik Indonesia Nomor 1 Tahun 2004 Tentang Perbendaharaan Negara,” Jakarta, 2004.

[32] P. R. Indonesia, “Undang-Undang Republik Indonesia Nomor 19 Tahun 2008 Tentang Surat Berharga Syariah Negara,” Jakarta, 2008.

[33] D. D. P. Syariah, “Tanya Jawab Surat Berharga Syariah Negara / Sukuk Negara,” Jakarta, 2010.

[34] M. K. R. Indonesia, “Putusan Nomor: 143/PUU-VII/2009,” Jakarta, 2016.

[35] M. K. R. Indonesia, “Peraturan Menteri Keuangan Republik Indonesia Nomor: 111/PMK.06/2016 Tentang Tata Cara Pelaksanaan Pemindahtanganan Barang Milik Negara,” Jakarta, 2016.

[36] AAOIFI, Exposure Draft of Shari’ah Standard No. 62, Sukuk. Bahrain: AAOIFI, 2023.

[37] AAOIFI, al-Mi’yaaru asy-Syar’iyyu Roqm 58: I’aadatu asy-Syiroo’. Bahrain: AAOIFI, 2017.

[38] A. Al-Burnu, al-Wajiiz fii Iidhoohi Qowaaídi al-Fiqhi al-Kuliyyati. Lebanon: Muasasah ar-Risalah, 1996.

[39] Fauzan, “Jual Beli yang Dilarang dalam Islam,” Almanhaj. Accessed: Nov. 18, 2024. [Online]. Available: https://almanhaj.or.id/2979-jual-beli-yang-dilarang-dalam-islam.html

[40] M. A. Mirah, Shukuk al-Ijarah (Dirasah Fiqhiyah Ta’shiliyah Tathbiqiyah). Riyadh: Dar al-Maiman, 2008.

[41] S. Sabiq, Fiqh as-Sunnah, 3rd ed. Lebanon: Dar Al-Fikr, 1983.

[42] E. Tarmizi, Harta Haram Muamalat Kontemporer. Bogor: Berkat Mulia Insani, 2001.

[43] A. ’. Al-Badawi, al-Wajiz fi Fiqhi as-Sunnah wa al-Kitabi al-"Aziz. Mesir: Dar Ibnu Rajab, 2001.

[44] A. A.-M. And and S. Ash-Shawi, “Akhlak Usahawan Muslim,” Alsofwah. Accessed: Nov. 29, 2024. [Online]. Available: available: https://www.alsofwah.or.id/cetakekonomi.php?id=160&idjudul=1

[45] M. A. Tuasikal, “Riba dalam Pegadaian,” Rumaysho. Accessed: Nov. 20, 2024. [Online]. Available: https://rumaysho.com/2318-riba-dalam-pegadaian.html

[46] K. Syamhudi, “Gadai (Ar-Rahn),” Almanhaj. Accessed: Nov. 20, 2024. [Online]. Available: https://almanhaj.or.id/14353-gadai-ar-rahn.html

[47] I. F. A. Jeddah, “Resolutions and recommendations of the council of the Islamic Fiqh Academy 1985-2000.” Islamic Research and Training Institute, Jeddah, 2000.

[48] A. Maisyarah and M. Z. Hamzah, “Zakat Distribution Management: A Systematic Literature Review,” Suhuf Int. J. Islam. Stud., vol. 36, no. 1, pp. 95–108, 2024, doi: https://doi.org/10.23917/suhuf.v36i1.4357

Downloads

Submitted

Accepted

Published

How to Cite

Issue

Section

License

Copyright (c) 2025 Joko Nugroho, Agus Darwanto

This work is licensed under a Creative Commons Attribution 4.0 International License.