The Role of Islamic Finance in Sustainable and Green Transition

DOI:

https://doi.org/10.23917/suhuf.v36i2.6314Keywords:

Financial institutions, Green economy, Islamic finance, Green financing, Environmental sustainabilityAbstract

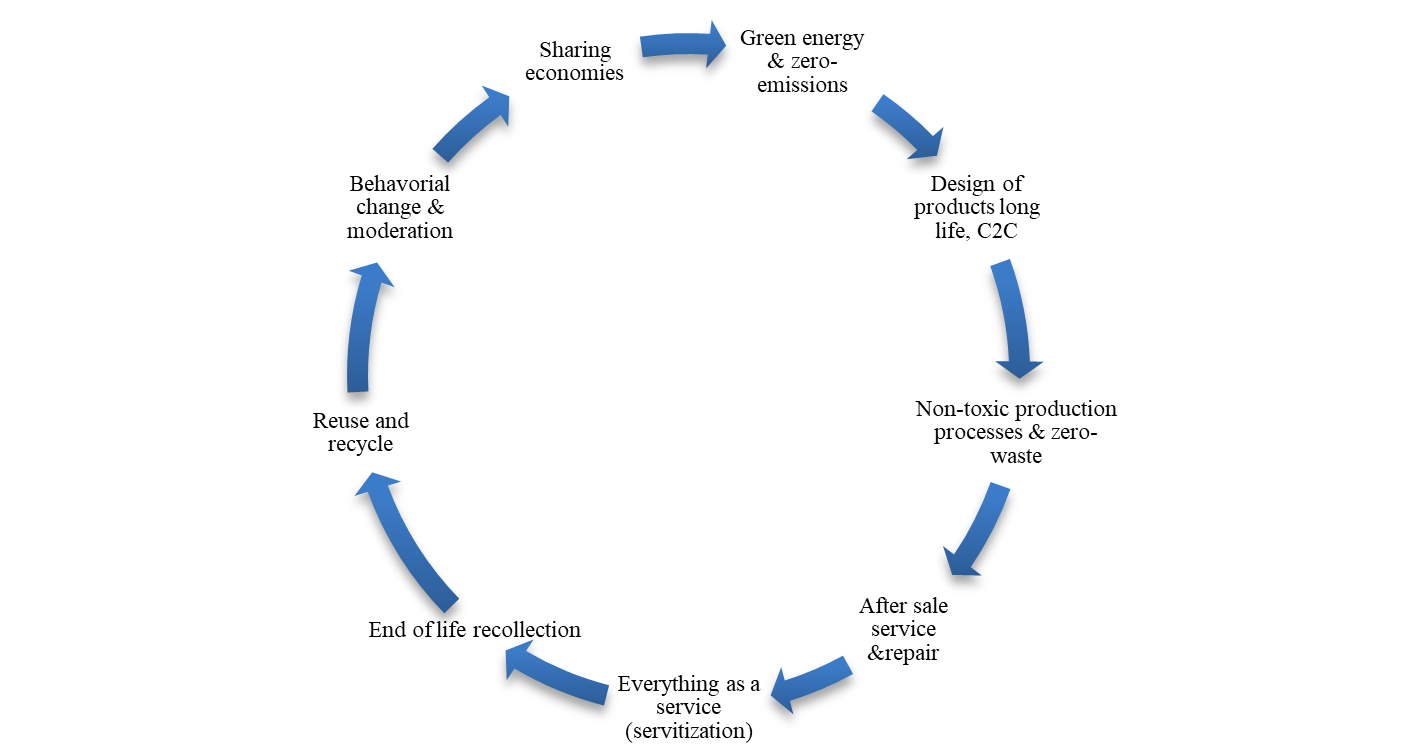

This study examines the role of Islamic finance in advancing the United Nations' Sustainable Development Goals (SDGs), focusing on often-overlooked conflicts among these goals, such as the tension between poverty alleviation (SDG 1), hunger eradication (SDG 2), and environmental sustainability. It emphasizes the need for balanced progress across SDGs, particularly in Muslim societies where welfare aligns with religious principles. The study advocates for a Green Economic Transition (GET) aimed at achieving high human development while respecting Maqasid Shariah and ecological limits. GET, it suggests, should be the core of climate-conscious policies and business strategies. Recognizing shifts in the global financial system to reconcile economic and social development with environmental goals, the study underscores the need for policies aligning these aspects. It also explores the contribution of Islamic economics and finance-including commercial finance (banking, takaful, Sukuk, Shariah-compliant equity markets) and social finance (Zakah, Waqf, charities, Qard)-in fostering sustainable green finance. Noting the gap where these tools are still tied to conventional finance, the study proposes a framework for developing coherent climate policies within Islamic finance and identifies opportunities for Islamic sustainable green finance.

Downloads

References

M. Friedman, "The Social Responsibility of Business is to Increase Its Profits," in Business Ethics: The Controversy, New Baskerville: DM Cradle Associates, 2007, pp. 33–38. [Online]. Available: https://www.inclusivegrowths.com/wp-content/uploads/2023/05/The-Social-Responsibility-of-Business.pdf

G. Hardin, "The Tragedy of the Commons," Science (80-. )., vol. 162, no. 3859, pp. 1243–1248, 1968, doi: https://doi.org/10.1126/science.162.3859.1243.

Y. Malhi, "The Concept of the Anthropocene," Annu. Rev. Environ. Resour., vol. 42, no. 1, pp. 77–104, 2017, [Online]. Available: https://www.annualreviews.org/content/journals/10.1146/annurev-environ-102016-060854

S. Vivien, "Sustainable Development: Balancing Economic Prosperity and Environmental Concerns," J. Econ. Econ. Educ. Res., vol. 24, no. 4, pp. 1–3, 2023, [Online]. Available: https://www.abacademies.org/articles/sustainable-development-balancing-economic-prosperity-and-environmental-concerns.pdf

A. G. Ismail, S. A. Shaikh, and M. H. Zaenal, "Ecosystem in Islamic Finance and Its Link with SDGs," 2019. [Online]. Available: https://puskasbaznas.com/publications/published/pwps/759-ecosystem-in-islamic-finance-and-its-link-with-sdgs

A. Ibrahim, "An Assessment of the Triple Bottom Line Concept on CSR Effort in FMCG in Nigeria," Electron. Res. J. Soc. Sci. Humanit., vol. 2, no. 1, pp. 123–147, 2020, [Online]. Available: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3753256

E. Tok and A. J. Yesuf, "Embedding Value-Based Principles in the Culture of Islamic Banks to Enhance Their Sustainability, Resilience, and Social Impact," Sustainability, vol. 14, no. 2, p. 916, 2022, doi: https://doi.org/10.3390/su14020916.

F. H. M. Liu and K. P. Y. Lai, "Ecologies of Green Finance: Green Sukuk and the Development of Green Islamic Finance in Malaysia," Environ. Plan. A Econ. Sp., vol. 53, no. 8, pp. 1896–1914, 2021, doi: https://doi.org/10.1177/0308518X211038349.

M. Campra, V. Brescia, V. Jafari Sadeghi, and D. Calandra, "Islamic Countries and Maqasid al-Shariah Towards the Circular Economy: The Dubai Case Study," Eur. J. Islam. Financ., vol. 17, pp. 1–10, 2021, doi: https://nrl.northumbria.ac.uk/id/eprint/46332/.

Islamic Financial Services Board, "Islamic Financial Services Industry Stability Report 2021," 2021. [Online]. Available: https://www.ifsb.org/publication-document/islamic-financial-services-industry-stability-report-2021/

N. Crossman et al., "Global Socio-Economic Impacts of Future Changes in Biodiversity and Ecosystem Services: State of Play and Approaches for New Modelling," 2018. [Online]. Available: https://coknow.de/files/CoKnow/Publikationen/2018/global_socio-economic_impacts_of_future_changes_in_biodiversity_and_ecosystem_services_final_feb18.pdf

Y. Hu, Y. Li, Y. Li, J. Wu, H. Zheng, and H. He, "Balancing urban expansion with a focus on ecological security: A case study of Zhaotong City, China," Ecol. Indic., vol. 156, no. December, pp. 1–16, 2023, doi: https://doi.org/10.1016/j.ecolind.2023.111105.

A. Halimatussadiah et al., Thinking Ahead: Indonesia's Agenda on Sustainable Recovery from COVID -19 Pandemic. Jakarta: Institute for Economic and Social Research, 2020.

M. Abdullah, "Waqf, Sustainable Development Goals (SDGs) and Maqasid al-Shariah," Int. J. Soc. Econ., vol. 45, no. 1, pp. 158–172, 2018, doi: https://doi.org/10.1108/IJSE-10-2016-0295.

U. F. S. S. Aly, "Green Sukuk: The Introduction of Islam's Environmental Ethics to Contemporary Islamic Finance," Georg. Int. Environ. Law Rev., vol. 27, no. 1, pp. 1–60, 2015, [Online]. Available: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2580864

M. A. Budiman, "The Role of Waqf for Environmental Protection in Indonesia," in Aceh Development International Conference (ADIC), Kuala Lumpur, 2011, pp. 880–889. [Online]. Available: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=1843391

E. Al-Anzi and N. Al-Duaij, "Islamic Waqf and Environmental Protection," Codicillus, vol. 45, no. 2, pp. 52–63, 2004, [Online]. Available: https://hdl.handle.net/10520/EJC27442

M. Obaidullah, "Managing Climate Change: The Role of Islamic Finance," IES J. Artic., vol. 26, no. 1, pp. 31–62, 2018, doi: https://doi.org/10.12816/0050310.

I. Ari and M. Koc, "Towards Sustainable Financing Models: A Proof-of-Concept for a Waqf-Based Alternative Financing Model for Renewable Energy Investments," Borsa Istanbul Rev., vol. 21, no. 1, pp. S46–S56, 2021, doi: https://doi.org/10.1016/j.bir.2021.03.007.

K. M. Ali and S. Kassim, "Waqf Forest: How Waqf Can Play a Role In Forest Preservation and SDGs Achievement?," Etikonomi, vol. 19, no. 2, pp. 349–364, 2020, doi: https://doi.org/10.15408/etk.v19i2.16310.

T. Khan, "Venture Waqf in a Circular Economy," ISRA Int. J. Islam. Financ., vol. 11, no. 2, pp. 187–205, 2019, [Online]. Available: https://www.emerald.com/insight/content/doi/10.1108/IJIF-12-2018-0138/full/html

M. A. Al Haq and N. Abd Wahab, "The Maqasid Al Shariah and the sustainability paradigm: Literature review and proposed mutual framework for asnaf development," J. Account. Financ. Emerg. Econ., vol. 5, no. 2, pp. 179–196, 2019, doi: https://doi.org/10.26710/jafee.v5i2.854.

R. B. Johnston, "Arsenic and the 2030 Agenda for sustainable development," in Arsenic Research and Global Sustainability, London: Taylor & Francis Group, 2016, pp. 12–14. doi: https://doi.org/10.1201/B20466-7.

C. Shine et al., The Economics of Ecosystems and Biodiversity in National and International Policy Making. London: Routledge, 2009.

S. Morse and I. N. Vogiatzakis, "Resource Use and Deprivation: Geographical Analysis of the Ecological Footprint and Townsend Index for England," Sustainability, vol. 6, no. 8, pp. 4749–4771, 2014, doi: https://doi.org/10.3390/su6084749.

M. Sujahangir and K. Sarkar, "Human Development Scenario of Malaysia: ASEAN and Global Perspective," Asian J. Appl. Sci. Eng., vol. 1, no. 1, pp. 23–34, 2012, [Online]. Available: https://d1wqtxts1xzle7.cloudfront.net/75438693/Human_Development_Scenario_of_Malaysia_A20211130-28144-972avu.pdf?1638324645=&response-content-disposition=inline%3B+filename%3DHuman_Development_Scenario_of_Malaysia_A.pdf&Expires=1729983286&Signature=CubGff

Earth Overshoot Day, "Country Overshoot Days 2022," 2022. [Online]. Available: https://www.overshootday.org/newsroom/country-overshoot-days/

Global Footprint Network, "Open Data Platform," 2021. [Online]. Available: https://data.footprintnetwork.org/#/sustainableDevelopment?cn=5001,101,165&type=BCpc,EFCpc&yr=2021

E. L. F. Schipper et al., "Climate Resilient Development Pathways," in Climate Change 2022: Impacts, Adaptation and Vulnerability. Contribution of Working Group II to the Sixth Assessment Report of the Intergovernmental Panel on Climate Change, Cambridge, UK and New York, USA: Cambridge University Press, 2022, pp. 2655–2807. doi: https://doi.org/10.1017/9781009325844.027.

S. Sachs and E. Rühli, Stakeholders Matter: A New Paradigm for Strategy in Society. London: Cambridge University Press, 2011. [Online]. Available: https://books.google.co.id/books?id=XTJLIiOqdpsC&dq=S.+Sachs+and+E.+Rühli,+Stakeholders+matter:+A+new+paradigm+for+strategy+in+society.+2011.+doi:+10.1017/CBO9781139026963.&lr=&hl=id&source=gbs_navlinks_s

B. S. Sairally, "Integrating Environmental, Social and Governance (ESG) Factors in Islamic Finance: Towards the Realisation of Maqāṣid al-Sharīʿah," ISRA Int. J. Islam. Financ., vol. 7, no. 2, pp. 145–154, 2015, [Online]. Available: https://journal.inceif.edu.my/index.php/ijif/article/view/210

M. K. Hassan, M. Saraç, and A. W. Alam, "Circular Economy, Sustainable Development, and the Role of Islamic Finance," in Islamic Perspective for Sustainable Financial System, Istanbul: Istanbul University Press, 2020, pp. 1–26. [Online]. Available: http://nek.istanbul.edu.tr:4444/ekos/KITAP/ekt0000034.pdf#page=9

B. D. Fath, D. A. Fiscus, S. J. Goerner, A. Berea, and R. E. Ulanowicz, "Measuring Regenerative Economics: 10 Principles and Measures Undergirding Systemic Economic Health," Glob. Transitions, vol. 1, pp. 15–27, 2019, doi: https://doi.org/10.1016/j.glt.2019.02.002.

A. Diemer and F. Dierickx, "Circular economy, a new paradigm for Europe," in Paradigms, Models, Scenarios and Practices for Strong Sustainability, France: Imprimerie Print Conseil, 2020, pp. 161–179. [Online]. Available: https://www.researchgate.net/profile/Arnaud-Diemer-2/publication/341164905_Paradigms_Models_Scenarios_and_Practices_for_strong_sustainability/links/5eb1d0ed45851592d6bd41dd/Paradigms-Models-Scenarios-and-Practices-for-strong-sustainability.pdf#page=168

D. Baresic, V. Prakash, J. Stewart, N. Rehmatulla, and T. Smith, "Climate Action in Shipping: Progress towards Shipping's 2030 Breakthrough," New York, NY, Denmark, 2022. [Online]. Available: https://discovery.ucl.ac.uk/id/eprint/10157648/

International Energy Agency, Coal in Net Zero Transitions. Paris: OECD, 2022. [Online]. Available: https://www.oecd-ilibrary.org/energy/coal-in-net-zero-transitions_5873f7bb-en

NGFS, "A Call for Action: Climate Change as a Source of Financial Risk," NGFS, no. April. pp. 1–40, 2019. [Online]. Available: https://www.ngfs.net/en/first-comprehensive-report-call-action

SRI, "Sustainable and Responsible Investment Sukuk Framework: An Overview Part 1," Malaysia, 2019. [Online]. Available: https://www.sc.com.my/api/documentms/download.ashx?id=84491531-2b7e-4362-bafb-83bb33b07416

Ministry of Finance Republic of Indonesia, "Green Sukuk: Allocation and Impact Report 2023," 2023. [Online]. Available: https://www.climatefinance-developmenteffectiveness.org/sites/default/files/Indonesia-CS.pdf

UNEP FI, "UNEP FI Annual Overview 2020," Geneva, 2020. [Online]. Available: https://www.unepfi.org/wordpress/wp-content/uploads/2021/07/2020-Annual-Overview.pdf

UN PRI, "UN Principles for Responsible Investments (PRI)," in Encyclopedia of Sustainable Management, Berlin: Springer International Publishing, 2023, pp. 3807–3814. doi: https://doi.org/10.1007/978-3-031-25984-5_537.

UNEP FI, "Principles for Responsible Banking-Guidance document Guidance." UNEP Finance Initiative, Geneva, pp. 1–48, 2022. [Online]. Available: https://www.unepfi.org/wordpress/wp-content/uploads/2022/04/PRB-Guidance-Document-Jan-2022-D3.pdf

UNEP Finance Initiative, "PSI: Principles for Sustainable Insurance." UNEP Finance Initiative, Geneva, pp. 1–4, 2014. [Online]. Available: https://www.unehttps//www.unepfi.org/psi/wp-content/uploads/2012/06/PSI-document.pdfpfi.org/psi/wp-content/uploads/2014/07/Bradesco_Disclosure_2.pdf

M. I. Dien, "Islam and the Environment: Theory and Practice," J. Beliefs Values, vol. 18, no. 1, pp. 47–57, 1997, doi: https://doi.org/10.1080/1361767970180106.

Cambridge Institute of Islamic Finance, "Global Islamic Finance Report 2021," London, 2021. [Online]. Available: https://www.qfc.qa/-/media/project/qfc/qfcwebsite/documentfiles/publications/research-insights-2021/cambridge-gifr-2021.pdf

A. H. Aygun, S. Kosal, and G. Uysal, "Unpacking the Effects of Covid-19 on Labor Market Outcomes: Evidence from Turkey," Economic Research Forum (ERF), Giza, 2022. [Online]. Available: https://erf.org.eg/app/uploads/2022/01/1643624731_988_842765_1533.pdf

D. A. Karimah, M. B. Pamuncak, and M. K. Mubin, "The Role of Waqf in Supporting Sustainable Development Goals: Linking theory and its practices," Suhuf Int. J. Islam. Stud., vol. 35, no. 2, pp. 31–38, 2023, doi: https://doi.org/10.23917/suhuf.v35i2.23018.

Bank Negara Malaysia, "Value-based Intermediation Financing and Investment Impact Assessment Framework Guidance Document," Cantral Bank of Malaysia, no. November. pp. 1–50, 2019. [Online]. Available: https://www.bnm.gov.my/documents/20124/761679/VBIAF_Final+guidance+1.11.2019.pdf

Islamic Financial Services Board, "Islamic Financial Services Industry Stability Report 2022: Resilience Amid A Resurging Pandemic," 2022. [Online]. Available: https://www.ifsb.org/download.php?id=6571&lang=English&pg=/index.php

Downloads

Submitted

Accepted

Published

How to Cite

Issue

Section

License

Copyright (c) 2024 Ubaid Ahmed, Aminudin Maruf, Shahbaz Alam, Lutfiatul Azizah

This work is licensed under a Creative Commons Attribution 4.0 International License.