A Conceptual Review Paper: Revisiting the Non-linear Relationship Between Dividend and Firm Value in Shariah and Non-Shariah Compliant Firms

DOI:

https://doi.org/10.23917/suhuf.v36i2.6260Keywords:

Dividend policy , Firm value , Non-Shariah-compliant firms , Shariah-compliant firms , Conceptual reviewAbstract

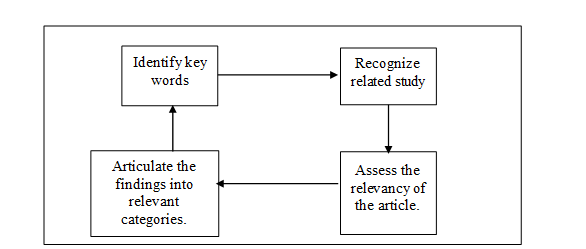

In the modern corporate world, dividend policy is a widely discussed topic. Early academic literature mainly focused on the linear relationship between dividends and firm value. However, a non-linear (J-shaped) relationship was later discovered in major economies, indicating that firm value may have a more complex connection to dividends. This study reviews existing literature on the non-linear relationship between dividends and company value, suggesting that this relationship might also exist between Shariah-compliant and non-Shariah-compliant firms. The low leverage characteristic of Shariah-compliant firms may contribute to this potential relationship. An extensive search through Google Scholar and Scopus revealed that few empirical studies have examined this non-linear relationship. Notably, no analysis has yet investigated the non-linear relationship between dividends and firm value specifically among Shariah-compliant firms. This article provides a conceptual overview of how and why such a relationship may exist. The review highlights the need for further research, offering insights that could help policymakers and firms make informed decisions to enhance firm performance.

Downloads

References

R. La Porta, F. Lopez-de-Silanes, A. Shleifer, and R. Vishny, "Investor Protection and Corporate Governance," J. financ. econ., vol. 58, no. 1–2, pp. 3–27, 2000, doi: https://doi.org/10.1016/S0304-405X(00)00065-9.

M. S. Rozeff, "Growth, Beta and Agency Costs as Determinants of Dividend Payout Ratios," J. Financ. Res., vol. 5, no. 3, pp. 249–259, 1982, doi: https://doi.org/10.1111/j.1475-6803.1982.tb00299.x.

M. C. Jensen and W. H. Meckling, "Theory of the Firm: Managerial Behavior, Agency Costs and Ownership Structure," in Corporate Governance, 1st ed., Gower, 2019, pp. 77–132. [Online]. Available: https://www.taylorfrancis.com/chapters/edit/10.4324/9781315191157-9/theory-firm-managerial-behavior-agency-costs-ownership-structure-michael-jensen-william-meckling

M. J. Gordon, "Optimal Investment and Financing Policy," J. Finance, vol. 18, no. 2, pp. 264–272, 1963, doi: https://doi.org/10.2307/2977907.

J. E. Walter, "Dividend Policy: Its Influence on the Value of the Enterprise," J. Finance, vol. 18, no. 2, pp. 280–291, 1963, doi: https://doi.org/10.2307/2977909.

K. John and J. Williams, "Dividends, Dilution, and Taxes: A Signalling Equilibrium," J. Finance, vol. 40, no. 4, pp. 1053–1070, 1985, doi: https://doi.org/10.1111/j.1540-6261.1985.tb02363.x.

J. Lintner, "Distribution of Incomes of Corporations Among Dividends, Retained Earnings, and Taxes," in Papers and Proceedings of the Sixty-eighth Annual Meeting of the American Economic Association (May, 1956), JSTOR, 1956, pp. 97–113. [Online]. Available: https://www.jstor.org/stable/1910664

S. Bhattacharya, "Imperfect Information, Dividend Policy, and ‘The Bird in the Hand' Fallacy," Bell J. Econ., vol. 10, no. 1, pp. 259–270, 1979, doi: https://doi.org/10.2307/3003330.

S. Kim, S. H. Park, and J. Suh, "A J-Shaped Cross-Sectional Relation Between Dividends and Firm Value," J. Corp. Financ., vol. 48, no. February, pp. 857–877, 2018, doi: https://doi.org/10.1016/j.jcorpfin.2016.09.010.

M. A. Bakri and C. C. Yong, "Determinants of Dividend Policies in Shariah Compliant and Non-Shariah Compliant Firms: A Panel Quantile Approach," Cap. Mark. Rev., vol. 31, no. 1, pp. 47–58, 2023, [Online]. Available: https://www.mfa.com.my/wp-content/uploads/2023/04/v31_i1_a3_pg47-58.pdf

O. Farooq and O. Tbeur, "Dividend Policies of Shariah-Compliant and Non-Shariah-Compliant Firms: Evidence from the MENA Region," Int. J. Econ. Bus. Res., vol. 6, no. 2, pp. 158–172, 2013, doi: https://doi.org/10.1504/IJEBR.2013.055537.

N. L. Adam and N. A. Bakar, "Shariah Screening Process in Malaysia," Procedia-Social Behav. Sci., vol. 121, no. March, pp. 113–123, 2014, doi: https://doi.org/10.1016/j.sbspro.2014.01.1113.

R. C. Higgins, "The Corporate Dividend-Saving Decision," J. Financ. Quant. Anal., vol. 7, no. 2, pp. 1527–1541, 1972, doi: https://doi.org/10.2307/2329932.

V. Aivazian, L. Booth, and S. Cleary, "Do Emerging Market Firms Follow Different Dividend Policies From U.S. Firms?," J. Financ. Res., vol. 26, no. 3, pp. 371–387, 2003, doi: https://doi.org/10.1111/1475-6803.00064.

M. Omran and J. Pointon, "Dividend Policy, Trading Characteristics And Share Prices: Empirical Evidence From Egyptian Firms," Int. J. Theor. Appl. Financ., vol. 7, no. 02, pp. 121–133, 2004, doi: https://doi.org/10.1142/S0219024904002384.

C. A. Marquardt and C. I. Wiedman, "How Are Earnings Managed? An Examination of Specific Accruals," Contemp. Account. Res., vol. 21, no. 2, pp. 461–491, 2004, doi: https://doi.org/10.1506/G4YR-43K8-LGG2-F0XK.

M. L. Caylor, "Strategic Revenue Recognition to Achieve Earnings Benchmarks," J. Account. Public Policy, vol. 29, no. 1, pp. 82–95, 2010, doi: https://doi.org/10.1016/j.jaccpubpol.2009.10.008.

G. A. Jarrell, J. A. Brickley, and J. M. Netter, "The Market for Corporate Control: The Empirical Evidence Since 1980," J. Econ. Perspect., vol. 2, no. 1, pp. 49–68, 1988, [Online]. Available: https://www.aeaweb.org/articles?id=10.1257/jep.2.1.49

S. Bhattacharya and A. V Thakor, "Contemporary Banking Theory," J. Financ. Intermediation, vol. 3, no. 1, pp. 2–50, 1993, doi: https://doi.org/10.1006/jfin.1993.1001.

L. Allen and A. A. Gottesman, "The Informational Efficiency of the Equity Market As Compared to the Syndicated Bank Loan Market," J. Financ. Serv. Res., vol. 30, no. July, pp. 5–42, 2006, [Online]. Available: https://link.springer.com/article/10.1007/s10693-006-8738-z

M. Guizani, "Free Cash Flow, Agency Cost and Dividend Policy of Sharia-Compliant and Non-Sharia-Compliant firms.," Int. J. Econ. Manag., vol. 11, no. 2, pp. 355–370, 2017, [Online]. Available: https://www.researchgate.net/profile/Moncef-Guizani/publication/322770512_Free_cash_flow_agency_cost_and_dividend_policy_of_sharia-compliant_and_non-sharia-compliant_firms/links/5adf09afa6fdcc29358da1d3/Free-cash-flow-agency-cost-and-dividend-policy-of-sh

L. A. Tyas and B. Bandi, "Sharia and Non-Sharia Firms: Analysis on the Dividend Policy of Indonesian Companies," J. ASET (Akuntansi Riset), vol. 13, no. 1, pp. 161–173, 2021, doi: https://doi.org/10.17509/jaset.v13i1.32975.

A. Maisyarah and M. Z. Hamzah, "Zakat Distribution Management: A Systematic Literature Review," Suhuf Int. J. Islam. Stud., vol. 36, no. 1, pp. 95–108, 2024, doi: https://doi.org/10.23917/suhuf.v36i1.4357.

A. Sinaga, "The Effect of Capital Structure, Firm Growth and Dividend Policy on Profitability and Firm Value of the Oil Palm Plantation Companies in Indonesia," Eur. J. Bus. Manag., vol. 8, no. 3, pp. 123–134, 1905, [Online]. Available: https://www.researchgate.net/publication/325657098_The_Effect_of_Capital_Structure_Firm_Growth_and_Dividend_Policy_on_Profitability_and_Firm_Value_of_the_Oil_Palm_Plantation_Companies_in_Indonesia

O. U. Rehman, "Impact of Capital Structure and Dividend Policy on Firm Value," J. Poverty, Invest. Dev., vol. 21, no. 1, pp. 40–57, 2016, [Online]. Available: https://iiste.org/Journals/index.php/JPID/article/view/28887

D. Sukmawardini and A. Ardiansari, "The Influence of Institutional Ownership, Profitability, Liquidity, Dividend Policy, Debt Policy on Firm Value," Manag. Anal. J., vol. 7, no. 2, pp. 211–222, 2018, [Online]. Available: https://journal.unnes.ac.id/sju/maj/article/view/24878

A. Munawar, "The Effect of Leverage, Dividend Policy, Effectiveness, Efficiency, and Firm Size on Firm Value in Plantation Companies Listed on IDX," Int. J. Sci. Res., vol. 8, no. 10, pp. 244–252, 2019, [Online]. Available: https://www.semanticscholar.org/paper/The-Effect-of-Leverage%2C-Dividend-Policy%2C-and-Firm-Munawar/9f4fce017e81b2958bf4602510bee5a433ebb93b

H. Sutomo and R. Budiharjo, "The Effect of Dividend Policy and Return on Equity on Firm Value," Int. J. Acad. Res. Accounting, Financ. Manag. Sci., vol. 9, no. 3, pp. 211–220, 2019, doi: http://dx.doi.org/10.6007/IJARAFMS/v9-i3/6364.

T. Husain and N. Sunardi, "Firm's Value Prediction Based on Profitability Ratios and Dividend Policy," Financ. Econ. Rev., vol. 2, no. 2, pp. 13–26, 2020, doi: https://doi.org/10.38157/finance-economics-review.v2i2.102.

D. R. Saputri and S. Bahri, "The Effect of Leverage, Profitability, and Dividend Policy on Firm Value," Int. J. Educ. Res. Soc. Sci., vol. 2, no. 6, pp. 1316–1324, 2021, doi: https://doi.org/10.51601/ijersc.v2i6.223.

D. A. Rizqia and S. A. Sumiati, "Effect of Managerial Ownership, Financial Leverage, Profitability, Firm Size, and Investment Opportunity on Dividend Policy and Firm Value," Res. J. Financ. Account., vol. 4, no. 11, pp. 120–130, 2013, [Online]. Available: https://www.semanticscholar.org/paper/Effect-of-Managerial-Ownership%2C-Financial-Leverage%2C-Rizqia-Aisjah/17f0875a0ac6459e34bef901bd2cb08647860552

Z. Morovvati Siboni and M. R. Pourali, "The Relationship between Investment Opportunity, Dividend Policy and Firm Value in Companies Listed in TSE: Evidence from IRAN," Eur. Online J. Nat. Soc. Sci. Proc., vol. 4, no. 1 (s), p. pp-263, 2015, doi: https://european-science.com/eojnss_proc/article/view/4230.

S. G. Anton, "The Impact of Dividend Policy on Firm Value. A Panel Data Analysis of Romanian Listed Firms," J. Public Adm. Financ. Law, no. 10, pp. 107–112, 2016, doi: https://www.ceeol.com/search/article-detail?id=743810.

N. Triani and D. Tarmidi, "Firm Value: Impact of Investment Decisions, Funding Decisions and Dividend Policies," Int. J. Acad. Res. Accounting, Financ. Manag. Sci., vol. 9, no. 2, pp. 158–163, 2019, doi: http://dx.doi.org/10.6007/IJARAFMS/v9-i2/6107.

A. Akhmadi and R. Robiyanto, "The Interaction Between Debt Policy, Dividend Policy, Firm Growth, and Firm Value," J. Asian Financ. Econ. Bus., vol. 7, no. 11, pp. 699–705, 2020, doi: https://doi.org/10.13106/jafeb.2020.vol7.no11.699.

P. W. Santoso, O. Aprilia, and M. E. Tambunan, "The Intervening Effect of the Dividend Policy on Financial Performance and Firm Value in Large Indonesian Firms," Int. J. Financ. Res., vol. 11, no. 4, pp. 408–420, 2020, doi: https://doi.org/10.5430/ijfr.v11n4p408.

M. A. Bakri, "Does Dividend Policy Affect Firm Value in an Emerging Market?: Evidence from Malaysian Firms," Labu. Bull. Int. Bus. Financ., vol. 19, no. 1, pp. 49–58, 2021, doi: https://doi.org/10.51200/lbibf.v19i1.3383.

F. P. Margono and R. Gantino, "The Influence of Firm Size, Leverage, Profitability, And Dividend Policy on Firm Value of Companies in Indonesia Stock Exchange," Copernican J. Financ. Account., vol. 10, no. 2, pp. 45–61, 2021, doi: https://doi.org/10.12775/CJFA.2021.007.

G. Agung, S. Hasnawati, and R. A. F. Huzaimah, "The Effect of Investment Decision, Financing Decision, Dividend Policy on Firm Value (Study on Food and Beverage Industry Listed on the Indonesia Stock Exchange, 2016-2018)," J. Bisnis dan Manaj., vol. 17, no. 1, pp. 1–12, 2021, doi: https://doi.org/10.23960/jbm.v17i1.189.

R. Hasanuddin, "The Influence of Investment Decisions, Dividend Policy and Capital Structure on Firm Value," J. Econ. Resour., vol. 4, no. 2, pp. 39–48, 2021, doi: https://doi.org/10.33096/jer.v4i1.845.

M. Kapons, P. Kelly, R. Stoumbos, and R. Zambrana, "Dividends, Trust, and Firm Value," Rev. Account. Stud., vol. 28, no. 3, pp. 1354–1387, 2023, doi: https://doi.org/10.1007/s11142-023-09795-4.

R. Sondakh, "The Effect of Dividend Policy, Liquidity, Profitability and Firm Size on Firm Value in Financial Service Sector Industries Listed in Indonesia Stock Exchange 2015-2018 Period," Accountability, vol. 8, no. 2, pp. 91–101, 2019, doi: https://doi.org/10.32400/ja.24760.8.2.2019.91-101.

I. G. Adiputra and A. Hermawan, "The Effect of Corporate Social Responsibility, Firm Size, Dividend Policy and Liquidity on Firm Value: Evidence from Manufacturing Companies in Indonesia," Int. J. Innov. Creat. Chang., vol. 11, no. 6, pp. 325–338, 2020, [Online]. Available: https://www.semanticscholar.org/paper/The-Effect-of-Corporate-Social-Responsibility%2C-Firm/c41e3899ac06d4bad6fae9d1e1b6f6da1f439aaa

M. A. Bakri, "Moderating Effect of Audit Quality: The Case of Dividend and Firm Value in Malaysian Firms," Cogent Bus. Manag., vol. 8, no. 1, p. 2004807, 2021, doi: https://doi.org/10.1080/23311975.2021.2004807.

L. S. Lumapow and R. A. F. Tumiwa, "The Effect of Dividend Policy, Firm Size, and Productivity to The Firm Value," Res. J. Financ. Account., vol. 8, no. 22, pp. 20–24, 2017, [Online]. Available: https://www.iiste.org/Journals/index.php/RJFA/article/view/39880

C. O. Winoto and F. A. Rudiawarni, "The Impact of the COVID-19 Pandemic on Dividend Policy Relevance to Firm Value: The Case of the Indonesian Banking Industry," in Entrepreneurship and Development for a Green Resilient Economy, Emerald Publishing Limited, 2024, pp. 277–296. doi: https://doi.org/10.1108/978-1-83797-088-920241011.

B. Jitmaneeroj, "The Impact of Dividend Policy on Price-Earnings Ratio: The Role of Conditional and Nonlinear Relationship," Rev. Account. Financ., vol. 16, no. 1, pp. 125–140, 2017, doi: https://doi.org/10.1108/RAF-06-2015-0092.

M. H. Miller and F. Modigliani, "Dividend Policy, Growth, and the Valuation of Shares," J. Bus., vol. 34, no. 4, pp. 411–433, 1961, [Online]. Available: https://www.jstor.org/stable/2351143

Downloads

Submitted

Accepted

Published

How to Cite

Issue

Section

License

Copyright (c) 2024 Mohd Ashari Bakri, Mohd Nasir Samsulbahri , Mohamad Isa Abd Jalil , Md Hafizi Ahsan, Chia Chia Yong

This work is licensed under a Creative Commons Attribution 4.0 International License.