Liquidity Risk in Islamic Banking: Structural Challenges and Shariah-Compliant Mitigation Strategies

DOI:

https://doi.org/10.23917/suhuf.v37i2.13223Keywords:

Islamic banks, Liquidity risk, Sharia compliance, Liquidity management, Islamic economicsAbstract

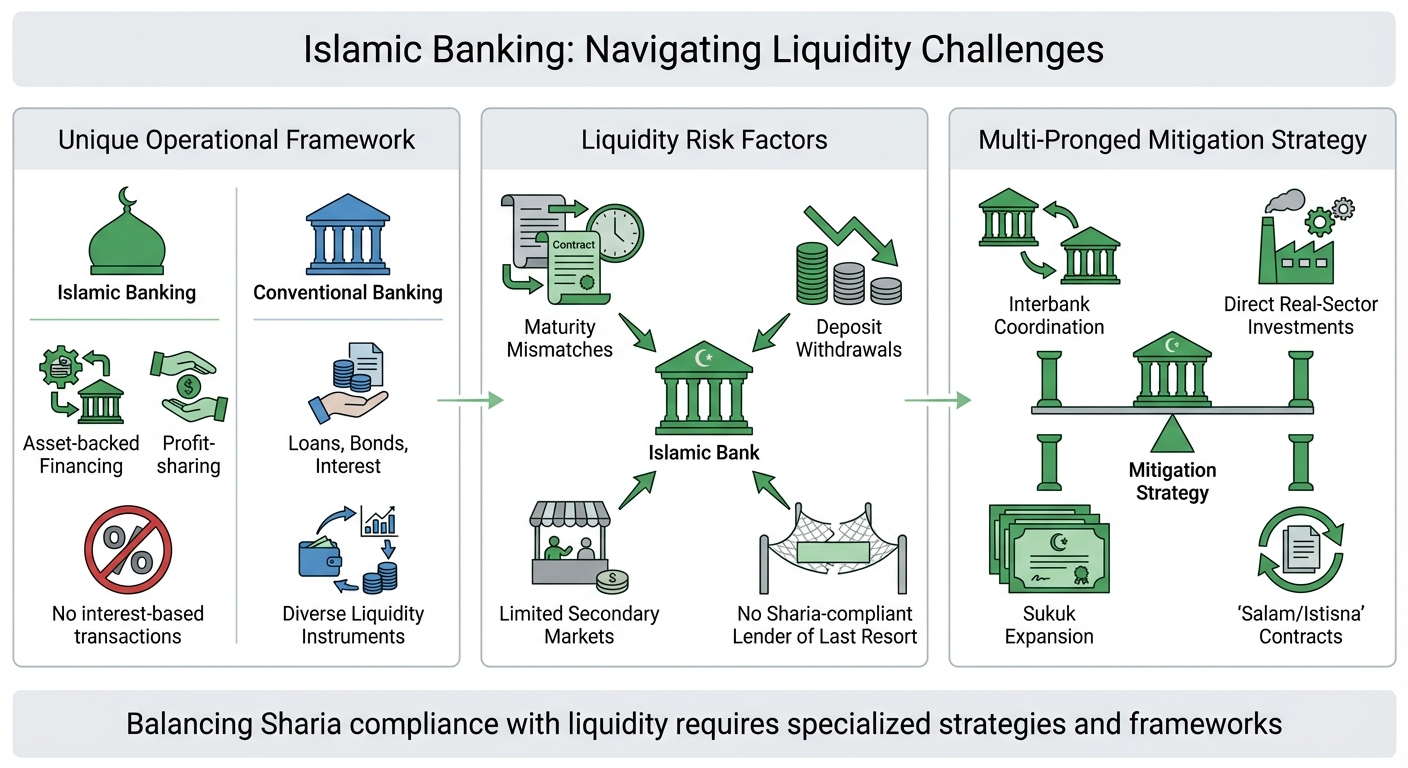

Liquidity management remains a critical challenge for Islamic banks due to their unique operational framework, which prohibits interest-based transactions and limits access to conventional monetary instruments. This study investigates the nature, causes, and effective mitigation strategies for liquidity risk within Islamic financial institutions. Adopting a descriptive-analytical approach, the research examines both internal and external factors contributing to liquidity imbalances such as maturity mismatches, sudden deposit withdrawals, underdeveloped secondary markets, and the absence of a Sharia-compliant lender of last resort. The findings reveal that Islamic banks face heightened liquidity pressures compared to conventional counterparts, primarily due to regulatory and structural constraints rooted in Islamic jurisprudence. To address these challenges, the study proposes a multi-pronged strategy: (1) strengthening interbank coordination among Islamic financial institutions, (2) expanding direct real-sector investments, (3) enhancing the use of Sharia-compliant instruments such as sukuk (Islamic bonds), and (4) activating short-term contracts like Salam and Istisna’ for efficient liquidity deployment. The paper concludes that effective liquidity management in Islamic banking requires not only robust internal governance but also supportive regulatory frameworks and deeper integration of Islamic capital markets. These measures are essential to ensure financial stability, protect depositor interests, and uphold the socio-economic objectives of Islamic finance.

Downloads

References

[1] A. Eltweri, N. Sawan, K. Al-Hajaya, and Z. Badri, “The Influence of Liquidity Risk on Financial Performance: A Study of the UK’s Largest Commercial Banks,” J. Risk Financ. Manag., vol. 17, no. 12, p. 580, Dec. 2024, doi: https://doi.org/10.3390/jrfm17120580.

[2] P. Kotsios, “Central Banking in Modern Democracies: Private vs. Public Control,” Rev. Econ. Anal., vol. 11, no. 2, pp. 233–254, Dec. 2019, doi: https://doi.org/10.15353/rea.v11i2.1627.

[3] M. Ichsan, F. Fitriyanti, K. R. Setiorini, and A. M. Al-Qudah, “Digitalization of Islamic Banking in Indonesia: Justification and Compliance to Sharia Principles,” J. Media Huk., vol. 31, no. 2, pp. 244–261, Sep. 2024, doi: https://doi.org/10.18196/jmh.v31i2.22485.

[4] Y. Barghathi, D. Collison, and L. Crawford, “Earnings Management Ethics: Stakeholders’ Perceptions,” in Research on Professional Responsibility and Ethics in Accounting, Emerald Publishing, 2020, pp. 161–177. doi: https://doi.org/10.1108/S1574-076520200000023009.

[5] E. Smolo and R. Nagayev, “Finance – growth nexus: evidence from systemically important Islamic finance countries,” J. Islam. Account. Bus. Res., vol. 15, no. 4, pp. 684–700, Mar. 2024, doi: https://doi.org/10.1108/JIABR-01-2022-0020.

[6] H. Mirashk, A. Albadvi, M. Kargari, and M. A. Rastegar, “News Sentiment and Liquidity Risk Forecasting: Insights from Iranian Banks,” Risks, vol. 12, no. 11, p. 171, Oct. 2024, doi: https://doi.org/10.3390/risks12110171.

[7] S. Ghosh, “Social unrest and bank liquidity creation: evidence from MENA banks,” J. Financ. Econ. Policy, vol. 16, no. 6, pp. 762–777, Nov. 2024, doi: https://doi.org/10.1108/JFEP-09-2023-0257.

[8] A. Delle Foglie and J. S. Keshminder, “Challenges and opportunities of SRI sukuk toward financial system sustainability: a bibliometric and systematic literature review,” Int. J. Emerg. Mark., vol. 19, no. 10, pp. 3202–3225, Oct. 2024, doi: https://doi.org/10.1108/IJOEM-04-2022-0601.

[9] M. N. R. Al Arif, D. N. Ihsan, and Zulpawati, “Understanding the Impact of Conversion on Profitability in Islamic Banks,” Iran. Econ. Rev., vol. 28, no. 4, pp. 1382–1395, 2024, doi: https://doi.org/10.22059/ier.2024.356287.1007663.

[10] S. Mseddi, “International issuance of Sukuk and companies’ systematic risk: An empirical study,” Borsa Istanbul Rev., vol. 23, no. 3, pp. 550–579, May 2023, doi: https://doi.org/10.1016/j.bir.2022.12.007.

[11] N. S. Abdel Megeid, “Liquidity risk management: conventional versus Islamic banking system in Egypt,” J. Islam. Account. Bus. Res., vol. 8, no. 1, pp. 100–128, Feb. 2017, doi: https://doi.org/10.1108/JIABR-05-2014-0018.

[12] N. Khatir and H. Madani, “The impact of digital transformation on achieving outstanding performance in educational administration,” Int. J. Educ. Manag., vol. 38, no. 7, pp. 1821–1838, Dec. 2024, doi: https://doi.org/10.1108/IJEM-06-2023-0289.

[13] A. Aswad, J. Purnami, A. Pratama, and A. B. M. Fuzi, “Is Islamic Monetary System Possible in Indonesia? Interrelation Study between BI 7 Days Reverse Repo Rate and Nisbah Rate,” Suhuf Int. J. Islam. Stud., vol. 36, no. 1 SE-Articles, pp. 12–20, May 2024, doi: https://doi.org/10.23917/suhuf.v36i1.4339.

[14] K. A. Dirie, M. M. Alam, and S. Maamor, “Islamic social finance for achieving sustainable development goals: a systematic literature review and future research agenda,” Int. J. Ethics Syst., vol. 40, no. 4, pp. 676–698, Dec. 2024, doi: https://doi.org/10.1108/IJOES-12-2022-0317.

[15] F. A. S. Rezeki et al., “Does Islamic Banking Contribute to Increasing Public Welfare? Evidence from Indonesian Province Panel Data,” Suhuf Int. J. Islam. Stud., vol. 36, no. 1 SE-Articles, pp. 33–43, May 2024, doi: https://doi.org/10.23917/suhuf.v36i1.4474.

[16] I. Cardinale, “Vulnerability, Resilience and ‘Systemic Interest’: a Connectivity Approach,” Networks Spat. Econ., vol. 22, no. 3, pp. 691–707, Sep. 2022, doi: https://doi.org/10.1007/s11067-019-09462-9.

[17] M. Murimbika and B. Urban, “Institutional and self-efficacy effects on systemic entrepreneurship: evidence from South Africa,” J. Small Bus. Entrep., vol. 35, no. 2, pp. 284–305, Mar. 2023, doi: 10https://doi.org/.1080/08276331.2020.1764739.

[18] T.-Y. Chen, W.-L. Lo, and L.-C. Kuo, “Medical students’ perception of a unique humanistic mentoring program in a religious university: a convergent parallel mixed methods study,” BMC Med. Educ., vol. 24, no. 1, p. 1532, Dec. 2024, doi: https://doi.org/10.1186/s12909-024-06547-z.

[19] J. Nugroho and A. Darwanto, “Transfer of Ownership in State Retail Sukuk: Shariah Review Based on DSN-MUI Fatwa and AAOIFI Sharia Standards,” Suhuf Int. J. Islam. Stud., vol. 37, no. 1 SE-Articles, pp. 211–224, May 2025, doi: https://doi.org/10.23917/suhuf.v37i1.8114.

[20] N. Hidayat, M. Anshari, and R. Setiawan, “Digitalization and diversification strategies for effective bank liquidity management in emerging markets,” Edelweiss Appl. Sci. Technol., vol. 8, no. 6, pp. 559–571, Oct. 2024, doi: https://doi.org/10.55214/25768484.v8i6.2128.

[21] A. Fariana and P. S. Nadya, “Elevating Investment Confidence,” in Innovative Ventures and Strategies in Islamic Business, 2024, pp. 157–168. doi: https://doi.org/10.4018/979-8-3693-3980-0.ch007.

[22] S. Ahmad, R. Lensink, and A. Mueller, “The double bottom line of microfinance: A global comparison between conventional and Islamic microfinance,” World Dev., vol. 136, p. 105130, Dec. 2020, doi: https://doi.org/10.1016/j.worlddev.2020.105130.

[23] J. Hurani, M. K. Abdel-Haq, and E. Camdzic, “FinTech Implementation Challenges in the Palestinian Banking Sector,” Int. J. Financ. Stud., vol. 12, no. 4, p. 122, Dec. 2024, doi: https://doi.org/10.3390/ijfs12040122.

[24] A. Hefetz, “Capturing Regulation Under Imperial Rule: The Regulation of Palestine’s Banking Sector,” Enterp. Soc., vol. 25, no. 3, pp. 762–788, Sep. 2024, doi: https://doi.org/10.1017/eso.2023.11.

[25] Y. J. Amuda and S. A. Al-Nasser, “Exploring encounters and prodigies of Islamic banks in non-Muslim states: towards enhancing regulatory frameworks of Islamic banking system,” Int. J. Law Manag., Nov. 2024, doi: https://doi.org/10.1108/IJLMA-11-2023-0250.

[26] F. O. Elmahgop, “Intellectual Capital and Bank Stability in Saudi Arabia: Navigating the Dynamics in a Transforming Economy,” Sustainability, vol. 16, no. 10, p. 4226, May 2024, doi: https://doi.org/10.3390/su16104226.

[27] V. Macchiati, G. Brandi, T. Di Matteo, D. Paolotti, G. Caldarelli, and G. Cimini, “Systemic liquidity contagion in the European interbank market,” J. Econ. Interact. Coord., vol. 17, no. 2, pp. 443–474, 2022, doi: https://doi.org/10.1007/s11403-021-00338-1.

[28] G. Ferrara, S. Langfield, Z. Liu, and T. Ota, “Systemic illiquidity in the interbank network,” Quant. Financ., vol. 19, no. 11, pp. 1779–1795, Nov. 2019, doi: https://doi.org/10.1080/14697688.2019.1612083.

[29] C. Huang, S. Tan, L. Li, and J. Cao, “Interbank complex network and liquidity creation: Evidence from European banks,” Math. Biosci. Eng., vol. 20, no. 11, pp. 19416–19437, 2023, doi: https://doi.org/10.3934/mbe.2023859.

[30] P. Rizkiningsih, C. Cintokowati, R. Swandaru, A. Muneeza, and M. K. Hassan, “The role of multilateral organizations in the development of Islamic finance in Asia,” in Islamic Finance in Eurasia, Edward Elgar Publishing, 2024, pp. 163–184. doi: https://doi.org/10.4337/9781035308705.00017.

[31] Q. A. Vo, “Interactions of capital and liquidity requirements: A review of the literature,” SSRN Electron. J., 2021, doi: https://dx.doi.org/10.2139/ssrn.3829231.

[32] M. W. Shongwe, “Evaluating Macroeconomic Policy Strategies for Managing Liquidity Surpluses in Africa,” SSRN Electron. J., 2025, doi: https://dx.doi.org/10.2139/ssrn.5417574.

[33] V. Rudevska, I. Boyarko, A. Shcherbyna, O. Sydorenko, I. Koblyk, and O. Ponomarоva, “The Impact Of The Banking System Liquidity On The Volume Of Lending And Investment In Government Securities During The War,” Financ. Credit Act. Probl. theory Pract., vol. 1, no. 54, pp. 37–50, Feb. 2024, doi: https://doi.org/10.55643/fcaptp.1.54.2024.4283.

[34] A. Bhaduri and S. Raghavendra, “Financial Growth and Crash under Shadow Banking,” Rev. Polit. Econ., vol. 36, no. 3, pp. 1156–1173, Jul. 2024, doi: https://doi.org/10.1080/09538259.2022.2099667.

[35] K. B. Akhmedjanov and I. S. Musakhonzoda, “Financial Performance Management System as a Factor of Efficiency of a Balanced Financial Management System,” J. Adv. Res. Dyn. Control Syst., vol. 12, no. 5, pp. 301–310, May 2020, doi: https://doi.org/10.5373/JARDCS/V12I5/20201718.

[36] O. E. Olalere, M. A. Islam, W. S. Yusoff, K. H. K. Ariffin, and M. Kamruzzaman, “The moderating role of financial innovation on financial risks, business risk and firm value nexus: Empirical evidence from Nigeria,” in AIP Conference Proceedings, 2021, p. 020108. doi: https://doi.org/10.1063/5.0045082.

[37] A. Alam, R. S. Nizam, and M. T. Hidayat, “The Role of Islamic Microfinance Institution in Empowering Indonesian Fishing Communities,” Univers. J. Account. Financ., vol. 9, no. 2, pp. 178–183, Apr. 2021, doi: https://doi.org/10.13189/ujaf.2021.090205.

[38] A. Muneeza and Z. Mustapha, “Blockchain and Its Shariah Compliant Structure,” Halal Cryptocurrency Manag., pp. 69–106, 2019, doi: http://dx.doi.org/10.1007/978-3-030-10749-9_6.

[39] M. M. Billah, “Shari’ah Paradigm of Risk Management,” Halal Cryptocurrency Manag., pp. 301–308, 2019, doi: http://dx.doi.org/10.1007/978-3-030-10749-9_19.

[40] J. Rafia, M. Ziky, and N. El Hamidi, “Ṣukūk al-Muḍārabah as a Financing and Liquidity Management Tool for Islamic Banks in Morocco: Exploratory Analysis of Expectations and Obstacles,” ISRA Int. J. Islam. Financ., vol. 16, no. 2, Jun. 2024, doi: https://doi.org/10.55188/ijif.v16i2.667.

[41] U. Can and M. E. Bocuoglu, “Evolution of Islamic liquidity management in Turkey,” Int. J. Islam. Middle East. Financ. Manag., vol. 15, no. 4, pp. 788–810, Aug. 2022, doi: https://doi.org/10.1108/IMEFM-10-2020-0506.

[42] A. Nasir, U. Farooq, K. I. Khan, and A. A. Khan, “Congruity or dispel? A segmented bibliometric analysis of Sukuk structures,” Int. J. Islam. Middle East. Financ. Manag., vol. 16, no. 2, pp. 343–365, Mar. 2023, doi: https://doi.org/10.1108/IMEFM-07-2021-0282.

[43] H. A. Alotaibi, “Examining the Integration of Legal and Shariah Principles In the London Metal Exchange,” J. Ecohumanism, vol. 3, no. 3, pp. 1346–1360, Aug. 2024, doi: https://doi.org/10.62754/joe.v3i3.3608.

[44] A. Haruna, H. T. Oumbé, and A. M. Kountchou, “What determines the adoption of Islamic finance products in a non-Islamic country? Empirical evidence from Cameroonian small- and medium-sized enterprises,” J. Islam. Mark., vol. 15, no. 5, pp. 1253–1279, Apr. 2024, doi: https://doi.org/10.1108/JIMA-08-2023-0234.

[45] S. Khandelwal and K. Aljifri, “Risk sharing vs risk shifting: a comparative study of Islamic banks,” J. Islam. Account. Bus. Res., vol. 12, no. 8, pp. 1105–1123, Nov. 2021, doi: https://doi.org/10.1108/JIABR-08-2018-0121.

[46] S. Suratkar, M. Shirole, and S. Bhirud, “Cryptocurrency Wallet: A Review,” 2020 4th Int. Conf. Comput. Commun. Signal Process., 2020, doi: 10.1109/icccsp49186.2020.9315193.

[47] R. A. Abdalla, H. K. Alaaraj, and G. S. Mulla, “The Contribution of Islamic Banking and Finance to the Sustainable Development Goals of 2030,” in Sustainable Innovations in Management in the Digital Transformation Era, London: Routledge, 2024, pp. 249–261. doi: https://doi.org/10.4324/9781003450238-25.

Downloads

Submitted

Accepted

Published

How to Cite

Issue

Section

License

Copyright (c) 2025 Muhammad Youssef Al-Deek

This work is licensed under a Creative Commons Attribution 4.0 International License.