Fiqh for Minority (Fiqh al-Aqalliyyāt): Principle and Current Practice on Food and Mortgage Finance

DOI:

https://doi.org/10.23917/suhuf.v37i2.11207Keywords:

Fiqh for minorities, Fiqh al-Aqalliyyat, Muslim minority, Mortgage, Sharia complianceAbstract

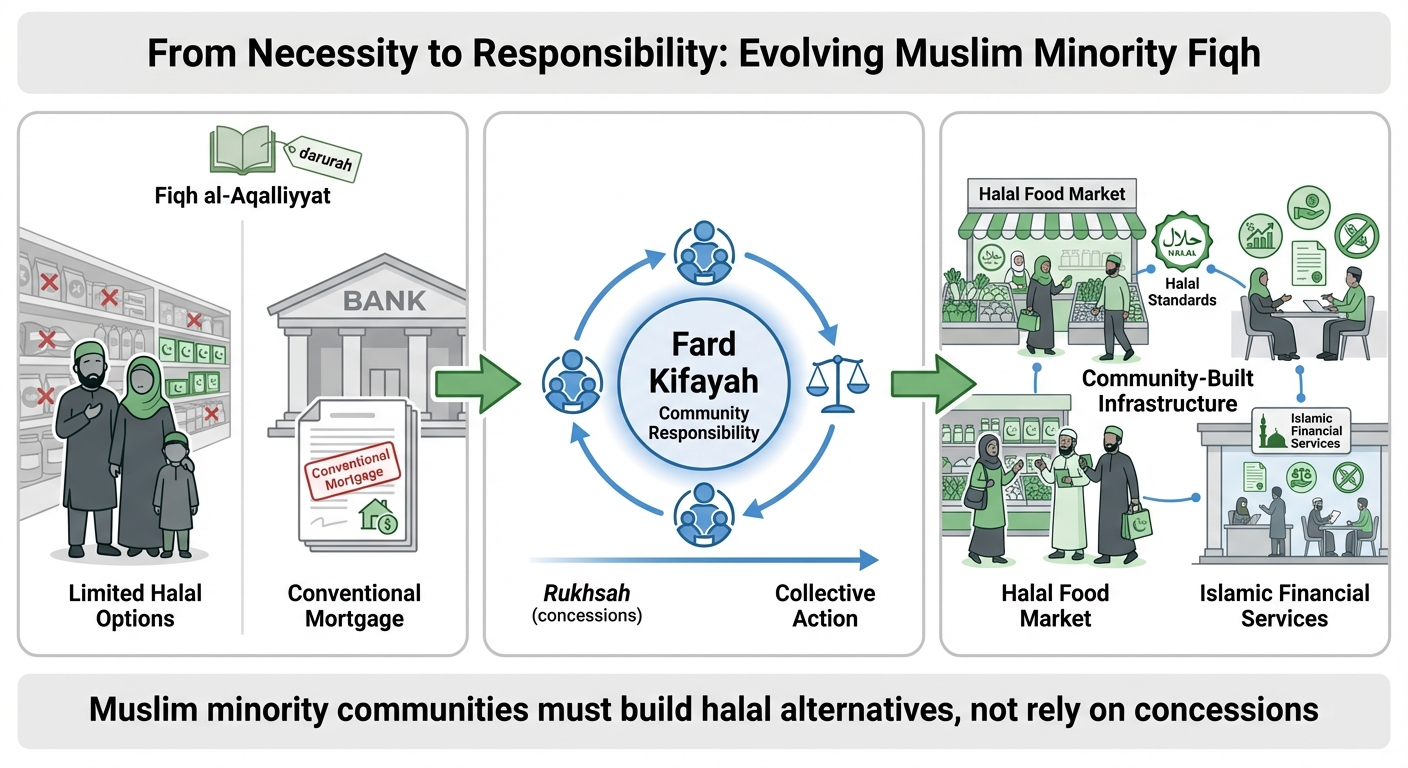

This paper examines Fiqh al-Aqalliyyat (Fiqh for Minorities), focusing on food and mortgage finance, and questions whether the principle of darurah (necessity) central to this jurisprudence remains valid today. Through library-based research, it analyzes foundational concepts primarily drawn from Yusuf al-Qaradawi’s work and contrasts them with contemporary realities. Over two decades since Fiqh al-Aqalliyyat emerged in 2003, halal food accessibility and Islamic finance options remain limited for Muslim minorities in non-Muslim-majority countries. While the fiqh offers legal concessions (rukhsah), it does not absolve Muslims of their duty to conduct muamalah (transactions) in line with Sharia. The study argues that establishing halal infrastructure and Sharia-compliant financial systems is a fard kifayah, a communal obligation. Neglecting this duty implicates the entire community in shared sin. Thus, the paper urges Muslim minorities to move beyond reliance on concessions and actively build halal alternatives. At minimum, raising awareness about halal standards and Islamic finance is an essential collective responsibility. This serves as a timely reminder that necessity should not become complacency.

Downloads

References

[1] A. Abubakar Muhammad, A. Ibrahim, A. A. Yakub, H. Khan, and N. Hamzah, “The Role of Islamic Finance in Promoting Economic Justice and Financial Inclusion among Marginalised Communities,” Suhuf Int. J. Islam. Stud., vol. 37, no. 1 SE-Articles, pp. 58–68, May 2025, doi: https://www.doi.org/10.23917/suhuf.v37i1.10167.

[2] M. N. Maarif, S. Munir, H. Towpek, and I. Zulqarnain, “Optimization of Welfare State Policy for the Development of Halal Industry in the Framework of Sharia Economy,” Suhuf, vol. 37, no. 1, pp. 1–15, May 2025, doi: https://www.doi.org/10.23917/suhuf.v37i1.9195.

[3] N. Nurhayati, “Fikih Minoritas: Suatu Kajian Teoretis,” AHKAM J. Ilmu Syariah, vol. 13, no. 2, Aug. 2013, doi: https://doi.org/10.15408/ajis.v13i2.932.

[4] Y. Qardhawi, “Fiqh of Muslim Minorities contentious issues & recommended solutions (englih version),” 2003, Al Falah Foundation.

[5] T. J. Al-Alwani and A. A. Shamis, Towards a Fiqh for Minorities: Some Basic Reflections. in Occasional papers. International Institute of Islamic Thought, 2010. [Online]. Available: https://books.google.co.id/books?id=NZrkD0gkY90C

[6] M. Wahib, “Implementation of the Minority Fiqh Concept for the Papuan Muslim Community/Implementasi Konsep Fikih Minoritas Bagi Komunitas Muslim Papua,” Jure J. Huk. dan Syar’iah, vol. 13, no. 1, Jul. 2021, doi: https://doi.org/10.18860/j-fsh.v13i1.11930.

[7] Z. Mun’im, “Peran Kaidah Fikih dalam Aktualisasi Hukum Islam: Studi Fatwa Yusuf Al-Qaradawi tentang Fiqh Al-Aqalliyat [The Role of Legal Maxims in the Actualization of Islamic Law: A Study of Yusuf Al-Qaradawi’s Fatwa on Fiqh al-Aqalliyat],” Al-Manahij J. Kaji. Huk. Islam, vol. 15, no. 1, pp. 151–172, (Indonesia), Jun. 2021, doi: https://doi.org/10.24090/mnh.v15i1.4546.

[8] A. Sahidin, “The Implementation of Maqāṣid al-Sharī‘ah in Shaykh Yusuf al-Qaradawi’s Fiqh al-Aqalliyyāt,” J. Huk. Islam, vol. 19, no. 2, pp. 295–312, Dec. 2021, doi: https://doi.org/10.28918/jhi.v19i2.4997.

[9] K. Aibak, Metodologi Pembaharuan Hukum Islam. Pustaka Pelajar, 2008.

[10] Z. Rasam, M. L. Zuhdi, and Shobichatul Aminah, “Fiqh Aqalliyah as a Legal alternative to Halal Standardization in Japan as a non-Majority Muslim Country,” Indones. J. Islam Muslim Soc., vol. 14, no. 1, pp. 177–202, Jul. 2024, doi: https://doi.org/10.18326/ijims.v14i1.177-202.

[11] A. Saeed, “13 Reflections on the Development of the Discourse of Fiqh for Minorities and Some of the Challenges it Faces,” in Applying Sharia in the West: Facts, Fears and the Future of Islamic Rules on Family Relations in the West, M. Berger, Ed., Leiden University Press, 2013, pp. 241–256. doi: https://doi.org/10.1515/9789400601055-014.

[12] B. Ibrahim, M. A. M. Yusuf, and F. Khairi, “The Importance of Considering the Desire (Hajat) and Emergency (Darurat) in Fatwa Related to Basic Needs of Muslim Minority,” Int. J. Acad. Res. Bus. Soc. Sci., vol. 8, no. 10, Oct. 2018, doi: https://doi.org/10.6007/IJARBSS/v8-i10/4744.

[13] L. Zakariyah, “Legal Maxims and Islamic Financial Transactions: A Case Study of Mortgage Contracts and the Dilemma for Muslims in Britain,” Arab Law Q., vol. 26, no. 3, pp. 255–285, 2012, doi: https://doi.org/10.1163/15730255-12341240.

[14] D. Taha, “Muslim Minorities in the West: Between Fiqh of Minorities and Integration,” Electron. J. Islam. Middle East. Law, vol. 1, pp. 1–36, May 2013, doi: https://doi.org/10.5167/uzh-7759310.5167/uzh-77593.

[15] T. Brekke and M. Larsen, “Allah, Villa, Volvo: Muslim Professionals in the Nordic Countries and Their Financial Attitudes and Practices,” Open Libr. Humanit., vol. 6, no. 2, Jul. 2020, doi: https://doi.org/10.16995/olh.570.

[16] S. Whyte, “Whither Minority Jurisprudence?,” Aust. J. Islam. Stud., vol. 2, no. 3, pp. 55–75, Oct. 2017, doi: https://doi.org/10.55831/ajis.v2i3.59.

[17] S. Chiu, R. Newberger, and A. Paulson, “Islamic Finance in the United States: A Small but Growing Industry,” 2005, Federal Reserve Bank of Chicago, Chicago. [Online]. Available: https://www.chicagofed.org/publications/chicago-fed-letter/2005/may-214

[18] JIC, “Begini Terobosan Pelaku Industri Keuangan Syariah di Amerika Serikat [Innovative Developments by Islamic Finance Industry Practitioners in the United States],” Jakarta Islamic Centre. Accessed: Aug. 20, 2025. [Online]. Available: https://islamic-center.or.id/begini-terobosan-pelaku-industri-keuangan-syariah-di-amerika-serikat/

[19] M. Z. Mughal, “The Development of Islamic Finance in the USA: A Journey of Growth and Opportunity,” Financial IT. Accessed: Aug. 20, 2025. [Online]. Available: https://financialit.net/blog/islamicfinance-usa/development-islamic-finance-usa-journey-growth-and-opportunity

[20] F. Company, “Halal Mortage are Becoming popular in America,” Fast Company. Accessed: Aug. 20, 2020. [Online]. Available: https://www.fastcompany.com/91191616/halal-mortgages-america-islam-muslims-explained

[21] S. Tahsin, “Home price growth and minority access to mortgage credit,” J. Econ. Bus., vol. 120, p. 106056, May 2022, doi: https://doi.org/10.1016/j.jeconbus.2022.106056.

[22] R. Jeffrey, G. Pires, and P. J. Rosenberger III, “Home loans and Muslims – an Australian perspective,” J. Islam. Mark., vol. 15, no. 9, pp. 2181–2197, Jun. 2024, doi: https://doi.org/10.1108/JIMA-12-2023-0392.

[23] K. Górak-Sosnowska, M. Pachocka, and J. Misiuna, Muslim Minorities and the Refugee Crisis in Europe. Warszawa: SGH PUBLISHING HOUSE, 2019.

Downloads

Submitted

Accepted

Published

How to Cite

Issue

Section

License

Copyright (c) 2025 Afief El Ashfahany, Muhamad Subhi Apriantoro, Aminudin Maruf

This work is licensed under a Creative Commons Attribution 4.0 International License.