The Role of Islamic Finance in Promoting Economic Justice and Financial Inclusion among Marginalised Communities

DOI:

https://doi.org/10.23917/suhuf.v37i1.10167Keywords:

Economic justice , Financial inclusion , Islamic finance, Marginalised communities, MudarabahAbstract

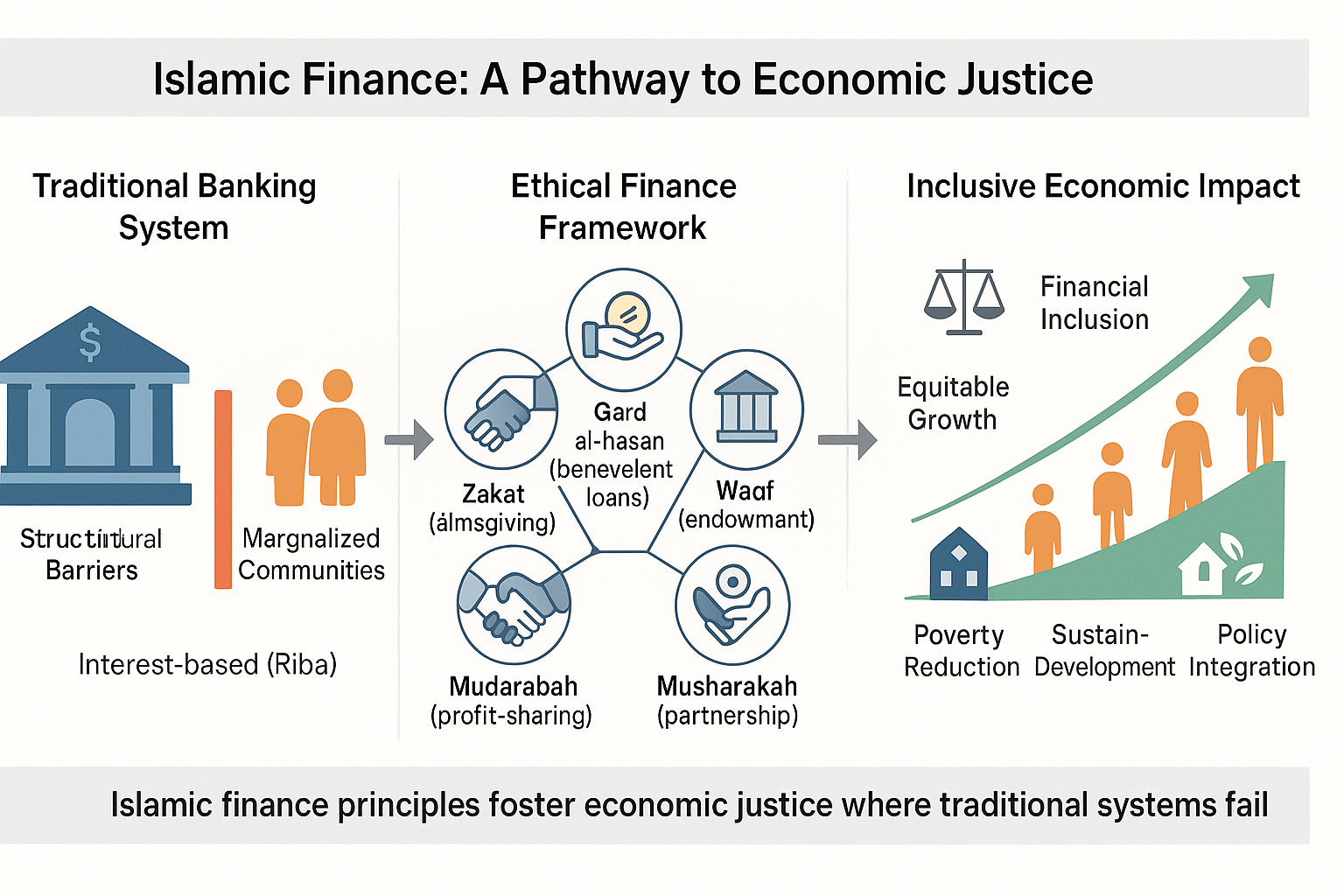

The unique framework provided by Islamic banking and finance, which is based on social welfare, equity, and moral principles that forbid exploitative practices like interest (riba), makes it particularly pertinent to underprivileged groups that experience structural economic marginalization. Because of structural obstacles and a lack of trust, many vulnerable groups continue to be neglected by traditional financial institutions, even in spite of the expansion of financial inclusion initiatives. The purpose of this study is to investigate the ways in which Islamic financial instruments, including qard al-hasan (benevolent loans), zakat (almsgiving), waqf (endowment), and profit-and-loss sharing models like mudarabah and musharakah, can be used to advance economic justice and increase financial inclusion in these communities. Purposive sampling, case study analysis, content analysis, and documentary/secondary data are all used in this qualitative study to examine how Islamic Financial Institutions (IFIs) contribute to inclusive growth. Thematic analysis is employed to find trends and evaluate the success of Islamic finance projects relative to traditional financial methods. According to preliminary research, Islamic finance's ethical investment practices, wealth redistribution, and risk-sharing all greatly enhance social justice and economic empowerment. Conclusion: The study comes to the conclusion that incorporating Islamic finance into national financial inclusion plans can be a long-term solution to combat poverty and promote equitable growth. It also makes policy suggestions to fortify its institutional and legal foundation. Economic justice and financial inclusion for underserved populations can be greatly improved by incorporating Islamic banking concepts into national financial systems.

Downloads

References

[1] Y. Ibrahim and S. Yahya, “Determinants of Islamic and conventional banks profitability: a contingency approach,” Asian J. Bus. Account., vol. 14, no. 2, pp. 279–319, 2021, doi: https://doi.org/10.22452/ajba.vol14no2.10.

[2] A. A. Muhammad, A. A. Fatimah, and G. S. Kawu, “The Success of Entrepreneurship Education in Tafarkin Tsira Islamic Center Azare of Bauchi State, Nigeria,” Nepal. J. Manag. Sci. Res., vol. 7, no. 1, pp. 76–87, 2024, [Online]. Available: https://www.nepjol.info/index.php/njmsr/article/view/64610

[3] M. A. Siddique, M. Haq, and M. Rahim, “The Contribution of Shariah-Compliant Products to SDGs Attending Through the Pace of Economic Growth: An Empirical Evidence from Pakistan,” Int. J. Islam. Middle East. Financ. Manag., vol. 15, no. 4, pp. 681–698, 2022, doi: https://doi.org/10.1108/IMEFM-02-2020-0062.

[4] M. Bitar, K. Pukthuanthong, and T. Walker, “Efficiency in Islamic vs. conventional banking: The role of capital and liquidity,” Glob. Financ. J., vol. 46, p. 100487, 2020, doi: https://doi.org/10.1016/j.gfj.2019.100487.

[5] H. A. Hussaini, A. A. Muhammad, Z. J. Muhammad, and S. A. Aliyu, “Methodological Approach of Reviving Zakat and Waqf Institutions in Bauchi and Gombe States Nigeria: The Way Forward,” J. Islam. Econ. Philanthr., vol. 7, no. 2, pp. 71–84, 2024, [Online]. Available: https://ejournal.unida.gontor.ac.id/index.php/JIEP/article/view/12785

[6] A. M. Ardo, A. A. Muhammad, M. B. Adam, S. A. Aliyu, and Z. J. Muhammad, “The Legal Framework of Waqf and Its Role in Modern Economic Development in Nigeria,” Ahlika J. Huk. Kel. dan Huk. Islam, vol. 1, no. 2, pp. 162–178, 2024, doi: https://doi:10.70742/ahlika.v1i2.109.

[7] A. A. Farah, M. A. Mohamed, M. Ali Farah, I. A. Yusuf, and M. S. Abdulle, “Impact of Islamic banking on economic growth: a systematic review of SCOPUS-indexed studies (2009–2024),” Cogent Econ. Financ., vol. 13, no. 1, p. 2490819, 2025, doi: https://doi.org/10.1080/23322039.2025.2490819.

[8] N. A. Abasimel, “Islamic banking and economics: concepts and instruments, features, advantages, differences from conventional banks, and contributions to economic growth,” J. Knowl. Econ., vol. 14, no. 2, pp. 1923–1950, 2023, doi: https://doi.org/10.1007/s13132-022-00940-z.

[9] A. A. Razak and M. Asutay, “Financial inclusion and economic well-being: Evidence from Islamic Pawnbroking (Ar-Rahn) in Malaysia,” Res. Int. Bus. Financ., vol. 59, p. 101557, 2022, doi: https://doi.org/10.1016/j.ribaf.2021.101557.

[10] S. Alhammadi, “Analyzing the role of Islamic finance in Kuwait regarding sustainable economic development in COVID-19 era,” Sustainability, vol. 14, no. 2, p. 701, 2022, doi: https://doi.org/10.3390/su14020701.

[11] M. Ali, S. H. Hashmi, M. R. Nazir, A. Bilal, and M. I. Nazir, “Does financial inclusion enhance economic growth? Empirical evidence from the IsDB member countries,” Int. J. Financ. Econ., vol. 26, no. 4, pp. 5235–5258, 2021, doi: https://doi.org/10.1002/ijfe.2063.

[12] M. M. Alshater, M. K. Hassan, A. Khan, and I. Saba, “Influential and intellectual structure of Islamic finance: a bibliometric review,” Int. J. Islam. Middle East. Financ. Manag., vol. 14, no. 2, pp. 339–365, 2021, doi: https://doi.org/10.1108/IMEFM-08-2020-0419.

[13] S. N. Azizah, “The adoption of FinTech and the legal protection of the digital assets in Islamic/Sharia banking linked with economic development: A case of Indonesia,” J. World Intellect. Prop., vol. 26, no. 1, pp. 30–40, 2023, doi: https://doi.org/10.1111/jwip.12257.

[14] A. Chazi, A. Mirzaei, Z. Zantout, and A. S. Azad, “Does the size of Islamic banking matter for industry growth: international evidence,” Appl. Econ., vol. 52, no. 4, pp. 361–374, 2020, doi: https://doi.org/10.1080/00036846.2019.1645288.

[15] Y. J. Amuda and S. Elshaarawy, “Utilization of Islamic Financial Instruments for Poverty Reduction and Sustainable Households in Nigeria,” J. Ecohumanism, vol. 3, no. 4, pp. 595–607, 2024, doi: https://doi.org/10.62754/joe.v3i4.3485.

[16] A. A. Muhammad, A. M. A. Ardo, S. A. Aliyu, and Z. J. Muhammad, “Waqf as an Islamic Endowment: A Solution for Improving Educational Attainment in Northern Nigerian Communities,” ITQAN J. Islam. Econ. Manag. Financ., vol. 4, no. 1, pp. 44–50, 2025, doi: https://doi.org/10.57053/itqan.v4i1.58.

[17] Y. Cai, Z. Huang, and X. Zhang, “FinTech adoption and rural economic development: Evidence from China,” Pacific-Basin Financ. J., vol. 83, no. February, p. 102264, 2024, doi: https://doi.org/10.1016/j.pacfin.2024.102264.

[18] J. Boukhatem and F. Ben Moussa, “The effect of Islamic banks on GDP growth: Some evidence from selected MENA countries,” Borsa Istanbul Rev., vol. 18, no. 3, pp. 231–247, 2018, doi: https://doi.org/10.1016/j.bir.2017.11.004.

[19] F. Chiad and A. Gherbi, “The role of Islamic banks in promoting economic growth and financial stability: Evidence from Saudi Arabia,” Munich Pers. RePEc Arch., vol. 21, no. 3, pp. 1–15, 2024, doi: https://doi.org/10.21511/imfi.21(3).2024.29.

[20] S. A. A. Shah, R. Sukmana, and B. A. Fianto, “Efficiencies in Islamic banking: a bibliometric and theoretical review,” Int. J. Product. Qual. Manag., vol. 32, no. 4, pp. 458–501, 2021, doi: https://doi.org/10.1504/IJPQM.2021.114268.

[21] I. Setyawati, S. Karyatun, D. T. Awaludin, and K. Wiweka, “Stability and resilience of Islamic banking system: A closer look at the macroeconomic effects,” Calitatea, vol. 23, no. 187, pp. 295–304, 2022, doi: https://doi.org/10.47750/QAS/23.187.36.

[22] I. D. Idriss, M. R. M. Nor, A. A. Muhammad, and A. I. Barde, “A Study on the Historical Development of Tsangaya System of Islamic Education in Nigeria: A Case Study of Yobe State,” Umr. Islam. Civilizational Stud., vol. 9, no. 2, pp. 59–71, 2022, doi: https://doi.org/10.11113/umran2022.9n2.553.

[23] S. A. Shaikh, “Financial inclusiveness in Islamic banking in Pakistan: A comparison of ideas and practices,” J. Muamalat Islam. Financ. Res., pp. 51–71, 2018, doi: https://doi.org/10.33102/jmifr.v15i1.100.

[24] T. Suri, “Mobile money,” Annu. Rev. Econom., vol. 9, no. 1, pp. 497–520, 2017, doi: https://doi.org/10.1146/annurev-economics-063016-103638.

[25] E. Smolo, M. H. Ibrahim, and G. Dewandaru, “Impact of bank concentration and financial development on growth volatility: the case of selected OIC countries,” Emerg. Mark. Financ. Trade, vol. 57, no. 7, pp. 2094–2106, 2021, doi: https://doi.org/10.1080/1540496X.2021.1903869.

[26] M. H. Zainuldin, “A bibliometric analysis of CSR in the banking industry : a decade study based on Scopus scientific mapping,” vol. 40, no. 1, pp. 1–26, 2022, doi: 10.1108/IJBM-04-2020-0178.

[27] D. A. Karimah, M. B. Pamuncak, and M. K. Mubin, “The Role of Waqf in Supporting Sustainable Development Goals: Linking Theory and its Practices,” Suhuf Int. J. Islam. Stud., vol. 35, no. 2, pp. 31–38, 2022, doi: https://doi.org/10.23917/suhuf.v35i2.23018.

[28] V. Swamy, “Financial inclusion, gender dimension, and economic impact on poor households,” World Dev., vol. 56, pp. 1–15, 2014, doi: https://doi:10.1016/j.worlddev.2013.10.019.

[29] A. Aryati, J. Junaidi, and R. A. Putra, “Financial Development and Economic Growth: Evidence from Indonesia Before and After the COVID-19 Pandemic,” Экономика региона, vol. 19, no. 4, pp. 1263–1274, 2023, doi: https://doi.org/10.17059/ekon.reg.2023-4-23.

[30] W. Jauhari, A. W. A. Muhaimin, and M. D. A. Khan, “Implementation of The Concept of’Urf and Maslahah in Buying and Selling Gold With Non-Cash Payment (Comparative Study of Fatwa DSN-MUI and Fatwa Al-Lajnah Ad Dāimah Li Al-Buhūṡ Al-‘Ilmiyyah Wa Al-Iftā’Saudi Arabia),” Suhuf Int. J. Islam. Stud., vol. 35, no. 1, pp. 54–65, 2023, doi: https://doi.org/10.23917/suhuf.v35i1.22638.

[31] S. M. Anwar, J. Junaidi, S. Salju, R. Wicaksono, and M. Mispiyanti, “Islamic Bank Contribution to Indonesian Economic Growth,” Int. J. Islam. Middle East. Financ. Manag., vol. 13, no. 3, pp. 519–532, 2020, doi: https://doi.org/10.1108/IMEFM-02-2018-0071.

[32] M. A. Khattak and N. A. Khan, “Islamic finance, growth, and volatility: a fresh evidence from 82 countries,” J. Islam. Monet. Econ. Financ., vol. 9, no. 1, pp. 39–56, 2023, doi: https://doi.org/10.21098/jimf.v9i1.1625.

[33] A. A. Alsmadi, “Beyond compliance: exploring the synergy of Islamic Fintech and CSR in fostering inclusive financial adoption,” Futur. Bus. J., vol. 11, no. 1, p. 7, 2025, doi: https://doi.org/10.1186/s43093-025-00430-z.

[34] S. Dewi and R. Febriamansyah, “The Role of Islamic Banking in Achieving Sustainable Development Goals (SDGs) in West Sumatera,” J. Ecohumanism, vol. 3, no. 4, pp. 3489–3502, 2024, doi: https://doi.org/10.62754/joe.v3i4.3866.

[35] E. R. Kismawadi, “Contribution of Islamic banks and macroeconomic variables to economic growth in developing countries: vector error correction model approach (VECM),” J. Islam. Account. Bus. Res., vol. 15, no. 2, pp. 306–326, 2024, doi: https://doi.org/10.1108/JIABR-03-2022-0090.

[36] Q. M. A. Eid, M. A. A. Al Houl, M. T. S. Alqudah, and M. A.-A. Almomani, “The role of financial inclusion in the stability of Islamic banks,” Int. J. Prof. Bus. Rev. Int. J. Prof. Bus. Rev., vol. 8, no. 4, p. 7, 2023, doi: https://doi.org/10.26668/businessreview/2023.v8i4.1214.

[37] E. Hariyanto, H. Harisah, M. Hamzah, F. Mujib, H. Hidayatullah, and C. L. Marheni, “In search of ummah welfare model: the revitalisation of sharia economic law in Indonesia,” Sriwij. Law Rev., vol. 7, no. 2, pp. 244–261, 2023, doi: https://doi.org/10.28946/slrev.Vol7.Iss2.1080.pp244-261.

[38] I. M. Gani and Z. Bahari, “Islamic Banking’s Contribution to the Malaysian Real Economy,” ISRA Int. J. Islam. Financ., vol. 13, no. 1, pp. 6–25, 2021, doi: https://doi.org/10.1108/IJIF-01-2019-0004.

[39] S. Kraus, M. Breier, and S. Dasí-Rodríguez, “The art of crafting a systematic literature review in entrepreneurship research,” Int. Entrep. Manag. J., vol. 16, no. February, pp. 1023–1042, 2020, doi: https://doi.org/10.1007/s11365-020-00635-4.

[40] I. D. B. Institute, “Annual Report 2021,” 2022. [Online]. Available: https://www.isdb.org/sites/default/files/media/documents/2022 10/IsDBI_AR21_EN_WEB_LR_30.5.22.pdf

Downloads

Submitted

Accepted

Published

How to Cite

Issue

Section

License

Copyright (c) 2025 Adamu Abubakar Muhammad, Aliyu Ibrahim, Abubakar Aliyu Yakub, Huma Khan, Namungo Hamzah

This work is licensed under a Creative Commons Attribution 4.0 International License.