Existence and Optimization of Zakat, Infaq, Sadaqah in Indonesia for Sustainable Development Goals (SDGs)

DOI:

https://doi.org/10.23917/profetika.v25i02.8424Keywords:

sustainable development goals (sdgs), zakat, infaq, sadaqah, islamic economicsAbstract

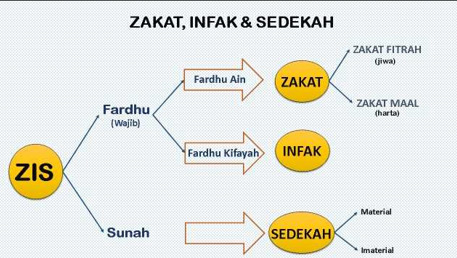

Objective: This study aims to analyze the development of the Zakat, Infaq, and Sadaqah (ZIS) system in Indonesia through a comprehensive literature review from a historical, legal, and social perspective. The main focus is to explore the evolution of ZIS as an instrument of wealth redistribution and social welfare in Islamic economics. In the context of rising poverty, unemployment, and other socio-economic challenges in modern Indonesia, this study evaluates the adaptation of traditional ZIS practices to contemporary needs, including their contribution to the Sustainable Development Goals (SDGs). Theoretical framework: The theoretical framework of this research is based on Islamic economic principles, especially those related to wealth redistribution, social justice, and poverty alleviation. Literature Review: The literature review includes an analysis of changes in the implementation of ZIS based on evolving legal frameworks, dynamic social expectations, and changing economic conditions. By bridging historical practices and modern demands, this study highlights the important role of ZIS in addressing poverty and inequality in Indonesia. Methods: The research method uses a qualitative approach through a systematic review of academic publications, government reports, and non-government studies. The data collected is analyzed to identify trends, challenges, and opportunities in the ZIS system. Results: The results show that despite progress in the institutionalization and modernization of ZIS in Indonesia, significant challenges remain. Key problems include inefficiencies in collection and distribution mechanisms, lack of public trust, and inadequate legal and regulatory frameworks. These factors hinder the effectiveness of ZIS in reaching vulnerable groups and maximizing their impact. Implications: The implications of this study include recommendations for policymakers, clerics, and Islamic financial institutions in creating a sustainable and equitable ZIS framework to address the issue of poverty and inequality. Novelty: The novelty of this study lies in the integration of historical, legal, and social perspectives in the analysis of the ZIS system in Indonesia. This research makes a unique contribution by offering a comprehensive understanding of the development and challenges of ZIS in meeting modern needs, as well as opening up further research opportunities for ZIS optimization in realizing social justice and global economic growth for sustainable development goals (SDGs).

References

S. East, N. Kailani, and M. Slama, “Accelerating Islamic charities in Indonesia : zakat, sedekah and the immediacy of social media Accelerating Islamic charities in Indonesia : zakat, sedekah and,” South East Asia Res., vol. 0, no. 0, pp. 1–17, 2019, https://doi.org/10.1080/0967828X.2019.1691939.

S. Hussain, “Taml ī k -proper to Quasi- taml ī k : Unconditional Cash Transfer ( UCT ) of Zakat Money, Empowering the Poor and Contemporary Modes of Distributing Zakat Money with Special Reference to British Muslim Charities,” 2021, https://doi.org/10.1080/13602004.2021.1894388.

F. Authors, “Corporate social responsibility and financial performance in Saudi Arabia Evidence from Zakat contribution Husam-Aldin Nizar Al-Malkawi,” 2018, https://doi.org/10.1108/MF-12-2016-0366.

F. Authors, “Corporate social responsibility, Waqf system and Zakat system as a faith-based model for poverty reduction,” 2014, https://doi.org/10.1108/WJEMSD-09-2013-0052.

E. Schaeublin and E. Schaeublin, “Islam in face-to-face interaction : direct zakat giving in Nablus ( Palestine ) Islam in face-to-face interaction : direct zakat giving in Nablus,” Contemp. Levant, vol. 00, no. 0, pp. 1–19, 2019, https://doi.org/10.1080/20581831.2019.1651559.

S. May, “Islamic Charitable Giving in the UK : A ‘ Radical ’ Economic Alternative ? Islamic Charitable Giving in the UK : A ‘ Radical ’ Economic,” New Polit. Econ., vol. 0, no. 0, pp. 1–13, 2019, https://doi.org/10.1080/13563467.2019.1664445.

D. M. Ross, “Muslim Charity under Russian Rule : Waqf, Sadaqa, and Zakat in Imperial Russia,” vol. 24, pp. 77–111, 2017, https://doi.org/10.1163/15685195-02412p04.

F. Authors, “Perceived Ihsan, Islamic egalitarian and Islamic religiosity towards charitable giving of cash waqf,” 2015.

E. Science, “Role of zakat in poverty reduction and food security,” 2019, https://doi.org/10.1088/1755-1315/343/1/012254.

F. Authors, “Journal of Islamic Accounting and Business Research,” 2016.

Y. Aziz, F. Mansor, S. Waqar, and L. H. Abdullah, “The nexus between zakat and poverty reduction, is the effective utilization of zakat necessary for achieving SDGs : A multidimensional poverty index approach,” no. September, pp. 235–247, 2020, https://doi.org/10.1111/aswp.12212.

“مدقت ثحب يف اهيلإ يأرل ا ص لخ يتلا ةيروفلا يفاني هب ءادد إ د هلف ، اعرد ةيب لا شافرد رتلا نآ ر قلا مومع يمع ناندع رمع . د . م . أ ر علا ةعماجلا رردصتك ادهيف رردصتلا ده ةيب ج تلا ي يلاد ةيمك مات ً ا ر,” vol. 44.

I. Ali and Z. A. Hatta, “Zakat as a Poverty Reduction Mechanism Among the Muslim Community : Case Study of Bangladesh, Malaysia, and Indonesia,” vol. 8, pp. 59–70, 2014, https://doi.org/10.1111/aswp.12025.

N. Arvas and S. Önder, “A Turkish İlmihâl belonging to Grand Vizier Lutfi Pasha: Tuhfetü’t-Tâlibîn’s Religious Sources,” Osmanli Medeni. Arastirmalari Derg., vol. 2024, no. 20, pp. 223–241, 2024, https://doi.org/10.21021/osmed.1400298.

A. O. H. Saleh, M. A. S. Qatawneh, and A. A. G. Saged, “Maqasid al-ShariâTMah of Zakat Towards Sustainable Economy,” in Islamic Sustainable Finance: Policy, Risk and Regulation, Sidi Mohamed Ben Abdullah University, Morocco: Taylor and Francis, 2024, pp. 149–159. https://doi.org/10.4324/9781003395447-18.

N. Mustari, R. Razak, J. Junaedi, F. Fatmawati, H. Hawing, and T. Baharuddin, “Multipartner governance and the urgency of poverty alleviation policy: Zakat fundraising management,” Cogent Soc. Sci., vol. 10, no. 1, 2024, https://doi.org/10.1080/23311886.2024.2361529.

H. Muhammad, M. S. Jalil, J. Arifin, A. Muhammud, and S. M. Muda, “Determinants of Zakat Payment among the Muslim Community in Terengganu,” Glob. J. Al-Thaqafah, vol. JULY 2024, no. SPECIAL ISSUE, pp. 212–227, 2024, https://doi.org/10.7187/GJATSI072024-14.

S. Bessais, H. Zakariyah, and A. Mohd Noor, “The possibility of establishing an endowment (Waqf) from the Islamic financial institutions’ provisioned funds in the United Arab Emirates,” Int. J. Islam. Middle East. Financ. Manag., 2024, https://doi.org/10.1108/IMEFM-12-2023-0466

N. D. Agadirun, N. A. Mutalib, A. H. Embong, I. L. M. Ismail, A. A. Halim, and M. M. Hasbullah, “Analysis Of Prayer Jurisprudence At The Ocean Based On The Book Of Is’af Ahl Al-’Asr Bi Ahkam Al-Bahr,” Rev. Gest. Soc. e Ambient., vol. 18, no. 9, 2024, https://doi.org/10.24857/rgsa.v18n9-009.

K. F. Khairi, A. Rafiki, S. N. Rahmadhani, and R. F. Ananda, “Strategies and Applications of Blockchain Technology of Zakat Collection and Distribution in Malaysia and Indonesia,” in Contributions to Management Science, vol. Part F3298, Universiti Sains Islam Malaysia, Negeri Sembilan, Nilai, Malaysia: Springer Science and Business Media Deutschland GmbH, 2024, https://doi.org/10.1007/978-3-031-61778-2_2.

M. A. Hughes and S. A. Siddiqui, “From Islamic Charity to Muslim Philanthropy: Definitions Across Disciplines,” Relig. Compass, vol. 18, no. 10, 2024, https://doi.org/10.1111/rec3.70002.

I. Hanifuddin and N. Kasanah, “Al-Qarḍ al-Ḥasan Program of Bankziska: Zakat Fund-Based Empowerment Model for Victims of Loan Sharks,” Juris J. Ilm. Syariah, vol. 23, no. 1, pp. 1–12, 2024, https://doi.org/10.31958/juris.v23i1.10799.

R. A. Abdalla, H. K. Alaaraj, and G. S. Mulla, “The Contribution of Islamic Banking and Finance to the Sustainable Development Goals of 2030,” in Sustainable Innovations in Management in the Digital Transformation Era: Digital Management Sustainability, University of Technology Bahrain, Bahrain: Taylor and Francis, 2024, pp. 249–261. https://doi.org/10.4324/9781003450238-25.

A. Wahab, B. Setiaji, and M. Tazhdinov, “Zakat Maal Management and Regulation Practices: Evidence from Malaysia, Turki, and Indonesia,” J. Hum. Rights, Cult. Leg. Syst., vol. 4, no. 2, pp. 569–592, 2024, https://doi.org/10.53955/jhcls.v4i2.204.

N. A. Ali, S. Sarif, and N. Azzah Kamri, “The Influence Of Spiritual Factors On Business Survival Of Asnaf Entrepreneurs In Malaysia,” Afkar, vol. 26, no. 1, pp. 89–120, 2024, https://doi.org/10.22452/afkar.vol26no1.3.

M. Shaukat, B. Shafique, and A. Madbouly, “Islamic Framework for Behavioral and Socio-Economic Justice,” in Islamic Finance in the Modern Era: Digitalization, FinTech and Social Finance, AAOIFI, Bahrain: Taylor and Francis, 2024, https://doi.org/10.4324/9781003366751-5.

R. Widagdo and S. Rokhlinasari, “Risk Mitigation on Management Institutions,” in Lecture Notes in Networks and Systems, A. B. and H. A., Eds., Institute of IAIN Syekh Nurjati Cirebon, West Java, Cirebon, Indonesia: Springer Science and Business Media Deutschland GmbH, 2024, https://doi.org/10.1007/978-3-031-67431-0_54.

M. K. Anwar, A. A. Ridlwan, Y. P. Timur, T. N. L. C. Dewi, J. Juliana, and A. A. Shikur, “Business Success of Asnāf Women’s Entrepreneur: an Islamic Law Perspective,” Al-Ihkam J. Huk. dan Pranata Sos., vol. 19, no. 2, pp. 1–26, 2024, https://doi.org/10.19105/al-lhkam.v19i1.8690.

A. I. Hunjra, M. Arunachalam, and M. Hanif, “The Role of Islamic Social Finance in Poverty Eradication,” in Islamic Finance in the Modern Era: Digitalization, FinTech and Social Finance, Rabat Business School, International University of Rabat, Morocco: Taylor and Francis, 2024, https://doi.org/10.4324/9781003366751-3.

B. Kasmon, S. S. Ibrahim, D. Daud, R. R. I. Raja Hisham, and S. Dian Wisika Prajanti, “FinTech application in Islamic social finance in Asia region: a systematic literature review,” Int. J. Ethics Syst., 2024, https://doi.org/10.1108/IJOES-07-2023-0155.

A. Binti Tamby Omar, R. Arshad, and R. Mat Isa, “A tie strength framework for improving the poor Asnaf students’ normative commitment and behavior,” J. Islam. Account. Bus. Res., 2024, https://doi.org/10.1108/JIABR-07-2022-0185.

I. Febrianto, N. Mohamed, and I. Bujang, “Developing Sharī͑ah-Compliant Asset Pricing Model in the Framework of Maqāsid al-Sharī͑ah and Islamic Wealth Management,” Intellect. Discourse, vol. 32, no. 1, pp. 133–158, 2024, https://doi.org/10.31436/id.v32i1.1910.

A. A. Nasution, S. A. Kesuma, J. Agustrisna, M. H. B. Rangkuti, and N. M. A. Aziz, “The Implementation of the Islamic Accounting Standard for Zakah, Infaq, and Shadaqah (ZIS) in Indonesia,” in Lecture Notes in Networks and Systems, A. B. and H. A., Eds., Universitas Sumatera Utara, Medan, 20155, Indonesia: Springer Science and Business Media Deutschland GmbH, 2024, https://doi.org/10.1007/978-3-031-67431-0_43.

M. D. H. Dol Malek, M. T. Bin Jima’Ain, N. Marni, F. Adenan, S. N. M. Mustafa, and A. S. Yusof, “Islamic economic development in the context of Islamic tax: A literature review,” in Studies in Systems, Decision, and Control, vol. 525, Islamic Civilization Academy, Faculty of Social Sciences and Humanities, Universiti Teknologi Malaysia (UTM), Johor, Malaysia: Springer Science and Business Media Deutschland GmbH, 2024, https://doi.org/10.1007/978-3-031-54383-8_50.

S. Herianingrum, S. Iswati, A. Ma’ruf, and Z. Bahari, “The role of Islamic economics and social institutions during the time of Covid-19,” J. Islam. Mark., vol. 15, no. 8, pp. 2144–2162, 2024, https://doi.org/10.1108/JIMA-05-2022-0134.

U. Al-Haddad, A. Maulana, R. Majid, and M. F. Rahman, “Zakat and Socio-Economic Impact: The Role of Local Government and Zakat Institutions,” Institutions Econ., vol. 16, no. 3, pp. 27–50, 2024, https://doi.org/10.22452/IJIE.vol16no3.2.

P. B. Saptono and I. Khozen, “Enhancing Taxpayer Compliance Through Fiscal Transparency, Participation, And Accountability: Insights From Key Figures Of Islamic Boarding Schools In Depok City,” ISRA Int. J. Islam. Finance., vol. 16, no. 2, pp. 20–44, 2024, https://doi.org/10.55188/ijif.v16i2.533.

I. Kateb and K. Ftouhi, “Ethical governance and the board’s moderating role in Zakat avoidance effects on firm value in Muslim nations,” J. Financ. Regul. Compliance, vol. 32, no. 1, pp. 98–117, 2024, https://doi.org/10.1108/JFRC-03-2023-0034.

J. A. Aziz, M. S. Q. Hamdan, A. Dahlan, and N. E. K. Aprianto, “Yusuf Al-Qaraḍāwī’s Theory of Zakat and Taxes and Its Relevance to Zakat and Taxation Law in Indonesia,” J. Ecohumanism, vol. 3, no. 4, pp. 1169–1182, 2024, https://doi.org/10.62754/joe.v3i4.3650.

M. A. A. Muin, A. C. Omar, A. H. A. Ghani, M. F. C. Majid, M. I. Shahruddin, and M. S. A. Razimi, “Proposed Value and Current Kifayah Limit (Haddul Kifayah) Items for Income Zakat in the State of Kedah,” Pakistan J. Life Soc. Sci., vol. 22, no. 1, pp. 4932–4941, 2024, https://doi.org/10.57239/PJLSS-2024-22.1.00363.

D. Calandra, F. Lanzalonga, and P. P. Biancone, “Exploring IFRS in Islamic finance: a bibliometric and coding analysis of emerging topics and perspectives,” Int. J. Islam. Middle East. Financ. Manag., vol. 17, no. 4, pp. 711–729, 2024, https://doi.org/10.1108/IMEFM-11-2023-0444.

Z. Mansyur and R. Mas’ud, “Worldview of Kiyai Sasak in the Practice of Individual Zakat Model in Lombok Indonesia,” J. Econ. Coop. Dev., vol. 45, no. 1, pp. 113–134, 2024, [Online]. Available: https://www.scopus.com/inward/record.uri?eid=2-s2.0-85202563862&partnerID=40&md5=5c281ce6e6b66ee4d046a3c1a902cc54

D. N. Ag Said, R. I. Ibrahim, A. Ab Rahman, and H. Hamdan, “Bridging the gap between the tradition of the Prophet in zakat payment and the current practice, through modern measurement,” J. Islam. Account. Bus. Res., 2024, https://doi.org/10.1108/JIABR-10-2023-0328.

M. Adinugroho, N. F. B. Azmi, U. Zuhdi, M. S. Hakiki, A. R. Abdullah, and Z. Ilmi, “Analysis Of Zakat Management Efficiency Levels In Two Asian Countries (Studies In Indonesia And Malaysia),” Rev. Gest. Soc. e Ambient., vol. 18, no. 5, 2024, https://doi.org/10.24857/rgsa.v18n5-044.

A. Wahyuni and N. R. Yunus, “Between Tradition and Religious Doctrine: Questioning Kiai’s Status as Zakāt Recipient,” Al-Ihkam J. Huk. dan Pranata Sos., vol. 19, no. 1, pp. 174–196, 2024, https://doi.org/10.19105/al-lhkam.v19i1.8780.

Y. Orgianus, F. R. I. Lapalanti, H. Tarmizi, and H. Oemar, “Optimizing scholarship distribution: a management information system approach,” Acta Logist., vol. 11, no. 2, pp. 197–209, 2024, https://doi.org/10.22306/al.v11i2.497.

N. N. Omar, M. S. Abdul Rashid, S. N. Abd Malek, A. S. Abu Bakar, N. H. Hassan, and C. N. A. Che Zainal, “Senior Citizens’ User Rate on Digital Healthcare Services in Selangor: A Case Study on SELangkah Application,” in Studies in Systems, Decision and Control, vol. 516, Faculty of Arts & Science, International University of Malaya-Wales, Kuala Lumpur, Malaysia: Springer Science and Business Media Deutschland GmbH, 2024, https://doi.org/10.1007/978-3-031-49544-1_40.

A. A. Rahman, A. Rafiki, H. Syahrial, and F. Tobing, “Professionalism and Competency of Amil Zakat in Malaysia and Indonesia: Strategies for Sustainability,” in Contributions to Management Science, vol. Part F3298, Universiti Sains Islam Malaysia, Negeri Sembilan, Nilai, Malaysia: Springer Science and Business Media Deutschland GmbH, 2024, https://doi.org/10.1007/978-3-031-61778-2_15.

A. M. Mustapha, N. Junoh, N. A. M. Jusoh, S. Safie, and M. S. M. Saleh, “The Had Kifayah Model for Asnaf Students at UiTM Kelantan Branch,” in CSR, Sustainability, Ethics, and Governance, vol. Part F3302, Academy of Contemporary Islamic Studies, University of Technology MARA, Kelantan, Machang, Malaysia: Springer Nature, 2024, https://doi.org/10.1007/978-3-031-53877-3_31.

B. Santoso, M. Nugroho, and L. O. Viktorovna, “Zakat Performance: The Role of Management Decision in Spiritual Servant Government Commitment,” Manag. Account. Rev., vol. 23, no. 1, pp. 459–496, 2024, [Online]. Available: https://www.scopus.com/inward/record.uri?eid=2-s2.0-85190471239&partnerID=40&md5=81b771efb11e2b3646fd69b1302fb024

A. Yumna, J. Marta, and R. Yanuarta Re, “The impact of a waqf-based microfinance program on clients’ well-being during COVID-19 pandemic: empirical evidence from Indonesia,” J. Islam. Account. Bus. Res., 2024, https://doi.org/10.1108/JIABR-02-2022-0040.

S. A. Siddiqui and J. R. Cheema, “Intention of filing tax claims for religious donations: Results from a Muslim American survey,” J. Philanthr. Mark., vol. 29, no. 2, 2024, https://doi.org/10.1002/nvsm.1852.

M. K. Hassan, M. Z. H. Khan, M. A. Miah, and M. K. Islam, “The national-level potential of Zakat and its integration into the fiscal framework: sector-specific insights from the economy of Bangladesh,” Int. J. Islam. Middle East. Financ. Manag., vol. 17, no. 1, pp. 146–169, 2024, https://doi.org/10.1108/IMEFM-09-2023-0313.

Z. Abdulrahman, T. Ebrahimi, and B. Al-Najjar, “Exploring the nexus between Islamic financial institutions Shariah compliance disclosure and corporate governance: New insights from a cross-country analysis,” Int. J. Financ. Econ., vol. 29, no. 4, pp. 4590–4612, 2024, https://doi.org/10.1002/ijfe.2891.

A. Alam, R. T. Ratnasari, A. Prasetyo, M. N. H. Ryandono, And U. Sholihah, “Systematic Literature Review on Zakat Distribution Studies as Islamic Social Fund,” J. Distrib. Sci., vol. 22, no. 2, pp. 21–30, 2024, https://doi.org/10.15722/jds.22.02.202402.21.

L. Mutmainah, I. Berakon, and R. Yusfiarto, “Does financial technology improve intention to pay zakat during national economic recovery? A multi-group analysis,” J. Islam. Mark., vol. 15, no. 6, pp. 1583–1607, 2024, https://doi.org/10.1108/JIMA-09-2022-0268.

A. Tahiiev, “Khums in the Shia Religious Tradition,” Religiovedenie, vol. 2024, no. 1, pp. 59–66, 2024, https://doi.org/10.22250/20728662_2024_1_59.

Y. Yahya, A. C. Azmi, W. M. Chan, and S. Zainuddin, “Spirituality, Tax Equity, and Religious Giving,” J. Manag. Spiritual. Relig., vol. 21, no. 4, pp. 461–480, 2024, https://doi.org/10.51327/ZHDM8894.

A. Bashori, M. mutho’am, F. Arianti, I. N. Kumala, E. Nurviani, and F. L. Mukarromah, “The Transformation Of Zakat Law: An Analysis of Ijtihād Maqāṣidī in the Modernisation of Zakat Practices in Indonesia,” Jurisdictie J. Huk. dan Syariah, vol. 15, no. 1, pp. 34–72, 2024, https://doi.org/10.18860/j.v15i1.26733.

S. Kamal, N. Safarida, and E. S. Kassim, “Investigating the role of fiqh zakat knowledge in moderating the behavior of the Acehnese to pay zakat digitally,” J. Islam. Mark., 2024, https://doi.org/10.1108/JIMA-02-2023-0055.

A. H. Mohammad Naim, N. Baharum, A. Zarifah, O. Zakirah, A. Fikriyah, and J. Jamaly Juwardy, “Unearthing Study in Asnafs’ Large-Scale SMART Paddy-Field (SMART SBBA): An Exploratory Case of Farmers in Yan, Kedah,” Pap. Asia, vol. 40, no. 3, pp. 42–47, 2024, https://doi.org/10.59953/paperasia.v40i3b.98.

H. Oemar, U. Alifani, and Y. Orgianus, “Strategic enhancement of Zakat collection and distribution in philanthropic institutions: integration of SERVQUAL, Kano, and QFD,” Acta Logist., vol. 11, no. 1, pp. 21–32, 2024, https://doi.org/10.22306/al.v11i1.446.

S. M. Yamaludin, S. F. Syed Alwi, R. Rosman, and M. R. Khamis, “The role of zakat distribution on the sustainability of gharimin (genuine debtors) in Islamic financial institutions in Malaysia,” J. Islam. Account. Bus. Res., vol. 15, no. 6, pp. 988–1008, 2024, https://doi.org/10.1108/JIABR-01-2023-0004.

L. Abu-Rajab, T. Steijvers, M. Corten, N. Lybaert, and M. Alsharairi, “The impact of the CEO’s Islamic religiosity on tax aggressive behavior in family firms,” Int. J. Islam. Middle East. Financ. Manag., vol. 17, no. 5, pp. 955–973, 2024, https://doi.org/10.1108/IMEFM-11-2023-0430.

S. Saputra and Y. Tanjung, “Enhancing Sustainability through Agricultural Zakāt-Based Philanthropy Movement: A Comprehensive Study on Social Welfare Capital,” J. Islam. Thought Civiliz., vol. 14, no. 1, pp. 231–246, 2024, https://doi.org/10.32350/jitc.141.14.

A. Ascarya, “An investigation of waqf-based Islamic micro financial institution models to identify the most effective model for Indonesia,” J. Islam. Account. Bus. Res., 2024, https://doi.org/10.1108/JIABR-12-2022-0325.

R. Irmadariyani, A. Roziq, and M. Shulthoni, “Formulating, Measuring, and Comparing Financial Performance Between National Amil Zakat Agency (BAZNAS) and Amil Zakat Institution (LAZ) in Indonesia,” Qual. - Access to Success, vol. 25, no. 199, pp. 205–211, 2024, https://doi.org/10.47750/QAS/25.199.22.

B. Berrahlia, F. L. Berrahlia, and M. K. Hassan, “Waqf Governance in Algeria: Current Status and Future Prospects in Light of AAOIFI Governance Standard 13,” Manchester J. Transnatl. Islam. Law Pract., vol. 20, no. 1, pp. 106–121, 2024, [Online]. Available: https://www.scopus.com/inward/record.uri?eid=2-s2.0-85193608672&partnerID=40&md5=b1e745cd27c35ff473edefd39de65410

M. Y. M. Hussin, A. A. Rahman, Z. Ismail, F. Muhammad, and A. A. Razak, “Islamic Social Finance as Alternative Mechanism for Well-being of the Community: A Bibliometric Analysis,” Pakistan J. Life Soc. Sci., vol. 22, no. 2, pp. 6509–6533, 2024, https://doi.org/10.57239/PJLSS-2024-22.2.00491.

A. H. Anfas, “Optimizing the Potential of Zakat to Alleviate Poverty Problems and Improve Community Economy in Surakarta City,” J. Ecohumanism, vol. 3, no. 3, pp. 121–127, 2024, https://doi.org/10.62754/joe.v3i3.3394.

I. Rahmatullah, P. Suwadi, and H. Purwadi, “Legal Reform of Zakat Management Based on Personal Data Protection Law in Indonesia,” Maz. J. Pemikir. Huk. Islam, vol. 23, no. 1, pp. 199–236, 2024, https://doi.org/10.21093/mj.v23i1.5917.

M. I. H. Kamaruddin, Z. Shafii, M. M. Hanefah, S. Salleh, and N. Zakaria, “Exploring Shariah audit practices in zakat and waqf institutions in Malaysia,” J. Islam. Account. Bus. Res., vol. 15, no. 3, pp. 402–421, 2024, https://doi.org/10.1108/JIABR-07-2022-0190.

Submitted

Accepted

Published

Issue

Section

License

Copyright (c) 2024 Masithoh, Kamsi, Asmuni

This work is licensed under a Creative Commons Attribution 4.0 International License.