Integration of Tax Justice Principles into Islamic Law for the Achievement of Sustainable Development Goals

DOI:

https://doi.org/10.23917/profetika.v26i02.12426Keywords:

tax justice, islamic law, sdgs, fiscal policy, public welfareAbstract

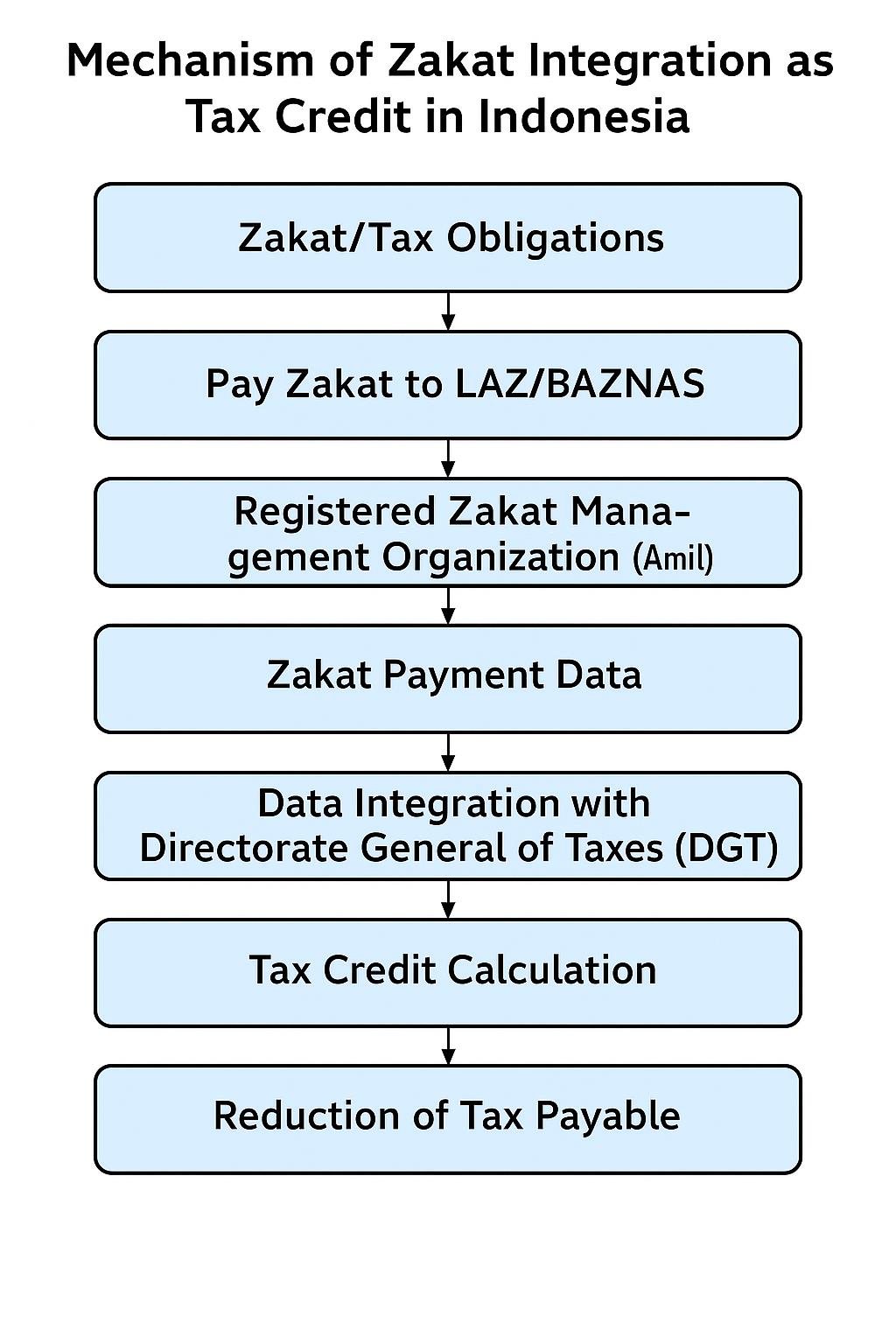

Objective: This study aims to examine how the principles of tax justice in Islamic Law can be integrated into modern tax policies to support the achievement of Sustainable Development Goals (SDGs). Theoretical framework: This study is based on the theory of justice in Islamic Law, which includes the concepts of distributive justice, benefit, and transparency, which in the context of Islamic history are realized through instruments such as zakat, kharaj, jizyah, and usyur. These principles are compared with modern taxation theory, which emphasizes the principles of justice, efficiency, and equity. Literature review: The literature review includes classical and contemporary fiqh literature related to fiscal obligations, tax laws and regulations in Indonesia, the Zakat Management Law, and official documents of the 2030 SDGs, which place economic justice as a main pillar of sustainable development. Methods: This study uses a qualitative approach with a juridical normative method through library research. Data were collected from Islamic legal sources, tax regulations, SDGs documents, and previous research results, then analyzed using content analysis to identify the relevance and potential for integrating the principles of Islamic tax justice with modern fiscal policies. Results: The results of the study indicate that the principle of tax justice in Islamic Law is oriented towards proportionality of burden based on taxpayers' ability, public welfare, and transparency of management. Integration of this principle with modern tax policy can strengthen the function of income redistribution, increase tax compliance, and support the achievement of SDG 1 (poverty alleviation), SDG 8 (inclusive economic growth), and SDG 10 (reduced inequality). Implication: These findings provide policy recommendations for the government to harmonize tax and zakat regulations, improve public fiscal literacy, and optimize the digitalization of tax and zakat payment systems to align with SDG targets. Novelty: This study offers a Hybrid Fiscal Model integration model that combines modern taxes and Islamic fiscal instruments proportionally and based on public welfare, thus creating a tax system that is not only based on Sharia values, but also relevant to the global development agenda.

References

[1] J. D. Sachs, W. T. Woo, N. Yoshino, and F. Taghizadeh-Hesary, “Importance of Green Finance for Achieving Sustainable Development Goals and Energy Security,” in Handbook of Green Finance: Energy Security and Sustainable Development, J. D. Sachs, W. T. Woo, N. Yoshino, and F. Taghizadeh-Hesary, Eds., Singapore: Springer Singapore, 2019, pp. 3–12. doi: https://doi.org/10.1007/978-981-13-0227-5_13.

[2] K. Alavuotunki, M. Haapanen, and J. Pirttilä, “The Effects of the Value-Added Tax on Revenue and Inequality,” J. Dev. Stud., vol. 55, no. 4, pp. 490–508, 2019, doi: https://doi.org/10.1080/00220388.2017.1400015.

[3] M. A. Khan and S. Nuryanah, “Combating tax aggressiveness: Evidence from Indonesia’s tax amnesty program,” Cogent Econ. Financ., vol. 11, no. 2, p. 2229177, 2023, doi: https://doi.org/10.1080/23322039.2023.2229177.

[4] M. I. Ariffin, “A Comparative Analysis on Economic Roles of Government and Principles of Taxation between Public Economics and Siyasah Shar‘iyyah,” Glob. Rev. Islam. Econ. Bus., vol. 11, no. 2, pp. 015–026, 2023, doi: https://doi.org/10.14421/grieb.2023.112-02.

[5] A. Rahman, A. F. Aseri, and M. R. Akbar, “Wealth Distribution in Sharia Economic Law : a Study Of Qs . Al-Hasyr Verse 7 on Islamic Fiscal Policy and Social Welfare in Indonesia,” Indones. J. Islam. Jurisprudence, Econ. Leg. Theory, vol. 3, no. 2, pp. 1752–1765, 2025, doi: https://doi.org/10.62976/ijijel.v3i2.1166.

[6] S. Herianingrum et al., “Zakat as an instrument of poverty reduction in Indonesia,” J. Islam. Account. Bus. Res., vol. 15, no. 4, pp. 643–660, 2024, doi: https://doi.org/10.1108/JIABR-11-2021-0307.

[7] S. Syamsuri, Y. Saâ€TMadah, and I. A. Roslan, “Reducing Public Poverty Through Optimization of Zakat Funding as an Effort to Achieve Sustainable Development Goals (SDGs) in Indonesia,” J. Ilm. Ekon. Islam, vol. 8, no. 1, pp. 792–805, Mar. 2022, doi: https://doi.org/10.29040/jiei.v8i1.3872.

[8] Y. Qardhawi, Fiqh al zakah. Cairo: Maktabah Wahabah, 1994.

[9] R. F. van Brederode, “Introduction: The Value of a Political Theory for the Proper Application of Taxation BT - Political Philosophy and Taxation: A History from the Enlightenment to the Present,” R. F. van Brederode, Ed., Singapore: Springer Nature Singapore, 2022, pp. 1–50. doi: https://doi.org/10.1007/978-981-19-1092-0_1.

[10] P. Procházka, “Tax Impact of Multinationals in Central and Eastern Europe on Sustainable Development Goals,” International Business and Sustainable Development Goals, vol. 17. Emerald Publishing Limited, p. 0, Jul. 31, 2023. doi: https://doi.org/10.1108/S1745-886220230000017011.

[11] S. Ahmad and S. Ghiasul Haq, “How Far Corporate Zakat May Contribute to Sustainable Development Goals?,” in Islamic Wealth and the SDGs: Global Strategies for Socio-economic Impact, M. M. Billah, Ed., Cham: Springer International Publishing, 2021, pp. 421–437. doi: https://doi.org/10.1007/978-3-030-65313-2_21.

[12] S. Rahim and M. O. Mohammed, “Operationalizing Distributive Justice from the Perspective of Islamic Economics,” Int. J. Econ. Manag. Account., vol. 26, no. 2, pp. 415–442, 2018, doi: https://doi.org/10.31436/ijema.v26i2.431.

[13] Departemen Agama RI, Al-Jumanatul ‘Ali Al-Qur’an dan Terjemahannya. Bandung: CV. Penerbit J-ART, 2014.

[14] M. D. H. D. Malek, M. T. Bin Jima’ain, N. Marni, F. Adenan, S. N. M. Mustafa, and A. S. Yusof, “Islamic Economic Development in the Context of Islamic Tax: A Literature Review,” in The AI Revolution: Driving Business Innovation and Research: Volume 2, B. Awwad, Ed., Cham: Springer Nature Switzerland, 2024, pp. 653–659. doi: https://doi.org/10.1007/978-3-031-54383-8_50.

[15] M. A. Muchsin and A. Manan, “Historical Development Of Tax During The Early Islamic Period: Jizyah And Kharaj: A Historical Analysis,” J. Al-Tamaddun, vol. 14, no. 2, pp. 1–7, 2019, doi: https://doi.org/10.22452/JAT.vol14no2.1.

[16] Sucyani and Amrin, “Development of Sharia Economic Law in Indonesia ( Positivation of Zakat Law ),” Leg. Br., vol. 11, no. 2, pp. 1335–1344, 2022.

[17] Amrin Khairusoalihin dan Muthoifin, “Tax Modernization In Indonesia : Study Of Abu Yusuf ’ S Thinking On Taxation In The Book Of Al-Kharaj,” Pofetika, J. Stud. Islam, vol. 23, no. 1, pp. 30–42, 2022, doi: https://doi.org/10.23917/profetika.v23i1.16792.

[18] Imam Al-Mawardi, Al-Ahkam as-Sulthaniyah: Hukum-Hukum Penyelengggaraan Negara dalam Syariat Islam, Penj Fadli Basri. Bekasi: PT. Daruh Falah, 2017.

[19] A. Baker and R. Murphy, “Modern Monetary Theory and the Changing Role of Tax in Society,” Soc. Policy Soc., vol. 19, no. 3, pp. 454–469, 2020, doi: DOI: https://doi.org/10.1017/S1474746420000056.

[20] C. Delmotte, “Tax Uniformity as a Requirement of Justice,” Can. J. Law Jurisprud., vol. 33, no. 1, pp. 59–83, 2020, doi: DOI: https://doi.org/10.1017/cjlj.2019.30.

[21] C. Delmotte and D. Nientiedt, “Classical Liberalism: Market-Supporting Institutions and Public Goods Funded by Limited Taxation,” in - Political Philosophy and Taxation: A History from the Enlightenment to the Present, R. F. van Brederode, Ed., Singapore: Springer Nature Singapore, 2022, pp. 135–150. doi: https://doi.org/10.1007/978-981-19-1092-0_4.

[22] Lexy J. Moleong, metodologi Penelitian Kualitatif. Bandung: PT. Remaja Rosdakarya, 2009.

[23] P. Connolly, Approaches to the study of Religion. London: The Continuum International Publishing Group, 2006.

[24] J. W. Creswell and J. D. Creswell, Research Design: Qualitative, Quantitative, and Mixed Methods Approaches. California: Sage publications, 2017.

[25] N. R. Philip Alston, Tax, Inequality, and Human Rights. London: Oxford University Press, 2019.

[26] Alwy Ahmed Mohamed and Abdulrohim E-sor, “Zakat as a Legal Obligation in Sharia within the Context of Contemporary Taxation Systems,” Demak Univers. J. Islam Sharia, vol. 3, no. 02, pp. 229–244, May 2025, doi: https://doi.org/10.61455/deujis.v3i02.345.

[27] M. A. F. Syahril and H. Hasan, “A Comparative Research on the Effectiveness of Progressive versus Proportional Tax Systems in Enhancing Social Justice,” Adm. Environ. Law Rev., vol. 5, no. 2, pp. 97–106, 2024, doi: https://doi.org/10.25041/aelr.v5i2.3479.

[28] A. Smith, The Wealth of Nations: Vol. 3. BoD–Books on Demand, 2024.

[29] Richard A. Musgrave and A. T. Peacock, Classics in the Theory of Public Finance. Springer, 1958.

[30] Havis Aravik, “Kontribusi pemikiran Ekonomi Abu Yususf terhadap Perkembangan Ekonomi Islam Modern,” Econ. Sharia, vol. 2, no. 1, pp. 29–38, 2016.

[31] A. I. Khaldun, Muqaddimah al-‘Allamah Ibn Khaldun. Beirut: Dar al Fikr, 998.

[32] Jamal Abdul Aziz, M. S. Q. Hamdan, and N. E. K. Aprianto, “Yusuf Al-Qaraḍāwī’s Theory of Zakat and Taxes and Its Relevance to Zakat and Taxation Law in Indonesia,” J. Ecohumanism, vol. 3, no. 4, pp. 1169–1182, 2024.

[33] F. Ariani, “Ushur and Jizyah in the Perspective of Islamic Economics,” in Acieb, 2022, pp. 184–199.

[34] M. U. Chapra, Islam and the Economic Challenge. International Institute of Islamic Thought (IIIT), 1992.

[35] M. U. Chapra, The Future of Economics: An Islamic Perspective. Leicester: Kube Publishing, 2016.

[36] M. Legendre, “Aspects of Umayyad Administration 1,” in The Umayyad World, London, 2020.

[37] M. Kahf, “The Performance of the Institution of Zakah in Theory and Practice.,” in International conference on Islamic economics towards the 21st Century, Kuala Lumpur, 1999.

[38] N. A. Abasimel, “Islamic Banking and Economics: Concepts and Instruments, Features, Advantages, Differences from Conventional Banks, and Contributions to Economic Growth,” J. Knowl. Econ., vol. 14, no. 2, pp. 1923–1950, 2023, doi: https://doi.org/10.1007/s13132-022-00940-z.

[39] N. A. Zauro, R. A. J. Saad, A. Ahmi, and M. Y. Mohd Hussin, “Integration of Waqf towards enhancing financial inclusion and socio-economic justice in Nigeria,” Int. J. Ethics Syst., vol. 36, no. 4, pp. 491–505, 2020, doi: https://doi.org/10.1108/IJOES-04-2020-0054.

[40] Suziraha Dzulkepli and Mohd Nizam Barom, “Financial inclusion and the goal of distributive justice in Islamic economics,” J. Muamalat Islam. Financ. Res., vol. 18, no. 1, pp. 66–77, 2021, doi: https://doi.org/10.33102/jmifr.v18i1.330.

[41] Q. Ayuniyyah, A. H. Pramanik, N. Md Saad, and M. I. Ariffin, “The impact of zakat in poverty alleviation and income inequality reduction from the perspective of gender in West Java, Indonesia,” Int. J. Islam. Middle East. Financ. Manag., vol. 15, no. 5, pp. 924–942, 2022, doi: https://doi.org/10.1108/IMEFM-08-2020-0403.

[42] S. Herianingrum et al., “Zakat as an instrument of poverty reduction in Indonesia,” J. Islam. Account. Bus. Res., vol. 15, no. 4, pp. 643–660, 2023, doi: https://doi.org/10.1108/JIABR-11-2021-0307.

[43] R. A. J. Saad, A. Ahmi, N. Sawandi, and N. M. Abdul Aziz, “Zakat administration reformation towards an effective and efficient zakat revenue generation,” J. Islam. Account. Bus. Res., vol. 14, no. 8, pp. 1232–1260, Jan. 2023, doi: https://doi.org/10.1108/JIABR-05-2021-0151.

[44] M. I. H. Kamaruddin and M. M. Hanefah, “Bridging Zakat Impacts Toward Maqasid Shariah and Sustainable Development Goals (SDGs), Influence of Corporatization and Experiences on COVID-19,” in Islamic Wealth and the SDGs: Global Strategies for Socio-economic Impact, M. M. Billah, Ed., Cham: Springer International Publishing, 2021, pp. 393–420. doi: https://doi.org/10.1007/978-3-030-65313-2_20.

[45] J. E. Stiglitz, People, Power, and Profits: Progressive Capitalism for an Age of Discontent. Penguin UK, 2019.

[46] A. Sen, “Development as Freedom: an India perspective,” Indian J. Ind. Relat., pp. 157–169, 2006, [Online]. Available: https://www.jstor.org/stable/27768063

[47] J. Miletzki and N. Broten, An Analysis of Amartya Sen’s Development as Freedom. London: Macat Library, 2017. doi: https://doi.org/10.4324/9781912281275.

[48] Z. Iqbal and A. Mirakhor, “Ethical Dimensions of Islamic Economics and Finance,” Ethical Dimens. Islam. Financ. Theory Pract., pp. 103–134, 2017.

[49] J. D. Sachs, W. T. Woo, N. Yoshino, and F. Taghizadeh-Hesary, “Importance of Green Finance for Achieving Sustainable Development Goals and Energy Security BT - Handbook of Green Finance: Energy Security and Sustainable Development,” J. D. Sachs, W. T. Woo, N. Yoshino, and F. Taghizadeh-Hesary, Eds., Singapore: Springer Singapore, 2019, pp. 3–12. doi: https://doi.org/10.1007/978-981-13-0227-5_13.

[50] F. Rahman, Islam & Modernity: Transformation of an Intellectual Tradition. London: University of Chicago Press, 2017.

[51] K. Suzumura, “Reflections on Arrow’s research program of social choice theory,” Soc. Choice Welfare, vol. 54, no. 2, pp. 219–235, 2020, doi: https://doi.org/10.1007/s00355-019-01172-y.

[52] K. Arrow, A. Sen, and K. Suzumura, “Chapter Thirteen - Kenneth Arrow on Social Choice Theory,” in Handbook of Social Choice and Welfare, vol. 2, K. J. Arrow, A. Sen, and K. B. T.-H. of S. C. and W. Suzumura, Eds., Elsevier, 2011, pp. 3–27. doi: https://doi.org/10.1016/S0169-7218(10)00013-4.

[53] H. Djatmiko, “Re-formulation zakat system as tax reduction in Indonesia,” Indones. J. Islam Muslim Soc., vol. 9, no. 1, pp. 135–162, 2019, doi: https://doi.org/10.18326/ijims.v9i1.135-162.

[54] S. Saoki and M. Mahir, “Integration of Maqasid Shariah in the Implementation of Digital Zakat based on the E-Zakat Platform at BAZNAS Surabaya,” Manag. Zakat Waqf J., vol. 7, no. 1, pp. 98–118, 2025, doi: https://doi.org/10.15642/mzw.2025.7.1.98-118.

[55] W. P. Wong, H. C. Tan, K. H. Tan, and M.-L. Tseng, “Human factors in information leakage: mitigation strategies for information sharing integrity,” Ind. Manag. Data Syst., vol. 119, no. 6, pp. 1242–1267, 2019, doi: 10.1108/IMDS-12-2018-0546.

[56] Amrin & Amirullah, “Contemporary Legal Istimbat: Study on the Theory of Changes in Fatwa According to Yusuf Qardhawi,” Mizan J. Islam. LawJournal Islam. Law Stud., vol. 6, no. 1, pp. 89–108, 2022, doi: https://doi.org/10.32507/mizan.v6i1.1244.

[57] A. A. Rahman, S. M. Nor, and S. E. Yaacob, “Technological Integration within Zakat Institutions: A Comprehensive Review and Prospective Research Directions,” Int. J. Islam. Thought, vol. 24, no. 1, pp. 31–43, 2023, doi: https://doi.org/10.24035/ijit.24.2023.268.

[58] B. De Clercq, “Tax literacy: what does it mean?,” Meditari Account. Res., vol. 31, no. 3, pp. 501–523, 2021, doi: https://doi.org/10.1108/MEDAR-04-2020-0847.

[59] R. Zaini and K. Ismail, “Innovation Barriers Obstructing the Transfer of Technology From University to Industry in ASEAN Developing Countries (Case Study on Brunei Darussalam),” ASEAN J. Sci. Technol. Dev., vol. 41, no. 2, pp. 163–172, 2024, doi: https://doi.org/10.61931/2224-9028.1582.

[60] N. Amrin, Adi Priyono, Ade Irma Imamah, “Implementation Of Professional Zakat Of State Civil Apparatus In Indonesian In Islamic Law,” Profetika J. Stud. Islam, vol. 24, no. 01, pp. 22–32, 2023.

[61] F. Meng, “Driving sustainable development: Fiscal policy and the promotion of natural resource efficiency,” Resour. Policy, vol. 90, p. 104687, 2024, doi: https://doi.org/10.1016/j.resourpol.2024.104687.

Downloads

Submitted

Accepted

Published

Issue

Section

License

Copyright (c) 2025 Cahyoginarti, Amrin, Alwy Ahmed Mohamed

This work is licensed under a Creative Commons Attribution 4.0 International License.