Sharia Finance, SDGs, and Economic Growth: Empirical Evidence from Muslim Countries in Asia

DOI:

https://doi.org/10.23917/profetika.v25i03.11986Keywords:

sharia finance, sdgs, economic growth, asian muslim countries, islamic economicsAbstract

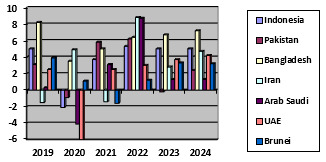

Objective: This study examines the role of Sharia finance in driving economic growth and supporting the achievement of the SDGs in Muslim countries in Asia. The main objective is to analyze the development, challenges, and contributions of Sharia financing systems, as well as to compare their performance with conventional financial systems in promoting economic growth, financial inclusion, and sustainability. Theoretical framework: The theoretical framework is grounded in Islamic financial principles that prohibit riba (usury), gharar (excessive uncertainty), and investment in haram sectors, while emphasizing social justice, risk-sharing, ethical investment, and inclusive development, which are closely aligned with the core objectives of the SDGs, particularly SDG 1, SDG 8, and SDG 10. Literature review: The literature review synthesizes previous studies on the development of Islamic finance in Malaysia, Indonesia, Brunei Darussalam, and Muslim regions of the Philippines, focusing on regulatory frameworks, levels of Islamic financial literacy, product innovation, and the sector’s contribution to regional economic growth and sustainable development. Methods: Methodologically, this study employs a descriptive and comparative literature-based approach, analyzing the implementation and evolution of Sharia and conventional financial systems across selected Asian Muslim countries, while identifying key challenges and opportunities in advancing SDG-oriented finance. Results: The findings reveal that Sharia finance has experienced significant growth in Asia, with Malaysia emerging as a global Islamic finance hub and Indonesia demonstrating substantial market potential. Despite this progress, challenges remain, including limited financial literacy, regulatory fragmentation, and the need for greater product and technological innovation. Empirical evidence suggests that Sharia finance contributes positively to financial inclusion, sustainable economic growth, financial stability, human capital development, and technological adoption, thereby reinforcing its relevance to SDG-driven development strategies. Implications: The study’s implications highlight the importance of strengthening Islamic financial literacy, harmonizing regulations, and encouraging innovation to position Sharia finance as a strategic pillar of sustainable and inclusive economic growth in Asia. Novelty: The novelty of this research lies in its comprehensive and integrative analysis of Sharia finance within an SDG framework, demonstrating its comparative advantages over conventional finance in fostering equitable and sustainable development.

References

[1] A. As-Salafiyah and M. Radwan, “Islamic Economics and Finance: Trend Topics and Thematic Evolution,” J. Islam. Econ. Lit., vol. 4, no. 2, 2023, https://doi.org/10.58968/jiel.v4i2.315.

[2] M. Zulkhibri, “The impact of monetary policy on Islamic bank financing: bank-level evidence from Malaysia,” J. Econ. Financ. Adm. Sci., vol. 23, no. 46, pp. 306–322, 2018, https://doi.org/10.1108/JEFAS-01-2018-0011.

[3] M. A. Ledhem and M. Mekidiche, “Economic growth and financial performance of Islamic banks: a CAMELS approach,” Islam. Econ. Stud., vol. 28, no. 1, pp. 47–62, 2020, https://doi.org/10.1108/ies-05-2020-0016.

[4] H. K. Notolegowo, I. F. Alamsyah, N. Saraswati, B. A. Jalil, and F. M. Bt Isahak Merican, “Relationship between Islamic Social Finance and Sustainable Development Goals: A Conceptual Framework,” KnE Soc. Sci., vol. 2023, p. 197, 2023, https://doi.org/10.18502/kss.v8i18.14245.

[5] A. Nuriyah and U. N. Fakhri, “Designing of digital-based Islamic social finance model through the role of mosque,” J. Ekon. Keuang. Islam, vol. 8, no. 1, pp. 77–93, 2022, https://doi.org/10.20885/jeki.vol8.iss1.art6.

[6] M. Kara, “The Contribution of Funding Shariah Banking to Developing Micro, Small, and Medium Enterprises Minority Jurisprudence,” Ahkam J. Ilmu Syariah, vol. 13, no. 2, pp. 315–322, 2013, https://doi.org/10.15408/ajis.v13i2.944.

[7] R. Harniati, A. Asnaini, and F. Muttaqin, “Analisis Peran Strategis Bank Syariah Indonesia Terhadap Pertumbuhan Ekonomi di Indonesia Pasca Covid-19,” JOVISHE J. Vision. Sharia Econ., vol. 1, no. 1, pp. 61–74, 2022, https://doi.org/10.57255/jovishe.v1i1.78.

[8] F. Nabila and H. Thamrin, “Kontribusi Perbankan Syariah Terhadap Pertumbuhan Ekonomi Negara Di Asia Tenggara,” J. Tabarru’ Islam. Bank. Financ., vol. 5, no. 2, pp. 336–376, 2022, https://doi.org/10.25299/jtb.2022.vol5(2).10371.

[9] S. M. Johari, “Pengaruh Bank Syariah Terhadap Perkembangan Perekonomian di Daerah,” J. Waqf Islam. Econ. Philanthr., vol. 1, no. 3, pp. 1–17, 2024, https://doi.org/10.47134/wiep.v1i3.300.

[10] R. Kristiyanto, “Konsep Pembiayaan Dengan Prinsip Syariah Dan Aspek Hukum Dalam Pemberian Pembiayaan,” Law Reform, vol. 5, no. 1, p. 104, 2010., https://doi.org/10.14710/lr.v5i2.12496

[11] Z. T. Temtime and J. Pansiri, “Small Business Critical Success/Failure Factors In Developing Economies: Some Evidence From Botswana,” Am. J. Appl. Sci., vol. 1, no. 1, pp. 18–25, 2004, https://doi.org/10.3844/ajassp.2004.18.25.

[12] E. O. A. B. Nasution, L. P. L. Nasution, M. Agustina, and K. Tambunan, “Pertumbuhan Ekonomi Dalam Perspektif Islam,” J. Manag. Creat. Bus., vol. 1, no. 1, pp. 63–71, 2023, https://doi.org/10.30640/jmcbus.v1i1.484.

[13] Muhammad Fahmul Iltiham, “Mekanisme Penentuan Margin Pembiayaan Murabahah di Lembaga Keuangan Syariah,” Malia (Terakreditasi), vol. 12, no. 1, pp. 109–124, 2020, https://doi.org/10.35891/ml.v12i1.2386.

[14] Irfan Harmoko, SE.I., MM, “Mekanisme Restrukturisasi Pembiayaan Pada Akad Pembiayaan Murabahah Dalam Upaya Penyelesaian Pembiayaan Bermasalah,” Qawãnïn J. Econ. Syaria Law, vol. 2, no. 2, pp. 61–80, 2018, https://doi.org/10.30762/q.v2i2.1042.

[15] F. Andiansyah, S. M. Hanafi, S. Haryono, And T. Wau, “Pengaruh Instrumen Keuangan Syariah Terhadap Pertumbuhan Ekonomi Indonesia,” Al-Masraf J. Lemb. Keuang. dan Perbank., vol. 7, no. 1, p. 69, 2022, https://doi.org/10.15548/al-masraf.v7i1.288.

[16] W. Asnuri, “Pengaruh Instrumen Moneter Syariah dan Ekspor Terhadap Pertumbuhan Ekonomi di Indonesia,” Al-Iqtishad J. Islam. Econ., vol. 5, no. 2, 2015, https://doi.org/10.15408/aiq.v5i2.2569.

[17] S. El Ayyubi, L. Anggraeni, and A. D. Mahiswari, “Pengaruh Bank Syariah terhadap Pertumbuhan Ekonomi di Indonesia,” Al-Muzara’ah, vol. 5, no. 2, pp. 88–106, 2018, https://doi.org/10.29244/jam.5.2.88-106.

[18] S. Hidayat and R. Irwansyah, “Pengaruh Dana Pihak Ketiga dan Pembiayaan Perbankan Syariah terhadap Pertumbuhan Ekonomi Indonesia,” J. Ekon. dan Perbank. Syariah, vol. 5, no. 1, pp. 1–21, 2020.

[19] R. Yulita Amalia, S. Fauziah, and I. Wahyuningsih, “Pengaruh Keuangan Syariah terhadap Pertumbuhan Ekonomi dan Indeks Pembangunan Manusia di Indonesia,” Al-Muzara’ah, vol. 7, no. 1, pp. 33–46, 2019, https://doi.org/10.29244/jam.7.1.33-46.

[20] M. Ro’is, A. A. Wahab, and A. Fajri, “Dampak Kinerja Sukuk terhadap Pertumbuhan Ekonomi di Negara Islam ASEAN,” Econ. Rev. J., vol. 3, no. 1, pp. 716–727, 2024, https://doi.org/10.56709/mrj.v3i1.229.

[21] T. N. Rachmawati and Z. A. I. Supardi, “Analisis Model Conceptual Change Dengan Pendekatan Konflik Kognitif Untuk Mengurangi Miskonsepsi Fisika Dengan Metode Library Research,” PENDIPA J. Sci. Educ., vol. 5, no. 2, pp. 133–142, 2021, https://doi.org/10.33369/pendipa.5.2.133-142.

[22] G. R. Somantri, “Memahami Metode Kualitatif,” Makara Hum. Behav. Stud. Asia, vol. 9, no. 2, p. 57, 2005, https://doi.org/10.7454/mssh.v9i2.122.

[23] D. Dwiyanto, “Metode Kualitatif:Penerapanna Dalam Penelitian,” vol. 0, pp. 1–7, 2021.

[24] M. Firmansyah, M. Masrun, and I. D. K. Yudha S, “Esensi Perbedaan Metode Kualitatif Dan Kuantitatif,” Elastisitas - J. Ekon. Pembang., vol. 3, no. 2, pp. 156–159, 2021, https://doi.org/10.29303/e-jep.v3i2.46.

[25] A. Komijani and F. Taghizadeh-Hesary, “An overview of Islamic banking and finance in Asia,” Routledge Handb. Bank. Financ. Asia, no. 853, pp. 505–518, 2019, https://doi.org/10.4324/9781315543222-28.

[26] M. Muthoifin, I. Amelia, and A. B. Eprahim Ali, “Islamic accounting: Ethics and contextualization of recording in Muamalah transactions,” Multidiscip. Rev., vol. 7, no. 8, 2024, https://doi.org/10.31893/multirev.2024132.

[27] M. Subhi Apriantoro, J. Herviana, Yayuli, and Suratno, “Sharia Financial Literacy: Research Trends and Directions for Future Inquiry,” JISEL J. Islam. Econ. Laws, vol. 6, no. 2, p. 2023, 2023, https://doi.org/10.23917/jisel.v6i2.22396

[28] M. Mohieldin, Z. Iqbal, A. Rostom, and X. Fu, “The Role of Islamic Finance in Enhancing Financial Inclusion in OIC Countries,” 8th Int. Conf. Islam. Econ. Financ., vol. 20, no. 5920, pp. 1–57, 2011, https://doi.org/10.1596/1813-9450-5920.

[29] G. Tajgardoon, M. Behname, and K. Noormohamadi, “Islamic Banking and Economic Growth: Evidence From Asia,” J. Mod. Account. Audit., vol. 9, no. 4, pp. 542–546, 2013.

[30] T. Aziz, M. G. U. Khan, M. T. Islam, and M. A. H. Pradhan, “An analysis on the relationship between ICT, financial development and economic growth: Evidence from Asian developing countries,” J. Int. Trade Econ. Dev., vol. 32, no. 5, pp. 705–721, 2023, https://doi.org/10.1080/09638199.2022.2134912.

[31] M. Saiful Islam, “Human capital formation and economic growth in South Asia: Heterogeneous dynamic panel cointegration,” Int. J. Educ. Econ. Dev., vol. 11, no. 4, pp. 335–350, 2020, https://doi.org/10.1504/IJEED.2020.110593.

[32] W. Mehmood, S. Mohy Ul Din, A. Aman-Ullah, A. B. Khan, and M. Fareed, “Institutional quality and economic growth: Evidence from South-Asian countries,” J. Public Aff., vol. 23, no. 1, 2023, https://doi.org/10.1002/pa.2824.

[33] M. Azam Khan and S. Khan, “Inflation And The Economic Growth: Evidence from Five Asian Countries,” Pakistan J. Appl. Econ., vol. 28, no. 2, pp. 235–252, 2018.

[34] R. Mohd. Yusof and M. Bahlous, “Islamic banking and economic growth in GCC & East Asia countries: A panel cointegration analysis,” J. Islam. Account. Bus. Res., vol. 4, no. 2, pp. 151–172, 2013, https://doi.org/10.1108/JIABR-07-2012-0044.

[35] Z. Samori, N. Z. Md Salleh, and M. M. Khalid, “Current trends on Halal tourism: Cases on selected Asian countries,” Tour. Manag. Perspect., vol. 19, pp. 131–136, 2016, https://doi.org/10.1016/j.tmp.2015.12.011.

[36] S. A. Naz And S. Gulzar, “Impact Of Islamic Finance On Economic Growth: An Empirical Analysis Of Muslim Countries,” Singapore Econ. Rev., vol. 67, no. 01, pp. 245–265, Jan. 2020, https://doi.org/10.1142/S0217590819420062.

[37] A. El Ashfahany, A. D. N. Hidayah, L. Hakim, and M. S. Bin Mohd Noh, “How Zakat Affects Economic Growth In Three Islamic Countries,” J. Islam. Econ. Laws, vol. 6, no. 1, pp. 45–61, 2023, https://doi.org/10.23917/jisel.v6i1.21242.

[38] B. HGB, “Impact of Islamic Modes of Finance on Economic Growth through Financial Stability,” J. Bus. Financ. Aff., vol. 06, no. 01, pp. 1–7, 2017, https://doi.org/10.4172/2167-0234.1000249.

[39] R. Grassa and K. Gazdar, “Financial development and economic growth in GCC countries: A comparative study between Islamic and conventional finance,” Int. J. Soc. Econ., vol. 41, no. 6, pp. 493–514, 2014, https://doi.org/10.1108/IJSE-12-2012-0232.

[40] H. Zarrouk, T. El Ghak, and E. Abu Al Haija, “Financial development, Islamic finance, and economic growth: evidence of the UAE,” J. Islam. Account. Bus. Res., vol. 8, no. 1, pp. 2–22, 2017, https://doi.org/10.1108/JIABR-05-2015-0020.

[41] W. Hakimah, W. Ibrahim, and A. G. Ismail, “Humanomics Conventional bank and Islamic banking as institutions: similarities and differences,” Humanomics Humanomics J. Financ. Report. Account. Iss Int. J. Islam. Middle East. Financ. Manag. Iss, vol. 31, no. 3, pp. 43–60, 2013, https://doi.org/10.1108/H-09-2013-0056.

[42] A. Salman and H. Nawaz, “Islamic financial system and conventional banking: A comparison,” Arab Econ. Bus. J., vol. 13, no. 2, pp. 155–167, 2018, https://doi.org/10.1016/j.aebj.2018.09.003.

[43] M. K. Hassan, “A Comparative Literature Survey of Islamic Finance and Banking,” SSRN Electron. J., no. 4, 2018, https://doi.org/10.2139/ssrn.3263061.

[44] A. Alam, R. S. Nizam, and M. T. Hidayat, “The role of an Islamic microfinance institution in empowering Indonesian fishing communities,” Univers. J. Account. Financ., vol. 9, no. 2, pp. 178–183, 2021, https://doi.org/10.13189/UJAF.2021.090205.

[45] M. Apriantoro, A. Suryaningsih, and M. Muthoifin, “Bibliometric Analysis of Research Development of Economic Dispute Settlement,” EUDL Eur. Union Digit. Libr., 2023, https://doi.org/10.4108/eai.19-10-2022.2329068.

Downloads

Submitted

Accepted

Published

Issue

Section

License

Copyright (c) 2024 Nisa Azzahro, Muthoifin, Shahbaz Alam

This work is licensed under a Creative Commons Attribution 4.0 International License.