Implementation of the Akad Murabahah Financing Program to Support SDGs: A Case Study at BMT Yaa Qawiyyu and BMT Sekawan Klaten

DOI:

https://doi.org/10.23917/profetika.v25i03.11329Keywords:

financing, akad murabahah, baitul mal wa tamwil, sdgs, shariaAbstract

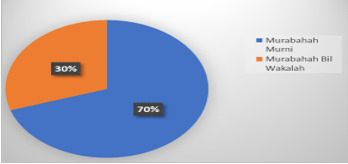

Objective: This study is to determine the implementation of the murabahah contract financing program at BMT Yaa Qawiyyu and BMT Sekawan Klaten and assess its suitability with the murabahah financing theory and fatwa of DSN MUI No. 04/DSN-MUI/IV/2000 regarding murabahah, while also supporting SDG Goal 8 and Goal 1 by encouraging inclusive, ethical, and sustainable financial access. Theoretical framework: The theoretical framework used is based on the theory of murabahah contracts in sharia economics and the provisions of sharia law formulated in the DSN MUI fatwa related to the mechanism for implementing murabahah contracts, which also aligns with global development agendas that promote responsible financial practices, as reflected in SDG Goal 16. Literature review: The literature review in this study covers theories about murabahah financing, implementation in Islamic financial institutions, and sharia regulations that regulate the practice, especially those issued by DSN MUI, emphasizing their role in achieving inclusive financial services as targeted in SDG Goal 10. Methods: The method used is a descriptive qualitative approach, with data collection techniques through observation, interviews, and documentation of two research objects, namely BMT Yaa Qawiyyu and BMT Sekawan Klaten, and using primary and secondary data, providing contextual relevance to SDG Goal 17 through collaboration with community-based financial institutions. Results: The results of the study show that the implementation of the murabahah contract in the two BMTs is by the murabahah theory and the provisions of the fatwa of DSN MUI No. 04/DSN-MUI/IV/2000. BMT Yaa Qawiyyu implements a pure murabahah contract, where BMT buys goods first from suppliers, and then sells them to members at agreed prices and profits. In addition, the two BMTs also use the murabahah bil wakalah scheme, where BMT gives power of attorney to members to purchase goods on behalf of BMT, and after the purchase transaction is carried out, the murabahah contract process is carried out with an explanation of the price, profit, and payment terms. Implications: The implication of this study is the importance of understanding and proper application of the provisions of DSN MUI's fatwa in sharia financing operations to remain by sharia principles and provide transparency to customers, which contributes to financial inclusion and ethical financing as envisioned in SDG Goals 1, 8, and 16. Novelty: The novelty of this study lies in a specific case study of two BMTs that shows two models of the implementation of the murabahah contract.

References

[1] J. Basri, A. K. Dewi, and G. Iswahyudi, “Pembiayaan Murabahah Pada Perbankan Syariah Dalam Perspektif Hukum Di Indonesia,” AL-MANHAJ J. Huk. Dan Pranata Sos. Islam 4, vol. 4, no. 2, pp. 375–80, 2022, https://doi.org/10.37680/almanhaj.v4i2.1802.

[2] E. S. A. Putra, F. H. N. Athief, and L. Hakim, “Pengembangan Produk Pembiayaan Konsumtif Pada Baitul Maal Wat Tamwil,” Al-Iqtishod J. Ekon. Syariah, vol. 5, no. 2, pp. 195–211, 2023, https://doi.org/10.51339/iqtis.v5i2.1469.

[3] A. Halim, “Perspektif Hukum Islam Dalam Implementasi Pembiayaan Murabahah Di Baitul Maal Wa Tamwil ( BMT ) UGT Sidogiri Capem Jember Kota Tahun 2023,” Lantabur J. Ekon. Syariah, vol. 4, no. 2, pp. 234–252, 2023, https://doi.org/10.53515/lantabur.2023.4.2.234-252.

[4] A. Alam, S. Septiana, A. El Asfahany, and R. A. Hamidah, “Persepsi Nasabah Pada Keunggulan Produk Pembiayaan Mudharabah Dan Murabahah di Lembaga Keuangan Mikro Islam BMT,” aL-IQTISHOD, vol. 11, no. 1, pp. 1–20, 2023, https://doi.org/10.37812/aliqtishod.v11i1.538.

[5] D. Khoirunnisa, H. Noviarita, and E. E. Elvia, “Revitalisasi Baitul Maal Wat Tamwil sebagai Pilar dalam Meningkatkan Perekonomian Masyarakat,” Media Law Sharia, vol. 4, no. 4, pp. 361–371, 2023, https://doi.org/10.18196/mls.v4i4.27.

[6] D. A. Purwasik, “Implementasi Akad Murabahah bil Wakalah di BMT Purwakarta Amanah Sejahtera ( PAS ),” Ammiah J. Ilm. Mhs. Ekon. Syariah, vol. 2, no. 2, pp. 121–131, 2022, https://doi.org/10.37726/jammiah.v2i2.255.

[7] N. Sobarna and S. Lutfadila, “Pelaksanaan Pembiayaan Murabahah di Koperasi Syariah,” Eco-Iqtishodi J. Ilm. Huk. Dan Keuang. Syariah, vol. 4, no. 2, pp. 97–109, 2023, https://doi.org/10.32670/ecoiqtishodi.v14i2.3094.

[8] D. Syaepudin, “Implementasi Akad Pembiayaan Mudharabah Pada Koperasi Syariah KSPPS BMT AL FATH IKMI,” J. MENTARI Manajemen, Pendidik. dan Teknol. Inf., vol. 3, no. 1, pp. 1–10, 2024, https://doi.org/10.33050/mentari.v3i1.522.

[9] J. Jureid, “Implementasi Pembiayaan Manindo Grameen Syariah dengan Akad Murabahah pada Koperasi Mitra Manindo Cabang Panyabungan,” J. BAABU AL-ILMI Ekon. dan Perbank. Syariah, vol. 6, no. 1, p. 15, 2021, https://doi.org/10.29300/ba.v6i1.4228.

[10] R. Riyaldi, H. Aravik, and C. Choirunnisak, “Analisis Strategi Pemasaran Pembiayaan Murabahah Pada Bank Syariah Indonesia ( Studi Kasus Bank Syariah Mandiri KC Simpang Patal Palembang ),” JIMPA J. Ilm. Mhs. Perbank. Syariah, vol. 2, no. 2, pp. 377–394, 2022, https://doi.org/10.36908/jimpa.v2i2.82.

[11] A. Alam, R. Sukmana, B. A. Fianto, and A. Izzuddin, “Comparative Analysis of Murabahah and Mudharabah Financing Risk from Islamic Microfinance Institutions Perspective Comparative Analysis of Murabahah and Mudharabah Financing Risk from Islamic Microfinance Institutions Perspective,” Al-Muzara’ah, vol. 10, no. 1, 2022, https://doi.org/10.29244/jam.10.1.79-92.

[12] T. K. Prameswari, D. P. Alvaro, E. S. Amanda, and F. Falikhatun, “Implementasi Akad Murabahah Pada BMT Usaha Mulya Masjid Raya Pondok Indah Jakarta,” Al-Kharaj J. Ekon. Keuang. Bisnis Syariah, vol. 4, no. 4, pp. 1090–1106, 2022, https://doi.org/10.47467/alkharaj.v4i4.840.

[13] N. Hidayah, A. Azis, and M. B. Muslim, “Complying with Sharia While Exemptinfrom Value-Added Tax: Murābaḥah in Indonesian Islamic Banks,” Ahkam J. Ilmu Syariah, vol. 22, no. 1, pp. 59–82, 2022, https://doi.org/10.15408/ajis.v22i1.22833.

[14] B. Khalidin, A. Musa, and A. Kiawan, “Murabaha Financing of the Indonesian Islamic Banks Under an Islamic Economic Law and the Fatwa Dsn Mui,” Petita J. Kaji. Ilmu Huk. dan Syariah, vol. 8, no. 2, pp. 203–218, 2023, https://doi.org/10.22373/petita.v8i2.238.

[15] A. Ibrahim and A. J. Salam, “A comparative analysis of DSN-MUI fatwas regarding murabahah contract and the real context application (A study at Islamic Banking in Aceh),” Samarah, vol. 5, no. 1, pp. 372–401, 2021, https://doi.org/10.22373/sjhk.v5i1.8845.

[16] A. El Ashfahany and M. N. Aini, “Analysis of the Economics and Psychological Impact of Baitul Maal Wat Tamwiil ( Bmt ) Financing,” I-Economics A Res. J. Islam. Econ., vol. 7, no. 1, pp. 1–10, 2021, https://doi.org/10.19109/ieconomics.v7i1.8572.

[17] M. S. Apriantoro, E. R. Puspa, D. I. Yafi, D. A. Putri, and R. Irfan Rosyadi, “Beyond Mortgages: Islamic Law and the Ethics of Credit Financing for Public Housing,” Profetika J. Stud. Islam, vol. 24, no. 02, pp. 196–206, 2023, https://doi.org/10.23917/profetika.v24i02.1795.

[18] M. Muchtar, “Analisis Risiko Akad Murabahah Di Perbankan Syariah,” Info Artha, vol. 5, no. 1, pp. 67–74, 2021, https://doi.org/10.31092/jia.v5i1.1246.

[19] R. A. Meirani, A. Damiri, and J. Jalaludin, “Penerapan Akad Murabahah pada Produk MULIA di Pegadaian Jalancagak Menurut Perspektif Ekonomi Syariah,” EKSISBANK Ekon. Syariah dan Bisnis Perbank., vol. 4, no. 1, pp. 60–68, 2020, https://doi.org/10.37726/ee.v4i1.69.

[20] Muhammad Fahmul Iltiham, “Mekanisme Penentuan Margin Pembiayaan Murabahah di Lembaga Keuangan Syariah,” Malia (Terakreditasi), vol. 12, no. 1, pp. 109–124, 2020, https://doi.org/10.35891/ml.v12i1.2386.

[21] R. K. Adnina, “Analisis Penerapan Akad Pembiayaan Murabahah Pada Lembaga Keuangan Syariah,” J. Huk. dan Kenotariatan, vol. 4, no. 1, p. 104, 2020, https://doi.org/10.33474/hukeno.v4i1.6451.

[22] M. D. bin Mahmud, “Pemenuhan Asas Transaksi Syariah Pada Pembiayaan Dengan Akad Murabahah,” El Dinar, vol. 9, no. 2, pp. 128–141, 2021, https://doi.org/10.18860/ed.v9i2.10914.

[23] A. Alam, Raditya Sukmana, Bayu Arie Fianto, and Azzam Izzuddin, “Comparative Analysis of Murabahah and Mudharabah Financing Risk from Islamic Microfinance Institutions Perspective,” Al-Muzara’Ah, vol. 10, no. 1, pp. 79–92, 2022, https://doi.org/10.29244/jam.10.1.79-92.

[24] A. Riyani, G. Pratama, and S. Surahman, “Analisis Sistem Pengelolaan Keuangan Pembiayaan Syariah Dengan Akad Murabahah,” Ecobankers J. Econ. Bank., vol. 3, no. 1, p. 1, 2022, https://doi.org/10.47453/ecobankers.v3i1.672.

[25] J. Basri, A. K. Dewi, and G. Iswahyudi, “Pembiayaan Murabahah pada Perbankan Syariah dalam Perspektif Hukum di Indonesia,” AL-MANHAJ J. Huk. dan Pranata Sos. Islam, vol. 4, no. 2, pp. 375–380, 2022, https://doi.org/10.37680/almanhaj.v4i2.1802.

[26] A. Yuliana, N. E. Fauziah, and I. Mujahid, “Tinjauan Fatwa DSN No : 04 / DSN-MUI / IX / 2000 tentang Murabahah dan Fatwa DSN No : 13 / DSN- MUI / IX / 2000 tentang Uang Muka dalam Murabahah terhadap Pembiayaan Griya di Bank Syariah Mandiri KCP Bandung Metro Margahayu,” Pros. Huk. Ekon. Syariah, vol. 6, no. 2, 2020, http://dx.doi.org/10.29313/syariah.v6i2.22118.

[27] B. A. Prabowo, “Konsep Akad Murabahah Pada Perbankan Syariah (Analisa Kritis Terhadap Aplikasi Konsep Akad Murabahah Di Indonesia Dan Malaysia),” J. Huk. Ius Quia Iustum, vol. 16, no. 1, pp. 106–126, 2009, https://doi.org/10.20885/iustum.vol16.iss1.art7.

[28] S. F. Nasution, “Pembiayaan Murabahah Pada Perbankan Syariah di Indonesia,” AT-TAWASSUTH J. Ekon. Islam, vol. 6, no. 1, p. 132, 2021, https://doi.org/10.30829/ajei.v6i1.7767.

[29] A. Hanjani and D. Ari Haryati, “Mekanisme Pembiayaan Murabahah Pada Nasabah di Baitul Maal Wa Tamwil Universitas Muhammadiyah Yogyakarta,” Jati J. Akunt. Terap. Indones., vol. 1, no. 1, pp. 46–51, 2018, https://doi.org/10.18196/jati.010105.

[30] Panetir Bungkes and M. Sahyuli, “Mekanisme Pengawasan Pembiayaan Murabahah Sebagai Upaya Meminimalisir Pembiayaan Bermasalah Pada Pt. Bank Syariah Mandiri Kantor Cabang Pembantu (Kcp) Takengon,” J. Penelit. Ekon. Akunt., vol. 5, no. 1, pp. 68–75, 2021, https://doi.org/10.33059/jensi.v5i1.3519.

[31] Irfan Harmoko, SE.I., MM, “Mekanisme Restrukturisasi Pembiayaan Pada Akad Pembiayaan Murabahah Dalam Upaya Penyelesaian Pembiayaan Bermasalah,” Qawãnïn J. Econ. Syaria Law, vol. 2, no. 2, pp. 61–80, 2018, https://doi.org/10.30762/q.v2i2.1042.

[32] N. L. Fatmawati and A. Hakim, “Analisis Tingkat Profitabilitas Perbankan Syariah di Indonesia,” J. BAABU AL-ILMI Ekon. dan Perbank. Syariah, vol. 5, no. 1, p. 1, 2020, https://doi.org/10.29300/ba.v5i1.3115.

[33] M. R. Kurniawan and S. T. Anggraeni, “The Problem of Akad Murabahah in Sharia Banks : Between Profit-Oriented and Sharia Compliance,” Demak Univers. J. Islam Sharia, vol. 2, no. 1, pp. 55–66, 2024, https://doi.org/10.61455/deujis.v2i01.97.

[34] M. Ali, “Analisis praktik pemberian diskon dalam pembiayaan murabahah di bank syariah indonesia kcp indramayu jatibarang berdasarkan fatwa dsn mui no: 16/dsn-mui/ix/2000,” J. Sharia Econ. Financ., vol. 2, no. 2, pp. 88–94, 2023, https://doi.org/10.31943/jsef.v2i2.30.

[35] D. Susanto, Risnita, and M. S. Jailani, “Teknik Pemeriksaan Keabsahan Data Dalam Penelitian Ilmiah,” J. QOSIM J. Pendidikan, Sos. Hum., vol. 1, no. 1, pp. 53–61, 2023, https://doi.org/10.61104/jq.v1i1.60.

[36] H. Zukriadi, Sulaiman, U., “Aneka Macam Penelitian,” SAMBARA J. Pengabdi. Kpd. Masy., vol. 1, no. 1, pp. 36–46, 2023, https://doi.org/10.58540/sambarapkm.v1i1.157.

[37] S. Y. L. Tumangkeng and J. B. Maramis, “Kajian Pendekatan Fenomenologi : Literature Review,” J. Pembang. Ekon. Dan Keuang. Drh., vol. 23, no. 1, pp. 14–32, 2022, https://doi.org/10.35794/jpekd.41379.23.1.2022.

[38] A. Sholikhah, “Statistik Deskriptif Dalam Penelitian Kualitatif,” KOMUNIKA J. Dakwah dan Komun., vol. 10, no. 2, pp. 342–362, 2016, https://doi.org/10.24090/komunika.v10i2.953.

[39] Annas Syams Rizal Fahmi, Muhammad Irkham Firdaus, May Shinta Retnowati, and Zulfatus Sa’diah, “Implementasi Fatwa Dsn-Mui No: 77/Dsn-Mui/V/2010 Terhadap Akad Murabahah Pada Produk Cicil Emas Di Bank Syariah Mandiri,” Al-Mizan J. Huk. dan Ekon. Islam, vol. 4, no. 2, pp. 1–12, 2020, https://doi.org/10.33511/almizan.v4n2.1-12.

[40] A. Iskandar, H. Wijaya, and K. Aqbar, “Analisis Shariah Compliance Praktik Murabahah Lil Aamir Bisy-Syiraa’ pada Bank Syariah di Indonesia,” Media Syari’ah Wahana Kaji. Huk. Islam dan Pranata Sos., vol. 22, no. 2, p. 114, 2021, https://doi.org/10.22373/jms.v22i2.8029.

[41] Y. S. Arief, M. Andi, and S. Maula, “Implementasi Pembayaran Denda Angsuran Keterlambatan Pembiayaan Murabahah di Perbankan Syariah ( Ditinjau dari Fatwa,” JIEI J. Ilim. Ekon. Islam, vol. 9, no. 1, pp. 1227–1236, 2023, http://dx.doi.org/10.29040/jiei.v9i1.7846.

[42] M. Ilyas, “Mekanisme Pembiayaan Mitraguna Berkah PNS dengan Akad Murabahah pada PT. Bank Syariah Mandiri Cabang Prabumulih,” Adl Islam. Econ., vol. 2, no. November, pp. 161–180, 2020, https://doi.org/10.56644/adl.v1i2.20.

[43] M. L. Istiqomah, “Penerapan Fatwa DSN MUI NO : 04 / DSN-MUI / IV / 2000 Tentang Pembiayaan Murabahah Di Lingkungan Perbankan Syariah Perspektif Maqashid Syariah,” Journal, Rechtenstudent Istiqomah, vol. 2, no. 3, pp. 242–254, 2021, https://doi.org/10.35719/rch.v2i3.68.

Submitted

Accepted

Published

Issue

Section

License

Copyright (c) 2024 Maulana Elpraja Sami’ul Haq, Muthoifin, Daffa Ghifari

This work is licensed under a Creative Commons Attribution 4.0 International License.