Predicting M-Payment Adoption Intention in Indonesia: Integrating Technology Acceptance Model and Psychological Factors

DOI:

https://doi.org/10.23917/indigenous.v8i3.2586Keywords:

Intention, m-payment adoption, path analysis, technology acceptance model, trustAbstract

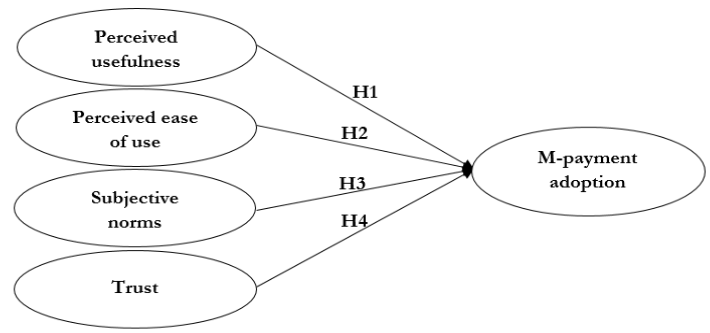

The government is currently promoting the growth of m-payment usage in Indonesia. Therefore, research is needed to identify the factors influencing the adoption intention of m-payment. One theory frequently employed to elucidate the usage intention of m-payment is the Technology Acceptance Model (TAM). According to this theory, intention arises from perceived usefulness and perceived ease of use. This study integrates TAM with psychological variables, namely, trust and subjective norms. This research aims to examine the factors influencing the adoption intention of m-payment. Before conducting the model test, this research begins with adapting and validating all measurement tools in the Indonesian language. Participants in this study are individuals aged 17 and above who own smartphones. The entire data collection is done online. The research instrument is validated with confirmatory factor analysis (CFA) on perceived usefulness, perceived ease of use, trust, subjective norm, and the adoption intention of m-payment (N=209). The model test is conducted through path analysis (N=210). The validation process confirms the theoretical model of the five instruments in the Indonesian version. The CFA results indicate that all five research instruments meet the cut-off criteria for fit indices RMSEA, CFI, TLI, and SRMR. The path analysis results reveal that perceived usefulness, perceived ease of use, and subjective norm influence the adoption intention of m-payment. In contrast, trust does not affect the adoption intention of m-payment. This research contributes both theoretically and practically, particularly regarding the factors influencing m-payment adoption.

References

AERA, APA, & NCME (2014). Standards for educational and psychological testing. American Educational Association.

Abrahão, R. de S., Moriguchi, S. N., & Andrade, D. F. (2016). Intention of adoption of mobile payment: An analysis in the light of the unified theory of acceptance and use of technology (UTAUT). RAI Revista de Administração e Inovação, 13(3), 221–230. https://doi.org/10.1016/j.rai.2016.06.003 DOI: https://doi.org/10.1016/j.rai.2016.06.003

Ajzen, I. (1991). The theory of planned behavior. Organizational Behavior and Human Decision Processes, 50(2), 179–211. https://doi.org/10.1016/0749-5978(91)90020-T DOI: https://doi.org/10.1016/0749-5978(91)90020-T

Bank Indonesia. (2019). Bank Indonesia: Menavigasi sistem pembayaran nasional di era digital Bank Indonesia. In Blueprint Sistem Pembayaran Indonesia 2025. retrieved from: https://www.bi.go.id/id/publikasi/kajian/Documents/Blueprint-Sistem-Pembayaran-Indonesia-2025.pdf

Beaton, D. E., Bombardier, C., Guillemin, F., & Ferraz, M. B. (2000). Guidelines for the process of cross-cultural adaptation of self-report measures. Spine, 25(24), 3186–3191. https://doi.org/10.1097/00007632-200012150-00014 DOI: https://doi.org/10.1097/00007632-200012150-00014

Behera, R. K., Bala, P. K., & Rana, N. P. (2022). Assessing factors influencing consumers’ non-adoption intention: exploring the dark sides of mobile payment. Information Technology and People, 36(7), 2941–2976. https://doi.org/10.1108/ITP-03-2022-0223 DOI: https://doi.org/10.1108/ITP-03-2022-0223

Busu, S., Karim, N. A., & Haron, H. (2018). Factors of adoption intention for near field communication mobile payment. Indonesian Journal of Electrical Engineering and Computer Science, 11(1), 98–104. https://doi.org/10.11591/ijeecs.v11.i1.pp98-104 DOI: https://doi.org/10.11591/ijeecs.v11.i1.pp98-104

Cain, M. K., Zhang, Z., & Yuan, K. H. (2017). Univariate and multivariate skewness and kurtosis for measuring nonnormality: Prevalence, influence and estimation. Behavior Research Methods, 49(5), 1716–1735. https://doi.org/10.3758/s13428-016-0814-1 DOI: https://doi.org/10.3758/s13428-016-0814-1

Czerwiński, S. K., & Atroszko, P. A. (2023). A solution for factorial validity testing of three-item scales: An example of tau-equivalent strict measurement invariance of three-item loneliness scale. Current Psychology, 42(2), 1652–1664. https://doi.org/10.1007/s12144-021-01554-5 DOI: https://doi.org/10.1007/s12144-021-01554-5

Davis, F. D. (1989). Perceived usefulness, perceived ease of use, and user acceptance of information technology. MIS Quarterly, 13(3), 319–340. https://doi.org/10.2307/249008 DOI: https://doi.org/10.2307/249008

de Mooij, M., & Hofstede, G. (2011). Cross-cultural consumer behavior: A review of research findings. Journal of International Consumer Marketing, 23(3), 181–192. https://doi.org/10.1080/08961530.2011.578057

Field, A., Miles, J., Field, Z. (2012). Discovering statistics using R. Choice Reviews Online, 50(4). https://doi.org/10.5860/choice.50-2114 DOI: https://doi.org/10.5860/CHOICE.50-2114

Handarkho, Y. D., Harjoseputro, Y., Samodra, J. E., & Irianto, A. B. P. (2021). Understanding proximity mobile payment continuance usage in Indonesia from a habit perspective. Journal of Asia Business Studies, 15(3), 420–440. https://doi.org/10.1108/JABS-02-2020-0046 DOI: https://doi.org/10.1108/JABS-02-2020-0046

APJII (2023). Survei APJII pengguna internet di Indonesia. Asosiasi Penyelenggara Jasa Internet Indonesia. APJII. Retrieved from: https://apjii.or.id/berita/d/survei-apjii-pengguna-internet-di-indonesia-tembus-215-juta-orang

Javier, F. (2022). E-wallet jadi alat pembayaran digital terpopuler di 2021. Tempo ID. https://data.tempo.co/data/1316/e-wallet-jadi-alat-pembayaran-digital-terpopuler-di-2021

Kamal, S. A., Shafiq, M., & Kakria, P. (2020). Investigating acceptance of telemedicine services through an extended technology acceptance model (TAM). Technology in Society, 60. https://doi.org/10.1016/j.techsoc.2019.101212 DOI: https://doi.org/10.1016/j.techsoc.2019.101212

Khan, S., Khan, S. U., Khan, I. U., Khan, S. Z., & Khan, R. U. (2023). Understanding consumer adoption of mobile payment in Pakistan. Journal of Science and Technology Policy Management. https://doi.org/10.1108/JSTPM-07-2021-0110 DOI: https://doi.org/10.1108/JSTPM-07-2021-0110

Kim, C., Mirusmonov, M., & Lee, I. (2010). An empirical examination of factors influencing the intention to use mobile payment. Computers in Human Behavior, 26(3), 310–322. https://doi.org/10.1016/j.chb.2009.10.013 DOI: https://doi.org/10.1016/j.chb.2009.10.013

Kumar, P. (2023). A meta-analysis of trust in mobile banking: The moderating role of cultural dimensions. International Journal of Bank Marketing, 60. https://doi.org/10.1108/IJBM-02-2022-0075 DOI: https://doi.org/10.1108/IJBM-02-2022-0075

Lew, S., Tan, G. W., Loh, X., Hew, J., & Ooi, K. (2020). The disruptive mobile wallet in the hospitality industry: An extended mobile technology acceptance model. Technology in Society, 63, 1–10. https://doi.org/10.1016/j.techsoc.2020.101430 DOI: https://doi.org/10.1016/j.techsoc.2020.101430

Liebana-Cabanillas, F. J., Sanchez-Fernandez, J., & Munoz-Leiva, F. (2014). Role of gender on acceptance of mobile payment. Industrial Management and Data Systems, 114(2), 220–240. https://doi.org/10.1108/IMDS-03-2013-0137 DOI: https://doi.org/10.1108/IMDS-03-2013-0137

Lisana, L. (2022). Understanding the key drivers in using mobile payment among generation Z. Journal of Science and Technology, 15(3), 420–440. https://doi.org/10.1108/JSTPM-08-2021-0118 DOI: https://doi.org/10.1108/JSTPM-08-2021-0118

Lu, J., Yao, J. E., & Yu, C. S. (2005). Personal innovativeness, social influences and adoption of wireless internet services via mobile technology. The Journal of Strategic Information Systems, 14(3), 245–268. https://doi.org/10.1016/j.jsis.2005.07.003 DOI: https://doi.org/10.1016/j.jsis.2005.07.003

Marriott, H., & Williams, M. (2016). Developing a theoretical model to examine consumer acceptance behavior of mobile shopping. Proceedings of the 15th IFIP WG 6.11, Conference on e-Business, e-Services and e-Society, 261–266. https://doi.org/10.1007/978-3-319-45234-0 DOI: https://doi.org/10.1007/978-3-319-45234-0_24

Matemba, E. D., & Li, G. (2018). Consumers’ willingness to adopt and use WeChat wallet: An empirical study in South Africa. Technology in Society, 53, 53–68. https://doi.org/10.1016/j.techsoc.2017.12.001 DOI: https://doi.org/10.1016/j.techsoc.2017.12.001

Mayer, R. C., Davis, J. H., & Schoorman, F. D. (1995). An integrative model of organizational trust. The Academy of Management Review, 20(3), 709–734. https://dMuthén, L. K., & Muthén, B. O. (2002). How to use a monte carlo study to decide on sample size and determine power. Structural Equation Modeling: A Multidisciplinary Journal, 9(4), 599–620. https://doi.org/10.1207/S15328007SEM0904_8

Mufiedah, L. A. A., Karyani, U., & Hertinjung, W. S. (2023). Determinants of health protocols compliance on office workers. Indigenous: Jurnal Ilmiah Psikologi, 8(1), 9–21. https://doi.org/10.23917/indigenous.v7i3.20346 DOI: https://doi.org/10.23917/indigenous.v8i1.20346

Muthén, L. K., & Muthén, B. O. (2002). How to use a monte carlo study to decide on sample size and determine power. Structural Equation Modeling: A Multidisciplinary Journal, 9(4), 599–620. https://doi.org/10.1207/S15328007SEM0904_8 DOI: https://doi.org/10.1207/S15328007SEM0904_8

Muthén, L. K., & Muthén, B. O. (2017). Mplus user’s guide (8th ed.). Muthén & Muthén.

Nguyen, T. N., Cao, T. K., Dang, P. L., & Nguyen, H. A. (2016). Predicting consumer intention to use mobile payment services: Empirical evidence from Vietnam. International Journal of Marketing Studies, 8(1), 117–124. https://doi.org/10.5539/ijms.v8n1p117 DOI: https://doi.org/10.5539/ijms.v8n1p117

Oliveira, T., Thomas, M., Baptista, G., & Campos, F. (2016). Mobile payment: Understanding the determinants of customer adoption and intention to recommend the technology. Computers in Human Behavior, 61, 404–414. https://doi.org/10.1016/j.chb.2016.03.030 DOI: https://doi.org/10.1016/j.chb.2016.03.030

Palvia, P. (2009). The role of trust in e-commerce relational exchange: A unified model. Information & Management, 46(4), 213–220. https://doi.org/https://doi.org/10.1016/j.im.2009.02.003 DOI: https://doi.org/10.1016/j.im.2009.02.003

Phonthanukitithaworn, C., Sellitto, C., & Fong, M. W. L. (2016). A comparative study of surrent and potential users of mobile payment services. SAGE Open, 6(4), 1–14. https://doi.org/10.1177/2158244016675397 DOI: https://doi.org/10.1177/2158244016675397

Rahardja, U., Sigalingging, C. T., Putra, P. O. H., Nizar Hidayanto, A., & Phusavat, K. (2023). The impact of mobile payment application design and performance attributes on consumer emotions and continuance intention. SAGE Open, 13(1), 1–18. https://doi.org/https://doi.org/10.1177/21582440231151919 DOI: https://doi.org/10.1177/21582440231151919

Rahman, M., Ismail, I., & Bahri, S. (2020). Analysing consumer adoption of cashless payment in Malaysia. Digital Business, 1(1), 1–11. https://doi.org/https://doi.org/10.1016/j.digbus.2021.100004 DOI: https://doi.org/10.1016/j.digbus.2021.100004

Rai, N. G. M., Ratu, A., & Savitri, E. D. (2021). Factors mediating work-family balance to job satisfaction in higher education during pandemic. Indigenous: Jurnal Ilmiah Psikologi, 6(3), 60–72. https://doi.org/https://doi.org/10.23917/indigenous.v6i3.15505 DOI: https://doi.org/10.23917/indigenous.v6i3.15505

Shamon, H., & Berning, C. (2020). Attention check items and instructions in online surveys with incentivized and nonincentivizedquality samples: Boon or bane for data quality?. Survey Research Methods, 14(1), 55–77. https://doi.org/10.18148/srm/2020.v14i1.7374 DOI: https://doi.org/10.2139/ssrn.3549789

Shankar, A., & Datta, B. (2018). Factors affecting mobile payment adoption intention: An Indian perspective. Global Business Review, 19(3), S72–S89. https://doi.org/10.1177/0972150918757870 DOI: https://doi.org/10.1177/0972150918757870

Shavitt, S., & Barnes, A. J. (2020). Culture and the consumer journey. Journal of Retailing, 96(1), 40–54. https://doi.org/10.1016/j.jretai.2019.11.009 DOI: https://doi.org/10.1016/j.jretai.2019.11.009

Shaw, B., & Kesharwani, A. (2019). Moderating effect of smartphone addiction on mobile wallet payment adoption. Journal of Internet Commerce, 18(3), 291–309. https://doi.org/10.1080/15332861.2019.1620045 DOI: https://doi.org/10.1080/15332861.2019.1620045

Skrondal, A., & Laake, P. (2001). Regression among factor scores. Psychometrika, 66(4), 563–575. https://doi.org/10.1007/BF02296196oi.org/10.2307/258792 DOI: https://doi.org/10.1007/BF02296196

Susiloadi, P., & Renanita, T. (2023). Understanding compulsive buying tendencies: The roles of attitude towards money. Indigenous: Jurnal Ilmiah Psikologi, 8(1), 70–81. https://doi.org/10.23917/indigenous.v8i1.20734 DOI: https://doi.org/10.23917/indigenous.v8i1.20734

Tew, H. T., Tan, G. W. H., Loh, X. M., Lee, V. H., Lim, W. L., & Ooi, K. B. (2021). Tapping the next purchase: Embracing the wave of mobile payment. Journal of Computer Information Systems, 62(3), 1–9. https://doi.org/10.1080/08874417.2020.1858731 DOI: https://doi.org/10.1080/08874417.2020.1858731

Tiwari, P., Tiwari, S. K., & Gupta, A. (2021). Examining the impact of customers’ awareness, risk and trust in m-banking adoption. FIIB Business Review, 10(4), 413–423. https://doi.org/10.1177/23197145211019924 DOI: https://doi.org/10.1177/23197145211019924

Türker, C., Altay, B. C., & Okumuş, A. (2022). Understanding user acceptance of QR code mobile payment systems in Turkey: An extended TAM. , 184. Technological Forecasting and Social Change, 184. https://doi.org/10.1016/j.techfore.2022.121968 DOI: https://doi.org/10.1016/j.techfore.2022.121968

Waechter, L. G. & K. A. (2015). Examining the role of initial trust in user adoption of mobile payment services: an empirical investigation. Information Systems Frontiers, 19(3), 525–548. https://doi.org/10.1007/s10796-015-9611-0 DOI: https://doi.org/10.1007/s10796-015-9611-0

Wang, J., & Wang, X. (2020). Structural equation modeling: Application using Mplus (2nd ed.). Wiley. DOI: https://doi.org/10.1002/9781119422730

Wei, M., Luh, Y., Huang, Y., & Chang, Y. (2021). Young generation’s mobile payment adoption behavior: Analysis based on an extended UTAUT model. Journal Of Theoretical and Applied Electronic Commerce Research, 16(4), 618–637. https://doi.org/10.3390/ jtaer16040037 DOI: https://doi.org/10.3390/jtaer16040037

Yang, Y., Liu, Y., Li, H., & Yu, B. (2015). Understanding perceived risks in mobile payment acceptance. Industrial Management and Data Systems, 115(2), 253–269. https://doi.org/10.1108/IMDS-08-2014-0243 DOI: https://doi.org/10.1108/IMDS-08-2014-0243

Yi, M. Y., Jackson, J. D., Park, J. S., & Probst, J. C. (2006). Understanding information technology acceptance by individual professionals: Toward an integrative view. Information and Management, 43(3), 350–363. https://doi.org/10.1016/j.im.2005.08.006 DOI: https://doi.org/10.1016/j.im.2005.08.006

Zhang, Q., Khan, S., Cao, M., & Khan, S. U. (2023). Factors determining consumer acceptance of NFC mobile payment: An extended mobile technology acceptance model. Sustainability, 15(4), 1–18. https://doi.org/10.3390/su15043664 DOI: https://doi.org/10.3390/su15043664

Zhao, Y., & Bacao, F. (2021). How does the pandemic facilitate mobile payment? An investigation on users ’ perspective under the covid-19 pandemic. International Journal of Environmental Research and Public Health, 18(3), 1–22. https://doi.org/10.3390/ijerph18031016 DOI: https://doi.org/10.3390/ijerph18031016

Downloads

Submitted

Published

How to Cite

Issue

Section

License

Copyright (c) 2023 Priyanto Susiloadi, Theda Renanita, Julaibib

This work is licensed under a Creative Commons Attribution 4.0 International License.