Sustainable Practice of Sukuk

DOI:

https://doi.org/10.23917/profetika.v26i02.8376Keywords:

sukuk, sustainability, islamic finance, transactions and development, sdgsAbstract

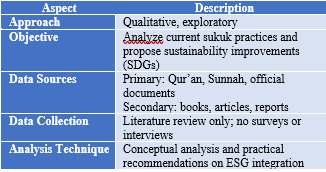

Objective: This study aims to analyze the current sukuk practices and formulate strategies to increase sustainability in sukuk transactions. The main focus of the research is to bridge the gap between sustainability principles and Islamic financial practices, particularly in sukuk transactions, to maximize their contribution to the Sustainable Development Goals (SDGs). Theoretical framework: Based on sharia principles and sustainable finance theory, especially ESG aspects in Sukuk instruments. Literature review: There is a considerable amount of sukuk literature, but studies on its relationship with sustainability and ESG are still limited and in-depth. Methods: Using qualitative methods through the analysis of literature and Islamic financial sector sources to evaluate the suitability of sukuk with sustainability principles. Results: The results show that sukuk has great potential as an innovative financial instrument that can directly support the Sustainable Development Goals (SDGs), including access to affordable renewable energy, infrastructure development, and the creation of sustainable cities and communities. Implications: Provides a basis for academics and policymakers to develop a sustainable sukuk policy framework. Novelty: Offers a new approach that explicitly links sukuk and ESG, as well as practical strategies for its integration in Islamic finance.

References

[1] P.-O. Klein and L. Weill, “Why do companies issue Sukuk?” Rev. Financ. Econ., vol. 31, pp. 26–33, 2016, https://doi.org/10.1016/j.rfe.2016.05.003.

[2] S. Kashfia, H. Rashedul, and D. M. Mohammad, “Underpinning the benefits of green banking: A comparative study between Islamic and conventional banks in Bangladesh,” Thunderbird Int. Bus. Rev, vol. 61, pp. 735–744, 2019, https://doi.org/10.1002/tie.22031.

[3] N. Alam, M. K. Hassan, and M. Aminul-Haque, “Are Islamic bonds different from conventional bonds? International evidence from capital market tests,” Borsa Istanbul Rev.., vol. 13, no. 3, pp. 22–29, 2013, https://doi.org/10.1016/j.bir.2013.10.006.

[4] N. Nader, M. Mourad, and B. Slah, “Do regional and global uncertainty factors affect differently the conventional bonds and sukuk? New evidence,” Pacific-Basin Financ. J., vol. 41, pp. 65–74, 2017, https://doi.org/10.1016/j.pacfin.2016.12.004.

[5] N. A. Borhan and N. Ahmad, “Identifying the determinants of Malaysian corporate sukuk rating,” Int. J. Islam. Middle East. Financ. Manag., vol. 11, no. 3, pp. 432–448, 2018, https://doi.org/10.1108/IMEFM-02-2017-0045.

[6] S. Mohamad, O. Lehner, and A. Khorshid, “A Case for an Islamic Social Impact Bond,” ACRN Oxford J. Financ. Risk Perspect., vol. 52, pp. 65–74, 2016, https://doi.org/10.2139/ssrn.2702507.

[7] S. Azmat, M. Skully, and K. Brown, “Issuer’s choice of Islamic bond type,” Pacific-Basin Financ. J., vol. 28, pp. 122–135, 2014, https://doi.org/10.1016/j.pacfin.2013.08.008.

[8] M. H. Uddin, S. H. Kabir, M. S. Hossain, N. S. A. Wahab, and J. Liu, “Which firms prefer Islamic debt? An analysis and evidence from global sukuk and bonds issuing firms,” Emerg. Mark. Rev., vol. 44, p. 100712, 2020, doi: 10.1016/j.ememar.2020.100712, https://doi.org/10.1016/j.ememar.2020.100712.

[9] H. Fathyah, M. N. Darina, and A. Azlan, “Corporate Governance and Sustainability Practices in Islamic Financial Institutions: The Role of Country of Origin,” Procedia Econ. Financ., vol. 31, pp. 36 – 43, 2015, https://doi.org/10.1016/S2212-5671(15)01129-6.

[10] S. Aristeidis, P. Spyros, and K. Drosos, “The connectedness between Sukuk and conventional bond markets and the implications for investors,” Int. J. Islam. Middle East. Financ. Manag., vol. 14, no. 5, pp. 928–949, 2020, https://doi.org/10.1108/IMEFM-04-2020-0161.

[11] A. Rym, R. Sonia, and S. Dhafer, “Toward the development of an Islamic banking sustainability performance index,” Int. J. Islam. Middle East. Financ. Manag., vol. 16, no. 4, pp. 734–755, 2023, https://doi.org/10.1108/IMEFM-12-2021-0479.

[12] K. Kusuma and A. Silva, “Sukuk markets: a proposed approach for development. World Bank Group,” Policy Res. Work. Pap., vol. 7133, pp. 1–39, 2014, https://doi.org/10.1596/1813-9450-7133.

[13] P. Andrea, D. Alberto, M. Milena, and P. Stefano, “Islamic finance development and banking ESG scores: Evidence from a cross-country analysis,” Res. Int. Bus. Financ., vol. 51, 2020, https://doi.org/10.1016/j.ribaf.2019.101100.

[14] Y. A. J. and A. Dalal, “Exploring synergies and performance evaluation between Islamic funds and socially responsible investment (SRIs) in light of the Sustainable Development Goals (SDGs),” Heliyon, vol. 6, p. 4562, 2020, https://doi.org/10.1016/j.heliyon.2020.e04562.

[15] N. Nader, H. Shawkat, and A. Mohamed S, “Dependence structure between sukuk (Islamic bonds) and stock market conditions: An empirical analysis with Archimedean copulas,” J. Int. Financ. Mark. Institutions Money, vol. 44, pp. 148–165, 2016, https://doi.org/10.1016/j.intfin.2016.05.003.

[16] M. Billah, A. H. Elsayed, and S. Hadhri, “Asymmetric relationship between green bonds and Sukuk markets: The role of global risk factors,” J. Int. Financ. Mark. Institutions Money, vol. 83, 2023, https://doi.org/10.1016/j.intfin.2022.101728.

[17] S. Najeeb, O. Bacha, and M. Masih, “Does a held-to-maturity strategy impede effective portfolio diversification for Islamic bond (Sukuk) portfolios? A multi-scale continuous wavelet correlation analysis,” Emerg. Mark. Financ. Trade, vol. 53, no. 10, pp. 2377–2393, 2017, https://doi.org/10.1080/1540496X.2016.1205977.

[18] A. Nawaf, “Sukuk versus bonds: New evidence from the primary market,” Borsa Istanbul Rev.., vol. 22, no. ue 5, pp. 1033–1038, 2022, https://doi.org/10.1016/j.bir.2022.06.005.

[19] K. M. Yassine and K. S. Hj, “An Innovative Financing Instrument to Promote the Development of Islamic Microfinance through 238 Socially Responsible Investment Sukuk,” J. Islam. Monet. Econ. Financ., vol. 4, no. 2, pp. 237 – 250, 2018, https://doi.org/10.21098/jimf.v4i2.935.

[20] R. Wilson, “Innovation in the structuring of Islamic sukuk securities,” Humanomics, vol. 24, no. 3, pp. 170–181, 2008, https://doi.org/10.1108/08288660810899340.

[21] N. Nader and H. Shawkat, “Do global financial distress and uncertainties impact GCC and global sukuk return dynamics?” Pacific-Basin Financ. J., vol. 39, pp. 57–69, 2016, https://doi.org/10.1016/j.pacfin.2016.05.016.

[22] A. Ameenullah, N. A. Mohamed, Y. Mohamad, E. I. Syed, and A. Azhar, “Factors affecting sukuk market development: empirical evidence from sukuk issuing economies,” Int. J. Islam. Middle East. Financ. Manag., vol. 15, no. 5, pp. 2022 884–902, 2022, https://doi.org/10.1108/IMEFM-03-2020-0105.

[23] H. Kalkavan, H. Dinçer, and S. Yüksel, “Analysis of Islamic moral principles for sustainable economic development in developing society,” Int. J. Islam. Middle East. Financ. Manag., vol. 14, no. 5, pp. 2021 982–999, 2021, https://doi.org/10.1108/IMEFM-07-2019-0271.

[24] B. S. Abdullahi, A. Akhtarzaite, Z. Luqman, and A. Muhammad, “Dana Gas Sukuk default: a juristic analysis of court judgement,” Int. J. Islam. Middle East. Financ. Manag., vol. 12, no. 4, 2019, https://doi.org/10.1108/IMEFM-01-2019-0033.

[25] S. M. Abubakar, H. Mirajul, and R. Memoona, “The contribution of Shariah Compliant products to SDGs attending through the pace of economic growth: an empirical evidence from Pakistan,” Int. J. Islam. Middle East. Financ. Manag., vol. 15, no. 4, pp. 2022 681–698, 2022, https://doi.org/10.1108/IMEFM-02-2020-0062.

[26] H. Rashedul, V. Sivakumar, and K. A. Faisal, “Socially responsible investment (SRI) Sukuk as a financing alternative for post-COVID-19 development project,” Int. J. Islam. Middle East. Financ. Manag., vol. 15, no. 2, pp. 425–440, 2022, https://doi.org/10.1108/IMEFM-07-2020-0379.

[27] H. Ahmed, M. K. Hassan, and B. Rayfield, “When and why firms issue sukuk?” Manag. Financ., vol. 44, no. 6, pp. 774–786, 2018, https://doi.org/10.1108/MF-06-2017-0207.

[28] I. Warde, Islamic finance in the global economy. Edinburgh University Press, 2000, https://doi.org/10.3366/edinburgh/9780748612161.001.0001.

[29] S. Chakrabarthy and W. Liang, “The Long Term Sustenance of Sustainability Practices in MNCs: A Dynamic Capabilities Perspective of the Role of R&D and Internationalization,” J. Bus. Ethics, vol. 110, pp. 205–217, 2011, https://doi.org/10.1007/s10551-012-1422-3.

[30] T. D. Le, T. H. Ho, D. T. Nguyen, and T. Ngo, “A cross-country analysis on diversification, Sukuk investment, and the performance of Islamic banking systems under the COVID-19 pandemic,” Heliyon, vol. 12, 8(3) 2022, https://doi.org/10.1016/j.heliyon.2022.e09106.

[31] A. A. Adam and E. Shauki, “Socially Responsible Investment in Malaysia: Behavioural Framework to Evaluate Investors’ Decision–Making Process,” Int. Grad. Sch. Bus. J., vol. 80, no. 2, pp. 224–240, 2012, https://doi.org/10.1016/j.jclepro.2014.05.075.

[32] C. J. Godlewski, R. Turk-Ariss, and L. Weill, “Sukuk vs conventional bonds: a stock market perspective,” J. Comp. Econ., vol. 41, no. 3, pp. 745–761, 2013, https://doi.org/10.1016/j.jce.2013.02.006.

[33] M. Hasan and J. Dridi, “The effects of the global crisis on Islamic and conventional banks: A comparative study,” IMF Work. Pap., no. 11/201, 2011, https://doi.org/10.5089/9781463902154.001.

[34] S. Wijnbergen and S. Zaheer, “Sukuk Defaults: On Distress Resolution in Islamic Finance.” SSRN, 2016. https://doi.org/10.2139/ssrn.2293938.

[35] A. Prayogi, “Pendekatan Kualitatif dalam Ilmu Sejarah: Sebuah Telaah Konseptual,” Hist. Madania J. Ilmu Sej., vol. 5, no. 2, pp. 240–254, 2021, https://doi.org/10.15575/hm.v5i2.15050.

[36] A. Sholikhah, “Statistik Deskriptif Dalam Penelitian Kualitatif,” KOMUNIKA J. Dakwah dan Komun., vol. 10, no. 2, pp. 342–362, 2016, https://doi.org/10.24090/komunika.v10i2.953.

[37] M. Mulyadi, “Penelitian Kuantitatif Dan Kualitatif Serta Pemikiran Dasar Menggabungkannya,” J. Stud. Komun. dan Media, vol. 15, no. 1, p. 128, 2013, https://doi.org/10.31445/jskm.2011.150106.

[38] D. Vita and L. Soehardi, “Sustainable Development Berbasis Green Economy,” Pros. Semin. Sos. Polit. Bisnis, Akuntasi dan Tek., pp. 31–39, 2022, https://doi.org/10.32897/sobat.2022.4.0.1908.

[39] E. Endris and A. Kassegn, “The role of micro, small and medium enterprises (MSMEs) to the sustainable development of sub-Saharan Africa and its challenges: a systematic review of evidence from Ethiopia,” J. Innov. Entrep., vol. 11, no. 1, 2022, https://doi.org/10.1186/s13731-022-00221-8.

[40] M., F. Typhano Rachmadie et al., “Bibliometric Analysis of the Socialization of Islamic Inheritance Law in the Scopus Database and Its Contribution to Sustainable Development Goals (SDGs),” J. Lifestyle SDG Rev.., vol. 5, no. 2, 2025, https://doi.org/10.47172/2965-730X.SDGsReview.v5.n02.pe03057.

[41] M., M. Abuzar et al., “Fostering Multicultural Community Harmony To Enhance Peace and Sustainable Development Goals (Sdg’S),” J. Lifestyle SDG’S Rev., vol. 5, no. 1, 2025, https://doi.org/10.47172/2965-730X.SDGsReview.v5.n01.pe01687.

[42] M., AM Rohimat et al., “Sharia Economic Empowerment of Low-Income Communities and Subsidy Recipients in Boyolali for Sustainable Development Goals,” J. Lifestyle SDG Rev.., vol. 5, no. 1, 2025, https://doi.org/10.47172/2965-730X.SDGsReview.v5.n01.pe02983.

[43] S. U. A. Khondoker, Waston, A. N. An, Mahmudulhassan, and M, “The Role of Faith-Based Education in Bangladesh’s Multicultural System and Its Impact on the Sustainable Development Goals (SDGs),” J. Lifestyle SDG’S Rev.., vol. 5, no. 2, 2025, https://doi.org/10.47172/2965-730X.SDGsReview.v5.n02.pe03472.

[44] M., Mahmudulhassan et al., “an Interfaith Perspective on Multicultural Education for Sustainable Development Goals (Sdgs),” J. Lifestyle SDG’S Rev., vol. 4, no. 3, p. e01720, Sep. 2024, https://doi.org/10.47172/2965-730X.SDGsReview.v4.n03.pe01720.

[45] M. Sri Mega Indah Umi Zulfiani and I. Rosyadi, “Corporate Social Responsibility (CSR) Practices Of Shariaconsumer Cooperatives For Sustainable Development Goals (SDGs) Ethical Perspective,” J. Lifestyle SDGs Rev.., vol. 4, pp. 1–20, 2024, https://doi.org/10.47172/2965-730X.SDGsReview.v4.n00.pe01752.

[46] H. Hikmatul, “Industri Halal Sebagai System Pendukung Sustainable Development Goals di Era Society 5.0,” Tabur, L A N Syari, J. Ekon., vol. 4, no. 1, pp. 43–59, 2022, https://doi.org/10.53515/lantabur.2022.4.1.43-59

[47] M, N. Yaman, I. Rosyadi, Isman, Masithoh, and I. Afiyah, “Fostering The Ummah’s Economy Through The Stock-investment System : The Views Of The Mui For Sustainable Development Goals ( SDGS ),” J. Lifestyle SDG’S Rev.., vol. 4, no. 1, pp. 1–19, 2024, https://doi.org/10.47172/2965-730X.SDGsReview.v4.n00.pe01685.

Submitted

Accepted

Published

Issue

Section

License

Copyright (c) 2025 Ataollah Rahmani, Dandy Okorontah

This work is licensed under a Creative Commons Attribution 4.0 International License.