Basic arithmetic on financial literacy skills: A new learning outcome

DOI:

https://doi.org/10.23917/jramathedu.v8i1.1252Keywords:

Basic arithmetics , Financial literacy , Merdeka currirulumAbstract

Multiplication is the most difficult basic arithmetic operation and has been documented since 1980. Another multiplication difficulty dealing with story problems, they tend to assume that multiplication produces a larger result and the other way for division. Several studies show basic mathematics as one of the cognitive factors that affect the financial literacy ability of each individual. This study used a qualitative descriptive analysis with the subject of three students from different schools and geographical locations. Basic mathematics as one of the cognitive factors that affect the financial literacy ability of each individual The introduction of cases such as ordering through online applications in learning mathematics may improve students' knowledge about activities related to finance. Individual context is important in personal financial management since the decision pertains to the fulfilment of personal needs.

INTRODUCTION

One of the objectives of learning mathematics in independent curriculum is to relate the subject matter to a field of study, across fields of study, across fields of science, or to everyday life (Kemendikbudristek, 2022). The independent curriculum mathematics learning outcomes in the quantity content element in phase C (equivalent to grades 5) make an explicit connection between mathematics and the financial field, namely students will be able to solve problems related to money. The Indonesian government's strategy in Merdeka Curriculum formulates Mathematics subjects with financial content in line with the Organization for Economic Cooperation and Development (OECD). Sole (2014) found that students became more familiar with economic terms and financial vocabulary through the integration of financial literacy in the school curriculum.

A number of previous studies on financial literacy in mathematics classrooms have shown that appropriate task design can lead to improved financial knowledge and mathematical skills (Blue & Grootenboer, 2019; Blue et al., 2018; Dituri et al., 2019; Sole, 2017). Task design in learning contains cognitive, emotional, and sociocultural aspects (Kieran et al., 2015). These three aspects are needed in designing mathematics tasks that contain financial contexts (Ozkale & Aprea, 2023; Blue et al., 2018). Several things to consider in implementing financial literacy in mathematics class, such as differences in students' understanding of the principles and concepts of financial literacy (Sole, 2014; Cupák, et al., 2018; Moreno-Herrero, et al., 2018; Arceo-Gomez & Villagómez, 2017), family background, gender differences, and socio-cultural environment (Lusardi, et al, 2020; Bottazzi & Lusardi, 2020; Hizgilov & Silber, 2019; Riitsalu & Põde, 2016), sufficient time at school to organize financial literacy in the school curriculum (Sole, 2014; Moreno-Herrero, et al., 2018).

Savard (2022) argues that financial concepts during this time were only used as contextual elements to introduce and relate mathematics to students' daily lives. Sawatzki provides an alternative for teachers in designing financial literacy tasks in mathematics lessons can adopt PISA questions. It aims to present problems that students can imagine and direct students to broaden their horizons, which PISA does by considering the aspects mentioned (Sawatzki & Sullivan, 2018). In fact, students can find solutions to math problems without explicitly talking about the importance, characteristics and functions of money (Hill 2010 ). Savard (2022) providing an illustration of a mathematical word problem using the context of money on decimal material: “Zoe is looking at buying stationery. Pencil cost $1.25, ruler cost $2.15, and notebook $3.55 How much does she need before taxes to buy one of each item?”. The financial context is seen as cosmetic, it can easily be replaced with another context, using the same numbers, the same operations, and therefore, the same mathematical structures: Zoe is measuring the height of trees in garden, the pine is 1.25 meters tall, the cypress is 2.15 meters tall, and the lychee is 3.55 meters tall. What is the total length of the trees? (Savard & Polotskaia, 2017). Task design with financial contexts are not only used to provide a relevant context for learning mathematics. However, at the same time they gain information about finance and economics from the various financial contexts used.

Research previously, the context of money has been used in mathematics learning for grade 4 and 5 students. Ozkale and Aprea (2023) used the context of the issue of wages on number material for grade 5 students. Meanwhile, Savard and Cavalcante (2022) introduced arithmetic and algebra material using the context of understanding our world in a time of crisis for grade 5 students and gambling activities as sociocultural contexts in probability material to foster students' knowledge about money (Savard, 2022). In this study, the context of money used is the transaction online. The massive development of the digital era has an impact on buying and selling transactions. Nowadays, online transactions provide convenience for customers, including children. Starting from transportation services, food delivery, digital payments, to purchasing goods. Companies are competing to provide bonuses and discounts to attract customers. Through tasks that contain product price comparisons on online transaction services, students will gain experience in choosing products to get the cheapest price. The task is in line with the competencies that students should have by the end of phase C on whole number materials, including (1) performing addition and subtraction operations of fractions, as well as performing multiplication and division operations of fractions with natural numbers, (2) they can reason proportionally and use multiplication and division operations in solving everyday problems with ratios and or related to proportions, and (3) they can also solve problems related to money (Kemendikbudristek, 2022).

Furthermore, using problems that contain mathematical concepts and are relevant to the financial context of students' daily activities can provide an overview and analysis of students' initial abilities. This research is important because the results of the analysis can reveal how grade 5 elementary school students use arithmetic operation competencies in making online service transaction decisions. In addition, it impacts students' knowledge of one of the contents in financial literacy, namely consumer awareness. Our analysis was based on the financial literacy domain in the 2021 financial literacy framework, such as content, context and process (OECD, 2020). The findings in this article can be used as a reference for teachers who will plan mathematics learning for quantity content in phase D, especially on quantity content (arithmetic operations on real numbers) in elementary or secondary school. In addition, the results of the study can be used by researchers in the field of mathematics or finance to develop assessment questions or learning tools by integrating mathematical and financial literacy knowledge.

METHODS

The case study design is used in this research to answer the question that has been formulated: how do grade 5 elementary school students use arithmetic operation competencies in making online service transaction decisions? In order to answer the research question, this research is designed as a study in which an empirical inquiry investigates a contemporary phenomenon ('case') in a real-life context (Merriam & Tisdell, 2015) concerning an individual, program, or event with the aim of learning more about it (Starman, 2013; Njie & Asimiran, 2014)

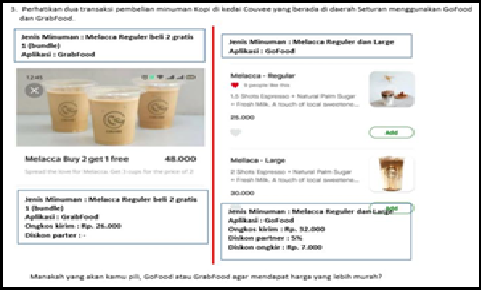

The data in the study of fifth grade elementary school students in the 2021/2022 academic year were 76 students with details of 24 private schools in Yogyakarta District, and 27 public schools in Yogyakarta District, and 25 public schools in Bantul sub-district. For ethical reasons, all names of schools and students were changed as initial. In order to obtain rich analysis results based on sociocultural differences students used schools from different districts and school types. The school sample selection was based on the geographical location of the city of Yogyakarta (private schools and public schools) and Bantul sub-district (public schools). Differences in geographic location were used to determine other effects of student answers on financial activities that have been presented. In line with Patton (2002) who stated that sampling aims to get a lot about issues that are very important for the purpose of investigation of the case to be studied. In the first stage, a financial literacy knowledge test adopted from the 2018 PISA financial literacy questionnaire was given to determine students' initial knowledge of financial terms. The research subjects consisted of two students from three different schools. The selection of the research subjects took into account the similarity in the competence of arithmetic operations and fluency in oral communication. Sample selection in qualitative research uses non-probability sampling method (Patton, 2022) purposively based on the assumption that the research questions (Patton, 2002). The second stage of data collection is done by completing test questions that contain the context of financial literacy. Furthermore, in-depth interviews to find out the dimensions of students' thinking process were conducted as the third data collection. Figure 1 presents a test used in the study, the question illustrates the purchase of Melacca coffee drink on two online applications, Grab Food (left red line) and Go Food (left red line).

The data collected through semi-structured interviews and written tests. The test composed based on content, context and process domain in the financial literacy framework of OECD yang diadopsi dalam pembelajaran matematika oleh Sagita, et al, (2022). This study's content, context, and process are limited to several aspects of the financial literacy domain. In detail, Table 1 presents financial literacy domain descriptors on the process aspects used.

Although the OECD framework measurement is intended for junior high school (students aged 15), some studies adopt the same formulation in the content, context, and process domains. Ozkale and Erdogan (2020) developed a conceptual model between mathematics and financial literacy by adopting the dimensions developed by OECD. This conceptual model has been tested on students in grades 1-8 (Ozkale & Aprea, 2023). Meanwhile, analysis of mathematical content is in accordance with new learning outcomes in Indonesian’s elementary school. Based on the learning outcome, basic arithmetic competencies possessed in grade V elementary school: do the operation of addition and subtraction of fractions and do the operation of multiplication and division of fractions of natural numbers, solve the multiplication of natural and whole numbers, and solve problems related to money. The descriptors used in analyzing students' abilities are as follows:

- Students are able to identify discount offers and rebates in the questions,

- Students are able to explain their online food service of choice based on arithmetic operations, and

- Students are able to identify the implementation of basic arithmetic (addition, subtraction, multiplication, and division) whole number and fraction in a financial problem.

The data analysis technique in this study used the Miles and Huberman model, namely data reduction, data presentation, and drawing conclusions (Sugiyono, 2017). Data reduction was selecting several parts of written answers and the results of interviews with research subjects. Data was presented in the form of pictures of student answers and transcript between researchers and subjects. Then conclusions were formulated from student’s answers and conversation’s script.

FINDINGS

The results were then reduced by taking one student randomly as a sample from each school. ALP was an initial of student from a private school in district Yogyakarta, RDV was an initial of student from a public school in district Yogyakarta, and ALM was a student from a public school in a sub-district Bantul.

First competence

ALP, ALM, dan RVD showed competence able to identify discount offers and rebates in the questions. ALP and RVD was able to identify all the discounts that are presented, such as partner discounts of 5% and delivery fee. ALP's mistake was applying the partner discount of 5% not on the product price, but on the total price after adding delivery fee as shown in Figure 2, possibility 1.

However, RDV made the same mistake as ALP when applying the 5% discount. RDV did not know the application of a percentage discount to the purchase price. RDV's knowledge of discounts was only "subtracting" from the purchase price. So that RDV made another mistake in calculating a discount of 5%, which reduced it to the purchase price of the item (RP.55,000.00). In addition, RDV did not add the delivery fee to the GoFood app order. Figure 3 represents the RDV result. In addition, ALM choose Go Food due to the various types of discounts, namely partner discounts and free delivery as shown in Figure 4.

Second competence

The second competence,students are able to explain their online food service of choice based on arithmetic operations. ALP displayed this competence, where he made four combinations of order options that can be purchased from the Go Food application as shown in Figure 2. Similarly, RDV made arithmetic calculations in choosing which online food delivery service as shown in Figure 3. In contrast, ALM did not apply arithmetic calculations in making decisions as shown in Figure 4. His choices were motivated by the various types of discounts namely partner discounts and delivery free discounts. Although the reasons given were correct, the resulting decisions were not based on proper analysis. ALM did not explore alternative answers/options.

Third competence

ALP made three choice combinations by applying arithmetic operations. The following is a description of the three possibilities written by ALP. First possibility in Figure 5 was to calculate the cost required when using the Grab Food application with a “buy 2 get 1 free regular melacca” bundle package offer.

The second possibility was to calculate the money spent for buying only one cup of melacca large using the Go Food application. The mathematical procedure was to add up the price of one large cup of melacca worth IDR 30,000 and a delivery fee of IDR 32,000, totaling IDR 52,000. Then, ALP subtracted the sum of the price of one large melacca cup and the delivery fee by the amount of the partner discount. However, in the percentage multiplication procedure, ALP found the amount of the discount not by multiplying the selling price by the discount (IDR 30,000 × 5% = IDR 1,500), but by dividing the selling price by 5% (IDR 30,000 : 5 = IDR 6000) as shown in Figure 6.

The third possibility was to calculate the cost required to purchase one cup of large melacca for IDR 30,000 and one cup of medium melacca for IDR 25,000 using the Go Food application. In Figure 4, ALP wrote the sum of the purchase prices of the two products namely IDR 55,000. Then, ALP added the purchase price with the delivery fee (IDR 32,000), totaling IDR87,000. There were two types of discounts in the Go Food application: partner discounts of 5% and delivery fee discounts. ALP divide the selling price with the discount value (IDR 55,000: 5 = IDR 11,000). In detail, the third possibility made by ALP is presented in Figure 7.

The fourth possibility was to calculate the purchase of three cups of regular melacca on the Go Food application as shown in Figure 8. The total purchase price for three regular melacca cups is 3 x IDR 25,000= IDR75,000 with a delivery fee of IDR 32,000. ALP summed the purchase price and the delivery fee correctly IDR 107,000). The mistake lay in the discount calculation, namely IDR 75,000 : 5 = IDR 15,000, where it should have been IDR75,000 x 5% = IDR3,750.

Based on the interview, the following is a dialogue recorded by the researcher (P):

P: do you know online app for buy something?

ALP: yeah, I’ve used my mother’s app to buy snacks

P: when and what did you buy?

ALP: I forgot, it was a while ago, I think it was meatballs. Mother also used it when she went to work by ride

P: do you think online ride-hailing helps?

ALP: yes, because of it I don’t have to go outside. Also, there's an ad about it on the TV

This is in contrast to ALM who never made transactions through online ride-hailing services.

P: do you know online app for buy something?

ALM: no

P: have your father or mother never used it?

ALM: I live with my grandma

P: but have you seen the ads on the TV?

ALM: oh was it that Shopee

P: yeah that’s called Market Place, a place to shop online, there is also Go Food and Grab Food

ALM: never heard of it, Miss

P: do you like snacks, ALM? Where do you buy them?

ALM: I only buy snacks at school. I rarely bought them when I’m at home

DISCUSSION

During the analysis first competence, the researchers identified not all students knew about the application of the discount in the price. Arithmetic operation errors were multiplication, especially when finding the discounted price. For example, calculating the discount price from the item price and delivery cost, students should multiply the discount percent only by the item price. Students' knowledge of discounts is "reducing the purchase price", whereas this only applies to discounts in the amount of money. Furthermore, we found interesting things in the analysis of the second competency. ALP and RDV made four combinations of order options that can be purchased from the Go Food application (Figure 2 and 3). In contrast, ALM did not apply arithmetic calculations in making decisions. Based on ALP’s answers, it can be concluded that ALP and RDV has the knowledge of financial transaction activities using online applications and can make decisions based on calculations. ALM did not have knowledge or experience about financial transactions, so they do not have the ability to make the considerations used when choosing online food services. ALM could not utilize the information related to discount offers and other rebates, excluding numerical calculations in decision making.

The third analysis on the process dimension of financial literacy: students are able to identify the implementation of basic arithmetic (addition, subtraction, multiplication, and division) whole number and fraction in a financial problem. ALP made three choice combinations by applying arithmetic operations, RDV made two choice combinations by applying arithmetic operations, and ALM only one choice without applying arithmetic operations. Focus our discussion on ALP and RDV's choices using the goFood app, since grab food does not offer order combinations. The combination of choices made by ALP is carried out to select a combination of orders on the GoFood application., such as one cup of melacca large, one cup melacca large and one cup medium, and three cups of regular melacca. Meanwhile, RDV did not create any order combinations, only used the information presented. Based on third competency, each individual faced problems that require financial decisions. The study's results indicated several factors that affect financial literacy, namely family background and social activities. Meanwhile, RDV made two online food orders using other services (not presented in the problem illustration). In line with previous research which found such as several factors that affect financial literacy, such as social and cultural background (Riitsalu & Põder, 2016; Bottazzi & Lusardi, 2020), gender (Bottazzi & Lusardi 2020; Hizgilov & Silber, 2019), individual characteristics (Cupák, et al., 2018; Moreno-Herrero, et al., 2018), and type of school (public schools vs. private schools) (Mancebón, et al., 2019; Arceo-Gomez & Villagómez, 2017).

Determining the amount of discount obtained is one of three types of exercise according Parker and Leinhard (1995). As in their article entitled “Percent: a privilege proportion”, Parker and Leinhard formulated three types of exercise about percent, including determining the percent value (15% of 120 = …), finding a percent (…% of 120 = 18), and finding base (15% of …=18). This type of error is referred to as a numerical operation or “random algorithm” (Ngu, 2019). When students do not know what operation to do, they will solve it by dividing or multiplying two known integers (Allinger & Payne, 1984). As done by ALP in calculating partner discount percentage of 5% where 30,000 : 5 = 6,000. It should be 30,000 x (5/100) = 1,500. In addition, students did not understand the impact of multiplying an integer by a percent resulting in a value that is smaller than the multiplier integer (Baratta, et al., 2010). For example, Baratta found that most students made mistakes when given five answer choices out of 80% of 10, namely “less than 10”, “more than 10”, “equal to 10”, “don't know”, and “don't understand”.

Indonesian students' financial literacy in 2015 ranked at proficiency level 1 with a below-average score (388 out of an average of 505). Proficiency level 1 shows that students are only able to apply basic arithmetic operations, such as addition, subtraction, or multiplication in a financial context (OECD, 2020). In addition, several studies show basic mathematics as one of the cognitive factors that affect the financial literacy ability of each individual (Huston, 2010; Sole, 2014; Lusardi, 2012; OECD, 2019; Bottazzi & Lusardi, 2020, Indefenso & Yazon, 2020). Multiplication is the most difficult basic arithmetic operation and has been documented since 1980. Gelman (2000) suggests that there is a broad consensus among researchers that student’s early experiences with number concepts lay a strong foundation for children to understand number concepts and operations. Another multiplication difficulty dealing with story problems, they tend to assume that multiplication produces a larger result and the other way for division (Fischbein et al., 1985; Graeber et al., 1989; Harel et al., 1994). Obviously, this procedure does not apply when students encounter multiplication of decimals, fractions, or percent.

Decisions made by a person at the age of 15 are influenced by family and environment (OECD, 2019). Family background affects ALP and RDV knowledge in transactional activities using online service applications or similar applications. They found out about the application through advertisements on television. ALP comes from a family who is used to doing online shopping transactions, specifically on online applications. The introduction of cases such as ordering through online applications in learning mathematics may improve students' knowledge about activities related to finance. Individual context is important in personal financial management since the decision pertains to the fulfilment of personal needs.

Based on the definition of financial literacy, three main aspects need to be considered. First, financial literacy is not only limited to knowledge and understanding of finance, but an ability to make decisions on financial matters effectively and with impact, not only for individuals but also for society (Lusardi, 2015; Ozkale & Ozdemir Erdogan, 2020). Second, the purpose of financial literacy does not affect one behavior such as increasing savings or reducing debt, but on increasing skills in financial management and the level of confidence to make decisions (Amagir et al., 2018). Third, financial literacy, which has the position of reading, writing and knowledge of science, is an important skill and life competence for the young generation in the 21st century (Lusardi, 2015; OECD, 2019; Ozkale & Ozdemir Erdogan, 2020).

CONCLUSIONS

Mathematics is one of the necessary competences in solving financial problems. The implementation of financial literacy in math curriculum is a fresh idea to boost financial knowledge and attitudes. This study obtains several benefits of math in solving financial problems from two students from two different schools. The descriptors of students' abilities identifying discount offers and rebates. The questions explain online food service choices based on arithmetic calculations and identify students' understanding of the application of basic arithmetic for percent, fractions.

Based on the analysis results, ALP shows some facility on financial transaction activities using online applications and can make decisions based on calculations. This is different from ALM who do not have knowledge or experience about financial transactions. ALM does not possess the ability to make judgments when choosing online food services. ALM is unable to utilize the information related to discount offers and other rebates, thereby excluding numerical calculations in decision-making.

ACKNOWLEDGMENT

The authors are grateful to Universitas PGRI Yogyakarta, Universitas Sriwijaya, and Universitas Ahmad Dahlan for giving us a research collaboration opportunity.

AUTHOR’S DECLARATION

References

Arceo-Gomez, E. O., & Villagómez, F. A. (2017). Literasi finansial among Mexican high school teenagers. International Review of Economics Education, 24, 1-17.https://doi.org/10.1016/j.iree.2016.10.001

Amagir, A., van den Brink, H. M., Groot, W., & Wilschut, A. (2021). SaveWise: The impact of a real-life financial education program for ninth grade students in the Netherlands. Journal of Behavioral and Experimental Finance, 100605. https://doi.org/10.1016/j.jbef.2021.100605

Allinger, G. D., & Payne, J. N. (1984). Teaching percent to general mathematics students. Unpublished manuscript, Department of Mathematical Sciences, Montana State University, Bozeman, MT.

Baratta, W., Price, B., Stacey, K., Steinle, V., & Gvozdenko, E. (2010). Percentages: The effect of problem structure, number complexity and calculation format. Mathematics Education Research Group of Australasia.

Blue, L. E., O’Brien, M., & Makar, K. (2018). Exploring the classroom practices that may enable a compassionate approach to financial literacy education.Mathematics Education Research Journal, 30(2), 143–164. https://doi.org/10.1007/s13394-017-0223-5

Bottazzi, L., & Lusardi, A. (2020). Stereotypes in literasi finansial: Evidence from PISA. Journal of Co IDRorate Finance, 101831. https://doi.org/10.1016/j.jco IDRfin.2020.101831.

Cupák, A., Fessler, P., Schneebaum, A., & Silgoner, M. (2018). Decomposing gender gaps in literasi finansial: New international evidence. Economics Letters, 168, 102-106. https://doi.org/10.1016/j.econlet.2018.04.004.

Fischbein, E., Deri, M., Nello, M., & Marino, M. (1985). The role of implicit models in solving problems in multiplication and division. Journal of Research in Mathematics Education, 16, 3–17. https://doi.org/10.2307/748969

Graeber, A. O., Tirosh, D., & Glover, R. (1989). Preservice teachers’ misconceptions in solving verbal problems in multiplication and division. Journal for Research in Mathematics Education, 20, 95–102. https://doi.org/10.2307/749100

Harel, G., Behr, M., Post, T., & Lesh, R. (1994). The impact of number type on the solution of multiplication and division problems: Further considerations. In G. Harel & J. Confrey (Eds.), The development of multiplicative reasoning in the learning of mathematics (pp. 365–388). SUNY Press

Hill, A. (2010). Money matters for the young learner. Social Studies and the Young Learner, 22(3), 25-31. https://www.socialstudies.org/system/files/publications/articles/yl_220325.pdf

Hizgilov, A., & Silber, J. (2019). On multidimensional approaches to literasi finansial measurement. Social Indicators Research, 1-44. https://doi.org/10.1007/s11205-019-02227-4

Indefenso, E. E., & Yazon, A. D. (2020). Numeracy Level, Mathematics Problem Skills, and Financial Literacy. Universal Journal of Educational Research, 8(10), 4393-4399. DOI: 10.13189/ujer.2020.081005

Kieran, C., Doorman, M., & Ohtani, M. (2015). Frameworks and principles for task design. In A. Watson & M. Ohtani (Eds.), Task design in mathematics education (pp. 19–81). Springer.

Lusardi, A. (2015). Literasi finansial skills for the 21st century: Evidence from PISA. Journal of consumer affairs, 49(3), 639-659. https://doi.org/10.1111/joca.12099

Lusardi, A. (2012). Numeracy, literasi finansial, and financial decision-making (No. w17821). National Bureau of Economic Research. https://doi.org/10.3386/w17821

Lusardi, A., Hasler, A., & Yakoboski, P. J. (2020). Building up literasi finansial and financial resilience. Mind & Society, 1-7. https://doi.org/10.1007/s11299-020-00246-0

Merriam, S. B., & Tisdell, E. J. (2015). Qualitative research: A guide to design and implementation. John Wiley & Sons.

Moreno-Herrero, D., Salas-Velasco, M., & Sánchez-Campillo, J. (2018). Factors that influence the level of literasi finansial among young people: The role of parental engagement and students' experiences with money matters. Children and Youth Services Review, 95, 334-351. https://doi.org/10.1016/j.childyouth.2018.10.042.

Ngu, B. H. (2019). Solution representations of percentage change problems: The pre-service primary teachers’ mathematical thinking and reasoning. International journal of mathematical education in science and technology, 50(2), 260-276. https://doi.org/10.1080/0020739X.2018.1494860

Njie, B & Asimiran, S. (2014) Case study as a choice in qualitative methodology. Journal ofResearch and Method in Education, 4(3), 35-40. e-ISSN: 2320–7388, p-ISSN: 2320–737X

OECD. (2015). Recommendation on Principles and Good Practices for Financial Education and Awareness. Paris: Directorate for Financial and Ente IDRrise Affairs.

OECD. (2017), PISA 2015 Results (Volume IV): Students’ Literasi finansial, PISA, OECD Publishing, Paris. http://dx.doi.org/10.1787/9789264270282-en

OECD. (2019). PISA 2018 Assessment and Analytical Framework. Paris: OECD Publishing.

OECD. (2020), PISA 2018 Results (Volume IV): Are Students Smart about Money?, PISA, OECD Publishing, Paris, https://doi.org/10.1787/48ebd1ba-en

OJK. (2021). OJK Bersama Kementrian atau Lembag Terkait Berkomitmen Berantas Pinjol Ilegal. Jakarta.

Ozkale, A., & Ozdemir Erdogan, E. (2020). An analysis of the interaction between mathematical literacy and literasi finansial in PISA. International Journal of Mathematical Education in Science and Technology, 1-21.

Ozkale, A., & Erdogan, E. O. (2020). A Conceptual Model for the Interaction of Mathematical and Financial Literacies. International Journal of Progressive Education, 16(5), 288-304. DOI: 10.29329/ijpe.2020.277.18

Ozkale, A., & Aprea, C. (2023). Designing mathematical tasks to enhance financial literacy among children in Grades 1–8. International Journal of Mathematical Education in Science and Technology, 54(3), 433-450.

Parker, M., & Leinhardt, G. (1995). Percent: A privileged proportion. Review of Educational Research, 65(4), 421-481.

Riitsalu, L., & Põder, K. (2016). A glimpse of the complexity of factors that influence literasi finansial. International Journal of Consumer Studies, 40(6), 722-731. https://doi.org/10.1111/ijcs.12291

Savard, A., & Polotskaia, E. (2017). Who’s wrong? Tasks fostering understanding of mathematical relationships in word problems in elementary students. Zdm, 49, 823-833. https://doi.org/10.1007/s11858-017-0865-5

Sagita, L., Putri, R. I. I., & Prahmana, R. C. I. (2022). Promising research studies between mathematics literacy and financial literacy through project-based learning. Journal on Mathematics Education, 13(4), 753-772. https://doi.org/10.22342/jme.v13i4.pp753-772

Siegler, R. S., & Lortie-Forgues, H. (2017). Hard Lessons: Why Rational Number Arithmetic Is So Difficult for So Many People. Current Directions in Psychological Science, 26(4), pp. 346–351. https://doi.org/10.1177/0963721417700129

Sole, M. A. (2014). Literasi finansial: An essential component of mathematics literacy and numeracy. Journal of Mathematics Education At Teacher College, 2(5), 55-62.

Sole, M. A. (2017). Financial education: Increase your purchasing power. The Mathematics Teacher, 111(1), 60-64.

Starman, A. B. (2013). The case study as a type of qualitative research. Journal of Contemporary Educational Studies, 1, 28–43.

Downloads

Submitted

Accepted

Published

How to Cite

Issue

Section

License

Copyright (c) 2023 Laela Sagita, Ratu Ilma Indra Putri, Zulkardi Zulkardi, Rully Charitas Indra Prahmana

This work is licensed under a Creative Commons Attribution-NonCommercial 4.0 International License.