IFRS-16 and Information Quality of Listed Non-Financial Firms in Nigeria

DOI:

https://doi.org/10.23917/reaksi.v9i1.3268Keywords:

leases, IFRS 16, information quality, value relevance, decision usefulness theoryAbstract

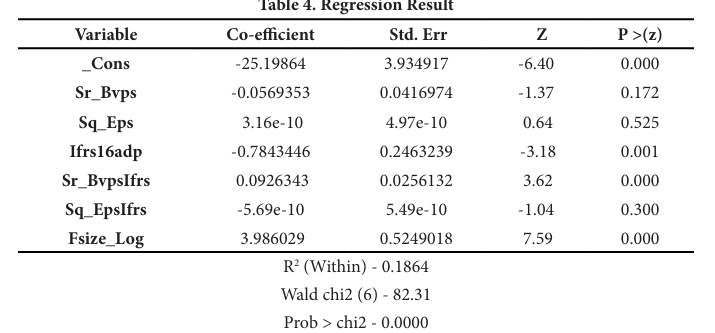

Lease accounting was revised in 2016 due to the contentious nature of its reporting in the financial statements under IAS 17- particularly in respect of operating leases. IAS 17 was criticized for impairing the quality of accounting information due to the inappropriate treatment of identified resources in control and financial obligations by lessee firms. IFRS 16 (effective 2019) eliminates the distinction between operating and finance leases requiring right-of-use assets and associated liabilities to be reported on the Statement of Financial Position. In cognizance of its objective of enhancing information quality, the paper assessed the relevance of accounting information reported subject to compliance with IFRS 16 in the context of listed non-financial firms in Nigeria utilizing lease finance. The Ohlson model was modified to regress share price on the book value of equity per share, earnings per share, and the interaction of these variables with IFRS 16 adoption using a data set for 2016-2021. GLS regression results indicate book value per share to have increased relevance with the adoption of IFRS 16, whereas the relevance of earnings per share remains unchanged. The paper concludes that IFRS 16 adoption enhances the information quality of listed non-financial firms in Nigeria. Recommendations are made for firms to optimize accounting processes to achieve or sustain information quality by adopting IFRS 16. The IASB, as a standard-setter, should also prioritize the cost-efficiencies of standards in their implementation, as this could account for a disparity in the perceived accounting information quality of varying-sized firms).

Submitted

Accepted

Published

Issue

Section

License

Copyright (c) 2024 Riset Akuntansi dan Keuangan Indonesia

This work is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike 4.0 International License.