Corporate Governance and Environmental Disclosure: Assessing The Role of Environmental Performance

DOI:

https://doi.org/10.23917/reaksi.v8i2.2457Keywords:

Environmental Disclosure, Corporate Governance, Environmental PerformanceAbstract

This research aims to examine and provide empirical evidence of the influence of Corporate Governance on Environmental Disclosure, with Environmental Performance as a mediating variable. The study was conducted on publicly traded companies that disclosed Corporate Social Responsibility during the period from 2018 to 2021 and participated in PROPER (Program for Environmental Performance Rating and Disclosure). The sample was determined using purposive sampling and consisted of 61 companies. The results of the research show that Corporate Governance is positively related to environmental performance and disclosure. The findings also indicate that environmental performance partially mediates the relationship between corporate governance and the quality of environmental disclosure.

Introduction

The rapid development of technology due to the advent of Industry 4.0 has prompted every company to introduce the latest innovations to enhance competition among companies in Indonesia and generate maximum profits. The use of technology in a company's operations often overlooks environmental aspects. This can be seen from the widespread environmental problems caused by corporate negligence. Ignorance arises from company activities that disregard or neglect the positive and negative contributions of waste to the surrounding environment [1]. In developing countries, economic growth correlates positively with environmental degradation [2]. This is due to industrial activities related to production, such as land conversion for industrial development, environmental degradation, and their implications for social and economic changes [3].

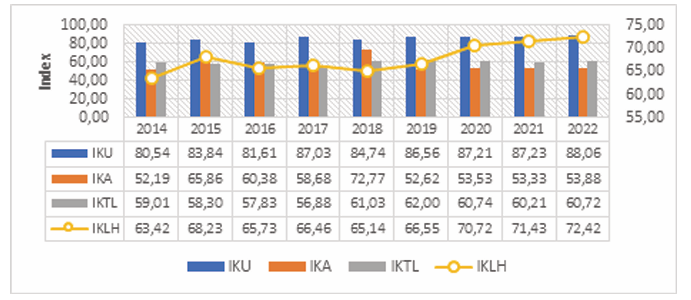

In Indonesia, the Environmental Quality Index (IKLH) is used as a measurement to assess the national environmental quality during specific periods. IKLH data is obtained from the Ministry of Environment and Forestry (KLHK). To obtain the IKLH score, three indicators are used: IKA (Water Quality Index), IKU (Air Quality Index), and IKTL (Land Cover Quality Index). Figure 1 shows the growth of IKLH from 2014 to 2022.

Figure 1. Growth of the Environmental Quality Index (IKLH) from 2014 to 2022

Source: Ministry of Environment and Forestry (KLHK)

Overall, the IKLH data shows an upward trend, indicating an improvement in the environmental quality of Indonesia. The IKLH score in 2022 is 72.42, categorized as a good rating since it falls within the range of 70-80. However, when considering the Environmental Performance Index (EPI), which measures environmental performance in a policy context, Indonesia ranks 164 out of 180 countries. Denmark holds the top position with an EPI score of 77.90, while India ranks last with an EPI score of 18.90. Table 1 presents a comparison of Indonesia's EPI scores with other Southeast Asian countries in 2022.

Table 1. EPI Scores of Southeast Asian Countries in 2022

Source: EPI, 2022

The data above indicates that Indonesia still needs to work harder to implement environmental policies so that environmental challenges can be addressed appropriately. Environmental issues are a special concern for various stakeholders, including investors. Investors are interested in companies that implement environmentally sustainable practices in their management. Companies should not only pursue profit as their primary goal but also pay attention to and be involved in environmental preservation [1].

Therefore, companies need to demonstrate transparency regarding their environmental responsibilities to gain legitimacy from stakeholders. Business activities conducted by companies should not harm environmental quality. Such pressure demands that companies make environmental disclosures. Environmental disclosure conveyed by company management to the public contains information about environmental investments and company activities [4].

Current regulations ensure that companies are responsible for not causing damage to the environment and are fully accountable for any environmental harm that occurs. The guidelines for implementing and reporting social and environmental responsibilities have not been explicitly issued by the Indonesian government, making environmental disclosure voluntary. This voluntary reporting leads to variations in the format, content, and disclosure of reports among companies in Indonesia. Therefore, in terms of environmental disclosure and its quality, Indonesia falls into the low category [3].

Several researchers have presented empirical evidence of the relationship of environmental disclosure and corporate governance. The Indonesia Corporate Governance Manual in 2014 defined Corporate governance is a system of relationships between shareholders, management and stakeholder(s) that defined by structures and processes [5]. Collectively, a company's compliance with good corporate governance practices can enhance resource allocation and the development of environmental strategies and disclosure activities [6].

Despite some studies suggesting a significant impact of Corporate Governance on environmental disclosure (Ofoegbu, Odoemelam, & Okafor, 2018; Fernandes et al., 2018), Wahyuningrum et al. (2020) found no significant relationship between the two. This disparity in previous research indicates a research gap with inconsistent findings. This study aims to fill that gap by re-examining the link between corporate governance and environmental disclosure, considering the potential mediating role of environmental performance.

Companies that adopt effective corporate governance practices have the potential to improve the quality of environmental disclosure by providing verifiable and measurable information. However, the extent of disclosure depends on the company's environmental performance (Adinehzadeh et al., 2018). Effective corporate governance includes policies to monitor and measure environmental compliance and performance. In essence, strong corporate governance leads to better environmental performance, encouraging companies to disclose more information to stakeholders. On the contrary, companies with weak corporate governance tend to exhibit poor environmental performance and disclose less information in their annual reports. Thus, the quality of environmental disclosure is closely tied to the level of environmental performance.

The research sample consists of publicly traded companies dedicated to Corporate Social Responsibility (CSR) and participating in PROPER, a program by the Ministry of Environment and Forestry (KLHK), which assesses companies' environmental management performance. PROPER participants are expected to have a strong commitment to environmental disclosure due to its close association with natural resources.

Environmental disclosure can be analyzed through legitimacy theory and stakeholder theory. [7] indicate that both theories are key in explaining social and environmental impact disclosure practices. Both legitimacy and stakeholder theories predict that organizations will respond to demands from various stakeholders to legitimize their actions [3]. [8] state that legitimacy becomes an issue if a company fails to maintain it and also propose two underlying principles for the stability and development of a company: (1) the final outcome of the company can be socially beneficial to the community, and (2) the distribution of economic, social, or political benefits based on the company's ownership power.

This study intends to investigate the correlation between corporate governance and environmental disclosure while also analyzing how environmental performance acts as a mediator in this relationship.

Figure 2. Conceptual Framework

Literature Review and Hypothesis Development

Corporate Governance plays a supervisory and control role in company management. As a form of responsibility towards stakeholders, companies provide information in the form of environmental disclosure. [9], [10], [11], [12] explain that corporate governance has a positive influence on environmental disclosure. [13], [14], [15], [16] also provide evidence that the environmental disclosure quality improves with better corporate governance. Thus, it is hypothesised that:

H1:Corporate Governance has a significant positive influence on Environmental Disclosure.

In addition to maintaining business operations, companies are required to consider a balanced strategy that takes into account the needs of various stakeholders. The increasing stakeholder concern for environmental quality has shifted the priorities, decisions, and strategies of companies towards environmental performance and better performance reporting.

Adinehzadeh et al. (2018) assert a positive association between corporate governance level and environmental performance. Similarly, Jaffar et al. (2018) affirm that corporate governance positively impacts environmental performance. This is due to corporate governance emphasizing not only its significance for the company but also its connection with environmental performance (Jacoby et al., 2018). Other researchers also propose that the effectiveness of governance mechanisms directly influences the quality of environmental information accessible to stakeholders (Przychodzen et al., 2018). Consequently, stakeholders' concern for environmental quality has motivated companies to adopt more environmentally friendly practices and operations. Therefore, the following hypothesis can be formulated:

H2:Corporate Governance has a significant positive influence on Environmental Performance.

Environmental performance is a strategy used by companies to enhance their reputation and image in the eyes of the overall public. [17], [18], [19], [20], [21] have found similar results regarding the influence of environmental performance on environmental disclosure. Their research findings show a positive and significant correlation between environmental performance and environmental disclosure. These researchers state that high-level disclosure of environmental performance can increase exposure to the company's environmental issues, ultimately attracting attention to the environmental challenges the company faces. Thus, environmental disclosure can be used as an attraction for companies to attract potential new investors.Top of Form

Adinehzadeh et al. (2018) assert a positive association between corporate governance level and environmental performance. Similarly, Jaffar et al. (2018) affirm that corporate governance positively impacts environmental performance. This is due to corporate governance emphasizing not only its significance for the company but also its connection with environmental performance (Jacoby et al., 2018). Other researchers also propose that the effectiveness of governance mechanisms directly influences the quality of environmental information accessible to stakeholders (Przychodzen et al., 2018). Consequently, stakeholders' concern for environmental quality has motivated companies to adopt more environmentally friendly practices and operations. Therefore, the following hypothesis can be formulated:

Bottom of Form

H3:Environmental Performance has a significant positive influence on Environmental Disclosure.

Adinehzadeh et al. (2018) elaborate in their study that environmental performance plays a mediating role in the relationship between corporate governance mechanisms and the quality of environmental disclosure. When corporate governance is effective, it improves the quality of environmental disclosure by providing verifiable and measurable information. However, the extent of disclosure is also influenced by the company's environmental performance. Companies with effective corporate governance mechanisms typically have policies in place to monitor and measure compliance and environmental performance. In essence, effective corporate governance leads to better environmental performance, resulting in increased information disclosure to stakeholders. Therefore, based on the aforementioned points, this study formulates the following hypothesis:

H4:Environmental Performance mediates the relationship between Corporate Governance and Environmental Disclosure.

Research method

This study utilizes a quantitative approach. The variables examined in the research are environmental disclosure as the dependent variable, corporate governance as the independent variable, environmental performance as the mediating variable, and profitability, leverage, and audit quality as control variables. The population of the study consists of companies listed on the Indonesia Stock Exchange (IDX). The sample is obtained through purposive sampling, with criteria including (1) companies that disclose Corporate Social Responsibility during the period from 2018 to 2021, (2) companies participating in PROPER, and (3) companies that provide data related to the research variables during the period from 2018 to 2021. As a result, 61 companies meet the predetermined criteria.

Environmental disclosure is one of the ways companies provide information to external parties regarding the company and its impact on the environment and social aspects. The variable of environmental disclosure is measured using the Global Reporting Initiative (GRI-G4) [1]. If an item is disclosed by a company, it receives a score of 1, and if an item is not disclosed, a score of 0 is assigned [22]. The following formula is used [20]:

Corporate Governance (CG) is a system or mechanism used to govern, direct, and control a company's operations in accordance with the expectations of stakeholders. The Corporate Governance variable is measured using the Corporate Governance Principle Implementation Index, which consists of 20 criteria based on the principles of CG, including transparency, accountability, responsibility, fairness, and equality [3].

Environmental performance of a company is measured using the PROPER program issued by the Ministry of Environment and Forestry (KLH). PROPER is a program by the Ministry of Environment and Forestry to evaluate companies' environmental management performance [17]. PROPER uses rankings to measure a company's environmental performance. There are five categories marked with different colors as rankings. In this study, the measurement is done by scoring each color in the PROPER assessment: Gold Ranking (Score 5), Green Ranking (Score 4), Blue Ranking (Score 3), Red Ranking (Score 2), and Black Ranking (Score 1).

Profitability ratio measures the profit by comparing net income to measure the company's ability to obtain its assets [20].

[18] state that measuring a company's ability to handle decline by dividing the total debt of the company by its total assets.

The involvement of external auditors is seen as a significant factor that affects the implementation of corporate environmental disclosure. When companies provide comprehensive disclosure, it enhances the reputation of the audit firm involved. Consequently, in a robust legal environment with strong investor protection and disclosure standards, it is anticipated that "Big 4" auditor types will have a considerable influence on the extent of corporate environmental disclosure. Companies audited by the Big 4 are assigned a score of 1, while those not audited by them receive a score of 0 (Adinehzadeh et al., 2018).

In this study, the influence of Corporate Governance (X) on Environmental Disclosure (Y) will be examined, with Environmental Performance (Z) as the mediating variable. The data used include cross-section and time series data, with a total of 244 observations. To combine these two types of data, a panel data approach will be used. The regression model formulation for panel data is as follows:

EDit = β0 + β1CGit + β2EPit + β3PROVit + β4LEVit + β5AQit + εit(1)

EPit = β0 + β1CGit + β2PROVit + β3LEVit + β4AQit + εit(2)

Where:

EDit: Environmental Disclosure for

company i in year t

EPit : Environmental Performance for

company i in year t

CGit : CG Index for company i in year t

β0 : Constant

β1-5: Regression coefficients

PROV : Profitability

LEV : Leverage

AQ : Audit Quality

ε : Error term

In this study, the Sobel test analysis method is employed to investigate whether the impact of the independent variable on the dependent variable occurs through the mediating variable or directly. The Sobel test involves comparing the difference between the direct effect coefficient of the independent variable on the dependent variable and the indirect effect coefficient of the independent variable on the mediating variable and subsequently on the dependent variable. If the indirect coefficient is statistically significant, it indicates that the effect of the independent variable on the dependent variable occurs through the mediating variable. The calculation of the Sobel test can be done using the formula provided by Bader and Jones (2021):

Where:

a: path coefficient of the independent

variable on the mediating variable

b: path coefficient of the mediating

variable on the dependent variable

SE: standard error

Furthermore, the Sobel test can also be conducted online through the Interactive Mediation Tests Online, which can be accessed at www.danielsoper.com [23]. If the p-value < 0.05 or the Sobel test value > 1.96, then the mediating variable can be considered to significantly mediate the relationship between the independent variable and the dependent variable.

Results and Discussion

Descriptive statistics can show the minimum value, maximum value, mean (average), and data dispersion through the standard deviation for each variable in this study. The results of descriptive statistics can be seen in Table 2.

Table 2. Results of Descriptive Statistical Analysis in the Study

Table 2 shows the results of descriptive statistical analysis for each variable in the study, including the minimum, maximum, mean, and standard deviation values. The minimum value of environmental disclosure is 0.029412, achieved by PT Tigaraksa Satria Tbk in 2018. This indicates that the company provides insufficient information about environmental impact and lacks consideration for environmental issues in its business activities. The maximum value of environmental disclosure is 0.911765, attained by PT Vale Indonesia Tbk in 2021. A high level of environmental disclosure demonstrates that the company provides comprehensive and detailed information about environmental impact, and takes environmental issues seriously with a commitment to minimizing negative impacts from its business operations. The average environmental disclosure is 0.406220 with a standard deviation of 0.253974, indicating that the environmental disclosure data of the companies is relatively homogeneous.

Corporate Governance variable is measured using the Corporate Governance Principle Implementation Index. The minimum value is 20.00000, achieved by PT Indo-Rama Synthetics Tbk in 2018, indicating that the company does not meet the minimum standards in practices, policies, and procedures governing its operations and oversight. The maximum value of Corporate Governance is 32.00000, observed in PT Aneka Tambang Tbk and PT Argo Pantes Tbk, indicating that both companies have clear and well-organized organizational structures, with transparent policies and procedures that are understood by all stakeholders involved, along with strong and independent oversight. The average value of Corporate Governance is 27.76230 with a standard deviation of 2.311372, indicating that the research data has relatively low variability.

The minimum and maximum values of environmental performance are 2.000000 and 5.000000, respectively. There are 8 companies with low environmental performance, including PT Waskita Beton Precast Tbk in 2020 and 2021, which scored 2. This indicates that these companies have engaged in environmental activities and reported them, but there are still shortcomings and non-compliance with the requirements. On the other hand, there are 4 companies that achieved the highest PROPER ranking with a score of 5, including PT Timah Tbk in 2021. Looking at the mean value, the sample companies have an environmental performance of 3.159836. The standard deviation of 0.531967 suggests that there is not a high degree of variation in environmental performance among the sample companies. Based on this, it can be concluded that the average environmental performance score of the companies is 3, which corresponds to a "blue" ranking, indicating compliance with the regulations set by the Ministry of Environment and conducting environmental management in accordance with those provisions.

Profitability, as measured by the profitability ratio, shows a range of values among the sample companies. PT Bakrie Sumatera Plantations Tbk attained the lowest value of -0.582526 in 2019, while PT Unilever Indonesia Tbk achieved the highest value of 0.446758 in 2018. The mean value of profitability is 0.037680. The standard deviation of 0.106740 indicates that the data dispersion of profitability varies, being larger than the mean value.

Regarding the leverage variable, PT Tifico Fiber Indonesia Tbk had the minimum value of 0.075826 in 2019, while PT Argo Pantes Tbk had the maximum value of 2.183258 in 2021. The average value of leverage is 0.488561, and the standard deviation of 0.322571 suggests relatively low data dispersion for this variable.

The audit quality variable, which assesses the quality of external audits conducted by independent auditors on the company's financial statements, ranges from a minimum value of 0.000000 to a maximum value of 1.000000. The mean value of audit quality is 0.651639, indicating that, on average, the sample companies use "Big Four" firms as their external auditors. The standard deviation of 0.477430 suggests that there is not a high degree of variation in the data dispersion of the audit quality variable.

To determine the appropriate model between Common Effect Model (CEM) and Fixed Effect Model (FEM), the research utilizes the Chow test. If the probability (p) is less than α (α = 0.05), then FEM or REM (Random Effect Model) is considered the more suitable model, followed by the Hausman test. On the other hand, if the probability value is equal to or greater than α (α = 0.05), then the preferred model is CEM, followed by the Lagrange Multiplier test. In this study, the Chow test results can be found in Table 3 and Table 4 below.

Table 3. Chow Test Results for Model I

Table 4. Results of Chow Test Model II

Source: Research Data, 2023

Based on the output results from models I and II, it can be observed that the probability result of the Chi-Square Cross Section is 0.0000. This indicates that the probability value is below α (α = 0.05), which means that the most suitable regression model based on the Chow Test is the Fixed Effect Model (FEM). Therefore, further testing will be conducted using the Hausman Test.

The Hausman Test results can be used to determine the best regression model between FEM and REM. If the p-value is less than α (α = 0.05), then FEM is the appropriate model. However, if the probability is equal to or greater than α (α = 0.05), then the suitable models are REM or CEM, followed by the Lagrange Multiplier test. In this study, the Hausman Test results are shown in Table 5 and Table 6 attached below:

Table 5. The Hausman Test - Model I

Table 6. The Hausman Test - Model II

Based on the generated results from models I and II, it can be observed that the probability of the Random Cross-section is greater than the α value (α = 0.05). Therefore, the conclusion is that the most appropriate regression model is the Random Effect Model (REM) based on the Hausman Test. Consequently, the research will proceed with the Lagrange Multiplier test.

The results of the Lagrange Multiplier test can help determine the best model between FEM and CEM. If the p-value is less than α (α = 0.05), then REM is the most suitable model. However, if the probability has the same value or greater than α (α = 0.05), then CEM is the more appropriate model. The following Table 7 and Table 8 show the results of the Lagrange Multiplier test conducted in this study:

Table 7. Lagrange Multiplier Test Results Model I

Table 8. Lagrange Multiplier Test Results Model II

Source: Research Data, 2023

Based on the results shown in Table 7 and Table 8, it can be observed that the probability value of the Breusch-Pagan test is 0.0000. Therefore, it can be concluded that this probability value is below α (α = 0.05) and the most suitable regression model based on the Lagrange Multiplier test is the Random Effect Model (REM).

Table 9. F Test Results Model I - Random Effect

Table 10. F Test Results Model II - Random Effect

Table 9 and Table 10 display the results of the F-test, with the respective F-statistic probability values of 0.003266 and 0.000142. From these numbers, it can be stated that the independent variables used in the research have a significant influence on the dependent variable as a whole.

Table 11. t-test Results

Table 12. Sobel Test Results

The t-test results in Table 11 demonstrate that Corporate Governance has a significant positive influence on Environmental Disclosure. The coefficient value obtained is 0.025065, with a probability value of 0.0071. Thus, these test results confirm the truth of Hypothesis 1 (H1). Strong Corporate Governance encourages companies to adopt greater responsibility towards the environment. In an effective Corporate Governance structure, management and the board of directors are responsible for considering the environmental impact of the company's activities by monitoring and transparently reporting the environmental practices adopted by the company.

Furthermore, good corporate governance in terms of environmental disclosure can also enhance a company's reputation [9]. Companies that actively and transparently disclose sustainable environmental practices tend to gain trust and support from stakeholders, including investors and consumers. This can have a positive impact on the company's value and improve access to financial resources. Consistent findings can be found in studies by [13], [14], [15], [10], [16], [11], and [12].

Table 11 also shows that Corporate Governance has a significant positive influence on Environmental Performance with a probability value of 0.0005 and a coefficient value of 0.067451, indicating the confirmation of H2. Strong Corporate Governance can lead to more effective monitoring and reporting of environmental performance. With effective oversight mechanisms, companies can improve and regularly report their environmental performance. This not only enhances the company's accountability to environmental issues but also provides stakeholders with the necessary information to make decisions based on the company's environmental performance.

Good Corporate Governance can create appropriate incentives to improve a company's environmental performance. In an effective governance structure, the board of directors and company management have a responsibility to consider the long-term interests of the company and stakeholders [24]. By integrating environmental issues into corporate governance, companies can reduce environmental risks, enhance operational efficiency, and strengthen their reputation. This can encourage long-term investments and garner support from stakeholders, including investors, customers, and the community. Similar research findings have also been obtained by [25] and [26].

Through the hypothesis analysis conducted in Table 11, it is shown that H3 is confirmed because Environmental Performance has a significant and positive influence on Environmental Disclosure, with a probability value of 0.0172 and a coefficient value of 0.071194. Companies that achieve high levels of environmental performance usually demonstrate greater awareness and attention to environmental issues as a whole. When companies implement sustainable environmental practices and successfully reduce negative impacts on the environment, they are more likely to proactively disclose information about their environmental efforts and performance outcomes. Good environmental performance reflects a company's commitment to social and environmental responsibility and encourages the sharing of information with stakeholders about positive practices that have been implemented.

In the effort to maintain and enhance positive environmental performance, companies often need to identify and disclose more detailed information about their environmental practices and initiatives. Thus, optimal environmental performance can be a driver for companies to increase transparency and disclose environmental information. These findings are consistent with the research by [17], [18], [19], [20], and [21].

The Sobel test results in Table 12 show a statistical value (z-value) of 1.97958631 to test the influence of the Environmental Performance variable as an intervening variable between the Corporate Governance and Environmental Disclosure variables. Additionally, the two-tailed probability value is 0.04775003. Since the p-value is lower than the significance level α = 0.05, it can be concluded that the indirect influence is significant. Therefore, Hypothesis 4 (H4) in this study is confirmed.

These results demonstrate that Environmental Performance plays an important role as a mediator between Corporate Governance and Environmental Disclosure. Strong Corporate Governance can encourage companies to implement environmentally oriented policies and practices. The outcomes of good environmental performance are then reflected in Environmental Performance, which in turn affects the quality and level of information disclosure in Environmental Disclosure. Through Environmental Disclosure, companies can provide relevant and accurate information about their environmental efforts, performance achievements, and sustainable goals. These research findings reinforce previous findings proposed by [25].

Table 13. Results of the Coefficient of Determination Test for Model I and II

Table 13 presents the adjusted R-square values for both Model I and Model II. The adjusted R-square for Model I is 0.051959, signifying that the independent variables in this model explain approximately 5.1959% of the variance in Environmental Disclosure. The remaining percentage is attributed to other variables not considered in this research. On the other hand, the adjusted R-square result for Model II indicates that 7.5199% of the dependent variable can be explained by the independent variables examined in this study, while the rest is accounted for by unexamined variables.

Conclusion

Based on the data analysis of 61 companies participating in PROPER and disclosing Corporate Social Responsibility from 2018 to 2021, this research confirms the relationship between corporate governance and environmental disclosure, as well as the influence of environmental performance as a mediator in the relationship between corporate governance and environmental disclosure. The limitations of this study include the restricted scope of the research, which focused only on companies participating in PROPER, and data collection limitations due to some companies not meeting the predefined data completeness criteria, resulting in the removal of certain samples from the analysis. The exclusion of these samples may impact the research results. Therefore, the researchers recommend several steps for further research, such as extending the research timeframe by including additional years to increase the available data and adding independent variables to improve the adjusted R-square value.

References

Abu-Bader, S., & Jones, T. V. (2021). Statistical Mediation Analysis Using the Sobel Test and Hayes Spss Process Macro. International Journal of Quantitative and Qualitative Research Methods, 9(1), 42–61.

Adinehzadeh, R., Jaffar, R., Abdul Shukor, Z., & Che Abdul Rahman, M. R. (2018). The mediating role of environmental performance on the relationship between corporate governance mechanisms and environmental disclosure. Asian Academy of Management Journal of Accounting and Finance, 14(1), 153–183. https://doi.org/10.21315/aamjaf2018.14.1.7

Adnan, J., & Kiswanto. (2017). Determinant of Auditor Ability to Detect Fraud with Professional Sceptisism as A Mediator Variable. Accounting Analysis Journal, 6(3), 313–325.

Agyemang, A. O., Yusheng, K., Ayamba, E. C., Twum, A. K., Chengpeng, Z., & Shaibu, A. (2020). Impact of board characteristics on environmental disclosures for listed mining companies in China. Environmental Science and Pollution Research, 27(17), 21188–21201. https://doi.org/10.1007/s11356-020-08599-2

Aliyu, U. S. (2018). Board characteristic and corporate environmental reporting in Nigeria. Asian Journal of Accounting Research, 4(1), 2–17. https://doi.org/10.1108/AJAR-09-2018-0030

Baalouch, F., Ayadi, S. D., & Hussainey, K. (2019). A study of the determinants of environmental disclosure quality: evidence from French listed companies. In Journal of Management and Governance (Vol. 23, Issue 4). Springer US. https://doi.org/10.1007/s10997-019-09474-0

Deswanto, R. B., & Siregar, S. V. (2018). The associations between environmental disclosures with financial performance, environmental performance, and firm value. Social Responsibility Journal, 14(1), 180–193. https://doi.org/10.1108/SRJ-01-2017-0005

Digdowiseiso, K., Subiyanto, B., & Setioningsih, R. (2022). What Drives Environmental Disclosure? Evidence from Mining Companies Listed on the Indonesia Stock Exchange. International Journal of Energy Economics and Policy, 12(4), 32–39. https://doi.org/10.32479/ijeep.13170

Ezhilarasi, G. (2019). Does corporate governance index impact on environmental disclosure evidence from India. International Journal of Corporate Governance, 10(3/4), 275–310. https://doi.org/10.1504/ijcg.2019.103228

Fernandes, S. M., Bornia, A. C., & Nakamura, L. R. (2018). The influence of boards of directors on environmental disclosure. Management Decision, 57(9), 2358–2382. https://doi.org/10.1108/MD-11-2017-1084

Gerged, A. M. (2020). Factors affecting corporate environmental disclosure in emerging markets: The role of corporate governance structures. Business Strategy and the Environment, 30(1), 1–21. https://doi.org/10.1002/bse.2642

Husted, B. W., & Filho, J. M. de S. (2018). Board structure and environmental, social, and governance disclosure in Latin America. Journal of Business Research, 102, 220–227. https://doi.org/10.1016/j.jbusres.2018.01.017

International Finance Corporation. (2014). The Indonesia Corporate Governance Manual - First Edition. In Otoritas Jasa Keuangan (Vol. 1, Issue 7). http://www.ojk.go.id/Files/box/THE-INDONESIA-CORPORATE-GOVERNANCE-MANUAL-First-Edition.pdf#search=governance

Jacoby, G., Liu, M., Wang, Y., Wu, Z., & Zhang, Y. (2018). Corporate governance, external control, and environmental information transparency: Evidence from emerging markets. Journal of International Financial Markets, Institutions and Money, 58, 269–283. https://doi.org/10.1016/j.intfin.2018.11.015

Jaffar, R., Aziendeh, R. R., Shukor, Z. A., & Rahman, M. R. C. A. (2018). Environmental performance: Does corporate governance matter? Jurnal Pengurusan, 52, 1–18. https://doi.org/10.17576/pengurusan-2018-52-11

Kilincarslan, E., Elmagrhi, M. H., & Li, Z. (2020). Impact of governance structures on environmental disclosures in the Middle East and Africa. Corporate Governance (Bingley), 20(4), 739–763. https://doi.org/10.1108/CG-08-2019-0250

Kurniansyah, F., Saraswati, E., & Rahman, A. F. (2021). Corporate Governance, Profitability, Media Exposure, and Firm Value: the Mediation Role of Environmental Disclosure. Jurnal Minds: Manajemen Ide Dan Inspirasi, 8(1), 69. https://doi.org/10.24252/minds.v8i1.20823

Mahmud, M. T. (2019). Legitimacy Theory and its Relationship to CSR Disclosures: A Literature Review. The Keizai Ronkyu, 163, 1–17.

Ofoegbu, G. N., Odoemelam, N., & Okafor, R. G. (2018). Corporate board characteristics and environmental disclosure quantity: Evidence from South Africa (integrated reporting) and Nigeria (traditional reporting). Cogent Business and Management, 5(1), 1–27. https://doi.org/10.1080/23311975.2018.1551510

Pareek, R., Pandey, K. D., & Sahu, T. N. (2019). Corporate Governance, Firms’ Characteristics and Environmental Performance Disclosure Practices of Indian Companies. Indian Journal of Corporate Governance, 12(2), 142–155. https://doi.org/10.1177/0974686219881091

Przychodzen, W., Gómez-Bezares, F., & Przychodzen, J. (2018). Green information technologies practices and financial performance – The empirical evidence from German publicly traded companies. Journal of Cleaner Production, 201, 570–579. https://doi.org/10.1016/j.jclepro.2018.08.081

Rahmawati, E., & Hutami, D. J. S. (2019). The Influence of Structure Ownership, Board Diversity, and Corporate Governance Perception Index (CGPI) Toward Environmental Disclosures and Environmental Performance as Moderating Variable (Empirical Study on Companies Registered in CGPI and PROPER of ye. Advances in Economics, Business and Management Research, 102, 45–52. https://doi.org/10.2991/icaf-19.2019.8

Solikhah, B., Wahyudin, A., & Subowo. (2020). Carbon emissions of manufacturing companies in Indonesia stock exchange: A sustainable business perspective. Journal of Physics: Conference Series, 1567(4). https://doi.org/10.1088/1742-6596/1567/4/042086

Solikhah, Badingatus, & Maulina, U. (2021). Factors influencing environment disclosure quality and the moderating role of corporate governance. Cogent Business and Management, 8(1). https://doi.org/10.1080/23311975.2021.1876543

Suhardjanto, D., Purwanto, Ashardianti, D., & Setiany, E. (2018). Environmental Disclosure in Agricultural Sector and Consumer Goods Annual Report (Comparison between Indonesia and Malaysia). Review of Integrative Business and Economics Research, 7(4), 203–215.

Suryarahman, E., & Trihatmoko, H. (2021). Effect of environmental performance and board of commissioners on environmental disclosures. Assets: Jurnal Akuntansi Dan Pendidikan, 10(1), 1. https://doi.org/10.25273/jap.v10i1.5984

Wahyuningrum, I. F. S., Budihardjo, M. A., Muhammad, F. I., Djajadikerta, H. G., & Trireksani, T. (2020). Do environmental and financial performances affect environmental disclosures? Evidence from listed companies in Indonesia. Entrepreneurship and Sustainability Issues, 8(2), 1047–1061. https://doi.org/10.9770/jesi.2020.8.2(63)

Wahyuningrum, I. F. S., Safitri, L., Oktavilia, S., & Setyadharma, A. (2022). The Determinant of Environmental Disclosure in ASEAN Countries. Jurnal Presipitasi, 19(1), 24–33.

Submitted

Accepted

Published

Issue

Section

License

Copyright (c) 2023 Riset Akuntansi dan Keuangan Indonesia

This work is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike 4.0 International License.