Strengthening Sharia Accountability and Transparancy for the Optimization of Cash Waqf Linked Sukuk

DOI:

https://doi.org/10.23917/reaksi.v8i2.2380Keywords:

Sthrengtening Sharia Accountability Transparency, CWLS, ANPAbstract

This research is motivated by the fact that the cash waqf linked Sukuk fund collection has not met expectations, where one of the causes is the low implementation of accountability and transparency. This study aims to analyze strategies to overcome problems and strengthen the implementation of sharia perspective accountability and transparency as an effort to optimize CWLS fundraising. The method used is the theme approach and Analytical Network Process (ANP). Data was collected through the FGD method and distributing questionnaires to several informants from BWI, nazir (waqf fund managers), Islamic Banks as LKS Collecting Cash Waqf Funds (LKSPWU), the government, and KNEKS. The results show that the main strategy in overcoming the problem is to increase the monitoring and supervision function of regulators and the government. The main strategy for strengthening accountability and transparency is competency development in related fields and setting rules for the types of information that must be conveyed to the public.

INTRODUCTION

Transparency and accountability are part of the professional aspects of waqf management which are one of the factors in the growth of public trust in waqf (Ayedh & Echchabi, 2020). This practice of transparency and accountability has not been implemented by most waqf managers in Indonesia, in this case including cash waqf managers which include nazirs and waqf collecting Islamic financial institutions (LKS-PW). Since 2018 the cash waqf manager has played the role of collecting CWLS funds , which is a State Sukuk instrument that integrates with cash waqf. CWLS is a product of collaboration between BWI, Bank Indonesia, the Ministry of Religion and the Ministry of Finance. This collaboration aims to optimize social benefits and make cash waqf more productive which is integrated with State Sukuk. However, this goal has not been realized due to low public interest so that the waqf management institution has not optimally collected cash waqf funds . One reason is that at least waqf is managed professionally and few waqf managers apply accountability in developing their strategy to increase cash waqf collection (Wulandari, Effendi, & Saptono, 2019). Most of the waqf management institutions have not implemented the principles of transparency and accountability in waqf cash management (Baihaqi & et.al, 2021); (AHmad & Rusdianto, 2020); (Adisti & et.al, 2021); (Rahmansyah, 2021); (Rusydiana A. S.); (Putri & et.al, 2020). Homisah (2021) also conveyed that the management of waqf funds at BWI and Nazir needs to be improved regarding aspects of transparency and accountability (Homisah, 2021). The implementation of accountability in waqf management institutions, in this case Nazir, is still weak which has resulted in nearly 95% of potential waqf assets in Indonesia not being optimally generated and utilized which has an impact on the not optimal role of Cash Wakaf Link Sukuk (CWLS) as a social function (Yuliafitri & Rivaldi, 2017).

Accountability practices that are still weak can be seen from several aspects. The first aspect relates to the application of standardized accounting and reports from waqf managers. Most nazhirs as cash waqf managers have not implemented standardized accounting practices in accordance with PSAK 112 (Baihaqi & et.al, 2021). Another problem related to this aspect is the practice of recording waqf assets by nazirs which still mixes standards with CSR model recording, differences in recognition and recording between nazirs and wakifs which are one of the obstacles in realizing accountability (Rahmansyah, 2021). The next aspect is the achievement of maqoshid sharia, in which case the principle of justice has not reached all levels of society. This can be seen from the number of Nazirs in Indonesia as many as 192 Nazirs, not all of them are involved in the management of CWLS. According to DJPPR data, there were 18 Nazirs who were appointed to be CWLS collectors or less than 10% of the number of Nazirs. Other problems are related to misuse of waqf funds and corruption in both waqf funds and their use (Kamarubahrina & et.al, 2019). There are conditions where there is still unprofessional waqf management and inadequate governance affecting the process of preparing documentation and establishing cash waqf transaction contracts which are the third and fourth aspects of accountability (Yasin, 2021). These four aspects are parameters of the fulfillment of accountability from a sharia perspective (Rosly, 2010). The definition of sharia accountability according to Triyuwono (2010) is as an embodiment of the process of actualizing the implementation of sharia values by an entity that gives mercy to humans and nature as a form of accountability to God Almighty. (Triyuwono, 2010).

The existence of sharia transparency and accountability practices that are inadequate for most waqf fund managers is one of the causes of a lack of trust in waqf management institutions so that people's intentions are low and cause the potential for CWLS collection to be not optimal (AHmad & Rusdianto, 2020); (Utomo & et.al, 2020); (AHmad S. , 2019); (Alifiandy & Sukmana, 2020); (Homisah, 2021). The community's intention to donate waqf is influenced by the existence of motivating factors, such as motivation because of the benefits obtained and the motivation for clear use of funds managed through accountability and transparency. The low intention of the community is shown from the value of cash waqf collected and also from the number of waqifs who give waqf in CWLS. The collection of cwls funds until now the realization of receipts is still far from what was estimated by the Indonesian Waqf Board (Utomo & et.al, 2020); (Homisah, 2021); (Putri & et.al, 2020); (Baihaqi & et.al, 2021). Related to this, BWI said that the potential for funds from cash waqf is very large, reaching IDR 180 trillion annually, but the realization only reaches less than 50%. BWI stated that the potential for cwls funds could be collected in the amount of Rp. 50 billion every quarter, but the realization was in the first issue of 2018, a realization of Rp. 50.8 billion was obtained over 1.5 years (BWI, 2020). There is still a gap of 49.98 % between CWLS's funding sources and the availability of the required funding for the APBN. Likewise with the publication of the next series of CWLS which have not achieved optimal results. CWLS issuance value can be seen in Table 1.

Table 1. Issuance of CWLS

Regarding the number of wakifs who donate as waqf, the potential that exists, seen from the number of Muslim population in Indonesia, has yet to be reached. According to DGPR information for 2021, according to DJPPR information, 1,632 waqf consist of 1,625 individual waqifs and 7 institutional waqifs. The number of wakifs is less than 2% of the existing potential, namely from the total middle-class Muslim population according to BCG data of 64.5 million .

Apart from the wakif side, the number of nazirs who are CWLS fundraising partners and managers of CSLW rewards is also still small, namely for the issuance of CWLS series SW 001 only 1 nazir, for the issuance of CWLS ser SWR 001 there are 7 nazirs, for CWLS series SWR 002 there are 9 nazirs . The number of nazirs who meet the criteria to become CWLS partners at this time is still far from the number of nazirs registered as cash waqf managers in Indonesia, namely based on the BWI report as of January 2022, there are 306 nazirs. If all money waqf money waqf are optimized through the nazir approach to each registered waqif, it is very likely that the potential for CWLS fundraising will increase, but the current phenomenon is that the number of nazir partners is very little less than 20%. This of course has an impact on the lack of wakifs who donate through CWLS.

Under these conditions, the implementation of optimal transparency and accountability has not yet had an impact. As we all know, CWLS is a source of sharia-based state financing which is used to finance infrastructure development in Indonesia, for public and social purposes (Rahmansyah, 2021). The benefits of CWLS aside from CWLS issuance funds are used to accelerate national development and for the benefit of the community, the rewards given to wakif are also used for the benefit and welfare of society. The reward is managed by the Nazir and according to Islamic provisions as much as 90% of the reward is used for the benefit of the people. C WLS is an instrument that has enormous potential for the development of the social economy of the people from various circles and from a financial standpoint as a source of state financing (Devi & Rusydiana, 2016). The benefits of CWLS are also one of the solutions in poverty alleviation (Lailatullailia, Setiyowati, & Wahab, 2021); (Diniyya, 2019); (Sanyinna, Osman, & Omar, 2017); (Oladapo & et.al, 2017). The slow receipt of CWLS funds has not yet reached its potential, the benefits generated from CWLS have not been fully realized.

Based on the description in the previous paragraph, the authors see that there are problems related to the implementation of transparency and accountability from a sharia perspective in the management of CWLS which has an impact not only on the low level of CWLS fundraising, but also has an impact on not optimal social programs that contribute to people's welfare. This causes the purpose of issuing CWLS based on social interests has not been realized optimally. Therefore, researchers have an interest in contributing to efforts to optimize the collection of cash waqf in the CWLS instrument through strengthening the application of transparency and accountability practices from a sharia perspective in waqf managers. This is due to the weak implementation of sharia transparency and accountability which is the cause of low motivation for waqif intentions which has an impact on CWLS fundraising far from its potential. In addition, the researcher will also conduct a ranking test to determine the aspects that most influence the achievement of the objectives to be achieved. In this regard, the topic to be raised is " Strengthening Sharia Accountability and Transparency for Optimizing the Collection of Cash Waqf Link Sukuk Funds (CWLS) " with several research questions, which include (1) what are the problems, solutions, strategies in realizing accountability from a sharia perspective and transparency over CWLS transactions?; (2) What strategy has the highest influence in overcoming the problem of realizing CWLS transaction accountability and transparency?; (3) What strategy has the highest influence in strengthening sharia perspective accountability and transparency of CWLS transactions?

Similar research was also conducted by previous researchers who raised the topic of accountability and transparency related to CWLS. Rusydiana researched the development of cash waqf in Indonesia by exploring obstacles, strategies, and the role of stakeholders in developing cash waqf where the element of accountability is a strategy that must be developed (Rusydiana A. , 2018). The next researcher takes a topic related to the role of accountability in moderating literacy and religiosity on interest in waqf (Adisti & et.al, 2021). Similar research related to the role of accountability and transparency in influencing interest in waqf (AHmad & Rusdianto, 2020). Other researchers, Baihaqi et.al (2021) also researched strengthening accountability by looking at it from the point of view of implementing PSAK 112 in waqf managers (Baihaqi & et.al, 2021), Ahmad (2019) exploring from the application side of reports generated by managers whether they are in accordance with standards or not (AHmad S. , 2019), Kamahrubarina (2019) examined Accountability practices in one of the waqf agency institutions in Malaysia are related to accounting and reporting practices (Kamarubahrina & et.al, 2019)and Ayedh examines accountability practices in Yemen (Ayedh & Echchabi, 2020). The difference with this research lies in the topics, objects and methods. The topic raised was regarding efforts to strengthen sharia transparency and accountability. This sharia ak takbilits raises from four aspects, namely accounting and report aspects, sharia maqoshid aspects, document aspects, and contract aspects. The object of this research is the manager of the principal funds and rewards from CWLS waqf which includes Nazir, LKS-PW, BWI, and the Government. The method used is the Analytical Network Process (ANP) approach.

Based on the background described in the previous paragraphs, the objectives of this study include (1) analyzing problems , solutions, and strategies in realizing sharia perspective accountability and transparency of CWLS transactions; (2) Analyze the strategy that has the highest influence in overcoming problems and realizing transparency and accountability as an effort to increase CWLS collection?

LITERATURE REVIEW

Definition of Cash Waqf, CWLS, Transparency, and Accountability from a Sharia Perspective

Waqf is considered to have the main objective of making a beneficial contribution to society through social welfare and economic development (Thaker, Mohammed, Duasa, & Abdullah, 2016). Waqf has been a major source of funding for Muslims over the past centuries, starting with the extensive waqf created by the Prophet Muhammad (peace be upon him) and his companions. Waqf occurs when a person's assets become non-transferable, whereby the income or benefits generated from those assets become alms-value (Siswantoro, Rosdiana, & Faturrakhman, 2018). Osman et al. (2012) stated that in the past, waqf was usually associated with physical assets such as land and buildings. However, in this form, few people can acquire assets to donate as waqf (Osman, Htay, & Muhammad, 2012). Therefore, cash waqf is an alternative for those who do not have immovable assets but can donate their money as waqf for the benefit of society (Shatar, et. Al, 2021). Through cash waqf, anyone in society can participate in almsgiving as long as they are willing to contribute voluntarily for the pleasure of Allah (SWT) (Sulaiman & et.al, 2019). Cash waqf is considered a key tool for increasing government funding and ultimately improving the welfare and economic status of Muslim communities (Kachkar, 2017); (Khan & et.al, 2020).

Cash Waqf is a perfect integration between Islamic social finance and commercial finance and is a new financial instrument for financing the Islamic economic sector in Indonesia. The integration of cash waqf with State Sukuk or better known as CWLS is a form of cash waqf investment in SBSN and is a concrete manifestation of strong support and commitment from the authorities, in this case BWI, Ministry of Finance, Ministry of Religion, and BI, for development and innovation efforts in the financial sector and Islamic social investment in Indonesia (Utomo & et.al, 2020); (Homisah, 2021). CWLS coupon returns are used for social programs that have a social and economic impact on the community. Waqf funds at CWLS can be temporary or permanent, thus providing flexibility in raising funds from waqf (donors) (Bank Indonesia, 2020).

Transparency is closely related to the ease of access to information obtained by stakeholders' information on an entity that is useful for decision making (Madhavan, Porter, & Weaver, 2005). In general, transparency in an organization is how stakeholders can monitor performance and can participate in decision making (AHmad & Rusdianto, 2020). Transparency is a perception of the quality of information obtained and needed by users, namely information openness, information clarity, and information accuracy (Schnackenberg & Tomlinson, 2016). Transparency can also be used to increase the reputation and trust of stakeholders (Diez & Sottorio, 2012).

Sharia accountability is an embodiment of the process of actualizing the implementation of sharia values by an entity that gives mercy to humans and nature as a form of servitude to God the Almighty (Triyuwono, 2010). Sharia values in this case are compliance with sharia principles in every business transaction that complies with the prohibition of maysir, ghoror and usury . This means that companies must implement all forms of accountability, nothing is covered up and manipulated, and based on honesty. Sharia accountability has four parameters that must be applied with the aim of avoiding material errors that will reduce legitimacy and public trust in sharia values attached to sharia instruments/products (Rosly, 2010). The four parameters include contract parameters, maqashid sharia, accounting and financial reporting, as well as legal documentation (Rosly, 2010). The Akad parameters show that the contract does not contain ghoror elements because when it contains ghoror, the contract is declared invalid or not in accordance with sharia. The parameters of maqashid sharia are intended for an entity to comply with Islamic ethics and morals for its products and commercial continuity and there is protection for basic needs, namely religion, mind, family, life, property (maal). The next parameter is the Accounting and Financial Reporting parameter which aims to provide information about the performance and accountability of a company. The last parameter is that legal contract documents must be prepared based on sharia principles and there is an element of fairness between the parties making the agreement.

Previous Research

The topic of accountability and transparency related to CWLS has been studied by previous researchers, but these topics have differences from this study. Rusydiana researched regarding the development of cash waqf in Indonesia, using the ISM ( Interpretative Structural Modeling ) method, exploring obstacles, strategies, and the role of stakeholders in developing cash waqf where an element of accountability is a strategy that must be developed (Rusydiana, 2018).

The next research was carried out by Adisti, 2021 using the multiple linear regression method with topics related to the role of accountability in moderating literacy and religiosity on interest in waqf. The results of his research show that accountability moderates the literacy variable in influencing people's waqf intentions, whereas for religiosity, accountability does not moderate the religiosity variable in influencing waqf intentions (Adisti, 2021). Similar research related to the role of accountability and transparency in influencing interest in waqf was conducted by Ahmad (2020) using the SEM PLS method where the results of his research show that perceptions of transparency and accountability have a significant influence on trust and intentions to endow money in Islamic financial institutions (Ahmad, 2020 ).

Other researchers link accountability and transparency with the application of standardized accounting and reporting generated by waqf managers. Baihaqi et.al (2021) examines strengthening accountability by looking at the implementation of PSAK 112 in waqf managers (Baihaqi, 2021), Ahmad (2019) explores in terms of the application of reports produced by managers whether they are in accordance with standards or not (Ahmad, 2019) , Kamahrubarina (2019) examines accountability practices in a waqf agency in Malaysia related to accounting and reporting practices, and Ayedh examines accountability practices in Yemen (Ayedh, 2020). The method used in this research is a qualitative method and the results show that accountability and transparency will be realized with standardized accounting practices and reports produced and used by stakeholders to make decisions.

Another topic is related to the analysis of the management of cash waqf funds which looks at the performance of waqf managers. The factors raised are related to trust, human resources, systems, and shariah compliance with the ANP method. The results show that the sub-factors that have the highest priority for finding solutions and strategies to overcome them are the lack of trust, unfulfilled waqf covenants , misappropriation of waqf funds, and the weaknesses in the managerial system.(Rusydiana & Devi, 2014). Yasin (2021) discusses CWLS in general regarding challenges and strategies for increasing CWLS collection. The results of his research include factors that need to be followed up are relatively new products, limited distribution partners and nadzir, low coupons, lack of public understanding, contracts, and incomplete literacy causing the potential of wakif not to be maximized (Yasin, 2021).

The difference with this research lies in the topics, objects and methods. The topic of this research raises the issue of strengthening transparency and accountability from a sharia perspective as a strategy for raising CWLS funds . legal aspects of documents. The method used is a qualitative method with the theme approach and ANP.

RESEARCH METHODS

The method used in this study is a qualitative method with a theme approach and an Analytic Network Process (ANP) approach. The thematic approach is used when seeking information on the implementation of transparency and accountability practices sharia in managing waqf funds, while the ANP approach used when determining the influence between elements in a cluster. This is in accordance with the opinion of Huda (2017) that Analytic Network Process (ANP) is a general theory of relative measurement used to derive the composite priority ratio of the individual ratio scale which reflects the relative measurement of the influence of interacting elements with respect to control criteria . (Huda, 2017).

Stages in the ANP model consists of three stages, the first stage is the model construction phase, the second stage is the model quantification phase, and the last stage is result analysis (Ascarya, 2010). These stages can be seen in Figure 1

Figure 1. Stages of the ANP Model Source: Ascarya 2020

At the capital construction stage the researcher collects data sources from previous research, interviews with users, and FGDs attended by several informants to obtain information related to the need for solving problems in raising CWLS funds , information on possible causes of problems, several alternative solutions, and future strategy. This information is also used in constructing the ANP model. At the model quantification stage, the information obtained was used as material in the preparation of the ANP questionnaire, which was then distributed to informants to ask for their opinion through filling out the questionnaire. Each informant will provide an assessment of which clusters, aspects and elements have the highest level of influence. The assessment follows the assessment in table 2 below

Table 2. ANP Rating Scale

The third stage is the stage of processing and analysis of ANP results . At this stage, the results of filling out the questionnaire are processed and meet the requirements for acceptance, the CR value must be <0.1. Based on the results of data processing, one narsum has a CR value of > 0.1 so that the narsum's answer is excluded from the average (Geo-mean) calculation. When determining the average value (Geo-mean), the W value must be 0.38. This value describes whether all narsums agree on the cluster or element that has the highest level of influence. The results of data processing for most of the clusters and elements have met the value of W >= 0.38

The types of data used are primary data and secondary data. Primary data is the result of interviews and ANP questionnaires from key informants, namely waqf managers who have been appointed by the government as CWLS nazir. Interviews were also conducted with waqf management informants to seek information on sharia transparency and accountability practices as well as strategies that can be implemented by waqf managers and regulations. The parties who will become key informants in this study can be seen in table 3 below.

Table 3 . List of Research Key Informants

The secondary data used are financial reports and other data on waqf managers and regulators/government.

Data collection methods used in this study using interviews and ANP. The interview method was conducted to obtain information from several key informants regarding the extent to which waqf fund managers apply transparency and accountability from a sharia perspective and also ask for opinions regarding possible strategies. The ANP method was carried out by distributing questionnaires to key informants. Each informant will fill out the ANP questionnaire by giving a scorepairwise comparison in the range of numbers 1 to 9. The documentation method is a method that collects information and data through literature studies and exploration of the literature and financial reports that are made. Based on the results of the data collection carried out, the data needed to measure the level of compliance, professionalism and accountability of waqf managers and regulators was obtained . Processing of data in this study is a series of stages starting from the stage of data collection, grouping data by business unit and year of analysis then the data is processed which will produce a source of information that can be interpreted descriptively.

Technical analysis of interview results using a qualitative descriptive thematic approach where the results of the information needed will be described descriptively and can explain the research objectives of optimizing the potential for CWLS collection by extracting information on intentions, obstacles and solutions for individual and institutional wakifs, as well as information on strategies expected from managers waqf and government. The stages of analysis carried out are as follows(Braun & Clarke, 2006)

At this stage, the results of the interview scripts are processed and grouped according to themes that often appear or are conveyed in accordance with existing data.

At this stage, or it can be said as coding stage 2, the author grouped the data based on a more general theme based on the themes made at the open coding stage . So from several themes that were generated during the initial coding, they were then combined into broader themes.

At this stage, the author begins to group the broad themes into themes according to research theory, namely the theory of intentions, barriers, solutions, and strategies.

- The initial coding stage of the data ( open code )

- Axial Coding

- Relating to the themes in accordance with the theory.

- Making conclusions whether the strategy to be implemented can overcome the problems experienced by wakif or not

The analysis technique for the results of the ANP questionnaire, the data from the questionnaire results were processed and analyzed using Microsoft Excel and the help of the "Super Decision" Software . The results will be analyzed by determining the order of the highest influence of each transparency and accountability factor, obstacles, solutions, and strategies as an effort to increase the implementation of transparency and accountability as an effort to optimize the potential for CWLS collection.

RESULTS AND DISCUSSION

Problems, Solutions, and Strategies in Realizing Sharia Accountability and Transparency

Regarding transparency and accountability, earlier it was stated that transparency and accountability are part of the professional aspects of waqf management which is one of the factors in the growing trust of the public to endowments (Ayedh & Echchabi, 2020). To examine how transparency and accountability are implemented in cash waqf managers, especially related to CWLS, along with problems, solutions, and strategies to improve transparency and accountability practices, researchers conducted several stages of gathering information to construct the model. The stages of information gathering were carried out by seeking sources of previous research, interviewing beneficiaries of CWLS funds , and holding Forum Group Discussions (FGD).

The purpose of the FGD was to gather information , apart from previous research and interviews , withmedia zoom . Informants who attended this FGD can be seen in table 4

Table 4 . List of Key Informants Who Attended the FGD

The FGD was divided into three sessions. In the first session, each Nazir in this case conveyed general information regarding the management of CWLS in institutions/entities. This information includes the type of compensation, amount, and distribution of the CWLS reward. The second session was a discussion session on the opinions of the informants regarding the practice of sharia transparency and accountability in CWLS managers. In general, the practice of transparency and accountability has been carried out by CWLS managers, as stated by informant 5

“….In general, transparency and accountability have been implemented in waqf management entities, it's just that there is some information that has not been presented or disclosed that may be needed by the public, such as which nazir received what compensation, wakif A donated what amount, the compensation received from CWLS how much was used by Nazir, what was the main waqf fund used for, maybe there was secrecy or something…” ( informant 5).

Based on the information submitted by informant 5, it is known that there is some information that might in the future be conveyed to the public which of course has gone through the considerations that have been discussed, such as consideration of the impact problems that occur if the information is published to the public. Regarding transparency and accountability in managing CWLS, informant 4 also conveyed this. This is related to questions from customers who will make waqf in CWLS which require explanation from LKSPW. The question is related to the distribution of waqf money and the distribution of rewards from the waqf. This question is often asked by customers.

Problems related to accountability practices were also conveyed by informant 3. This is related to the application of accounting practices in accordance with auditing standards and practices.

"Some Nazirs still experience difficulties in implementing PSAK 112, besides that there are some Nazirs who have produced audited financial reports, but there are also Nazirs who have produced financial reports that have not been audited, even though all Nazirs who manage CWLS compensation have prepared financial reports periodically submitted to BWI and the Ministry of Finance.” ( informant 3)

Problems in the application of PSAK 112 were also conveyed by informant 2 related to differences in perceptions between Nazir and KAP in applying the PSAK. The problem of recording related to CWLS is also experienced by institutional wakif, namely in terms of recording the return of the principal of waqf funds at CWLS at the end of the CWLS period what will be recognized. There is no standardized treatment for recording this return, so there is a possibility that there will be different treatment by each wakif institution and also the LKS as an intermediary institution for receiving CWLS funds. The obligation to prepare separate financial reports as a nazir and also as a non-waqf fund management entity is also a matter that needs to be discussed whether in the future it will only be made into one financial report so that it will be more effective. So if the foundation has a license as a waqf fund manager , ZIS fund manager, and manager of other fields, the financial reports to be prepared must be separated into three financial reports according to the entity. This is enough to cause difficulties for the non-profit entity.

The third session was exploring strategic proposals to create transparency and accountability from a shariah perspective in CWLS Managers . The strategy proposed by the informants for this problem to become a common and standardized solution for CWLS managers is described below:

- Optimizing the role of BWI as a regulator and setting standardized guidelines regarding Transparency and Accountability Materials that must be met by Nazhir

- Competency Development related to understanding CWLS and application of Waqf Management Accounting Standards

- Disclosure of the Use of CWLS Principal Funds which is the collection of cash waqf from wakif in the form of CWLS

- There is a standard for reporting information on beneficiaries and the use of CWLS rewards

The strategies to improve transparency practices are as follows:

- Reports that are integrated on the BWI channel which can be accessed by the public

- Reports that are integrated on the Nazir channel which can be accessed by the public

- Integrated Data Collection in nazhir and speed reporting of activities in nazhir

- Newsletter on waqf program development, collection and management plans

- Increasing HR competencies related to digital media

The results of the strategy are then put together into several strategies that can cover both clusters, namely sharia accountability and transparency. The results of the strategy include:

- Competency development and socialization for sustainable waqf managers and communities related to the CWLS program, professional management, and accounting and reporting

- Determination of the rules of what information is presented for individual waqif and non-individual waqif parties, such as regulators, government, LKSPW

- Re-arrangement of provisions for making pledge content more effective and relevant

- Increasing the monitoring and supervision function of the regulator

Based on the information obtained from the FGD results, previous research sources, and also from interviews, the researcher carried out the coding stage by grouping the information according to the classification that had been determined based on the problem solving method with the ANP approach, namely grouping into clusters and elements. supporting elements of each cluster. The clusters consist of problem clusters, solution clusters that have been implemented, strategy clusters for developing solutions, strategies for overcoming problems, and strategies for supporting sharia transparency and accountability practices. The clusters are then grouped according to existing theories related to transparency and accountability from the sharia perspective and supporting aspects. The results of grouping according to the theory (theme) are used as model construction. The following picture is the ANP scheme which serves as a guideline in the next stage of the ANP model, namely making the ANP questionnaire which will be distributed and asked for all informants to fill it out. The ANP scheme can be seen in Figure 2 below

Figure 2. Scheme of ANPStrengthening Transparancy and Accountability Source: Processed by Author

The ANP scheme has six clusters. The first cluster is the goal to be achieved, namely optimizing the collection of CWLS funds through strengthening transparency and accountability from a sharia perspective in CWLS managers. The second cluster is an aspect of strengthening sharia transparency and accountability which has two elements in the transparency aspect, namely the element of information disclosure and the element of clarity and accuracy. The aspect of sharia accountability has 4 elements, namely the aqad element, the legal document element, the sharia maqoshid element, and the accounting and report element.

The third cluster is a problem cluster consisting of several problem elements. The elements of the problem are grouped based on the aspects of sharia transparency and accountability where the objective of the ANP assessment results is to obtain information on what problems most cause transparency and accountability to be not achieved. The fourth cluster is a solution that has been carried out by every CWLS manager to overcome the problems they face. Solution clusters also consist of several elements. The fifth cluster is a strategy cluster that has five elements. Elements of the strategy cluster include:

- Competency development and socialization for sustainable waqf managers and communities related to the CWLS program, professional management, and accounting and reporting

- Determination of the rules of what information is presented for individual waqif and non-individual waqif parties, such as regulators, government, LKSPW

- Re-arrangement of provisions for making pledge content more effective and relevant

- Increasing the monitoring and supervision function of the regulator

The discussion in this section is a reciprocal relationship which is a characteristic of the ANP model, namely explaining how much influence the proposed strategy has in overcoming problems and explaining how much influence the strategy has in strengthening sharia accountability. This explanation is presented in the following paragraphs. The results of the magnitude of the influence of the strategy in overcoming problems can be seen in table 5.

Table 5. Results of the Level of Influence of Strategy in Overcoming Problems

Based on the data presented in table 5, the strategy that has the highest influence in overcoming problems related to sharia accountability is the strategy to increase the monitoring and supervision function of regulators and the government. At this time BWI has made rules regarding the obligation for every Nazhir to submit reports, both reports on social programs that have been implemented including the amount spent for running the program, reports on mauquf alaih data, the amount of compensation received and managed and other documents. which supports. However, in practice there are still nazirs who have not complied with these regulations. This is as stated by informant 3:

"...as for the documents that must be submitted by nazhir, BWI has made these rules, but at this point in the field there are nazhirs who have not complied with the complete documents. For now, yes, we can't impose sanctions yet, but maybe in the future this will get better, this regulation can be implemented by every Nazhir."

This information was also conveyed by informant 5:

"From the government's point of view, the data regarding the number of CWLS issuance results, the number of institutional endowments, the number of individual endowments, social programs from rewards, distribution partners have all been announced on the Ministry of Finance's website, but maybe what has not been fulfilled is what the CWLS funds are for. , data on how much compensation Nazir received from LKS-PW A, how much compensation Nazir received from LKS-PW B, anyone who wants to pay, how much compensation he received to finance the program. So, maybe in the future, more transparency is needed.”

Related to this condition, in the future the monitoring and supervision function is urgently needed, of course there must also be a mentoring program for Nazhir to increase competence in the field of fulfilling accountability and transparency.

In order to fulfill sharia accountability in the maqoshid sharia aspect, it is necessary to have rules standardizing what information needs to be conveyed by CWLS managers both from the nazhir and LKS-PW sides. This information will provide confidence that the protection of religion, mind, soul, property and wakif derivatives is always maintained. This strategy results in an importance level of 27% or gets second place in overcoming existing problems. The background to this strategy is that there are problems at the moment when the public's trust in CWLS and cash waqf is still low, there are still many waqif candidates who question the CWLS program, what are the benefits, who wants to be alaihi who receives the benefits. In addition, there are still many Nazhirs who have not fulfilled the completeness of the documents required by BWI. If these two strategies are followed up by policy makers, they will overcome problems related to sharia accountability and transparency

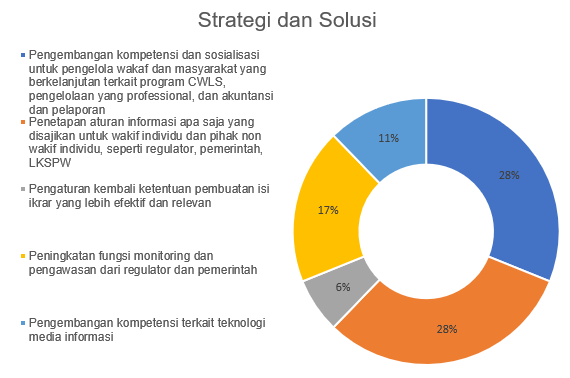

Overall the types of strategies and results of the level of influence of each strategy in overcoming problems can be seen in Figure 3 below

Figure 3

Based on the description above and the results of the level of influence which is also presented in Figure 3 where the monitoring function, setting rules regarding information that must be presented to the public, problems that occur in every aspect of sharia accountability can be resolved so as to realize the maximum application of sharia accountability, results This has similarities with previous research that the application of standardized accounting and reporting produced by waqf managers will strengthen accountability (Ahmad, 2019) .

- Strategies that Have the Highest Influence in Overcoming Problems

- The Level of Influence of Strategy in Strengthening Sharia Transparency and Accountability as a Factor for Increasing CWLS Collection

The strategy that has been proposed by the informants can be a great solution which in this case includes existing solutions and future solutions in overcoming problems. Besides that, these strategies can also directly overcome the problems that occur in optimizing the collection of CWLS. The next question is whether these strategies can directly realize sharia accountability and transparency which will have an impact on increasing the collection of CWLS? The results of data processing show the influence of strategy in strengthening aspects of sharia accountability which can be a factor in increasing the collection of CWLS, which is equal to 68% compared to other aspects.

The level of influence of each strategy and the type of strategy proposed to realize sharia accountability and transparency can be seen in table 6 below.

Table 6. Results of the Level of Influence of the Strategy in Realizing Sharia Accountability and Transparency

The most influential strategy is that there are two solutions that get the same value, namely competency development and socialization strategies for waqf managers and the community related to the CWLS program, professional management, and understanding of accounting and reporting (28%) and strategies for setting rules by regulators about what information only to be served (28%). This strategy is long-term in nature which of course will continue to be refined. This strategy is intended to overcome the low level of understanding from the community and Nazhir. As we know, people's understanding of cash waqf is still relatively low, there are still many people who have not accepted the concept of cash waqf and it is even more difficult to force people to understand the combination of sukuk and cash waqf. This requires maximum effort in providing literacy and outreach in the future until the community is sure that nothing has been violated both in terms of Islamic rules and law as well as from the perspective of sharia maqoshid which is part of the aspect of sharia accountability.

The socialization and literacy that has been carried out so far needs to be carried out intensely in the future and there must be a follow-up of the socialization activities, for example by approaching potential waqif candidates by offering cash waqf and CWLS products directly. Several LKS-PWs have done this by profiling data on potential customers who have participated in established waqf savings programs and have invested in sukuk. Socialization must also be carried out in developing nazhir competencies related to the obligation to prepare reports. So far, BWI has also issued rules regarding documents and reports that must be submitted by Nazhir. This is a solution that has been carried out by BWI. In the future, these regulations will be further strengthened by the existence of a monitoring and supervisory function, besides that it is also necessary to conduct training for cash waqf managers (nazhir and LKS-PW) related to BWI rules and preparation of reports according to standards.

The results of the level of influence of the strategy in realizing sharia accountability and transparency can be seen in Figure 4. Based on the description above and the results also presented in Figure 4, this research has similarities with previous research, namely research that results in strengthening accountability will be realized by implementing rules which is standardized in waqf management (Baihaqi, 2021); Kamahrubarina (2019);(Ayedh, 2020).

Figure 10.Figure 4. Results of the Level of Influence Strategy in Strengthening Sharia Accountability and Transparency

The determination of these rules is of course applied to all aspects of sharia transparency and accountability which include contractual aspects where the CWLS program complies with sharia principles and Islamic laws, document aspects where the existence of rules and strengthening the monitoring and supervisory functions can realize document aspect accountability. Socialization and literacy regarding CWLS, cash waqf, training and assistance in the preparation of financial reports can strengthen accounting and reporting aspects as well as the obligation to submit reports and supporting documents regarding data on the amount of compensation received, explanation of social program realization, mauquf alaih data, sharia opinion from DPS , the existence of internal audit, the aspect of sharia maqoshid, which is also an aspect of sharia accountability, proves that these strategies can strengthen sharia accountability which has an impact on increasing the collection of CWLS.

Overall the results of this study have similarities with Rusydiana's research which produces elements of accountability and transparency as one of the strategic targets that must be developed in an effort to increase interest in waqf waqf in CWLS (Rusydiana, 2018).

CONCLUSION

The problems experienced by waqf managers in realizing transparency are grouped into two aspects, namely the aspect of information disclosure and the aspect of clarity and openness. Problems with the aspect of information disclosure, namely the existence of negative responses from the public, the existence of confidential matters that cannot be informed, the understanding of reports, the media, and the different information needs of the waqif, and the lack of regular reports uploaded on the waqf manager's website. For the aspect of clarity and accuracy, the problems include data collection that has not been integrated, the speed of reporting activities on Nazir Mash channels is still lacking, the clarity of waqif information, the value of waqf, rewards, products of rewards, mauquf alaih. Problems in realizing sharia accountability, namely for document aspects including document requirements that are difficult to fulfill Nazir and mechanisms/procedures that have not been understood and management that is not yet mature; for the aspect of the contract, the problems that occur are the conditions that make the pledge difficult to fulfill and the problem of convincing the wakif regarding the elements of maysir, ghoror, and usury when determining the CWLS contract; for the accounting and reporting aspects, the problem is that the separate ZISWAF accounting standards are ineffective, difficult to understand, different perceptions, unaudited financial reports for some Nazirs, and there has been no review of the scope of reported information; for the maqoshid sharia aspect, the problems experienced are that trust has a stronger influence on interest, wakifs tend to want to see the physical assets of the waqf funds, there are many questions regarding the distribution of the principal funds being donated, the beneficiaries of the rewards, and who wants to be alaihi. Solutions that have been made to overcome the problem, namely the implementation of socialization about CWLS, delivery of information, clarity and accuracy have been carried out according to Nazir's capacity, clarification of community views, it is necessary to establish a more comprehensive strategy/rules. There are technical guidelines for preparing reports and other technical regulations , and the information has been presented on Nazir's website according to Nazir's condition. The rest Nazir still follow the existing provisions.

In the strategy cluster, the provisions for CR values and W values have also fulfilled the provisions, where the highest strategy in influencing the success of developing solutions that have been and have not been carried out and realizing sharia accountability and transparency is competency development and socialization for sustainable waqf managers and communities related to the CWLS program, professional management, and accounting and reporting (28%) and determining the rules of what information is presented for individual waqif and individual non-waqif parties, such as regulators, government, LKSPW (28%).

The level of influence at the reciprocal stage (upwards) which characterizes ANP, in this study, is connecting the strategy cluster to the problem cluster and the strategy cluster to the transparency and accountability factor cluster. All of them have met the criteria for CR values and W scores with the results of strategies to improve the monitoring and supervisory function of regulators and the government obtaining the highest level of influence (28%) in overcoming problems, while the influence of strategy on transparency and sharia accountability factors, the results of these strategies have more influence on the realization of accountability (68%) and transparency (32%).

References

Ab Shatar, W., & et.al. (2021). Determinants of cash waqf fund collection in Malaysian Islamic banking institutions.

Adeyemi, AA, Ismail, NA, & Hassan, SS (2016). An Empirical Investigation of the Determinants of Cash Waqf Awareness in Malaysia. Intellectual Discourse , 501–520.

Adisti, D., & et.al. (2021). The Role of Accountability as Moderation of Waqf Religiosity and Literacy Relationships on Interests in Cash Endowments. Indonesian Accounting and Business Review , Vol. 5(2), 122-137.

AHmad, S. (2019). Accountability of Waqf Reporting Based on Sharia PSAK. Journal , Vol IV No2.

AHmad, ZA, & Rusdianto. (2020). Impact of Transparency and Accountability on Trust and Intention to Donate Cash Waqf. Shirkah, Journal of Economics and Business , Vo.5 No2.

Ahmed, E., Islam, M., & Amran, A. (May 2019). Examining The Legitimacy of Sukuk Structure via Shariah Pronouncements. Journal of Islamic Marketing .

Alifiandy, M., & Sukmana, R. (2020). The Influence Of Planned Behavior Theory And Knowledge Toward The Waqif Intention In Contributing Waqf. Journal of Islamic Economics and Business , 6(2), 260–272.

Ayedh, A., & Echchabi. (2020). Waqf Accountability in The Republic of Yemen: an Empirical Analysis. Qudus International Journal of Islamic Studies .

Baihaqi, J., & et.al. (2021). Strengthening Waqf Accountability (Illustration on Cases of Cash Waqf and Stock Waqf. Neutral Accounting, Accountability, Objectives , Vol.4 Number 1.

Braun, V., & Clarke. (2006). Using thematic analysis in psychology. Qualitative Research in Psychology. thematic_analysis_revised.

Devi, & Rusydiana, USA (2016). Islamic Group Lending Model (GLM) and Financial Inclusion. International Journal of Islamic Business Ethics , Vol. 1 No. 1, pp. 80-94.

Diez, E., & Sottorio, L. (2012). The Influence of Transparency of University Social Responsibility in the Creation of Reputation. Regional and Sectoral Economic Studies , 12(3), 21–30.

Diniyya, A. (2019). Development of Waqf Based Microfinance and its Impact in Alleviating The Poverty. Ihtifaz: Journal of Islamic Economics, Finance, and Banking , 2(2), 107–123.

Fitri, IY, & Rivaldi, AI (2017). The Effect of Applying the Principles of Good Governance and Promotion on Acceptance of Cash Waqf in Waqf Management Institutions in Indonesia. Investment , Vol. 13 No. 1.

Homisah, NS (2021). Level of Understanding and Factors Influencing Community Intentions Towards CWLS. Bogor Agricultural University thesis .

Jazil, T., Rofifah, S., & Nursyamsiah, T. (2019). Determinant Factors Motivated Waqif to Donate Waqf . Vol. : 2(2) 162-190.

Kachkar, O. (2017). Toward the establishment of cash waqf microfinance funds for refugees. ISRA International Journal of Islamic Finance, , Vol. 9 No. 1, pp. 81-86.

Kamarubahrin, AF, Ahmed, AM, & Khaira, KF (2019). Accountability Practices of Waqf Institutions in Selected States in malaysia: A Critical Analysis. International Journal of Economics, Management and Accounting , 27 No.2.

Finance, K. (2017). Central Government Financial Statements.

Khan, & et.al. (2020). Demographic determinants of charity donors and their implications for cash waqf institutions in Malaysia. Journal of Islamic Marketing .

Lailatullailia, D., Setiyowati, A., & Wahab. (2021). The Role of Islamic Banks as Nazhir Partners in Management of CWLS Retail Investment Products SWR001 in the Perspective of the Basic Principles of Waqf. Perisai, Islamic Banking and Finance Journal , Vol 5 (1). 95-109.

Madhavan, A., Porter, A., & Weaver, D. (2005). Should securities markets be transparent? Journal of Financial Markets , 8(3), 265–287.

Oladapo, H., & et.al. (2017). Cash Waqf as an Alternative Panacea to Poverty Alleviation, An Overview of Human Development in Nigeria. Turkish Journal of Islamic Economics , 4(2), 83–90.

Osman, A., Htay, S., & Muhammad, M. (2012). Determinants of cash waqf giving in Malaysia: survey of selected works. paper presented at the International Workshop on Islamic Based Development V, , Medan, 10 April.

Putri, MM, & et.al. (2020). Implementation Strategy for Cash Waqf Linked Sukuk Management in Supporting Community Economic Development: Analytic Network Process (ANP) Approach. AL-INFAQ: Journal of Islamic Economics , Vol. 11(2) .

Rahmansyah. (2021). Recognition of Waqf Assets by Company Waqf in Cash Waqf Linked Sukuk Products (Synchronization of Nadzhir and Wakif Financial Statements in PSAK 112). Journal of Religious Studies , Vol 9 Number 1.

Rosly. (2010). Shariah Parameters Considered. International Journal of Islamic and Middle Eastern Finance and Management, 3 (2) , : 37-47.

Rusydiana, USA (2018). Interpretives Structural Modeling Application of Cash Waqf Development Strategy in Indonesia. Journal of Islamic Economics and Business , Vol. 4, No.1.

Rusydiana, A., & Devi, A. (2014). analysis Of Cash Waqf Fund Management in Indonesia: An Analytic Network Process (ANP) Methode. International Conference, AICIF Sunan Kalijaga, Yogyakarta .

Saati, TL (1990). The Analytical Hierarchy Process in Conflict Management. International Journal of Conflict Management, 1 (I.PP), 47-68.

Sanyinna, Osman, & Omar, H. (2017). Sustainable Poverty Alleviation through Integration of Waqf and Microfinance : A Case Study of Sokoto State, Nigeria. International Journal of Business and Technopreneurship. , 7(3), 273–306.

Schnackenberg, & Tomlinson. (2016). Organizational Transparency: A New Perspective on Managing Trust in Organization-Stakeholder Relationships. Journal of Management , 42(7), 1784–1810.

Siswantoro, D., Rosdiana, H., & Faturrakhman, H. (2018). Reconstructing accountability of the cash waqf (endowment) institution in Indonesia. Managerial Finance. , Vol. 44 No. 5, pp. 624-644.

Siti Homisah, NN (2021). Level of Understanding and Factors Influencing Community Intentions Towards CWLS. Thesis, IPB .

Sukmana, R. (2020). Critical assessment of Islamic endowment funds (Waqf) literature: lessons for government and future directions. Heliyon .

Sulaiman, S., & et.al. (2019). Proposed models for unit trust waqf and the parameters for their application. ISRA International Journal of Islamic Finance , Vol. 11 No. 1, pp. 62-81.

Suryadi, K., & Ramdhani, A. (2000). Decision Support Systems: A Structural Discourse on the Idealization and Implementation of the Concept of Decision Development. PT Rosidakarya Offsa. Bandung.

Thaker, M., Mohammed, M., Duasa, J., & Abdullah, M. (2016). Developing cash waqf model as an alternative source of financing for micro enterprises in Malaysia. Journal of Islamic Accounting and Business Research , Vol. 7 No. 4, pp. 254-267.

Triyuwono, I. (2010). Perspective, Methodology, and Islamic Accounting Theory. Jakarta: PT Raja Grafindo Persada.

Utomo, BS, & et.al. (2020). Why Cash Waqf Fails to Meet the Expectation: Evidence from Indonesia. Financial Services Authority .

Wulandari, S., Effendi, & Saptono. (2019). Selection of Nazhir in Optimizing Cash Waqf Management. Journal of Management and Business Applications , 5(2), 295–307.

Yasin, R. (2021). Cash Waqf Linked Sukuk: Issues, Challenges, and Future Direction in Indonesia. ISRA International Journal of , Vol. 13 No. 2.

Yuliafitri, I., & Rivaldi, AI (2017). The Effect of Applying the Principles of Good Governance and Promotion on Acceptance of Cash Waqf (In Waqf Management Institutions in Indonesia. Journal of Investment , Vol. 13 No. 1, 217 – 226.

Yuliafitri, I., & Rivaldi, AI (2017). The Effect of Applying the Principles of Good Governance and Promotion on Acceptance of Cash Waqf (In Waqf Management Institutions in Indonesia. Journal of Investment , Vo. 13 (1).

Submitted

Accepted

Published

Issue

Section

License

Copyright (c) 2023 Riset Akuntansi dan Keuangan Indonesia

This work is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike 4.0 International License.