The Role of Intellectual Capital in the Relationship between Good Corporate Governance, Financial Performance and Financial Distress

DOI:

https://doi.org/10.23917/reaksi.v8i2.2364Keywords:

Financial Distress, Financial performance, good corporate governance, intellectual capitalAbstract

This study examines the effect of good corporate governance and financial performance on financial distress, with intellectual capital as a moderating variable. Good Corporate Governance, Financial Performance and Intellectual Capital are important tools that assure investors of the health of a business, thereby attracting interest to invest in companies that affect the capital to be obtained so as to increase company profits. Companies that are continuously able to make profits will avoid financial distress. This is due to the good management of the company, thereby increasing the value of the company. The sample in this study consisted of 150 observations from 75 manufacturing sector companies listed on the Indonesia Stock Exchange from 2020-2021. Manufacturing companies are the leading industry with the highest GDP contribution compared to other sectors. The Research result are derived from the multiple regression and MRA methods used in this study. Research results show that good corporate governance and financial performance have a positive effect on financial distress. Meanwhile, intellectual capital can strengthen the link between good corporate governance and financial distress. This research can support signal theory which can provide a good framework for understanding the impact of good corporate governance and financial performance on financial distress. This theory explains that companies, as senders of information (information owner), want to make the information relevant to the use of the information by the recipients or users most concerned.

Introduction

There are several things that can trigger a company to experience difficulties or a decline in financial conditions, one of which is when the economic conditions that occur in a country are unstable. If the difficulties or decline in the financial condition that is being experienced by the company continues for several operational periods, it will result in bankruptcy. Management must be able to predict the changes that occur in the economy so as to affect the company's financial condition. The bankruptcy of a company is generally marked by the occurrence of financial distress conditions. In 2019 there were 6 companies whose shares were delisted or delisted from the Indonesia Stock Exchange. This is because several companies on the Indonesia Stock Exchange are experiencing financial difficulties or are in a state of financial distress. The delisted company does not show any indication of adequate recovery. At the time of 2020, companies that were delisted from the Indonesia Stock Exchange were increasing, this was related to the occurrence of the Covid-19 pandemic that occurred in Indonesia. The Indonesian Issuers Association (AEI) explained that the Covid-19 pandemic has caused 50 issuers to experience cash flow difficulties, one of which is the manufacturing sector.

The manufacturing sector has a very significant influence because there are many factories that have stopped their operations. Weakening product sales and operational activities in the manufacturing sector due to the cessation of factory operations due to large-scale social restrictions carried out during the covid pandemic from 2020-2021. The impact of the spread of the corona virus in Indonesia has hit all sectors of the economy, especially the activities of manufacturing companies in Indonesia. In 2020 the JCI for the manufacturing sector fell to 45.3 from the previous level of 51.9. At the same time, factory closures also dragged down production. This activity was also accompanied by a decrease in demand, which prompted companies to reduce purchasing activities of capital goods.

Financial and non-financial issues that the organization manages can have an impact on financial distress. By sound corporate governance, it is possible to identify both the financial and non-financial aspects that can impact a company's financial success. Financial performance related to the usage of funds and the allocation of funds may be observed in the financial statements provided by businesses; these financial performance indicators are often measured by capital adequacy, capital, and earnings [1]. In addition to financial aspects, the value of a business is also affected by non-financial aspects, one of which is good corporate governance. Corporate governance is one of the key factors in a company because both the asset structure, financial structure and policies and strategic steps that are decided to respond to pressure from external conditions of the company are determined by the components of corporate governance, especially the board of directors, commissioners and/or GMS.

From the explanation above, the factors that affect financial distress are both influenced by financial and non-financial factors, companies need good management to improve company performance. Improved operational management is expected to be able to provide increased profits received by the company, so that it is able to free the company from financial difficulties. According to signal theory, the company will try to give a positive signal to stakeholders. This positive signal can be seen from good company management, one of which is by managing the company's intellectual capital. Intellectual capital provides an explanation of how a company manages its resources efficiently and effectively so as to increase the profits the company gets. Intellectual capital management is a factor or strategy in increasing investor confidence in companies [2].

Based on the background described above, the formulation of the problem in this study is:

- Does Good Corporate Governance have a positive effect on Financial Distress?

- Does Financial Performance have a positive effect on Financial Distress?

- Does Intellectual Capital strengthen the relationship between Good Corporate Governance and Financial Distress?

- Does Intellectual Capital strengthen the relationship between Financial Performance and Financial Distress?

Based on the background of the problems above, the contributions in this study are as follows:

The signalling theory, which can offer a useful framework for comprehending the effects of sound corporate governance and financial performance on financial distress, may be supported by this research. This theory explains that companies, as senders of information (owners of information), want to make the information relevant to the use of the information by the recipients or users most concerned. The receiving party then adjusts its behaviour according to its understanding of the signal. If the signal is a positive signal, it is hoped that this will be able to attract potential investors to invest in the company as additional capital for the company's operations so as to be able to score higher profits.

Literature Review and Hypothesis Development

Signal theory can provide a good framework for understanding the positive effect of good corporate governance on financial distress. According to [3] signal theory holds that based on information (signals) from the service provider related to the performance of the company, the company should be able to provide relevant information to its recipients. Receivers adapt their behaviour based on their understanding of the information (signal) provided by the company (sender). Through reporting that is detailed in the company's annual report, the company will attempt to convey encouraging signals or information to potential investors in order to get them to participate and help the company avoid financial issues. [4].

Previous research conducted by [5] the results of their research explained that strong corporate governance proxied by institutional ownership and management ownership has a significant impact on financial distress. Subsequent research was conducted by [6] according to the study's findings, institutional ownership and management ownership had no impact on financial hardship, whereas the percentage of independent commissioners and the size of the board of directors together had a beneficial impact.

According to the signal theory, which is supported by prior research that shows a positive correlation between good corporate governance and financial distress, good corporate governance is a company's strength in managing companies better, increasing company value so that it can increase investor confidence in companies to invest in companies, helping increase company income and returns, the hypothesis proposed in this study is:

H1 a: Institutional ownership has a positive effect on financial distress

H1 b: Managerial ownership has a positive effect on financial distress

H1 c: The Independent Board of Commissioners has a positive effect on financial distress

H1 d: The size of the Board of Directors has a positive effect on financial distress

According to signaling theory, businesses would make an effort to let potential investors know something favorable by publishing financial data in their annual reports [4]. Business leaders who have better information about the company are encouraged to report it by publishing it in the company's annual report in order to transmit this information to investors, copies that can increase the profit of the company. company from company publications [7].

According to Gitman & Zutter (2015), financial performance is the ability of the company to obtain profits (profits) from a certain level of sales, assets and capital shares. Investors will definitely invest their money in the business with good results in order to reap the benefits of the invested money. This is supported by research by Ulum et al., (2018), which explains that business performance can be explained using financial or non-financial information. Company performance is mostly measured using financial ratios in a certain period. Business performance measurement is an important part of business because it aims to ensure that the interests of stakeholders are met by assessing whether business objectives have been achieved.

According to [8] profitability is a company's success in obtaining net profits while carrying out its operations. The higher the value of the profitability ratio, it indicates that the use of capital in the company is more effective. If profits increase from year to year, it can increase the company's stock price so that the company's value also increases [9]. While further research conducted by [10] explains the possibility of leverage due to higher interest payments reflecting the risk to the company's income. Hence, one of the variables influencing stock returns may be debt. The debt to asset ratio (DAR), which assesses how much of the assets are financed by debt, is used to make the measurement.

Based on the consideration of signal theory which states that financial performance is a strategic resource that can increase higher profits and is used as a positive signal to attract the interest of potential investors and there are also several previous studies which explain that financial performance has an effect on financial distress, the hypothesis proposed in this study namely:

H2 a: Leverage has a negative effect on financial distress

H2 b: Liquidity has a negative effect on financial distress

H2 c: Profitability has a negative effect on financial distress

H2 d: Asset Turnover has a negative effect on financial distress

Signal theory states that intellectual capital can be a strategy in attracting the attention of investors in providing or providing information (signals) that can be sent to signal recipients through reports presented by companies [4]. Related to Good Corporate Governance, one that encourages companies to achieve competitive advantage is by reporting company intangible assets (intangible assets) which are assets that do not have physical substance but are able to become a company's competitive advantage [11].

Research conducted by [12] explains that intellectual capital has a positive effect on good corporate governance. This can be interpreted that intellectual capital is able to strengthen the value of good corporate governance which in turn will affect the value of financial distress which is getting lower. Subsequent research was carried out by [13] and [14] explaining the results of the research conducted that intellectual capital has a positive effect on good corporate governance, so it can be concluded that the better the management of intellectual capital, the better the GCG value. which is a positive signal to assess lower financial distress.

Based on the idea that intellectual capital is a strategic resource that can boost investor responses to information about intellectual capital reporting, as well as a number of earlier studies that explain how intellectual capital positively affects good corporate governance, which in turn affects financial distress, the hypothesis proposed in this research are:

H3: Intellectual capital strengthens the effect of Good Corporate Governance on Financial Distress

[3] suggests that the signal's sender (the information's owner) makes an effort to give the receiving party useful pieces of information. The recipient will subsequently alter his behavior in accordance with how he interprets the company's signal (owner of the information). According to signaling theory, businesses will make an effort to let potential investors know good news by reporting it in the annual report. [4].

Previous research conducted by [15] explained that intellectual capital has a positive effect on financial performance. This gives a signal that by managing intellectual capital properly, the value of financial performance increases so as to prevent the company from experiencing financial distress. Subsequent research conducted by [16] explains that intellectual capital has a better impact as a strategy to improve financial performance. When the value of financial performance is better, it will indicate higher profits so that the company avoids financial distress.

Based on the idea that intellectual capital is a strategic resource that can increase investor responses to information about intellectual capital reporting and on a number of earlier studies that demonstrate that intellectual capital has a favorable impact on financial performance that can influence financial distress, the hypothesis proposed in this study namely:

H4: Intellectual capital strengthens the effect of Financial Performance on Financial Distress

Research Method

The approach in this research is a quantitative approach with a positivism paradigm. This type of research is explanatory research which aims to analyze the impact of good corporate governance and financial performance on financial distress with intellectual capital as a moderating variable. The websites of the sample companies and the Indonesia Stock Exchange (www.idx.co.id) were used to gather the specific data in the form of annual reports.

This variable makes use of independent, moderating, and dependent variables. Financial distress is the study's dependent variable. Financial performance and good corporate governance serve as the study's independent variables. Intellectual capital serves as the study's moderating variable. The following description details the definitions and measurements of the variables that will be examined in this study.

Data analysis method

There are two multiple regression equations that become models for data analysis in testing the hypothesis. The MRA method used in this study serves to determine the type of moderating variable.

- FDit = α + β1IOit + β2 MOit + β3 PICit + β4 BDit + β5 DARit + β6 CRit + β7 ROEit + β8 ATit + ɛit

- FDit = α + β9IOit *ICit + β10 MOit * ICit + β11 PICit * ICit + β12 BDit * ICit + β13 DARit * ICit + β14 CRit *ICit + β15 ROEit * ICit + β16 ATit * ICit + ɛit

Result and Discussion

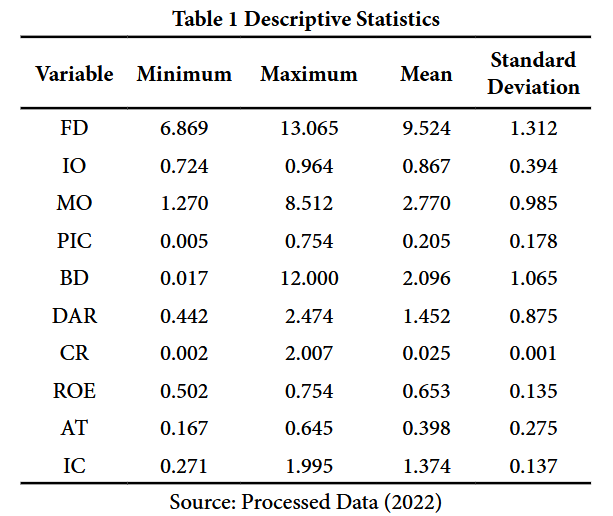

In this study, the descriptive analysis aimed to provide an overview of the research characteristics of each variable. The data characteristics used in this analysis included the minimum, maximum, mean, and standard deviation values of the variables studied.

Table 1 Descriptive Statistics

Descriptive statistics serve to describe the distribution of data from research variables that occur from Financial Distress, Good Corporate Governance, Financial Performance, and Intellectual Capital. The data distribution includes minimum, maximum, average and standard deviation values. All variables have a standard deviation value < mean value, this gives an indication that the spread of data for all variables tends to be normally distributed.

Table 2 Regression Test Results without Moderation

Model 1 has an adjusted R2 value of 0.598 which indicates that the variable good corporate governance and financial performance can explain the dependent variable, namely financial distress of 59.8%. The remaining 41.2% is explained by other variables outside the model. Model 1 has an F value of 8,576 and a significance of 0000 < 0.05. Model 1 shows the value of the regression coefficient and the significance value of the Good Corporate Governance variable which is explained by four variable measurements of Financial Distress. It can be explained that hypothesis 1 can be accepted, namely the effect of managerial ownership and the size of the board of directors on financial distress. While the second variable, namely financial performance, is explained using four variable measurements of Financial Distress, it can be explained that hypothesis 2 can be accepted, namely the effect of profitability and leverage on financial distress.

Table 3 Result of Regression Analysis with Moderation

Model 2 has an adjusted R2 value of 0.618 which indicates that the variables of good corporate governance, financial performance and intellectual capital, as well as the role of moderating variables are able to explain the dependent variable, namely financial distress of 61.8%. The remaining 38.2% is explained by other variables outside this research model. Model 2 has an F value of 5.111 and a significance of 0.000 < 0.05. These results indicate that model 2 is feasible for use in predicting the Financial Distress variable. Model 2 shows that the R2 value has increased when there is a moderating variable role with the independent variable.

The results of testing hypothesis 1 statistically show that H1 is accepted. The good corporate governance variable is measured using four measurements in which the statistical results explain that there are two variables that have an influence with a significance value below 0.05, namely the managerial ownership variable with a significance value of 0.040 and the size of the board of directors with a significance value of 0.050. The results of this study support previous research conducted by [5] explaining that strong corporate governance as measured by managerial ownership has a significant impact on financial distress. Meanwhile, research conducted by [6] also explains that the proportion of the size of the board of directors has a positive and significant effect on financial distress. In this study, companies in the manufacturing sector demonstrated how well the percentage of managerial ownership may affect the company's performance management. The board of directors is in charge of making sure the management of the company is operating effectively and in line with company objectives, therefore their size has a positive and significant impact on minimizing financial distress. The advantage of a larger board of directors is that it adds to the value of the business, increasing its efficacy.

The results of testing hypothesis 2 statistically show that H2 is accepted. The Financial Performance variable is measured using four measurements in which the statistical results explain that there are two variables that have an influence with a significance value below 0.05, namely the leverage variable with a significance value of 0.000 and profitability with a significance value of 0.050. The results of this study support previous research conducted by [9] explaining that profitability has a significant positive effect on financial distress. Meanwhile, research conducted by [10] also explains that leverage has a negative and significant effect on financial distress. According to the statistical findings, the coefficient value demonstrates a negative value, indicating that manufacturing enterprises should not use excessive amounts of leverage in order to lower the likelihood that the business may experience financial trouble. This is consistent with research findings on the profitability variable, which indicate a high positive value, hence lowering the likelihood that the business will experience financial trouble. The study's findings show that manufacturing enterprises could nonetheless effectively manage their assets during the Covid era in order to produce profits for the business.

The results of testing hypothesis 3 statistically show that H3 is accepted. The good corporate governance variable is measured using four measurements which are interacted with the moderating variable, namely intellectual capital. Statistical results explain that there is one variable that has an influence with a significance value below 0.05, namely the interaction of managerial ownership variables with intellectual capital with a significance value of 0.032. That is, hypothesis 3 in this study is supported, namely the better the management of corporate governance can produce higher corporate value, so that this can reduce the risk of financial distress occurring in the company. The results of this study are based on [12], [13] and [14] explaining that intellectual capital has a positive effect on corporate governance. This can be interpreted that intellectual capital is able to strengthen the value of corporate governance, where better corporate governance management will also have a good impact on company performance, increasing company performance will reduce the risk of financial distress occurring in the company. The results of this study indicate that management will be more responsible if there is share ownership in the company being managed, because if the company's goals are achieved, personal goals by obtaining the expected returns will also be achieved.

The results of testing hypothesis 4 statistically show that H4 is accepted. The Financial Performance variable is measured using four measurements which are interacted with the moderating variable, namely intellectual capital. The statistical results explain that there are two variables that have an influence with a significance value below 0.05, namely the interaction of the leverage variable with intellectual capital with a significance value of 0.046, and the profitability variable with intellectual capital with a significance value of 0.05. The results of this study are in line with those conducted by [15], and [16] explaining that intellectual capital has a positive impact on a company's financial performance. This can be interpreted that intellectual capital is able to strengthen the value of the company's financial performance, where the higher the value of the company's financial performance will also have a good impact on the value of the company, so that it can reduce the risk of financial distress occurring in a company.

During the Covid-19 pandemic, most manufacturing companies were still able to generate profits from company operations. The results of the study explain that the leverage value owned by the company shows a decrease, so that it can reduce the risk of financial distress occurring in the company. In increasing maximum financial performance, maximum management is needed, companies can manage tangible assets and intangible assets properly. The company's intangible assets are commonly referred to as intellectual capital, where intellectual capital does not only manage cash assets, but also manages how the company's financial allocation is appropriate in accordance with the company's financial proportions, which can be measured by increasing the value of the company's financial management. The better the company's financial management will further increase the value of the company which is able to attract the interest or trust of investors, thereby reducing the risk of financial distress occurring in the company.

Conclusion

The purpose of this study is to analyse Good Corporate Governance and Financial Performance on Financial Distress with Intellectual Capital as a moderating variable. The results of this study provide empirical evidence that financial distress decreases when the value of Good Corporate Governance and Financial Performance increases. Therefore, the higher the Good Corporate Governance and Financial Performance in the company, the lower the occurrence of Financial Distress. Management of Good Corporate Governance and Financial Performance properly can be a strategic resource for companies in creating and increasing corporate profits obtained from investors' investment returns, thus being able to increase the performance of the company, to reduce the occurrence of Financial Distress.

The results of this study also provide evidence that Financial Distress can be weakened by managing Intellectual Capital. In other words, Intellectual Capital can increase the influence of Good Corporate Governance on Financial Distress. This is because the company maximally regulates and implements good corporate governance, so that the potential of its human resources and financial resources can be considered from the aspect of intellectual capital management and reports that have been carried out and submitted by the company.

The difficulties experienced by researchers while carrying out this research are related to the identification of goodwill or intangible assets which are often found in other asset components, while there are several other companies that have reported them separately, namely as intangible assets. In addition, the components of salaries, benefits and post-employment benefits in salary and benefits items are also often reported separately. In their reporting, there are companies that have combined all components, but there are also companies that have only combined some components such as salary and benefits without combining post-employment benefits.

Future researchers are expected to first determine the research posts to be used and review the annual reports and financial reports made by the company in order to facilitate the process of identifying and calculating intellectual capital. Future researchers can also investigate more deeply about why it is necessary to invest in intellectual capital by companies.

References

Abugri, A. (2022). I NTERNATIONAL J OURNAL OF Effect of Corporate Governance on Financial Distress : Evidence from Listed Firms at Ghana Stock Exchange. INTERNATIONAL JOURNAL OF MULTIDISCIPLINARY RESEARCH AND ANALYSIS, 5(02), 319–327. https://doi.org/10.47191/ijmra/v5-i2-12

Asare, N., Alhassan, A. L., Asamoah, M. E., & Ntow-Gyamfi, M. (2017). Intellectual capital and profitability in an emerging insurance market. Journal of Economic and Administrative Sciences, 33(1), 2–19. https://doi.org/10.1108/jeas-06-2016-0016

Bayraktaroglu, A. E., Calisir, F., & Baskak, M. (2019). Intellectual capital and firm performance: an extended VAIC model. Journal of Intellectual Capital, 20(3), 406–425. https://doi.org/10.1108/JIC-12-2017-0184

Bontis, N., William Chua Chong, K., & Richardson, S. (2000). Intellectual capital and business performance in Malaysian industries. Journal of Intellectual Capital, 1(1), 85–100. https://doi.org/10.1108/14691930010324188

Chowdhury, L. A. M., Rana, T., Akter, M., & Hoque, M. (2018). Impact of intellectual capital on financial performance: evidence from the Bangladeshi textile sector. Journal of Accounting and Organizational Change, 14(4), 429–454. https://doi.org/10.1108/JAOC-11-2017-0109

Dalwai, T., & Mohammadi, S. S. (2020). Intellectual capital and corporate governance: an evaluation of Oman’s financial sector companies. Journal of Intellectual Capital, 21(6), 1125–1152. https://doi.org/10.1108/JIC-09-2018-0151

Destriwanti, O., Sintha, L., Bertuah, E., & Munandar, A. (2022). Analyzing the impact of Good Corporate Governance and Financial Performance on predicting Financial Distress using the modified Altman Z Score model. American International Journal of Business Management (AIJBM), 5(02), 27–36.

Gitman, L. J., & Zutter, C. J. (2015). Principles of Managerial Finance (14th ed.). Pearson Education.

Harahap, L. R., Anggraini, R., Ellys, E., & Effendy, R. Y. (2021). Analisis Rasio Keuangan Terhadap Kinerja Perusahaan Pt Eastparc Hotel, Tbk (Masa Awal Pandemi Covid-19). COMPETITIVE Jurnal Akuntansi Dan Keuangan, 5(1), 57. https://doi.org/10.31000/competitive.v5i1.4050

Leland, H. E., & Pyle, D. H. (1977). Informational Asymmetries, Financial Structure, and Financial Intermediation. The Journal of Finance, 32(2), 371–387.

Martini, R., Vera Riama, L. P., Susi Wardhani, R., & Febriani, M. (2016). Effect of Intellectual Capital To Return on Equity (Study on Consumer Goods Industry Listed in Indonesia Stock Exchange). International Journal of Business, Accounting and Management, 1(2), 2527–3531. www.doarj.orgwww.doarj.org

Miftahurrohman. (2021). Dampak Pandemi Covid-19 terhadap Kinerja Keuangan Perusahaan Farmasi (Studi pada Perusahanaan terdaftar di Bursa Efek Indonesia). Jurnal Manajemen Sosial Ekonomi, 1(1), 1–13.

Pratama, I. G. B. A., & Wiksuana, I. G. B. (2016). Pengaruh Ukuran Perusahaan dan Leverage terhadap Nilai perusahaan dengan Profitabilitas sebagai Variabel Moderasi. E-Jurnal Manajemen Unud, 5(2), 1338–1367.

Pulic, A. (1998). measuring the performance of intellectual potential in knowledge economy. Presented in 1998 at the 2nd McMaster World Congress on Measuring and Managing Intellectual Capital by the Austrian Team for Intellectual Potential.

Shahwan, T. M., & Fathalla, M. M. (2020). The mediating role of intellectual capital in corporate governance and the corporate performance relationship. International Journal of Ethics and Systems, 36(4), 531–561. https://doi.org/10.1108/IJOES-03-2020-0022

Soewarno, N., & Tjahjadi, B. (2020). Measures that matter: an empirical investigation of intellectual capital and financial performance of banking firms in Indonesia. Journal of Intellectual Capital, 21(6), 1085–1106. https://doi.org/10.1108/JIC-09-2019-0225

Spence, M. (1972). Job Market Signaling. The Quarterly Journal of Economics, 87(3), 355–374.

Ulum, I., Ghozali, I., & Chariri, A. (2018). Intellectual Capital dan Kinerja Keuangan Perusahaan; Suatu Analisis dengan Pendekatan Partial Least Squares. Simposium Nasional Akuntansi XI, 19(19), 1–31.

Whiting, R. H., & Miller, J. C. (2008). Voluntary disclosure of intellectual capital in New Zealand annual reports and the “hidden value.” Journal of Human Resource Costing & Accounting, 12(1), 26–50. https://doi.org/10.1108/14013380810872725

Submitted

Accepted

Published

Issue

Section

License

Copyright (c) 2023 Riset Akuntansi dan Keuangan Indonesia

This work is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike 4.0 International License.