Transformation of the Concept of Maslahah in Sustainable Islamic Finance: a Hermeneutic Analysis of al-Ghazali's Thoughts and ash-Syatibi

DOI:

https://doi.org/10.23917/profetika.v26i01.9616Keywords:

maslahah, sharia finance, al-Ghazali, ash-Syatibi, hermeneuticsAbstract

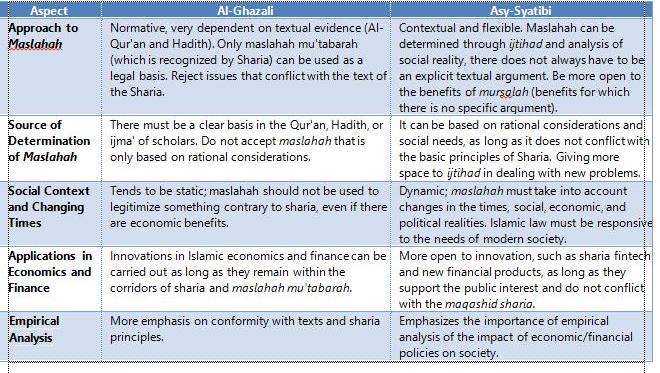

Objective: This research aims to examine the transformation of the concept of maslahah in modern Islamic finance, especially in the shift from a normative approach in classical jurisprudence to a contextual approach in the contemporary financial system. Theoreticalframework: The research is based on the thoughts of Al-Ghazali, who structured maslahah within the maqashidshariah paradigm (protection of religion, life, intellect, lineage, and property), and Asy-Syatibi, who introduced the flexible concept of maslahahmursalah. Literature review: involves an in-depth study of classical sources such as Al-Mustashfa and Al-Muwafaqatas well as contemporary literature on Islamic finance and sustainability. Methods: Using a hermeneutic approach, this study analyzes classical and modern texts through literature studies, referring to the works of Al-Ghazali (Al-Mustashfa) and Asy-Syatibi (Al-Muwafaqat) as well as various secondary literature. The results: The study indicate that the concept of maslahah has undergone significant development, from a text-based approach to a more flexible application in modern Islamic finance, such as in Islamic banking, green sukuk, and social-based financial instruments. This transformation strengthens the role of Islamic finance in supporting economic sustainability and the Sustainable Development Goals (SDGs). Implication: the reinforcement of Islamic finance as a value-based system capable of promoting inclusive and sustainable development. Novelty: This research lies in its hermeneutic reinterpretation of classical Islamic legal theory to justify and support its modern, sustainability-oriented applications.

References

[1] A. A. Ibrahim, “Islamic concept of development in the light of Siyasah Shar’iyyah and Maqasid Shariah frameworks: A literature review approach,” J. Islam. Stud. Socio-economic Dev., vol. 13, no. 3, pp. 36–60, 2020.

[2] Nurlinda, “Al-Ghazali’s Views On The Economy And Development Of The Ummah,” J. Nusant. Econ., vol. 2, no. 1, pp. 25–35, 2023, [Online]. Available: https://juna.nusantarajournal.com/index.php/numy/article/view/88

[3] S. Sardini, M. Nasution, and R. Harahap, “Determinants of Human Development Index Using Asy Syatibi’s Maqashid Sharia Approach in North Sumatra Province,” Indones. Interdiscip. J. Sharia Econ., vol. 6, no. 3, 2023, doi: https://doi.org/10.31538/iijse.v6i3.3904.

[4] N. Murray, A. K. Manrai, and L. A. Manrai, “The financial services industry and society,” J. Econ. Financ. Adm. Sci., vol. 22, no. 43, pp. 168–190, 2017, doi: https://doi.org/10.1108/JEFAS-02-2017-0027.

[5] H. Baber, “How crisis-proof is Islamic finance?,” Qual. Res. Financ. Mark., vol. 10, no. 4, pp. 415–426, 2018, doi: https://doi.org/10.1108/QRFM-12-2017-0123.

[6] M. Nouman, M. F. Siddiqi, K. Ullah, and S. Jan, “Nexus between higher ethical objectives (Maqasid Al Shari’ah) and participatory finance,” Qual. Res. Financ. Mark., vol. 13, no. 2, pp. 226–251, 2021, doi: https://doi.org/10.1108/QRFM-06-2020-0092.

[7] T. I. Tanin, A. U. F. Ahmad, and A. Muneeza, “Shariah-compliant equities and Shariah screening: need for convergence of ethical screening of stocks with Shariah screening,” Int. J. Emerg. Mark., vol. 18, no. 2, pp. 296–315, 2023, doi: https://doi.org/10.1108/IJOEM-09-2020-1041.

[8] M. M. Alam, C. S. Akbar, S. M. Shahriar, and M. M. Elahi, “The Islamic Shariah principles for investment in stock market,” Qual. Res. Financ. Mark., vol. 9, no. 2, pp. 132–146, 2017, doi: https://doi.org/10.1108/QRFM-09-2016-0029.

[9] A. T. M. Monawer, N. N. Abdul Rahman, A. A. A. Qasem Al-Nahari, L. Haji Abdullah, A. K. Ali, and A. Meguellati, “The actualization of maqāṣid al-Sharīʿah in Islamic finance: a conceptual framework,” Int. J. Islam. Middle East. Financ. Manag., vol. 15, no. 5, pp. 847–864, 2022, doi: https://doi.org/10.1108/IMEFM-06-2020-0293.

[10] M. S. Ifwat Ishak and N. S. Mohammad Nasir, “Maqasid al-Shari’ah in Islamic finance: Harmonizing theory and reality,” J. Muamalat Islam. Financ. Res., vol. 18, no. 1, pp. 108–119, 2021, doi: https://doi.org/10.33102/jmifr.v18i1.334.

[11] M. U. Chapra, The Future of Economics: An Islamic Perspective. United Kingdom: The Islamic Foundation Markfield Conference Centre, 2000.

[12] E. Solehudin et al., “Transformation of Shariah Economic Justice: Ethical and Utility Perspectives in the framework of Maqashid Shariah,” Al-Risalah Forum Kaji. Huk. dan Sos. Kemasyarakatan, vol. 24, no. 1, pp. 101–115, 2024, doi: https://doi.org/10.30631/alrisalah.v24i1.1467.

[13] F. D. Abdullah, M. S. Is, and S. M. Wiwaha, “Contemporary Challenges for Sharia Financial Institutions to Increase Competitiveness and Product Innovation Perspective of Sharia Economic Law: Evidence in Indonesia,” MILRev Metro Islam. Law Rev., vol. 3, no. 2, pp. 141–173, 2024, doi: https://doi.org/10.32332/milrev.v3i2.9202.

[14] Sugiyono, Metode Penelitian Kuantitatif, Kualitatif dan R&D. Bandung: CV. Alfabeta, 2016.

[15] M. B. Miles, A. M. Huberman, and J. Saldana, Qualitative data analysis: A methods sourcebook. Sage Publications, Inc, 2014.

[16] J. W. Creswell and J. D. Creswell, Research Design: Qualitative, Quantitative, and Mixed Methods Approaches. California: Sage publications, 2017.

[17] Imam Ghazali, Al-Mustasfa min al-Usul, Jilid II. Cairo: Amiriyah, 1442.

[18] R. Ramli, “The Principle Of Natural Resources Management Based On Maqasid Al-Shari’ah: A Conceptual Framework,” Int. J. Islam. Econ. Financ. Res., vol. 3, no. 1 July SE-, pp. 57–74, Aug. 2020, doi: https://doi.org/10.53840/ijiefer12.

[19] A. Maulidizen, “Business Ethics: Analysis of al-Ghazali’s Economic Thought With Sufism Approach,” Religia, vol. 22, no. 2, pp. 160–177, 2019, doi: https://doi.org/10.28918/religia.v22i2.2067.

[20] R. Murdani, Al-Amin, H. Subeno, and F. Sulaiman, “Maslow and Al-Ghazali’s Hierarchy of Needs Theory is an Implementation of Sharia Maqashid to the Perspective of Islamic Economics,” Proceeding Int. Conf. Bus. Econ., vol. 2, no. 1, pp. 127–142, 2024, doi: https://doi.org/10.56444/icbeuntagsmg.v2i1.1612.

[21] N. Nurlinda, “The Integration of Islamic Spiritual Values and Economics in Al-Ghazali’s Perspective for Community Development,” Nusant. J. Law Stud., vol. 3, no. 1, pp. 23–37, 2024, [Online]. Available: https://juna.nusantarajournal.com/index.php/juna/article/view/37

[22] M. F. Nur Arbaien, I. A. Dafi, D. S. S. Ramlan Sandiyana, M. Latifa, and S. R. Nurkaromah, “Islamic Economics in Indonesia: Exploring the Philosophical Contributions of Imam Al-Ghazali and Imam Al-Mawardi,” ULIL ALBAB J. Ilm. Multidisiplin, vol. 4, no. 1, pp. 108–119, 2024, doi: https://doi.org/10.56799/jim.v4i1.6308.

[23] A. Atsar and A. Izuddin, “Implementation of fi qh based on the maslahah in murabahah fi nancing in sharia banking,” J. Wacana Huk. Islam dan Kemanus., vol. 18, no. 1, pp. 119–136, 2018, doi: https://doi.org/10.18326/ijtihad.v18i1.119-136.

[24] B. Harahap, T. Risfandy, and I. N. Futri, “Islamic Law, Islamic Finance, and Sustainable Development Goals: A Systematic Literature Review,” Sustainability, vol. 15, no. 8. p. 6626, 2023. doi: https://doi.org/10.3390/su15086626.

[25] D. Mubarak, N. Othman, M. A. S. Nadzri, K. Universiti, and I. Antarabangsa, “Maqasid-Shariah And Well-Being: A Systematic,” in Proceedings of the 1st International Conference on Islamic Economics, 2022, pp. 170–201.

[26] Ash-Syatibi, Al-Muwafaqat fi Usul al-Shariah Terjemahan oleh Ibrahim Musa dalam buku “Maqasid alShariah as Philosophy of Islamic Law: A Systems Approach”. International Institute of Islamic Thought. 2006.

[27] I. bin M. Al-Shatibi, al-Muwafaqat. ttp: Dar Ibn ‘Affa, 1997.

[28] J. A. Kholik and I. Muzakki, “Implementasi Maqashid Syari’ah Dalam Ekonomi Islam dan Psikologi Islam,” Happiness J. Psychol. Islam. Sci., vol. 5, no. 2, pp. 1–27, Sep. 2022, doi: https://doi.org/10.30762/happiness.v5i2.381.

[29] I. F. Lubis, A. A. Tarigan, and M. Ridwan, “Kontinuitas dan Perubahan Pemikiran Ekonomi Islam dari Masa Klasik hingga Abad Pertengahan (850-1350 H/1446-1932 M),” J. Masharif Al-Syariah J. Ekon. dan Perbank. Syariah, vol. 9, no. 3, 2024, doi: https://doi.org/10.30651/jms.v9i3.22674.

[30] M. Amin, “Konsep Keadilan dalam Perspektif Filsafat Hukum Islam,” Al-Daulah J. Huk. dan Perundangan Islam, vol. 4, no. 02, pp. 322–343, 2015, doi: https://doi.org/10.15642/ad.2014.4.02.322-343.

[31] M. Asutay and I. Yilmaz, “Constituting an Islamic social welfare function: an exploration through Islamic moral economy,” Int. J. Islam. Middle East. Financ. Manag., vol. 14, no. 3, pp. 524–540, 2021, doi: https://doi.org/10.1108/IMEFM-03-2019-0130.

[32] M. A. Choudhury, M. S. Hossain, and M. T. Mohammad, “Islamic finance instruments for promoting long-run investment in the light of the well-being criterion (maslaha),” J. Islam. Account. Bus. Res., vol. 10, no. 2, pp. 315–339, 2019, doi: https://doi.org/10.1108/JIABR-11-2016-0133.

[33] A. Munawir, M. Azwar, S. Khaliza, and M. Yasir, “Islamic Economic Thought Abu Yusuf , Al-Ghazali , Asy- Syatibi ( Comparative Study of Relations , Comparison and Relevance with Modern Islamic Economics ),” Riwayat Educ. J. Hist. Humanit., vol. 6, no. 2, pp. 270–282, 2023, doi: https://doi.org/10.24815/jr.v6i2.29968.

[34] A. H. Ghozali, Ihya Ulumuddin, 2nd ed. 2005.

[35] M. Akram Laldin, Handbook of Ethics of Islamic Economics and Finance. De Gruyter Oldenbourg, 2020. doi: doi: https://doi.org/10.1515/9783110593419-002.

[36] S. Lahuri, E. Nurkholifah, M. R. Zarkasyi, and S. A. Ramdani, “Basic Needs as the Foundation of Consumer Behavior : An Analytical Study of Al-Ghazali ’ s Thought,” J. Penelit. Huk. Ekon. Syariah, vol. 9, no. 2, pp. 223–235, 2024, doi: https://doi.org/10.24235/jm.v9i2.16764.

[37] M. S. Arifin, “The concept of ideal leader in Al-Ghazali’s thought,” Indones. J. Interdiscip. Islam. Stud., vol. 4, no. 1, pp. 84–103, 2020, doi: https://doi.org/10.20885/ijiis.vol4.iss1.art5.

[38] M. Mukri and I. Mustofa, “Deradicalizing Islam in Indonesia Through the Perspective of Al- Ghazali ’ s Maqasid al- Syari ’ ah ( Purposes of Islamic law ),” in Proceedings of the 1st Raden Intan International Conference on Muslim Societies and Social Sciences (, 2020, pp. 227–232. doi: https://doi.org/10.2991/assehr.k.201113.043.

[39] A. Rakhmanov, A. Thommandru, and S. Tillaboev, “Historical Trajectories and Modern Dynamics of Islamic Financial Law in Central Asia,” Int. J. Leg. Inf., vol. 52, no. 1, pp. 74–87, 2024, doi: DOI: https://doi.org/10.1017/jli.2024.15.

[40] K. Mudrikah, A. J. w Mahri, and A. Nurasyiah, “The Role of Islamic Philanthropy in the Orphans’ Socio-Economic Development Based on Maqashid Sharia (Case Study in the Gerakan Infaq Beras Bandung),” Rev. Islam. Econ. Financ., vol. 3, no. 2, pp. 117–144, 2020, doi: https://doi.org/10.17509/rief.v3i2.30572.

[41] L. Nugroho, The Concept of Accounting in Islamic Bank (Indonesia Empirical Cases). Rijeka: IntechOpen, 2022. doi: https://doi.org/10.5772/intechopen.103140.

[42] Deny Susanto, “The Significance of Compliance Functions in Ensuring the Continuity of Sharia Insurance Companies,” J. Nusant. Econ., vol. 2, no. 2, pp. 56–64, 2023, [Online]. Available: https://juna.nusantarajournal.com/index.php/numy/article/view/87

[43] R. R. Samad and Z. Shafii, “The Realization on Maqasid al-Shariah and Maslahah Concepts in Cooperative Governance Practices,” Int. J. Adv. Res. Econ. Financ., vol. 3, no. 4, 2021.

[44] N. S. Kasri, S. Bouheraoua, and S. Mohamed Radzi, Maqasid al-Shariah and Sustainable Development Goals Convergence: An Assessment of Global Best Practices BT - Islamic Finance, FinTech, and the Road to Sustainability: Reframing the Approach in the Post-Pandemic Era. Cham: Springer International Publishing, 2023. doi: https://doi.org/10.1007/978-3-031-13302-2_4.

[45] J. Duasa and M. Munir, “Green Waqf and Sustainable Development Cases in Malaysia and Indonesia,” in Islamic Finance and Sustainability, London: Routledge, 2025.

[46] M. K. Hassan, A. Muneeza, and R. Hasan, “Islamic Finance and Sustainable Development.” in Elements in the Economics of Emerging Markets. Cambridge University Press, Cambridge, 2025. doi: DOI: https://doi.org/10.1017/9781009464963.

[47] M. S. I. Ishak and F. Asni, “The role of maqasid al-Shariʿah in applying fiqh muamalat into modern Islamic banking in Malaysia,” J. Islam. Account. Bus. Res., vol. 11, no. 10, pp. 2137–2154, 2020, doi: https://doi.org/10.1108/JIABR-12-2019-0224.

[48] M. M. Al-Qosimi, A. Amrin, and D. Saepudin, “WAKF OF MONEY IN SHARIA ECONOMIC LAW PERSPECTIVE: Study of Human Resource Management in Indonesian Waqf Savings Dompet Dhuafa,” Profetika J. Stud. Islam, vol. 23, no. 2, pp. 249–264, 2022, doi: https://doi.org/10.23917/profetika.v23i2.19659.

[49] M. I. Anjum, “An Islamic critique of rival economic systems’ theories of interest,” Int. J. Ethics Syst., vol. 38, no. 4, pp. 598–620, 2022, doi: https://doi.org/10.1108/IJOES-08-2021-0155.

[50] N. Hikmah and M. Yazid, “Maqashid Al-Syariah as a Contemporary Economic Solution According to Yusuf Al-Qaradawi,” ITQAN J. Islam. Econ. Manag. Financ., vol. 4, no. 1, pp. 51–63, 2024, doi: https://doi.org/10.57053/itqan.v4i1.62.

[51] M. F. Amir, S. Kadir, and Sumarlin, “Decentralized Finance and Its Maslahah: Shaping the Future of Financial Services in Indonesia,” Share J. Ekon. dan Keuang. Islam, vol. 13, no. 2, pp. 739–769, 2024, doi: http://dx.doi.org/10.22373/share.v13i2.22857.

[52] M. N. Omar and N. M. Sari, “Maqasid Al-Shariah Philosophy nn Monetary Regime Towards Inclusive Sustainable Growth,” International Journal of Islamic Economics, vol. 1, no. 02. pp. 95–110, 2019. doi: https://doi.org/10.32332/ijie.v1i02.1802.

[53] N. Aulia and H. Muchtar, “Imam Al-Ghazali ’ s Perspective on Money : Function , Ethics , and Economic Implications in Islamic Finance,” Istihlak J. Islam. Econ. Southeast Asia, vol. 1, no. 1, pp. 43–56, 2024.

[54] I. M. Sifat and A. Mohamad, “Revisiting Fiat Regime’s Attainability of Shari’ah Objectives and Possible Futuristic Alternatives,” J. Muslim Minor. Aff., vol. 38, no. 1, pp. 1–23, 2018, doi: https://doi.org/10.1080/13602004.2018.1435057.

Submitted

Accepted

Published

Issue

Section

License

Copyright (c) 2025 Muhammad Zuardi, Ahmad Kholil, Amrin, Ishma Amelia

This work is licensed under a Creative Commons Attribution 4.0 International License.