GOLD SAVINGS AT PAWNSHOPS IN THE PERSPECTIVE OF ISLAMIC LAW

DOI:

https://doi.org/10.23917/profetika.v25i01.6642Keywords:

Pawnshops, gold savings, Islamic lawAbstract

Saving assets in the form of gold is a form of safeguarding the value of the property from inflation. Pawnshops has service products in the form of gold savings in the form of gold balance deposit services that make it easier for people to invest in gold. Pawnshops's gold savings product allows customers to invest in gold easily, cheaply, safely, and reliably. Gold transactions use an ijarah contract with buyback, add balance (top up), transfer, and print facilities. The purpose of the research conducted by the authors in this journal is to find out how the scholars view Pawnshops Gold Savings. The research method used is normative juridical which is a literature study based on law and is carried out by examining library materials or secondary data.Based on the discussion in this study, it can be concluded that Pawnshops makes gold savings products with buying and selling (Murabaha) and leasing (ijarah) services. Trading or investing in non-cash gold at a pawn shop is legally permissible as long as gold is not used as the official medium of exchange (money). However, there are some limitations and conditions that must be met

References

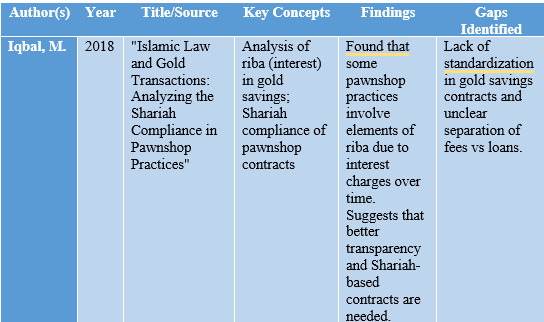

Khaerul Aqbar, A. Aswar, and Muh. Sepriadi, “Tabungan Emas dalam Tinjauan Hukum Islam (Studi Kasus di Pawnshops Syariah Cabang Pinrang),” BUSTANUL FUQAHA J. Bid. Huk. Islam, vol. 1, no. 4, pp. 673–691, 2020, https://doi.org/10.36701/bustanul.v1i4.281.

A. Aziz and R. Ramdansyah, “Esensi Utang Dalam Konsep Ekonomi Islam,” BISNIS J. Bisnis dan Manaj. Islam, vol. 4, no. 1, p. 124, 2016, https://doi.org/10.21043/bisnis.v4i1.1689.

Antonio Muhammad Syafi’i, Bank Syariah dari Teori ke Praktik, Cet 1, vol. 3, no. 2. Jakarta: Gema Insan Press, 2001.

M. Ichsan, “Konsep Uang Dalam Perspektif Ekonomi Islam,” Profetika J. Stud. Islam, vol. 21, no. 1, pp. 27–38, 2020, https://doi.org/10.23917/profetika.v21i1.11646.

R. Iriani and N. Suprayogi, “Akuntansi Tabungan Emas Pawnshops Syariah,” in Jurnal Ekonomi Syariah Teori dan Terapan, vol. 5, no. 10, 2019, p. 848. https://doi.org/10.20473/vol5iss201810pp848-859.

Marzuqi Yahya, Jurus Cerdas Investasi Emas. Jakarta: Laskar Aksara, 2012.

A. H. Luthfi, A. Khakiki, Y. B. Wijayanti, C. F. Sari, and A. N. Putri, Investasi Emas Secara Kredit di Pawnshops Syariah Dalam Perspektif Hukum Islam, vol. 13, no. 1. Az-Zarqa: Jurnal Hukum Bisnis Islam, 2021. https://doi.org/10.14421/azzarqa.v13i1.2429.

T. Andiko, “Signifikansi Implementasi Konsep Ekonomi Islam Dalam Transaksi Bisnis Di Era Modern,” J. Ilm. Mizani Wacana Hukum, Ekon. Dan Keagamaan, vol. 4, no. 1, pp. 9–22, 2018, https://doi.org/10.29300/mzn.v4i1.1004.

A. Rahman, “Pengaruh Pelayanan terhadap Kepuasan Pelanggan (Studi Kasus : Rumah Makan Ayam Bakar Penyet KQ5 Mayestik Jakarta Selatan),” Cakrawala, vol. XVII, no. 2, pp. 237–242, 2020, [Online]. Available: https://ejournal.bsi.ac.id/ejurnal/index.php/cakrawala/article/view/2504

H. Taufik, Buku Pintar Investasi. Jakarta: Media Kita, 2011.

Pawnshops, “Tabungan Emas,” Pawnshops.co.id. 2024. [Online]. Available: https://www.Pawnshops.co.id/produk/tabungan-emas#tabungan-emas

S. Sarina, A. Hamzah, and M. Masyhuri, “Strategi Pemasaran Produk Tabungan Emas Dalam Upaya Menarik Minat Nasabah (Studi Pada Pawnshops Syariah Bone),” Mutiara Multidiciplinary Sci., vol. 2, no. 5, pp. 402–421, 2024, https://doi.org/10.57185/mutiara.v2i5.188.

A. Soemitra, Bank dan Lembaga Keuangan Syariah. Jakarta: Kencana, 2010.

K. V. Hamida, D. Septiandani, and D. I. Astanti, “Tabungan Emas Pawnshops Syariah Dalam Perspektif Hukum Islam Dan Hukum Positif Indonesia: Studi Kasus Pt. Pawnshops (Persero) Syariah Unit Ngaliyan Square,” Semarang Law Rev., vol. 3, no. 1, p. 130, 2022, https://doi.org/10.26623/slr.v3i1.5051.

N. S. Maharani, “Pengaruh Promosi dan Fluktuasi Harga Emas terhadap Minat Nasabah Pada Produk Tabungan Emas,” Muhasabatuna J. Akunt. Syariah, vol. 2, no. 2, p. 80, 2020, https://doi.org/10.54471/muhasabatuna.v2i2.820.

P. Montolalu and M. C. Raintung, “Analysis Of Effect Of Promotion Strategy, Brand Image and Perception on Decision of Usage Customer Given Given Customers at Pawnshops (Persero) Kanwil Manado,” J. Ris. Ekon. Manajemen, Bisnis dan Akunt., vol. 6, no. 3, p. 1809, 2018, https://doi.org/10.35794/emba.v6i3.20663.

L. A. Bongso and A. Kristiawan, “Kenyamanan Online Dalam Menciptakan Kepuasan Pelanggan Online Pada Pengguna Tokopedia,” JMBI UNSRAT (Jurnal Ilm. Manaj. Bisnis dan Inov. Univ. Sam Ratulangi)., vol. 9, no. 1, pp. 123–140, 2022, https://doi.org/10.35794/jmbi.v9i1.38621.

R. Lupiyoadi, Manajemen Pemasaran Jasa. Jakarta: Salemba Empat, 2018.

N. Haryanti and D. A. Baqi, “Strategi Service Quality Sebagai Media Dalam Menciptakan Kepuasan Dan Loyalitas Pelanggan,” J. Sharia Econ., vol. 1, no. 2, pp. 101–128, 2019, https://doi.org/10.35896/jse.v1i2.72.

Sambodo Rio Sasongko, “Faktor-Faktor Kepuasan Pelanggan Dan Loyalitas Pelanggan (Literature Review Manajemen Pemasaran),” J. Ilmu Manaj. Terap., vol. 3, no. 1, pp. 104–114, 2021, https://doi.org/10.31933/jimt.v3i1.707.

C. Narbuko and A. Achmadi, Metodologi Penelitian. Jakarta: Bumi Aksara, 2003.

M. S. Armia, Penentuan Metode dan Pendekatan Penelitian Hukum. Banda Aceh: Lembaga Kajian Konsistusi Indonesia (LKKI), 2017. https://doi.org/10.1016/j.ijfatigue.2019.02.006

S. Soerjono and S. Mamudji, Penelitian Hukum Normatif Suatu Tinjauan Singkat. Jakarta: Raja Grafindo Persada, 2014.

D. Mulyana, Metodologi Penelitian Kualitatif. Bandung: PT Remaja Rosda Karya, 2008.

R. A. Meirani, A. Damiri, and J. Jalaludin, “Penerapan Akad Murabahahhh pada Produk MULIA di Pawnshops Jalancagak Menurut Perspektif Ekonomi Syariah,” EKSISBANK Ekon. Syariah dan Bisnis Perbank., vol. 4, no. 1, pp. 60–68, 2020, https://doi.org/10.37726/ee.v4i1.69.

E. Pardiansyah, “Investasi dalam Perspektif Ekonomi Islam: Pendekatan Teoritis dan Empiris,” Econ. J. Ekon. Islam, vol. 8, no. 2, pp. 337–373, 2017, https://doi.org/10.21580/economica.2017.8.2.1920.

A. Karim, Bank Islam: analisis fiqih dan keuangan. Jakarta: RajaGrafindo Persada, 2008.

A. Hasan, A. Saparuddin Harahap, M. Tsaqifa Az-Zahra, M. Ibrahim, and A. Amalia Zahra, “Pendapatan Nasional Dalam Perspektif Ekonomi Islam,” Eco-Iqtishodi J. Ilm. Ekon. dan Keuang. Syariah, vol. 5, no. 1, pp. 19–34, 2023, https://doi.org/10.32670/ecoiqtishodi.v5i1.3608.

Pawnshops, “Apa itu Tabungan Emas.” 2023. [Online]. Available: https://www.Pawnshops.co.id/produk/tabungan-emas.

mukhlas, Implementasi Gadai Syariah Dengan Akad Murabahahhh Dan Rahn (Studi di Pawnshops Syariah Cabang Mlati Sleman Yogyakarta). Surakarta: , Tesis Fakultas Hukum, 2010. [Online]. Available: https://repository.uinjkt.ac.id/dspace/bitstream/123456789/73184/1/Tesis_Ata Amrullah.pdfi

A. I. Sholihin, Pedoman Umum Dewan Keuangan Syariah. Jakarta: PT Gramedia Pustaka, 2013. [Online]. Available: https://books.google.co.id/books?id=nF9nDwAAQBAJ&dq=Dalam+hal+seluruh+atau+sebagian+barang+tidak+tersedia+sesuai+dengan+waktu+penyerahan,+kualitas+atau+jumlahnya+sebagaimana+kesepakatan+maka+bank+memiliki+pilihan+untuk:+++1.%09Membatalkan+(mem-fasakh-kan)

Z. Z. Rahmah, Yuliani, and B. Mutfarida, “Peranan Pendapatan Nasional sebagai Maslahah Ekonomi dalam Kerangka Ekonomi Islam,” J. Ilm. Ekon. Bisnis dan Akunt., vol. 1, no. 2, pp. 67–78, 2024, https://doi.org/10.61722/jemba.v1i2.98.

N. Suliswati, “Jual Beli Emas Secara Tidak Tunai,” in Raabu Al-Ilmi, vol. 2, no. 2, 2017, p. 35.

Raiha Ravitta Putri, Intan Ayu Noverita, Sekar Arumandani, and Muhammad Taufiq Abadi, “Konsep Tabungan Dan Investasi,” J. Ekon. Bisnis Dan Manaj., vol. 2, no. 1, pp. 172–179, 2024, https://doi.org/10.59024/jise.v2i1.559.

Ki. M. Kisanda and S. Handayani, “Jual Beli Emas Secara Tidak Tunai Ditinjau Secara Hukum Fikih,” J. Ekon. Syariah Pelita Bangsa, vol. 6, no. 01, pp. 10–19, 2021, https://doi.org/10.37366/jespb.v6i01.172.

S. Sabiq, Fikih Sunnah, Terjemahan, Jilid 12, Terjemahan Kamaluddin AM. Bandung: PT. Al-Ma’arif, 1998.

D. P. S, 05/DPS-DSN/V/2018 Tentang Akad Pada Produk Tabungan Emas. Art: PT. Pawnshops.

M. Hasanudin, “Multiakad dalam Transaksi Syariah Kontemporer pada Lembaga Keuangan Syariah di Indonesia,” Al-Iqtishad J. Islam. Econ., vol. 3, no. 1, p. 175, 2015, https://doi.org/10.15408/aiq.v3i1.2223.

D. S. Nasional, Fatwa DSN No. 77 DSN-MUI/V/2010 tentang Jual-Beli Emas Secara Tidak Tunai. Jakarta: MUI (Majelis Ulama Indonesia), 2010. [Online]. Available: https://tafsirq.com/fatwa/dsn-mui/jual-beli-emas-secara-tidak-tunai

M. R. Fauziah, Investasi Logam Mulia (Emas) di Penggadaian Syari’ah dalam Perspektif Hukum Ekonomi Syari’ah. Tahkim: Tahkim: Jurnal Hukum dan Syari’ah, 2019.

Submitted

Accepted

Published

Issue

Section

License

Copyright (c) 2024 Nanda Kurnia Putra, Idad Difaul Haq, Rizka Rizka, Muthoifin

This work is licensed under a Creative Commons Attribution 4.0 International License.