THE EFFECTS OF ETHICS ON MORAL HAZARD IN BUSINESS MANAGEMENT MODERATED BY CORPORATE GOVERNANCE: A LITERATURE REVIEW

DOI:

https://doi.org/10.23917/profetika.v24i02.2594Keywords:

etika, moral hazard, corporate governance, business, moralAbstract

Ethics was a significant aspect based on violation of the central manager. A moral hazard situation happens when an individual has a bigger tendency to take risks caused by the individual potential that appears to bear the risks. Many scandals involving accountants have appeared in headlines within these few weeks since they lost their morals, some reasons that made the corporates critical to obey norms and certain ethical standards. This scandal has increased scepticism for those who were already critical of their professional work and ethical integrity. In recent decades, moral hazard has become a hot and crucial issue in corporations, especially in Indonesia. This research method is a qualitative type with a descriptive phenomenological approach and literature review. The results of the study concluded, in running business activity, a company should avoid negative activities by practising appropriate business ethics and good corporate governance.

Andy Ismail1, Hendri Dwi Purnomo2, Muhammad Arifin3, Syavergio Avia Difaputra4, Hunik Sri Runing Sawitri5

1Department of Management, University of Sebelas Maret, Surakarta, Indonesia

2Department of Management, University of Sebelas Maret, Surakarta, Indonesia

3Department of Management, University of Sebelas Maret, Surakarta, Indonesia

4Department of Management, University of Sebelas Maret, Surakarta, Indonesia

5Department of Management, University of Sebelas Maret, Surakarta, Indonesia

INTRODUCTION

The importance of ethics in the business realm needs to be highlighted by several violations of the central manager. This moral hazard situation occurs when an individual has a bigger tendency to take risks, which causes his potential that emerges to bear the risks. The moral hazard appears because an individual or institution decides without having to bear all consequences for their actions . According to ethical theory, a consequential thought appears when the individual in a company makes a decision based on what is best for him, regardless of the consequences for others. Business culture has brought up certain parties who strive to maximise profit amount either personal or corporate. If the means for the goal differ depending on what we see in that person or organization, greed is widely considered to take precedence over the organizational goal .

In 2021, corruption of insurance officials was unexpectedly uncovered, since during the pandemic of COVID-19, about eight executive officials of PT Asabri (Asuransi Angkatan Bersenjata Republik Indonesia) have been declared as the suspects by Attorney General. The loss impacted by the Asabri case to the country that arises from their corruption has reached 23,73 trillion rupiah. The President Director, Investment Director, and Investment Finance of Asabri have agreed with an external party of Asabri which is not an investment consultant or investment manager, to buy or exchange stocks in Asabri’s portfolio by the number of shares owned by the outside party at price that has been highly manipulated, so the performance of asabri’s portfolio looks as if it is good. This situation is related to the breakdown of governance of Indonesia’s leading insurance company and violators of business entity ethics that have been the worst financial scandal in Indonesia.

Lately, many scandals that have involved several accountants have appeared in the headlines in several weeks. Since they have lost their morals and some reasons the company should be critical to fulfilling certain norms and ethical standards . Moreover, this scandal has increased scepticism for those who have been critical of their professional works and ethical integrity people have questioned whether the experts in their fields already have adequate moral skills and moral will . A lot of problems are found in moral acts and have adopted ethics based on a strict rule in which the system should be at least based on the rules of motivation and morality elements, not only emphasizing autonomic principles .

To answer the question above of having ethical practice and being ethical, this article is aimed to identify ethics against moral hazard which is moderated by corporate governance that has been a scandal issue. A wise person is an individual who thinks and most important acts wisely and in line with the nature of diversity while a noble person is an individual who shows traits at the right time and place . In the last few decades, moral hazard has become a hot and crucial issue in corporations, especially in Indonesia. In running the business activities, the corporation should be able to avoid negative activities by applying appropriate business ethics and procurement of good corporate governance.

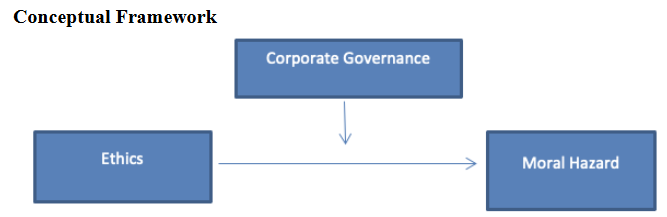

Conceptual Framework

Figure 1. Conceptual Framework

From figure 1 above, it can be affirmed that the conceptual framework to be built is a corporate governance pattern that prioritizes ethical values and deviant values or often known as moral hazard.

Ethics

Ethics is a question within theory about what is good and bad, what is right and wrong, and question about what should be done and should not be done On the other hand, ethical behaviour is an act referring to the standard of fair and right behaviour among parties within a certain situation . In the same way that the ability to Ethics and Morality is part of what makes us human, much like the capacity for language . Regardless of the public growing, increasingly want to behave in socially responsible ways . Similarly, ethics is also defined as a study of good and bad human behaviour, including attitude and related human values . Ethics in the business field is a guideline in business activity, which the businessman must understand and interpret for the sustainability of the corporation. Business and ethics are believed to be compatible and provide tools for moral hazard. In other words, they can be used to rationalize behaviour. That would with one's self-image as an ethically upright person . Through the implementation of ethics in business, it can indirectly raise trust among colleagues, society, and customers, which trust is the capital of corporate sustainability . Many studies related to this approach , and . This article outlines some of the most common indicates of discussion regarding corporate ethics programs in particular and ethics in the workplace in general: whether businesses should implement ethics policies in the first place, how such programs should be designed more exactly, and what specific values of workplace moral hazard such programs corporate governance should include.

Moral Hazard

Moral hazard complex is really important to explain and how ambiguity can be solved The condition of moral hazard occurs when an individual or institution expects more tendencies to take risks without having responsibility for all negative consequences that might appear from their actions. The moral hazard is attached to the financial system and has elements of general characteristics and corporate in particular and needs to be controlled. Further, ethical behaviour against stakeholders should be analyzed and considered, so it can improve corporate governance Lately, have defined moral hazard as a situation when a big risk must be carried out, while the one who should bear the consequences if things go bad is someone else. Many studies related to this approach argue that corporate governance may lead to a financial crisis if a moral hazard emerges ;[1];[2];[3].

Corporate Governance

Implementation of corporate governance principles will be difficult to apply in a corporation. Individual deviation will appear due to the absence of integrity in corporate governance. The implementation of corporate governance is not only dependent on the principle, but the concept of corporate governance is used by the corporations which expect for their structure, culture, ethics, and guidelines in taking any ethical decision . However, in the new, it has evolved into a more inclusive business model . This perspective can imply an assumption that increases corporate responsibility to all stakeholders over ethical decision-making and moral hazard situations that should be settled. This ethical behaviour in a corporation needs moral hazard to be identified and managed . Should be perceptive that the inadequate control of moral hazard in business decisions leads to social inefficiency . In the context of modern organizations, the central manager should function as a service manager who puts orientation on individual goals to balance between organizational principles and goals. The noble service manager is also interpreted as an ethical leader and guard of resources, ethics, and social needs and customs attached to the organization . Improving information transparency through better corporate governance can help reduce the negative market response . Firms with good governance may benefit from reducing the stability of the financial system and the prevention of financial crises .

METHODOLOGY

The method in this study is qualitative, with a normative approach and literature review. This literature review research method is synthesized using the narrative method by grouping similar extracted data according to the measured results to answer the objectives.

In other words, this literature review is a systematic, explicit and reproducible method for identifying, evaluating and synthesizing research works and thoughts that have been produced by researchers and practitioners.

So the use of this type of method to uncover the effects of ethics on moral hazard in business management moderated by corporate governance: a literature review.

RESULT AND DISCUSSIONS

Moral Hazard

Nyman in his research has stated the determination of corporate governance, particularly about the wellbeing of moral hazard.

The researchers assert that the research needs a re-calculation since the loss caused by moral hazard has not been significant. It enables the consumers to get access to treatment procedures that should be affordable.

Moral Hazard becomes a way to explain how individuals can influence possible losses for the company or take advantage of unfavourable events. substitution effect and the welfare-increasing income effect, which means that moral hazard is not solely a welfare loss .

Another article by Everett and Tremblay has argued that the internal auditor plays an active role in embracing an ambiguous moral will, if it is not contradictory, it will bring a professional association relating to ethical resources and capabilities to advance moral skill effectively.

The researchers claim that the previous research does not only need an ethical consideration in the audit but also a consideration of the individual type or ethical character of the auditor itself.

McCaffrey has said that the moral hazard is situated between economics and ethics.

The researchers evaluate the preliminary study that the significance of moral hazard will enable getting insights about the implications of moral hazard.

Dembe and Boden have asserted that the moral hazard appears in a situation when the agents have the incentive to put their interest above security concerns, which might be affected by their previous action and most of their incentives are either positive or negative in business context.

The researchers claim that the previous research from this concept precisely the moral aspect of moral hazard to limit moral hazard with ethical behaviour in an organization requires efforts that are aligned with the quality model.

Ethics to Moral Hazard

Muraskin has written about the significance of moral and ethics training which is aimed at the overall organizational welfare that is beneficial that the moral norm is one of the social media types for both the economic and social welfare of society or organization.

The researchers note from the previous research that the need for moral and ethics training is about customs, norms, attitudes, and networks which can motivate people to work for the common good.

Stevens and Thevaranjan have stated that ethics and moral sensitivity can develop the individual capability to encourage moral behaviour and enable getting an immediate benefit and productivity advantage that might arise due to the improvement of organizational production technology.

The researchers argue from the previous research that the issue of moral hazard specifically has several levels of moral sensitivity that might cause a decline in corporate productivity to seek moral solutions through incentive solutions.

Vallaster have referred that ethics can build up the framework of behaviour and action either for individual or organizational businesses involved in entrepreneurial activity and function as a justification of action.

The researchers remark on the previous research to present an ethical image in social business and economics, individual culture and society in establishing ethical norms to moral hazard and how this ethical context can affect entrepreneur assessment.

Weber and Getz have written that the ethical standard has been established to prevent bribery cases. The standard especially ethics is regarded as a social responsibility of organization, quality, and compliance.

The researchers argue the previous research that bribery in an international business realm has been the main concern among business circles, government, and community leaders. This research is aimed at tracking the newest effort and finding the impacts on economic development.

Corporate Governance Moderating between Ethics and Moral Hazard

Arjoon in their research has discussed the issues of corporate governance from the perspective of compliance and ethics. They have proposed a research model which hypothesizes the relation between corporate governance and ethical perspective. The failure of corporate governance can be identified from the effectiveness of integrity and trust core values.

The researchers conclude from the research that the economic strategy can be achieved in an organization which has specific characters and ethical values relating to consumers, employees, leaders, and shareholders.

Kaptein has asserted that ethical principles need an ethical limitation that will require element integration to empower behaviour and ethics within an organization and lessen ethical behaviour.

The researchers opine about the research that compliance can be an interesting tool that functions to involve ethical factors in this sector. Moreover, we have also found that moral hazard is interpreted as any situation when someone decides on how great the risks that must be taken.

Gonzalo has written that the extent of a social gap can refer to moral hazard and the range of behaviour varies greatly from one organization to the other organizations.

The researchers state that the research needs to identify the causal factors of moral hazard situations in the organization and the need for ethical principles that are aimed at maintaining organizational tension.

Martín-Castilla has explained the economic and mixed ethical character of moral hazard to contribute to the analysis and for the tool development that can restrict ethical features of moral hazard and also organizational attempts to decrease the emergence caused by moral hazard situations with ethical behaviour, so it can minimize organizational loss.

The researchers comment on the previous research that the framework applied in the organization has required greater ethical efforts than mere acceptance of established legal frameworks. Furthermore, this effort should be performed to develop ethical behaviour against moral hazard.

CONCLUSION

Based on the accessible kinds of literature, the researchers concluded these points: 1. Ethics could affect moral hazard. The management should arrange a system which states that ethics is important to achieve corporate goals. The employee should be given positive pieces of training which could reflect a good corporate image in achieving corporate goals. Moreover, ethics could provide a guideline that was useful in determining how the employee should act and behave. A good ethics program should involve some enforcement mechanism, which includes observation and sanction application if needed. The observation was informal, as it was performed by the leader, or might involve formal investigation by the internal or external auditor, or even legal enforcement institution. The observation must be carried out either by the leader, work colleague (mutual control, or internal auditor. The rule breaker should be sanctioned. Next, appreciation should be given to the employee who could achieve the organizational target, so it would motivate the other employees to improve their performance to realize the organizational goals. 2. Corporate governance could affect ethics and moral hazard. Good corporate governance was highly needed by stakeholders, so the stakeholders could make decisions and take a closer or thorough look at the corporation. The financial report should be honest and balanced which could explain the corporate condition. Corporate integrity is dependent on the individual responsible for preparing and presenting financial reports. Further, the accountability of the board of directors played an important role in confirming the information quality given to the shareholders as the business owners. Also, good corporate governance and ethics could lessen moral hazard within the corporate.

Acknowledgements

We would like to thank the team for their cooperation so that this research was completed and our highest gratitude and appreciation to the editors and reviewers who have reviewed this article to completion. Especially for the collaboration team from the Master of Management, Faculty of Economics and Business, University of Sebelas Maret, Surakarta, Indonesia. hopefully, this collaboration adds to the scientific treasures of our insights for the world.

Author Contribution

All authors contributed equally to the main contributor to this paper, some are as chairman, member, financier, article translator, and final editor. All authors read and approved the final paper.

Conflicts of Interest

All authors declare no conflict of interest.

References

L. San-Jose, J. F. Gonzalo, and M. Ruiz-Roqueñi, “The management of moral hazard through the implementation of a Moral Compliance Model (MCM),” Eur. Res. Manag. Bus. Econ., vol. 28, no. 1, p. 100182, Jan. 2022. https://doi.org/10.1016/j.iedeen.2021.100182.

D. Nordberg, “The ethics of corporate governance,” J. Gen. Manag., vol. 33, no. 4, pp. 35–52, Jun. 2008. https://doi.org/10.1177/030630700803300403.

J. Everett and M.-S. Tremblay, “Ethics and internal audit: Moral will and moral skill in a heteronomous field,” Crit. Perspect. Account., vol. 25, no. 3, pp. 181–196, May 2014. https://doi.org/10.1016/j.cpa.2013.10.002.

A. R. Wyatt, “Accounting Professionalism—They Just Don’t Get It!” Account. Horiz., vol. 18, no. 1, pp. 45–53, Mar. 2004. https://doi.org/10.2308/acch.2004.18.1.45.

B. Schwartz and K. E. Sharpe, “Practical Wisdom: Aristotle meets Positive Psychology,” J. Happiness Stud., vol. 7, no. 3, pp. 377–395, Sep. 2006. https://doi.org/10.1007/s10902-005-3651-y.

L. P. Pojman and J. Fieser, Ethics: discovering right and wrong, 6th ed. in Cengage advantage books. Belmont, CA: Wadsworth/Cengage Learning, 2009. [Online]. Available: https://search.worldcat.org/title/ethics-discovering-right-and-wrong/oclc/232649449.

J. R. Francis, “After Virtue? Accounting as a Moral and Discursive Practice,” Account. Audit. Account. J., vol. 3, no. 3, Dec. 1990. https://doi.org/10.1108/09513579010142436.

R. Crisp, “Virtue Ethics and Virtue Epistemology,” Metaphilosophy, vol. 41, no. 1–2, pp. 22–40, Jan. 2010. https://doi.org/10.1111/j.1467-9973.2009.01621.x.

T. L. Beauchamp and N. E. Bowie, Eds., Ethical theory and business, 2nd ed. Englewood Cliffs, N.J: Prentice-Hall, 1983. [Online]. Available: https://philpapers.org/rec/BEAETA-7.

D. D. Runes, Ed., The dictionary of philosophy. New York: Citadel, 2001. [Online]. Available: https://philpapers.org/rec/RUNTDO.

J. Brennan, Business ethics for better behaviour. New York, NY: Oxford University Press, 2021. https://doi.org/10.1093/oso/9780190076559.001.0001.

H. Von Kriegstein and K. A. Scott, “Business Ethics Denial: Scale development and validation,” Personal. Individ. Differ., vol. 210, p. 112229, Aug. 2023. https://doi.org/10.1016/j.paid.2023.112229.

V. E. Barry, Moral issues in business. Belmont, Calif: Wadsworth Pub. Co, 1979. [Online]. Available: https://search.worldcat.org/title/moral-issues-in-business/oclc/4932858.

L. Kaufmann, “Feminist Epistemology and Business Ethics,” Bus. Ethics Q., vol. 32, no. 4, pp. 546–572, Oct. 2022. https://doi.org/10.1017/beq.2021.33.

O. C. Ferrell, D. E. Harrison, L. Ferrell, and J. F. Hair, “Business ethics, corporate social responsibility, and brand attitudes: An exploratory study,” J. Bus. Res., vol. 95, pp. 491–501, Feb. 2019. https://doi.org/10.1016/j.jbusres.2018.07.039.

Z. Liu, H. Tang, and C. Zhang, “Corporate governance, moral hazard, and financialization,” Int. Rev. Econ. Finance, vol. 88, pp. 318–331, Nov. 2023. https://doi.org/10.1016/j.iref.2023.06.042.

G. Jiang, C. M. C. Lee, and H. Yue, “Tunneling through intercorporate loans: The China experience☆,” J. Financ. Econ., vol. 98, no. 1, pp. 1–20, Oct. 2010. https://doi.org/10.1016/j.jfineco.2010.05.002.

F. Jiang, Z. Jiang, and K. A. Kim, “Capital markets, financial institutions, and corporate finance in China,” J. Corp. Finance, vol. 63, p. 101309, Aug. 2020. https://doi.org/10.1016/j.jcorpfin.2017.12.001.

P. R. Krugman, The return of depression economics and the crisis of 2008. New York: Norton, 2009. [Online]. Available: https://wwnorton.com/books/9780393337808.

D. Tsiddon, “A Moral Hazard Trap to Growth,” Int. Econ. Rev., vol. 33, no. 2, p. 299, May 1992. https://doi.org/10.2307/2526896.

R. I. McKinnon and H. Pill, “Credible Economic Liberalizations and Overborrowing,” Am. Econ. Rev., vol. 87, no. 2, pp. 189–193, 1997. [Online]. Available: https://www.hbs.edu/ris/Publication%20Files/AER97_06b99a82-652d-4634-ade4-45884d75700d.pdf

G. A. Calvo, “Capital Flows and Capital-Market Crises: The Simple Economics of Sudden Stops,” J. Appl. Econ., vol. 1, no. 1, pp. 35–54, Nov. 1998. https://doi.org/10.1080/15140326.1998.12040516.

C. Verberi, S. Yasar, and I. H. Sugozu, “Capital liberalization, growth and moral hazard: Lessons from the global financial crisis,” Int. Rev. Financ. Anal., vol. 90, p. 102901, Nov. 2023. https://doi.org/10.1016/j.irfa.2023.102901.

C. Marsden, “The New Corporate Citizenship of Big Business: Part of the Solution to Sustainability?” Bus. Soc. Rev., vol. 105, no. 1, pp. 8–25, Jan. 2000. https://doi.org/10.1111/0045-3609.00062.

J. S. Harrison, R. A. Phillips, and R. E. Freeman, “On the 2019 Business Roundtable ‘Statement on the Purpose of a Corporation,’” J. Manag., vol. 46, no. 7, pp. 1223–1237, Sep. 2020. https://doi.org/10.1177/0149206319892669.

S. Arjoon, “Corporate Governance: An Ethical Perspective,” J. Bus. Ethics, vol. 61, no. 4, pp. 343–352, Nov. 2005. https://doi.org/10.1007/s10551-005-7888-5.

J. F. Gonzalo, L. San-Jose, and J. L. Retolaza, "Moral compliance as a facilitator for ethical reflection in management: catalysts and situations," Total Qual. Manag. Bus. Excell., vol. 32, no. 9–10, pp. 1106–1121, Jul. 2021. https://doi.org/10.1080/14783363.2019.1668263.

L. M. Sama, A. Stefanidis, and R. M. Casselman, “Rethinking corporate governance in the digital economy: The role of stewardship,” Bus. Horiz., vol. 65, no. 5, pp. 535–546, Sep. 2022. https://doi.org/10.1016/j.bushor.2021.08.001.

K.-C. Huang and Y.-C. Wang, “How do investors underreact to seasoned equity offerings? Evidence from Taiwan’s corporate governance evaluation,” Int. Rev. Financ. Anal., vol. 89, p. 102782, Oct. 2023. https://doi.org/10.1016/j.irfa.2023.102782.

M. A. C. Komath, M. Doğan, and Ö. Sayılır, “Impact of corporate governance and related controversies on the market value of banks,” Res. Int. Bus. Finance, vol. 65, p. 101985, Apr. 2023. https://doi.org/10.1016/j.ribaf.2023.101985.

J. A. Nyman, “The economics of moral hazard revisited,” J. Health Econ., vol. 18, no. 6, pp. 811–824, Dec. 1999. https://doi.org/10.1016/S0167-6296(99)00015-6.

R. Chetty and A. Finkelstein, “Social Insurance: Connecting Theory to Data,” in Handbook of Public Economics, vol. 5, Elsevier, 2013, pp. 111–193. https://doi.org/10.1016/B978-0-444-53759-1.00003-0.

M. McCaffrey, “The morals of moral hazard: a contracts approach: The morals of moral hazard: a contracts approach,” Bus. Ethics Eur. Rev., vol. 26, no. 1, pp. 47–62, Jan. 2017. https://doi.org/10.1111/beer.12121.

A. E. Dembe and L. I. Boden, “Moral Hazard: A Question of Morality?” NEW Solut. J. Environ. Occup. Health Policy, vol. 10, no. 3, pp. 257–279, Nov. 2000. https://doi.org/10.2190/1GU8-EQN8-02J6-2RXK.

W. Muraskin, “The Moral Basis of a Backward Sociologist: Edward Banfield, the Italians, and the Italian-Americans,” Am. J. Sociol., vol. 79, no. 6, pp. 1484–1496, 1974. https://doi.org/10.1086/225716.

D. E. Stevens and A. Thevaranjan, “A moral solution to the moral hazard problem,” Account. Organ. Soc., vol. 35, no. 1, pp. 125–139, Jan. 2010. https://doi.org/10.1016/j.aos.2009.01.008.

C. Vallaster, S. Kraus, J. M. Merigó Lindahl, and A. Nielsen, “Ethics and entrepreneurship: A bibliometric study and literature review,” J. Bus. Res., vol. 99, pp. 226–237, Jun. 2019. https://doi.org/10.1016/j.jbusres.2019.02.050.

J. Weber and K. Getz, “Buy Bribes or Bye-Bye Bribes: The Future Status of Bribery in International Commerce,” Bus. Ethics Q., vol. 14, no. 4, pp. 695–711, 2004. https://doi.org/10.5840/beq200414441.

M. Kaptein, “The Battle for Business Ethics: A Struggle Theory,” J. Bus. Ethics, vol. 144, no. 2, pp. 343–361, Aug. 2017. https://doi.org/10.1007/s10551-015-2780-4.

J. I. Martín-Castilla, “Possible Ethical Implications in the Deployment of the EFQM Excellence Model,” J. Bus. Ethics, vol. 39, no. 1/2, pp. 125–134, 2002. https://doi.org/10.1023/A:1016344304416.

Downloads

Submitted

Accepted

Published

Issue

Section

License

Copyright (c) 2023 Andy Ismail, Hendri Dwi Dwi Purnomo, Muhammad Arifin, Syavergio Avia Difaputra, Hunik Sri Runing Sawitri

This work is licensed under a Creative Commons Attribution 4.0 International License.