FINANCIAL PERFORMANCE ANALYSIS USING CAMELS AT PT. BANK SYARIAH INDONESIA BEFORE AND AFTER MERGER

DOI:

https://doi.org/10.23917/profetika.v25i01.2470Keywords:

financial performance, reports, mergers, camels ratios, bankAbstract

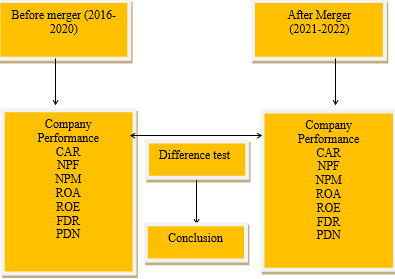

This study discusses the comparison of the financial performance of PT Bank Syariah Indonesia (BSI) TBK before the merger of PT Bank Syariah Mandiri (BSM), PT Bank Rakyat Indonesia Syariah (BRIS), and PT Bank Negara Indonesia Syariah (BNIS) and after the merger became PT Bank Indonesian Sharia (BSI) TBK. This study aims to analyze the financial performance of PT BSI TBK before and after the merger using CAMELS, namely Capital, Assets, Management, Earnings, Liquidity, and Sensitivity of the Market with a focus on CAR, NPF, NPM, ROA, ROE, FDR, and PDN assessments. The method used uses descriptive quantitative analysis by analyzing annual reports through the company's website and accessed from www.idx.co.id. The data used consists of Islamic banking financial reports from BSM, BRIS, and BNIS before the merger, namely 2016-2020 and on BSI in 2021 and 2022. The results show that the ratio analysis of PT BSI TBK before the merger focuses on CAR, NPF, NPM assessment, ROA, ROE, FDR, and PDN yielded a value of 19.20%, 2.31%, 4.37%, 1.05%, 8.56%, 76.94% and PT BSI TBK after the merger, respectively are 21.19%, 0.72%, 6.18%, 1.80%, 15.28% and 76.38%. So these results indicate that the performance of financial ratios using the CAMELS method after the merger is better than the financial performance before the merger.

References

Y. M. Rahman, R. S. Bachro, E. H. Djukardi, and U. Sudjana, “Digital Asset/Property Legal Protection in Sharia Banking Financing and its Role in Indonesian Economic Development,” Int. J. Crim. Justice Sci., vol. 16, no. 2, pp. 149–161, 2021. [Online]. Available: https://ijcjs.com/menu-script/index.php/ijcjs/article/view/57

Sutrisno and A. Widarjono, “Maqasid sharia index, banking risk and performance cases in Indonesian Islamic banks,” Asian Econ. Financ. Rev., vol. 8, no. 9, pp. 1175–1184, 2018, https://doi.org/10.18488/journal.aefr.2018.89.1175.1184

M. Sueb, Prasojo, Muhfiatun, L. Syarifah, and R. N. A. Putra, “The effect of shariah board characteristics, risk-taking, and maqasid shariah on an Islamic bank’s performance,” Banks Bank Syst., vol. 17, no. 3, pp. 89–101, 2022, https://doi.org/10.21511/bbs.17(3).2022.08

A. Nurfitriana and F. Yuniar, “Analysis of Bank Health Level Comparison Before and During the Covid-19 Pandemic”. [Online]. Available: https://feb.untan.ac.id/wp-content/uploads/2023/02/13-1.pdf

H. Lending, “Banking on Health and Financial Institutions,” North, 2004. [Online]. Available: https://pdf.usaid.gov/pdf_docs/Pnadp123.pdf

L. Lian Ong, P. Jeasakul, S. Kwoh, and P. by Li Lian Ong, “HEAT! A Bank Health Assessment Tool IMF Working Paper Monetary and Capital Markets Department HEAT! A Bank Health Assessment Tool,” 2013. [Online]. Available: https://www.imf.org/en/Publications/WP/Issues/2016/12/31/HEAT-A-Bank-Health-Assessment-Tool-40872

A. D. Amri et al., “Development and Growth of Financial Sector Stock Market on Investment Climate : Study on Bank Syariah Indonesia and Bank Mandiri,” Solo Int. Collab. Publ. Soc. Sci. Humanit., vol. 2, no. 1, pp. 11–24, 2024. [Online]. Available: https://scholar.google.com/citations?view_op=view_citation&hl=id&user=isELa9EAAAAJ&citation_for_view=isELa9EAAAAJ:hFOr9nPyWt4C

I. F. Aznita, A. Sudarma, and G. W. Nugroho, “Pengaruh Metode CAMEL Terhadap Tingkat Ksehatan Bank Dalam Pengambilan Keputusan Merger,” Optima, pp. 50–60, 2022. https://jurnal.unitri.ac.id/index.php/Optima/article/view/3242

N. N. SH, R. Sahabuddin, A. Rauf, and S. Sahade, “Profitability Analysis Before and After the Merger in Islamic Banking Companies Listed on the IDX,” J. Off., vol. 8, no. 2, p. 243, 2022, https://doi.org/10.26858/jo.v8i1.38335

Y. A. Sari and Musdholifah, “Analysis of Company Performance Before and After The Merger,” J. Ilmu Manaj., vol. 5, no. 3, pp. 1–9, 2023. [Online]. Available: https://ejournal.unesa.ac.id/index.php/jim/article/download/20395/18568.pdf

K. P. Mentor, “Signaling Theory”. [Online]. Available: http://repository.umy.ac.id/bitstream/handle/123456789/263/bab%20ii.pdf?sequence=3&isAllowed=y

Mohammad Yusuf and Reza Nurul Ichsan, “Analysis of Banking Performance in The Aftermath of The Merger of Bank Syariah Indonesia in Covid 19,” Int. J. Sci. Technol. Manag., vol. 2, no. 2, pp. 472–478, 2021, https://doi.org/10.46729/ijstm.v2i2.182

E. Carletti, P. Hartmann, and G. Spagnolo, “Bank Mergers, Competition and Financial Stability,” Comm. Glob. Financ. Syst. Conf., no. February, pp. 1–28, 2002. https://doi.org/10.2139/ssrn.302879

M. Ekadjaja, H. P. Siswanto, and R. Rorlen, “The Impact of Mergers on the Performance of Conventional Banks in Indonesia,” Proc. tenth Int. Conf. Entrep. Bus. Manag. 2021 (ICEBM 2021), vol. 653, no. Icebm 2021, pp. 448–452, 2022, https://doi.org/10.2991/aebmr.k.220501.068

I. B. Yusgiantoro, R. Wirdiyanti, and A. D. Harjanti, “How do Banks Fare after Merger and Acquisition? Evidence from Indonesia,” pp. 1–23, 2020. [Online]. Available: https://www.ojk.go.id/id/data-dan-statistik/research/working-paper/Documents/OJK_WP.20.10.pdf

E. Wijayanti, “Loan growth and bank profitability of commercial banks in Indonesia,” Akuntabel, vol. 17, no. 1, pp. 2020–2058, 2020, [Online]. Available: https://journal.feb.unmul.ac.id/index.php/AKUNTABEL/article/view/7298

Undang-Undang Republik Indonesia, “Undang-Undang No. 10 Tahun 1998 tentang Perubahan atas Undang-Undang Nomor 7 Tahun 1992 tentang Perbankan,” 1998. [Online]. Available: https://ojk.go.id/id/kanal/perbankan/regulasi/undang-undang/pages/undang-undang-nomor-7-tahun-1992-tentang-perbankan-sebagaimana-diubah-dengan-undang-undang-nomor-10-tahun-1998.aspx

H. Lebdaoui, Y. Chetioui, and T. Harkat, “Propensity towards Islamic banking among non-users: a mixed-methods analysis,” J. Financ. Serv. Mark., vol. 29, no. 1, pp. 45–66, 2024, https://doi.org/10.1057/s41264-022-00178-5

M. U. Mai and T. Djuwarsa, “Do board characteristics influence Islamic banks’ capital structure decisions? Empirical evidence from a developing country,” Cogent Econ. Finance., vol. 12, no. 1, 2024, https://doi.org/10.1080/23322039.2023.2295155

A. Lebbe and A. Rauf, “Towards Increasing the Financial Performance: An Application of CAMEL Model in Banking Sector in the Context of Sri Lanka,” Res. J. Financ. AccountingOnline), vol. 7, no. 5, pp. 2222–2847, 2016. [Online]. Available: https://core.ac.uk/download/pdf/234631293.pdf

K. G. Ping and S. Kusairi, “Analysis of CAMEL Components and Commercial Bank Performance: Panel Data Analysis,” J. Organ. dan Manaj., vol. 16, no. 1, pp. 1–10, 2020, https://doi.org/10.33830/jom.v16i1.835.2020

S. I. J. Saiya and M. Pandowo, “Analysis of Banking Soundness Using Camel Method (Study of Pt. Bank Mandiri-Persero Tbk From 2012 ± 2014) Analisa Kesehatan Bank Dengan Menggunakan Metode Camel (Studi Pada Pt. Bank Mandiri-Persero Tbk Tahun 2012 ± 2014),” Anal. Bank. Soundness« 132 J. EMBA, vol. 3, no. 2, pp. 132–140, 2015. [Online]. Available: https://ejournal.unsrat.ac.id/index.php/emba/article/view/8473

S. H. Al-Hunnayan, “The capital structure decisions of Islamic banks in the GCC,” J. Islam. Account. Bus. Res., vol. 11, no. 3, pp. 745–764, 2020, https://doi.org/10.1108/JIABR-02-2017-0026

A. Denziana and E. Octavianto, “The Analysis of Productive Assets Quality on Bank Health Rating of Commercial Banks in Indonesia,” … Int. Conf. …, no. August, pp. 165–178, 2015, [Online]. Available: https://jurnal.darmajaya.ac.id/index.php/icitb/article/view/447%0Ahttps://jurnal.darmajaya.ac.id/index.php/icitb/article/download/447/283

Fdic-rms, “Asset Quality Section 3.1 RMS Manual of Examination Policies 3.1-1 Asset Quality (1/24) Federal Deposit Insurance Corporation Asset Quality Section 3.1 Asset Quality (1/24) 3.1-2 RMS Manual of Examination Policies Federal Deposit Insurance Corporation,” pp. 3–5. [Online]. Available: https://www.fdic.gov/resources/supervision-and-examinations/examination-policies-manual/section3-1.pdf

J. H. Rosa, J. L. V. Barbosa, M. Kich, and L. Brito, “A Multi-Temporal Context-aware System for Competences Management,” Int. J. Artif. Intell. Educ., vol. 25, no. 4, pp. 455–492, 2015, https://doi.org/10.1007/s40593-015-0047-y

D. Maria and R. M. Sari, “Profitability of Bank Muamalat Indonesia,” Proceeding 7th ICITB, 2021. [Online]. Available: https://jurnal.darmajaya.ac.id/index.php/icitb/article/view/3026

M. Parhan, “The Determinant of Banking Profitability in Indonesia (A Study of Commercial Banks Listed on the Indonesia Stock Exchange in 2013-2019),” J. Ilm. Mhs. FEB, 2021, [Online]. Available: https://jimfeb.ub.ac.id/index.php/jimfeb/article/view/7163

R. M. Yusof, M. Bahlous, and H. Tursunov, “Are profit sharing rates of mudharabah account linked to interest rates? An investigation on Islamic banks in GCC Countries,” J. Ekon. Malaysia, vol. 49, no. 2, pp. 77–86, 2015, [Online]. Available: https://ideas.repec.org/a/ukm/jlekon/v49y2015i2p77-86.html

Federal Deposit Insurance Corporation, “Liquidity and Funds Management (L),” RMS Man. Exam. Policies, vol. 4, pp. 2–24, 2019. [Online]. Available: https://www.fdic.gov/resources/bankers/capital-markets/liquidity-and-funds-management/

W. B. Ateke and J. U. D. Didia, "Consumer Knowledge and Purchase Intention of Healthcare Product Consumers in Rivers State", vol. 6, no. 1, pp. 1–7, 2018. [Online]. Available: https://www.researchgate.net/publication/322554172_Consumer_Knowledge_and_Purchase_Intention_of_Healthcare_Product_Consumers_in_Rivers_State

H. Sarjono and A. Market Sensitivity and Business Wellness of Deposit Money Banks,” Int. J. Res. Bus. Stud. ManaT. Suprapto, “Camel Ratio Analysis of Banking Sector Share Price in Indonesia Stock Exchange,” Palarch’s J. Archaeol. Egypt/Egyptology, vol. 17, no. 7, pp. 2213–2222, 2020. [Online]. Available: https://archives.palarch.nl/index.php/jae/article/view/1538

S. I. J. Saiya and M. Pandowo, “Analysis of banking soundness using camel method,” vol. 3, no. 2, pp. 132–140, 2014. [Online]. Available: https://ejournal.unsrat.ac.id/index.php/emba/article/view/8473

K. Hairani, T. Wulandari, N. Dewi, P. M. Samosir, D. R. Purba, and N. Q. Hasanah, “Financial Performance Before And After The,” vol. 5, no. 1, pp. 876–886, 2024. [Online]. Available: https://jurnal.umsu.ac.id/index.php/insis/article/view/18638

I. Yunus, L. O. Rasuli, and A. Lukum, “Comparative Analysis of Financial Performance Before and After Acquisition (A Study in Acquiring Company Listed in Indonesian Stock Exchange, Period of 2012-2018),” Adv. Econ. Bus. Manag. Res., vol. 173, no. Kra 2020, pp. 175–186, 2021. https://doi.org/10.2991/aebmr.k.210416.023

N. Dianingtyas, “Pengaruh Capital Adequacy Ratio (Car), Debt To Equity Ratio (Der), Return On Asset (Roa) Dan Financing To Deposit Ratio (Fdr) Terhadap Risiko Likuiditas Pada Bank Syariah Di Indonesia Periode 2008-2012,” 2012. [Online]. Available: http://repository.uinjkt.ac.id/dspace/handle/123456789/23840

N. Ula, “Pengaruh Non Performing Financing (Npf), Financing To Deposit Ratio (Fdr), Dan Return On Assets (Roa) Terhadap Pertumbuhan Aset Bank Umum Syariah Di Indonesia Tahun 2015 − 2019,” F. Crop. Res., vol. 212, no. 1, pp. 61–72, 2017, https://doi.org/10.1016/j.fcr.2017.06.020

M. Djunaedi, “Analisis Pengaruh Financial Leverage, Net Profit Margin (Npm) Dan Inflasi Terhadap Return On Equity (Roe) Bagi Perbankan Syariah,” vol. 8, pp. 1–154, 2019. [Online]. Available: https://jurnal.ummi.ac.id/index.php/JIIE/article/view/600

S. Di and I. Tahun, “Pengaruh Capital Adequacy Ratio ( Car ), Financing To Deposit Ratio ( Fdr ) Dan Non Performing Financing ( Npf ) Terhadap Profitabilitas ( Roa ) Pada Bank Umum,” 2022. https://doi.org/10.33395/owner.v5i2.470

Y. F. Somantri and W. Sukmana, “Analisis Faktor- Faktor yang Mempengaruhi Financing to Deposit Ratio ( FDR ) pada Bank Umum Syariah di Indonesia,” vol. 04, no. 02, pp. 61–71, 2019. https://doi.org/10.20473/baki.v4i2.18404

C. de Soyres, M. Wang, and R. Kawai, “Public Debt and Real GDP: Revisiting the Impact,” IMF Work. Pap., vol. 2022, no. 076, p. 1, 2022, https://doi.org/10.5089/9798400207082.001

M. Białas and A. Solek, “Evolution of capital adequacy ratio,” Econ. Sociol., vol. 3, no. 2, pp. 48–57, 2010, https://doi.org/10.14254/2071-789X.2010/3-2/5

Submitted

Accepted

Published

Issue

Section

License

Copyright (c) 2023 Rusli Moch. Rusli

This work is licensed under a Creative Commons Attribution 4.0 International License.