ZAKAT FUND MANAGEMENT STRATEGY FOR MUSTAHIK WELFARE MAQASHID SHARIA PERSPECTIVE

DOI:

https://doi.org/10.23917/profetika.v24i02.2469Keywords:

management strategy, zakat, maqasid sharia, mustahiq, zakat fundAbstract

The purpose of this study is to explain the Management Strategy of Zakat Funds towards Mustahik in the Perspective of Maqashid Sharia Case Study at Baznas Samarinda City Prov. East Kalimantan. With the formulation of the problem: 1. What are the indicators used to identify Mustahik Faqir and Poor Groups who are entitled to receive Zakat funds? 2. How is the impact of acceptance and Zakat on Mustahik from the Faqir and Poor groups in the Maqashid Sharia perspective? This research is qualitatively descriptive with a sociological approach, data collection methods are observations, interviews and documentation at Baznas Samarinda City. Data analysis techniques are reducing data, presenting data, and drawing conclusions. The results showed that the Management Strategy of Zakat Funds Towards Mustahik in the Perspective of the Maqashid Sharia Case Study at Baznas Samarinda Prov. East Kalimantan. namely, the program is channelled into 5 programs: Samarinda Smart, Samarinda Healthy, Samarinda Empowered, Samarinda Berdakwah, and Samarinda Care by covering the fields of Economy, Health, Education, Da'wah, and Humanity. Indicators of zakat recipients used to determine the mustahik zakat categories of poor and poor, namely: a. Home/residence ownership index by looking at the condition of the house (roof, floor, walls), whether the family owns a house or not, the source of residential lighting. b. Ownership of assets including assets owned by families or individuals, local transportation owned, and facilities in accessing news/information. c. Income by looking at sources of income not exceeding 1,000,0000 and not having savings / high-value goods. The impact of the distribution of zakat funds on the welfare of mustahiq from the poor and poor groups in the maqashid sharia perspective is that the distribution of zakat funds is carried out in the form of consumptive zakat fund assistance, with this mustahiq program can increase their income which the percentage level of success is 80 per cent (%) as evidenced by surveys by Baznas Samarinda and information reports from the results of mustahiq businesses that experience profits and can meet their basic needs. Mustahiq has been able to independently change the status of mustahik to munfiq or muzakki through business capital assistance and business equipment assistance that has been provided by Bazas Samarinda City.

Muhammad Syafry Firman1, Isman2, Muhammad Ammar Al-amudi3, Prabu Arya Sembara4

1Master of Sharia Economic Law, Muhammadiyah University of Surakarta, Indonesia

2Master of Sharia Economic Law, Muhammadiyah University of Surakarta, Indonesia

3Islamic Studies, Sidi Muhamed Ben Abdellah University, Morocco

3Kulliyatul Syari’ah Qism Fiqih, Al Rayyan University, Yemen

INTRODUCTION

Currently, Indonesia is still facing various challenges and obstacles in its efforts to achieve social welfare. Some of the challenges faced include the high data on the number of people below the poverty line . The role of Zakat, infaq, and alms in Islam is very strategic in efforts to minimize poverty or economic development towards prosperity. Unlike other sources of development financing, Zakat has no effect other than creating empowerment and hope for rewards from God alone. However, that does not mean there is no control system in the Zakat mechanism.

To accommodate the management of Zakat funds, Indonesia has a special institution that deals with this problem, namely the National Zakat Amil Agency (BAZNAS). Zakat is a fundraising tool that comes from Islamic teachings intending to share wealth where people who have wealth distribute some of their wealth to people in need or to the poor.

The level of trust is also inseparable from the public's view of the accuracy of the distribution of Zakat funds by Muzakki which is then distributed to mustahik, whether they are right on target and optimal to improve their welfare through innovative and productive programs . With proper and targeted management of the distribution of zakat, the level of income and welfare of mustahik households will certainly increase, and from a spiritual perspective, mustahik will also increase.

Zakat management is a process that cannot be considered simple in its implementation because it requires careful planning and good coordination between many parties starting from the beginning of the collection process to its distribution. The person responsible for managing zakat must meet various criteria including understanding Islamic law, trustworthiness, expediency, fairness, honesty, legal certainty, integration and accountability . Zakat is part of Islamic law which also has its own rules in Indonesia's positive law system. Nationally, the regulation of zakat in Indonesia is recorded in the Law of the Republic of Indonesia Number. 23 of 2011 concerning the Management of Zakat. In this regard, the management of zakat must not only be following legal standards but also truly following the values of maqasid sharia. Zakat has great potential in Indonesia and if zakat is distributed effectively it can contribute to national development, especially poverty alleviation.

In this legality, the regulation is based on the role of an institution known as BAZNAS, which stands for National Zakat Agency Agency. From this perspective, it shows that the rules for the management of zakat in legislation are the economic policies of the Indonesian government which originate from Islamic teachings. The basic value of legality is a potential source of funds to realize general welfare based on social justice .

In distributing Zakat funds, Amil has an important role in the distribution process and knows best who meets the criteria as the beneficiary. So that later it can be determined who has the right and deserves to get Zakat funding assistance and is obliged to be helped. With good management by Amil Zakat, zakat is certainly able to help bridge the gap between the economic groups of the poor and those who can afford it.

This research was conducted in Samarinda City, East Kalimantan Province. The interesting thing is that the city of Samarinda is one of the areas that has promising prospects for economic growth with a rate of 4.25 per cent in 2022, an increase from the previous year of 1.53 per cent.

This research itself focuses on indicators of recipients of Zakat funds in the Mustahik category, the Faqir and Poor groups who are eligible as recipients of Zakat funds, as well as the impact obtained from receiving Zakat funds from the perspective of maqashid sharia. The purpose of this study is to find out the criteria for Zakat recipients and their impact based on the Maqashid Sharia review.

METHODOLOGY

This study uses a qualitative method with a narrative or qualitative descriptive study approach. The type of research that the author uses in this case is descriptive research with qualitative methods. The researcher tries to reveal the symptoms as a whole and follow the context by collecting data with a natural background by utilizing the researcher himself as a key instrument. Qualitative research is research that produces descriptive data in the form of written or spoken words from people and observed behaviour

Researchers use qualitative research methods because this research contains research procedures that produce descriptive data in the form of written or spoken words from people and observed behaviour.

RESULTS AND DISCUSSION

Achieving a goal requires the right strategy in achieving it. All organizations have a strategy to achieve organizational goals. This is a consideration for all organizations to have the right strategy . The word "strategy" comes from the Greek, namely "strategic" (Stratos = military and ag = lead), which means "generalship" or something that is done by war generals in making plans to win the war . In general, strategy is a way to achieve goals. Strategy is a long-term plan to achieve goals .

The definition or definition of strategic management in the literature on management science has a wide scope, and there is no single definition that is considered standard . Nevertheless, from the various definitions or definitions given by management experts, a common mindset can be found, that strategic management is a science that combines management functions in the context of making strategic organizational decisions, to achieve organizational goals effectively. and efficient .

The following authors quote several experts who expressed their opinions about strategic management : 1. Wahyudi, "Strategic Management is an art and science of formulating, implementing and evaluating strategic decisions between functions that enable an organization to achieve its future goals”. 2. Gluek & Jauch, "Strategic Management is the flow of decisions and actions that lead to the development of an effective strategy or strategies to help achieve company goals . 3. J. David Hunger & Thomas L. Wheelen "Strategic Management is a series of managerial decisions and activities that determine the success of the company in the long term" . 4. Miller, "Strategic Management is a combination process between three activities, namely strategy analysis, strategy formulation and strategy implementation . 5. Fred R. David, strategic management is the art and science of formulating, implementing and evaluating cross-functional decisions that enable an organization to achieve its goals . 6. E. Mulyasa, defines Strategic Management as a systematic and coordinated effort to continuously improve service quality so that the focus is directed to customers (students, parents, graduate users, teachers, employees, government, and society) . implement and evaluate cross-functional decisions that make the organization able to achieve its goals [16]. 6. E. Mulyasa, defines Strategic Management as a systematic and coordinated effort to continuously improve service quality so that the focus is directed to customers (students, parents, graduate users, teachers, employees, government, and society) . implement and evaluate cross-functional decisions that make the organization able to achieve its goals . 6. E. Mulyasa, defines Strategic Management as a systematic and coordinated effort to continuously improve service quality so that the focus is directed to customers (students, parents, graduate users, teachers, employees, government, and society) .

According to Imam Al-Ghazali, the meaning of maqasid shari'ah is that maintaining the aims and objectives of shari'ah is a fundamental effort to survive, withstand the factors of damage and promote prosperity . The main purpose of implementing sharia is aimed at maslahah (welfare for all human beings) where humans can get protection and benefit from all the provisions of sharia, as well as daf'ul mafsadah (avoiding harm) . Maqashid Sharia covers various aspects as introduced by Asy-Syatibi through ad-dharuriyah al-khamsa which includes protecting religion (hifdzu ad-din), life (hifdz an-nafs), reason (hifdz al-'aql), offspring ( hifdz an-nasl) and assets (hifdz al-maal) .

According to asy-Syatibi, maqashid shari'a is the goal of shari'a which pays more attention to the public interest. Imam ash-Syathibi is of the view that the main purpose of maqashid ash shari'a is to maintain and fight for three categories of law, namely among others : First, dharuriyat, (basic/primary needs), namely benefit that must exist to produce benefits for both religion and the world, which if not fulfilled, it will result in life becoming chaotic, damaged, and even destroyed, also having an impact on loss of safety and enjoyment in the hereafter, as well as leading to a clear loss . Second, (secondary needs) hajiyat, namely benefit which if there is no impact on damage, but not to the level of damage that is dharuriyat. As-Syatibi interprets hajiyat as everything that is needed as a support, avoiding complications and difficulties. If these hajiyat things are not protected, then the impact will be damage or ugliness, but not as bad as the damage arising from public benefits (dharuriyat). Third, takmiliyah or tahsiniyah,

Broadly speaking, the scholars provide an overview of the theory of Maqhasid Sharia, namely that Maqasid Sharia must be centred and based on five points of benefit , namely: Preserving the Soul (Hhifz al-Nafs), Maintaining the Intellect (Hifzh al-'Aql), Maintaining the Mind (Hifzh al-'Aql), Offspring (Hifzh al-Nasl), Maintaining Property (Hifzh al-Mal) and the last is Environmental Protection (Hifz al-bi'ah) .

In managing zakat funds based on maqāshid syarī'ah, the aspect of protecting the mustahik's faith is a top priority . Zakat funds must be managed with great care to ensure that the income used for zakat comes from halal sources and follows Islamic teachings . Sanctifying income assets is one of the crucial steps in ensuring this is achieved .

An important concept from the explanation above in the context of maqāshid syarī'ah as a theoretical basis for analyzing the strategy of implementing zakat funds is that maqāshid syarī'ah aims to achieve benefit and benefit for mankind . In managing zakat funds, the main objective of implementing Islamic law is to create social justice and welfare for the community, especially mustahik who are recipients of zakat .

The groups entitled to receive zakat have been regulated in the teachings of Islamic law, namely, there are eight groups, namely the needy, the poor, amil, converts, riqab (slaves), gharimin, fi sabilillah (people who strive in the way of Allah), and ibnu sabil (people en route) . This provision is regulated in the Qur'an letter At-Taubah verse 60 which means:

“Indeed, sadaqah (zakat) is only for the needy, the poor, administrators of zakat, converts who are persuaded by their hearts, to (free) slaves, people who are in debt, for the way of Allah, and people who are on his way, as a decree obligated by Allah and Allah is All-Knowing, All-Wise.” (QS At-Tauba: 60)

The benefits and wisdom of zakat include growing and developing, zakat accelerating worship, zakat and work ethic, zakat and work ethics, zakat and community development, zakat and peace, zakat overcoming humanitarian crises, and zakat rejecting disasters .

Zakat is an obligation for Muslims as stipulated in the Koran, hadith, and Ijma' (consensus of Islamic scholars), and this obligation is the same as the obligation to pray. This shows the importance of zakat . Zakat is also one of the main fiscal pillars in the Islamic economic system so ideally, zakat must be managed by professional management.

In the Qur'an zakat is etymologically (language) zakat means to grow and develop, fertility or increase, it can also be called cleansing or purifying . In terminology, zakat is a certain amount of property that according to Allah's law must be paid to those who are entitled to receive it, namely eight asnaf are obligations mandated to Muslims wherever they are with the category of baliqh, intelligent, independent, and have fulfilled nisab and haul with a certain percentage based on benefits as prescribed in the Qur'an letter Albaqarah verse 43 .

Mustahiq is a group of zakat recipients or zakat targets. Epistemologically (language) mustahiq comes from the word istahaqqa which means istaujaba which makes it obligatory and ista'hala, (makes it an expert). As for the terminology (term syara'), mustahiq means a person entitled to receive zakat assets or a person entitled to a distribution of zakat funds .

In the letter at-Taubah verse 60, Allah explains in detail about the people who are entitled to receive zakat. And this verse is the only standard source regarding the allocation of zakat which there is no conflict among the juhur of scholars. In this verse it is stated that there are eight groups/asnaff recipients, namely: the needy, the poor, zakat administrators, Paramu'allaf whose hearts are persuaded, to (liberate) slaves, people who are in debt, for the road Allah and for those who are on their way .

Baznas Kota Samarinda distributes its zakat into two categories, namely distribution and utilization. As for the distribution itself, it is consumptive, so BAZNAS Samarinda distributes zakat in consumptive forms such as groceries, school equipment, health costs or medical and educational expenses. As for the utilization of BAZNAS, Samarinda City distributes it in the form of business assistance, such as MSMEs, purchasing sewing machines, training, and the Zakat community development (ZCD) program.

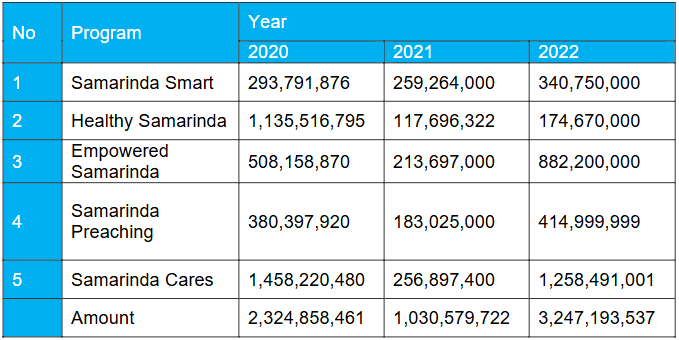

Distribution of zakat funds at Baznas Kota Samarinda is channelled into 2 different forms of distribution, namely distribution directly from Baznas and distribution through an application form surveyed in advance by a team from Baznas, from the two forms of distribution can be grouped into 5 main programs of Baznas. The program implemented by the Amil Zakat Agency, Samarinda City, East Kalimantan Province, is as follows:

1. Smart Samarinda This program later aims to help with the cost of education for students and students in Samarinda City. The Smart Samarinda City Program is the distribution of zakat funds in the education sector. 2. Healthy Samarinda, Health aids as a healing process. The Samarinda City Healthy Program includes the distribution of funds in the health sector which targets the poor and mustahiq. Enjoying health is the dream of every human being, but there are not a few poor people who have not enjoyed the health services they should be entitled to. The Samarinda City National Amil Zakat Agency (BAZNAS) comes with the Samarinda City Healthy program to serve mustahik who are less fortunate in medical expenses, and provide assistance in the form of medication, Mustahik compensation, monthly Mustahik consumptive, one-time Mustahik consumptive assistance, Mustahik home rehabilitation and house renovation Mustahik. 3. Empowered Samarinda, Helping in terms of improving the economy of the people of Samarinda City. The Empowered Samarinda City Program is the distribution of zakat funds in the economic field. The family's economic aspirations are realized through the provision of working capital for Mustahik's productive businesses in various regions, including small and medium enterprises, fried food traders, vegetable traders, hawkers, tailors, and others. 4. Samarinda Preaching, Helping in terms of Da'wah activities and Advocacy The Samarinda City Takwa program is the distribution of zakat funds in the field of da'wah. This program distributes zakat funds to religious teachers, assistance for MDA/MDTA infrastructure, assistance for inland da'wah broadcasts and assistance for places of worship. 5. Samarinda Cares, Helps in Humanity The Samarinda City Cares program is a form of channelling zakat funds in the field of social services or channelling zakat funds through the community in a consumptive form. This program has a humanitarian commitment that is fast and responsive when there is an incident that must be handled immediately. Various disasters such as fires, floods, landslides, and other natural disasters.

The following is a table of data on the distribution of zakat funds in the city of Samarinda through the five leading BAZNAS programs for the last three years, starting from 2020 to 2022 as follows:

Table 1. Data on the distribution of zakat funds in the city of Samarinda

Distribution The current distribution of zakat can be given to several groups as follows. a. Business capital loans so that existing businesses can develop. b. Build agricultural and industrial facilities for those who do not get jobs. c. Building educational and training facilities to educate them to be skilled and to be freed from poverty.

Baznas of Samarinda city identifies the needy & and poor people referring to the standards set by the government through the BPS. The Central Statistics Agency (BPS) as a government agency that has the authority to determine poverty criteria and standards divides poverty into two types, namely relative poverty and absolute poverty. First, Relative Poverty. Relative poverty is a poor condition due to the influence of development policies that have not been able to reach all levels of society, causing inequality in income distribution. Minimum standards are set based on the living conditions of a country at a given time and attention is focused on the “poorest” population, for example, the lowest 20 per cent or 40 per cent of the total population sorted by income/expenditure. This group is a relatively poor population. Thus, the measure of relative poverty is highly dependent on the distribution of population income/expenditure.

Furthermore, Baznas Kota Samarinda also reviews poverty from the current conditions that are owned by a person or a family. The current conditions referred to by the Samarinda City Baznas are basic needs which include food intake, shelter, clothing and social conditions consisting of religious, economic or income aspects, health and social behaviour. Regarding the method used, Baznas Kota Samarinda has its path, which starts with surveying mustahik candidates while filling out the application form for zakat recipients for the poor and poor categories, then it will be determined at a joint meeting. Apart from that, the Samarinda City Baznas also make aspects of religiosity and behaviour one of the indicators considered in determining the criteria for being poor and poor. as well as making the aspect of income the main consideration. Basic needs in this context refer to a person's need for food. However, clothing and shelter needs also fall into this category.

The indicators that have been determined by Kotabaznas Samarinda will later be used to determine which people belong to the poor and poor categories. Then the existing indicators will be determined based on several variables that have the highest weight. Some of these main variables can be different for different regions, but for the Samarinda City BAZNAS area, you can see the indicators and determining variables specifically for the poor and the poor in the table from the results of the interview with Mr. Aziz as follows:

Table 2. Faqir and Poor Indicators

As explained above, several aspects are used as indicators in determining the poor and the poor, where these aspects are the adequacy limits or basic standards for the needs of a person/family coupled with the adequacy of existing dependents as an effort to determine the eligibility of mustahik zakat recipients. poor and poor according to the conditions of the city of Samarinda. In the following, the author describes as a whole in the table, what indicators are the level of adequacy of a person's life or whether a household is classified as mustahik, poor, as follows:

Table 3. Faqir and Poor Criteria

The provision of productive zakat fund assistance is further expected to break the cycle of poverty. Productivity is closely related to capital and the quality of human resources. The productivity referred to here is that after they receive productive capital assistance, the zakat recipients can produce something that has added value. In the information provided by BAZNAS, throughout 2023 there have been 30 mustahik recipients of productive zakat funds as explained by the BAZNAS distribution division in Samarinda City.

In the following, the author describes in the table the distribution of productive zakat funds in 2023 and includes a description of the business results where out of the 30 mustahik recipients of productive zakat funds, 23 experienced profits 5 were still in the progress of business development 2 experienced bankruptcy or no reports, with a success percentage of 80% after getting productive economic zakat funds as follows:

Table 4. Distribution of Productive Zakat Funds in 2023

As for the strategy of Baznas Samarinda in determining its mustahiq indicators, if it is tested based on its suitability with Maqashid al-maslahah, it can be summarized in the table as follows:

Table 5. Strategy of Baznas Samarinda in Determining its Mustahiq Indicators

1. Prioritizing the Public Benefit and Interest

This explanation is related to efforts to determine the mustahik zakat class by using certain indicators. This approach is in line with the principle of maqashid al-maslaha which prioritizes the benefit and general interest of society. With indicators such as house ownership, assets and income, it is hoped that zakat can be given to those who need it and are entitled to receive it.

2. Compatibility with Maqashid al-'Adl (Justice):

The approach to determining the class of mustahik zakat by looking at indicators of house ownership, assets and income also reflects the principle of justice (maqashid al-'adl). In this way, zakat can be more just and equitable in its distribution, so that people who are entitled to receive zakat can be identified more precisely and no party is left behind or sidelined.

3. Compatibility with Maqashid al-Hifz al-Mal (Property Maintenance):

This explanation is also related to the aspect of maintaining assets (maqashid al-hifz al-mal) in the collection and distribution of zakat. By using relevant indicators, zakat can be given to those who need it and ensure that the assets are used properly to improve the welfare and maintenance of assets for the recipients of zakat.

4. Compatibility with Maqashid al-Hifz al-Nafs (Care of the Soul):

Giving zakat to mustahik who meet basic needs indicators such as housing, property and income is also in line with maqashid al-hifz al-nafs, namely taking care of the soul. By giving zakat to those in need, it is hoped that they will be able to meet their needs for life and health properly, improve their quality of life and protect their souls from hardship and suffering.

5. Compatibility with Maqashid al-'Ilm (Development of Science):

Although not directly related to scientific aspects, this explanation can provide an overview of how a scientific approach is used in determining zakat recipients. The use of measurable and relevant indicators demonstrates efforts to collect data carefully and identify zakat recipients objectively, following the objectives of maqashid al-film, namely the development of knowledge and proper understanding of various aspects of life.

6. Compliance with Hifz al-bi'ah Environmental Care

Mahfudz added one aspect of protecting the environment (hifz al-bi'ah) in social fiqh. This is because of the importance of protecting the environment in this modern era. Protecting the environment is also following Islamic teachings which are not only concerned with relationships with God (hablun minallah), and relationships with humans (hablun minannas), but also relationships with the environment or nature (hablun minal alam). So hifz al bi'ah is something important.

Baznas of Samarinda City is also aware of the importance of protecting the environment. In Samarinda City BAZNAS efforts to always protect the environment through community empowerment activities through the productive zakat program, Banas always encourages the general public and beneficiaries of zakat funds to protect their environment and not litter and business production results do not pollute the environment, by which BAZNAS also contributes to the waste in every place productive businesses beneficiary communities in particular. From this activity, although it is not yet big, BAZNAS KOA Samarinda and its empowering community can help protect the environment from waste pollution.

CONCLUSION

Based on the results of the analysis in this study, it can be concluded that the Zakat Fund Management Strategy for Mustahik in the Perspective of Maqashid Sharia Case Studies at Baznas Kota Samarinda Prov. East Kalimantan. namely, the program is channelled into 5 programs namely: Smart Samarinda, Healthy Samarinda, Empowered Samarinda, Da'wah Samarinda, and Caring Samarinda covering the fields of Economy, Health, Education, Da'wah, and Humanity. The indicators of zakat recipients used to determine the mustahik zakat category are poor and poor, namely: a. Home ownership index/dwelling by looking at the condition of the house (roof, floor, walls), whether the family owns a house or not, the source of lighting for the residence. b. Property ownership includes assets owned by families or individuals, owned local transportation, and facilities for accessing news/information. c. Income by looking at the source of income is not more than 1,000,0000 and does not have savings/items of high value. The impact of channelling zakat funds on the welfare of mustahiq from the needy and poor in the perspective of maqashid sharia is that the distribution of zakat funds is carried out in the form of consumptive zakat funding assistance, with this program mustahik can increase income with a percentage level of success of 80 per cent (%) as evidenced by a survey by BAZNAS samarinda and information reports on the business results of mustahik who experience profits and can meet their basic needs. Mustahiq has been able to independently change the status of mustahik to munfiq or muzakki through business capital assistance and business equipment assistance that has been provided by the Samarinda City Bazas.

Acknowledgements

All authors would like to thank the editors and anonymous reviewers for their assistance in improving the quality of research documents.

Author Contribution

All authors contributed equally to the main contributor to this paper, some are as chairman, member, financier, article translator, and final editor. All authors read and approved the final paper.

Conflicts of Interest

All authors declare no conflict of interest.

References

Ab Rahman, A. (2019). Management of Zakat Institutions Based on Maqasid Sharia and Sustainable Development Goals (SDG). Journal of Fatwa Management and Research, 17(2), 42-59. https://doi.org/10.33102/jfatwa.vol0no0.282.

Achmad Beadie Busyroel Basyar. (2020). Nasab Protection in Maqashid Sharia Theory: Achmad Beadie Busyroel Basyar. MAQASHID Journal of Islamic Law, 3(1), 1–16. https://doi.org/10.35897/maqashid.v3i1.286

Adam, B. (2021). The Role of Strategic Management and Operational Management in Improving the Quality of Education. Journal of Tahdzibi: Management of Islamic Education, 3(2), 57-66. https://doi.org/10.24853/tahdzibi.3.2.57-66.

Alili, A. (2021). Maqashid Sharia Theory in Islamic Law. TERAJU: Journal of Sharia and Law, 3(02), 71 - 80. https://doi.org/10.35961/teraju.v3i02.294.

Amal, I. (2022). The Role of Zakat, Infaq, Sadaqoh and Waqf Islamic Philanthropy in Community Economic Empowerment. Journal of Community Service and Empowerment. https://doi.org/10.31219/osf.io/w84nc.

Arif, M. (2023). Fiqh al-Bi'ah: Historical Study of the Concept of Cleanliness in Classical and Contemporary Fiqh Literature. Salimiya: Journal of Islamic Religious Studies, 4(1), 22-43. https://ejournal.iaifa.ac.id/index.php/dirasah.

Bobby, M. (2023). Implementation of Maqashid Sharia on the Indonesia Smart College Card Policy (KIP-KULIAH). NUSANTARA: Journal of Social Sciences, 10(1), 217-232. http://dx.doi.org/10.31604/jips.v10i1.2023.217-232.

Cakhyaneu, A. (2018). Performance Measurement of Sharia Commercial Banks in Indonesia Based on the Sharia Maqashid Index (SMI). Amwaluna: Journal of Islamic Economics and Finance, 2(2), 154-163. https://doi.org/10.29313/amwaluna.v2i2.3753

Faujiah, S., Syaifudin, M., & Andriani, T. (2023). Implementation of Strategic Management in Educational Institutions. Journal of Information Systems Management Economics, 4(3), 641-650. https://doi.org/10.31933/jemsi.v4i3.1400.

Fitri, M. (2017). Management of Productive Zakat as an Instrument for Increasing People's Welfare. Economica: Journal of Islamic Economics, 8(1), 149–173. https://doi.org/10.21580/economica.2017.8.1.1830.

Habib, M. (2020). Implementation of Islamic Maqashid in Formulating the Objectives of Islamic Bank Financial Reports. AKTSAR: Journal of Sharia Accounting, 3(2), 177-192. http://dx.doi.org/10.21043/aktsar.v3i2.8414.

Habib, M. (2020). Implementation of Islamic Maqashid in Formulating the Objectives of Islamic Bank Financial Reports. AKTSAR: Journal of Sharia Accounting, 3(2), 177-192. http://dx.doi.org/10.21043/aktsar.v3i2.8414.

Hasyim, F., Awwal, MA-F., & al Amin, NH (2020). ZISWAF Digital Payment as An Effort to Reach Millennials. Economica: Journal of Islamic Economics, 11(2), 183–210. https://doi.org/10.21580/economica.2020.11.2.5752.

Hidayat, A., & Mukhlisin, M. (2020). Analysis of Zakat Growth in the Dompet Dhuafa Online Zakat Application. Scientific Journal of Islamic Economics, 6(3), 675. https://doi.org/10.29040/jiei.v6i3.1435.

Ikhlas Darmawan, M., Aslamatis Solekah, N. (2022). Optimization of Distribution of Zakat, Infaq, Alms (ZIS) BAZNAS Pasuruan City Against Mustahik Welfare Levels. Scientific Journal of Islamic Economics, 8(02), 1196–1204. https://doi.org/10.29040/jiei.v8i2.5287.

Iskandar, J. (2017). Implementation of Strategic Management in Madrasah Quality Improvement. Idaarah: Journal of Education Management, 1(2). https://doi.org/10.24252/idaarah.v1i2.4270.

Khairina, N., & Al-Amjad, PI (2019). Analysis of Zakat, Infaq, and Alms Management (ZIS) to Improve the Duafa Economy (Case Study at the Amil Zakat Nurul Hayat Institution, Medan Branch). At-Tawassuth: Journal of Islamic Economics, 4(01), 160-184. http://dx.doi.org/10.30829/ajei.v4i1.4091.

Kristian, M., Junaidi, H., Rusydi, M. (2022). Expansion of the Meaning of Ar-Riqob as an Effort to Optimize Zakat Distribution in Indonesia. Syntax Literate: Indonesian Scientific Journal. 7(7), 10143-10158. http://dx.doi.org/10.36418/syntax-literate.v7i7.9010.

Lexy J. Moleong, Qualitative Research Methods, (Bandung: Rosdakarya Youth, 2005). [Online]. Available: https://lib.ui.ac.id/m/detail.jsp?id=117801&lokasi=lokal.

Mansyur, Z. (2020). Implementation of Maqashid Syari'ah Asy-Syatibi Theory in Contemporary Muamalah. Jurisdiction: Journal of Law and Sharia, 11(1), 67-92. https://doi.org/10.18860/j.v11i1.7675.

Munandar, A. (2020). Strategic Management and Quality of Islamic Education. NUR EL-ISLAM: Journal of Religious Education and Social Affairs, 6(2), 73-97. https://doi.org/10.51311/nuris.v6i2.132

Munawir, M., Husnudin, I., & Kholis, N. (2022). Fundraising Strategy and Distribution of Zis Funds at LAZ Sidogiri Banyuwangi Branch. Journal of Islamic Banking, 3(1), 48-74. http://journal.iaialhikmahtuban.ac.id/index.php/JIB/article/view/347.

Musa, A., Zulfikar, T., & Khalidin, B. (2022). Digital-Based Information System of Zakat Management in Indonesia: Strategies for Increasing Revenue in Fiqh Muamalah Perspectives. Samarah: Journal of Family Law and Islamic Law, 6(2), 614. https://doi.org/10.22373/sjhk.v6i2.11960.

Muthoifin, NAK (2021). Didin Hafidhuddin Thinking about The Concept of Zakat Distribution. In Proceeding International Conference on Sharia and Legal Studies (ICSLS) (Vol. 1). [Online]. Available: https://my.ums.ac.id/media/insentif/seminar/mut122/Proceeding_Book_ICSLS_Muthoifin.pdf

Nasution, I., Annisa, F., Zuraira, T., Rahmi, A., Anggara, AB, & Gani, AA (2022). Implementation of Strategic Management in Improving Education Quality. Journal of Religious Information, Management and Strategy: Journal of Islamic Education Management (IKAMaS), 2(2), 172-179. https://ikamas.org/jurnal/index.php/ikamas/article/view/63.

Nazarudin. Strategic Management, Cet. III, (Palembang: CV. Amanah: 2020). [Online]. Available: https://www.coursehero.com/file/84708052/Buku-manajemen-strategik-digabungkanpdf/

Opan Arifudin, et al. Strategic Management Theory and Implementation, (Central Java: Pena Persada, 2020).

Purnama, A., Tanjung, H., & Ayuniyyah, Q. (2022). Analysis of the Impact of Zakat on Mustahik Welfare). Al-Infaq: Journal of Islamic Economics, 13(2), 319-337. [Online]. Available: https://www.jurnalfai-uikabogor.org/index.php/alinfaq/article/view/1346.

Qori, I. (2019). Analysis of the implementation of strategic management in improving the quality of Islamic boarding schools. MBR (Management and Business Review), 3(2), 83-94. https://doi.org/10.21067/mbr.v3i2.4605

Safarina, L. ., Mulyasa, E. ., & Koswara, N. . (2021). Managerial Strategy for Strengthening Principals in Improving Teacher Performance. Journal of Education FKIP UNMA, 7(4), 2036–2043. https://doi.org/10.31949/educatio.v7i4.125

Samsul Haidir, M., Islamic Economics and Business, F., & Sunan Kalijaga Yogyakarta, U. (2019). Revitalization of Productive Zakat Distribution as an Effort to Alleviate Poverty in the Modern Era. https://doi.org/10.18326/muqtasid.v10i1.57.

Samudra, GW, Lahmudin, MR, & Mujanah, S. (2023). Description of Implementation of Strategic Management on Performance at PT Wisang Utama Mandiri. JUMBIWIRA: Entrepreneurial Business Management Journal, 2(2), 69-77. https://doi.org/10.56910/jumbiwira.v2i2.759

Sholikhah, V. (2021). Agribusiness Economic Strategy Management in the Context of Microeconomics. LAN TABUR: Journal of Islamic Economics, 2(2), 113-129. https://doi.org/10.53515/lantabur.2021.2.2.113-129.

Syamsoni, UR, & Ismail, MS (2021). Application of Maqashid Asy-Syari‘ Ah in the Islamic Economic System. ISTIKHLAF: Journal of Sharia Economics, Banking and Management, 3(1), 80-89. https://doi.org/10.51311/istikhlaf.v3i1.295.

Syamsoni, UR, & Ismail, MS (2021). Application of Maqashid Asy-Syari‘ Ah in the Islamic Economic System. ISTIKHLAF: Journal of Sharia Economics, Banking and Management, 3(1), 80-89. https://doi.org/10.51311/istikhlaf.v3i1.295.

Tardian, A. (2019). Strategic Management of School Quality: A Case Study at SD Al Irsyad Al Islamiyyah 02 Purwokerto. Journal of Education, 7(2), 192–203. https://doi.org/10.24090/jk.v7i2.2989.

Yudhira, A. (2020). Analysis of the Effectiveness of the Distribution of Zakat, Infaq and Alms Funds at the Rumah Zakat Foundation. Values, 1(1), 1-15. https://doi.org/10.36490/value.v1i1.87.

Downloads

Submitted

Accepted

Published

Issue

Section

License

Copyright (c) 2023 Muhammad Syafry Firman, Isman, Muhammad Ammar Al-amudi, Prabu Arya Sembara

This work is licensed under a Creative Commons Attribution 4.0 International License.