Analysis of Murabahah Contracts in Financing and Their Contribution to SDGs in Sharia Financial Institutions

DOI:

https://doi.org/10.23917/profetika.v26i01.11883Keywords:

murabahah contracts, islamic financial institutions, sharia compliance, sdgs, transaction risk managementAbstract

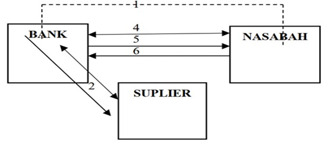

Objective: The purpose of this study is to analyze the implementation of murabahah contracts in Islamic financial institutions, focusing on the implementation mechanism, the application of sharia principles, and the challenges faced in the transaction process. This study also explores how the implementation of murabahah contracts contributes to the achievement of several Sustainable Development Goals (SDGs), particularly in promoting inclusive economic growth (SDG 8), strengthening financial institutions (SDG 16), and supporting ethical consumption and production patterns (SDG 12). Theoretical framework: The theoretical framework used in this study is based on Islamic economic principles and sharia provisions related to murabahah contracts, including the important role of cooperation with third parties such as suppliers. It is contextualized with the SDGs framework to assess the alignment between Islamic finance practices and global development goals. Literature review: A literature review is conducted through a literacy study that collects various views and previous findings regarding the practice of murabahah contracts in Islamic financial institutions. The review also includes discussions on how Islamic finance can serve as a tool for achieving SDGs, particularly in enhancing financial inclusion and responsible financing. Methods: The method used is a qualitative approach with literature studies as the main data collection technique. Results: The results of the study show that even though the murabahah contract is theoretically in line with sharia principles, in practice there are still various obstacles such as unclear costs and uncertainty between related parties. In addition, cooperation with suppliers as third parties is considered important for smooth transactions but requires strict supervision to remain in accordance with sharia rules. Effective murabahah implementation supports SDGs by ensuring equitable access to financing and enhancing trust in Islamic financial systems. Implications: The implication of this study is the need to increase sharia efficiency and compliance in the implementation of murabahah contracts, especially in the aspects of transparency and supervision of third parties. These improvements are crucial to align Islamic financial practices with SDGs, particularly in ensuring justice, accountability, and sustainable economic systems. Novelty: The novelty of this study lies in a comprehensive discussion of the strategic role of cooperation with suppliers in the implementation of murabahah contracts, which has not been studied in depth in previous studies.

References

[1] M. Iqbal, F. R. Ramadhanti, N. A. Zahra, and B. Izzah, “Synergicity of Sharia Financial Institutions and Sharia Economic Institutions in Optimizing the Potential of Productive Zakat,” Formosa J. Sci. Technol., vol. 3, no. 3, pp. 461–474, 2024, https://doi.org/10.55927/fjst.v3i3.8073.

[2] M. Ghozali and L. W. Roficoh, “Kepatuhan Syariah Akad Murabahah Dalam Konsep Pembiayaan Pada Perbankan Syariah Di Indonesia,” Jurnal Sains dan Seni ITS, vol. 6, no. 1. pp. 51–66, 2017. https://doi.org/10.1016/j.ijfatigue.2019.02.006

[3] A. Alam, Raditya Sukmana, Bayu Arie Fianto, and Azzam Izzuddin, “Comparative Analysis of Murabahah and Mudharabah Financing Risk from Islamic Microfinance Institutions Perspective,” Al-Muzara’Ah, vol. 10, no. 1, pp. 79–92, 2022, https://doi.org/10.29244/jam.10.1.79-92.

[4] A. Budiono, “Penerapan Prinsip Syariah Pada Lembaga Keuangan Syariah,” Law Justice, vol. 2, no. 1, pp. 54–65, 2017, https://doi.org/10.23917/laj.v2i1.4337.

[5] R. Syauqoti, “Aplikasi Akad Murabahah Pada Lembaga Keuangan Syariah,” J. Masharif al-Syariah J. Ekon. dan Perbank. Syariah, vol. 3, no. 1, 2018, https://doi.org/10.30651/jms.v3i1.1489.

[6] R. K. Adnina, “Analisis Penerapan Akad Pembiayaan Murabahah Pada Lembaga Keuangan Syariah,” J. Huk. dan Kenotariatan, vol. 4, no. 1, p. 104, 2020, https://doi.org/10.33474/hukeno.v4i1.6451.

[7] Muhammad Fahmul Iltiham, “Mekanisme Penentuan Margin Pembiayaan Murabahah di Lembaga Keuangan Syariah,” Malia (Terakreditasi), vol. 12, no. 1, pp. 109–124, 2020, https://doi.org/10.35891/ml.v12i1.2386.

[8] M. Marzuki and M. Marzuki, “Aktualisasi Prinsip Keadilan Pada Akad Murabahah Dalam Menetapkan Margin Keuntungan Di Lembaga Keuangan Syariah,” J. Ilm. Ekon. Islam, vol. 10, no. 1, p. 709, 2024, https://doi.org/10.29040/jiei.v10i1.11936.

[9] A. Alam, R. T. Ratnasari, N. A.-K. Makkawi, and A. Ma’ruf, “The Problem of Murabaha Financing of Islamic Microfinance Institution and The Handling Strategies in Indonesia: A Literature Review,” Al-Muzara’Ah, vol. 11, no. 1, pp. 17–30, 2023, https://doi.org/10.29244/jam.11.1.17-30.

[10] E. W. H. Budianto, “Pemetaan Penelitian Akad Mudharabah Pada Lembaga Keuangan Syariah: Studi Bibliometrik Vosviewer Dan Literature Review,” in J-EBIS (Jurnal Ekonomi dan Bisnis Islam), 2022, pp. 43–68. https://doi.org/10.32505/j-ebis.v7i1.3895.

[11] A. N. Beladiena, N. Nurhasanah, and U. Saripudin, “Analisis Nilai-Nilai Etika Bisnis Islam Terhadap Strategi Penanganan Pembiayaan Bermasalah pada Produk Akd Murabahah,” Iqtisaduna, vol. 7, no. 1. pp. 51–60, 2021.

[12] F. A. Al-Hasan, “Analisis Pelaksanaan Akad Murabahah Di Lembaga Mikro Keuangan Syariah (BMT),” 2014, pp. 1–23.

[13] M. Ikbal and C. Chaliddin, “Akad Murabahah dalam Islam,” Al-Hiwalah J. Syariah Econ. Law, vol. 1, no. 2, pp. 143–156, 2022, https://doi.org/10.47766/alhiwalah.v1i2.896.

[14] F. Melina, “Pembiayaan Murabahah Di Baitul Maal Wat Tamwil (Bmt),” J. Tabarru’ Islam. Bank. Financ., vol. 3, no. 2, pp. 269–280, 2020, https://doi.org/10.25299/jtb.2020.vol3(2).5878.

[15] M. F. Iltiham, “Mekanisme Penentuan Margin Pembiayaan Murabahah Di Lembaga Keuangan Syariah,” Malia (Terakreditasi, vol. 12, no. 1, pp. 109–24, 2020, https://doi.org/10.35891/ml.v12i1.2386.

[16] H. Rafsanjani, “Analisis Praktek Riba, Gharar, Dan Maisir Pada Asuransi Konvensional Dan Solusi Dari Asuransi Syariah,” Maqasid J. Stud. Huk. Islam, vol. 11, no. 1, pp. 2615–2622, 2022, https://doi.org/10.30651/mqsd.v11i1.14485.

[17] M. Ramli, D. Setiyawan, and N. Rahmad, “Kedudukan Ruislagh Dalam Investasi Tanah Wakaf Perspektif Maqasid Syari’ah,” Jatijajar Law Rev., vol. 1, no. 1, p. 47, 2022, https://doi.org/10.26753/jlr.v1i1.730.

[18] A. Rachman, “Dasar Hukum Kontrak (Akad) dan Implementasinya Pada Perbankan Syariah di Indonesia,” J. Ilm. Ekon. Islam, vol. 8, no. 1, p. 47, 2022, https://doi.org/10.29040/jiei.v8i1.3616.

[19] H. Zukriadi, Sulaiman, U., “Aneka Macam Penelitian,” SAMBARA J. Pengabdi. Kpd. Masy., vol. 1, no. 1, pp. 36–46, 2023, https://doi.org/10.58540/sambarapkm.v1i1.157.

[20] A. Sholikhah, “Statistik Deskriptif Dalam Penelitian Kualitatif,” KOMUNIKA J. Dakwah dan Komun., vol. 10, no. 2, pp. 342–362, 2016, https://doi.org/10.24090/komunika.v10i2.953.

[21] M. Mulyadi, “Penelitian Kuantitatif Dan Kualitatif Serta Pemikiran Dasar Menggabungkannya,” J. Stud. Komun. dan Media, vol. 15, no. 1, p. 128, 2013, https://doi.org/10.31445/jskm.2011.150106.

[22] A. A. Mekarisce, “Teknik Pemeriksaan Keabsahan Data pada Penelitian Kualitatif di Bidang Kesehatan Masyarakat,” JJurnal Ilm. Kesehat. Masy. Media Komun. Komunitas Kesehat. Masy., vol. 12, no. 3, pp. 145–151, 2020, https://doi.org/10.52022/jikm.v12i3.102.

[23] Y. S. Arief, M. Andi, and S. Maula, “Implementasi Pembayaran Denda Angsuran Keterlambatan Pembiayaan Murabahah di Perbankan Syariah ( Ditinjau dari Fatwa,” JIEI J. Ilim. Ekon. Islam, vol. 9, no. 1, pp. 1227–1236, 2023, http://dx.doi.org/10.29040/jiei.v9i1.7846.

[24] J. Arfaizar, N. Ayu, F. Riyanto, D. Selamat Muliadi, and S. Tinggi Agama Islam Yogyakarta, “Inovasi Dan Tantangan Perbankan Syariah Pada Era Digital Di Indonesia,” WADIAH J. Perbank. Syariah, vol. 7, no. 2, pp. 163–191, 2023, https://doi.org/10.30762/wadiah.v7i2.327.

[25] M. Ilyas, “Mekanisme Pembiayaan Mitraguna Berkah PNS dengan Akad Murabahah pada PT. Bank Syariah Mandiri Cabang Prabumulih,” Adl Islam. Econ., vol. 2, no. November, pp. 161–180, 2020, https://doi.org/10.56644/adl.v1i2.20.

[26] M. Ali, “Analisis praktik pemberian diskon dalam pembiayaan murabahah di bank syariah indonesia kcp indramayu jatibarang berdasarkan fatwa dsn mui no: 16/dsn-mui/ix/2000,” J. Sharia Econ. Financ., vol. 2, no. 2, pp. 88–94, 2023, https://doi.org/10.31943/jsef.v2i2.30.

[27] M. L. Istiqomah, “Penerapan Fatwa DSN MUI NO : 04 / DSN-MUI / IV / 2000 Tentang Pembiayaan Murabahah Di Lingkungan Perbankan Syariah Perspektif Maqashid Syariah,” Journal, Rechtenstudent Istiqomah, vol. 2, no. 3, pp. 242–254, 2021, https://doi.org/10.35719/rch.v2i3.68.

[28] Annas Syams Rizal Fahmi, Muhammad Irkham Firdaus, May Shinta Retnowati, and Zulfatus Sa’diah, “Implementasi Fatwa Dsn-Mui No: 77/Dsn-Mui/V/2010 Terhadap Akad Murabahah Pada Produk Cicil Emas Di Bank Syariah Mandiri,” Al-Mizan J. Huk. dan Ekon. Islam, vol. 4, no. 2, pp. 1–12, 2020, https://doi.org/10.33511/almizan.v4n2.1-12.

[29] A. Iskandar, H. Wijaya, and K. Aqbar, “Analisis Shariah Compliance Praktik Murabahah Lil Aamir Bisy-Syiraa’ pada Bank Syariah di Indonesia,” Media Syari’ah Wahana Kaji. Huk. Islam dan Pranata Sos., vol. 22, no. 2, p. 114, 2021, https://doi.org/10.22373/jms.v22i2.8029.

[30] M. S. Anam, I. Sopingi, E. N. Hanifah, and A. Murabahah, “Implementasi Akad Wadi ’ ah Dan Akad Murabahah Pada Program Gold To Baitullah Pada BSI KCP Pasuruan Balaikota,” Khozana J. Islam. Econ. Bank., vol. 9, no. 1, 2025, https://doi.org/10.69604/gkngqs88.

[31] R. J. Permata, U. Albab, and Mawardi, “Penerapan Etika Bisnis Islam Dalam Jual Beli Marketplace,” Mu’amalatuna J. Ekon. Syariah, vol. 7, no. 1, pp. 17–27, 2024, https://doi.org/10.36269/muamalatuna.v7i1.2462.

[32] M. Yunus, “Analisis Fatwa DSN-MUI terhadap Kontrak Akad Qardh Di Lembaga Keuangan Syariah (Studi Kasus pada BPRS Baiturridha Pusaka),” J. Ilm. Univ. Batanghari Jambi, vol. 21, no. 3, p. 1104, 2021, https://doi.org/10.33087/jiubj.v21i3.1641.

[33] N. L. Fatmawati and A. Hakim, “Analisis Tingkat Profitabilitas Perbankan Syariah di Indonesia,” J. BAABU AL-ILMI Ekon. dan Perbank. Syariah, vol. 5, no. 1, p. 1, 2020, https://doi.org/10.29300/ba.v5i1.3115.

[34] B. Khalidin, A. Musa, and A. Kiawan, “Murabaha Financing of the Indonesian Islamic Banks Under an Islamic Economic Law and the Fatwa Dsn Mui,” Petita J. Kaji. Ilmu Huk. dan Syariah, vol. 8, no. 2, pp. 203–218, 2023, https://doi.org/10.22373/petita.v8i2.238.

[35] B. A. Prabowo, “Konsep Akad Murabahah Pada Perbankan Syariah (Analisa Kritis Terhadap Aplikasi Konsep Akad Murabahah Di Indonesia Dan Malaysia),” J. Huk. Ius Quia Iustum, vol. 16, no. 1, pp. 106–126, 2009, https://doi.org/10.20885/iustum.vol16.iss1.art7.

[36] A. Alam, R. Sukmana, B. A. Fianto, and A. Izzuddin, “Comparative Analysis of Murabahah and Mudharabah Financing Risk from Islamic Microfinance Institutions Perspective Comparative Analysis of Murabahah and Mudharabah Financing Risk from Islamic Microfinance Institutions Perspective,” no. June, 2022, https://doi.org/10.29244/jam.10.1.79-92.

[37] A. Yuliana, N. E. Fauziah, and I. Mujahid, “Tinjauan Fatwa DSN No : 04 / DSN-MUI / IX / 2000 tentang Murabahah dan Fatwa DSN No : 13 / DSN- MUI / IX / 2000 tentang Uang Muka dalam Murabahah terhadap Pembiayaan Griya di Bank Syariah Mandiri KCP Bandung Metro Margahayu,” Pros. Huk. Ekon. Syariah, vol. 6, no. 2, 2020, http://dx.doi.org/10.29313/syariah.v6i2.22118.

[38] Irfan Harmoko, SE.I., MM, “Mekanisme Restrukturisasi Pembiayaan Pada Akad Pembiayaan Murabahah Dalam Upaya Penyelesaian Pembiayaan Bermasalah,” Qawãnïn J. Econ. Syaria Law, vol. 2, no. 2, pp. 61–80, 2018, https://doi.org/10.30762/q.v2i2.1042.

[39] J. Basri, A. K. Dewi, and G. Iswahyudi, “Pembiayaan Murabahah pada Perbankan Syariah dalam Perspektif Hukum di Indonesia,” AL-MANHAJ J. Huk. dan Pranata Sos. Islam, vol. 4, no. 2, pp. 375–380, 2022, https://doi.org/10.37680/almanhaj.v4i2.1802.

[40] A. Hanjani and D. Ari Haryati, “Mekanisme Pembiayaan Murabahah Pada Nasabah di Baitul Maal Wa Tamwil Universitas Muhammadiyah Yogyakarta,” Jati J. Akunt. Terap. Indones., vol. 1, no. 1, pp. 46–51, 2018, https://doi.org/10.18196/jati.010105.

[41] S. F. Nasution, “Pembiayaan Murabahah Pada Perbankan Syariah di Indonesia,” AT-TAWASSUTH J. Ekon. Islam, vol. 6, no. 1, p. 132, 2021, https://doi.org/10.30829/ajei.v6i1.7767.

Submitted

Accepted

Published

Issue

Section

License

Copyright (c) 2025 Haidar Ali, Muthoifin, Mariam Elbanna

This work is licensed under a Creative Commons Attribution 4.0 International License.