Unravelling the Drivers of Profitability in Pakistani Islamic Banking: An Investigation of Key Factors

DOI:

https://doi.org/10.23917/jep.v24i1.21988Keywords:

ROE, ROA, Profitability, Regression, Islamic Banks, PakistanAbstract

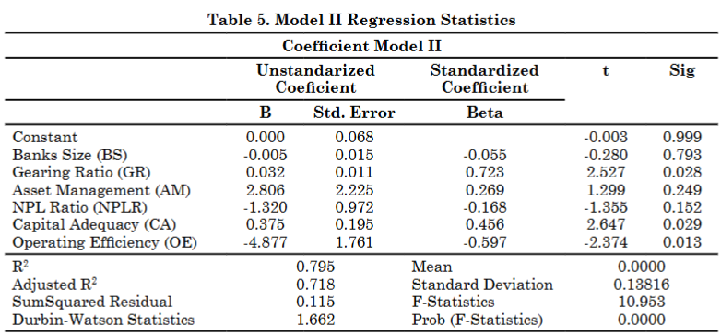

This study examines the impact of financial institution-specific profitability variables on the performance of Islamic banks in Pakistan from 2017 to 2021. The study finds a positive and statistically significant relationship between the gearing and capital adequacy ratios, with a significance level of 5% in both statistical multivariate regression models. Asset management is found to be statistically significant in model I and insignificant in model II, with a positive relationship in both cases. The bank’s size is found to have a negative and negligible relationship in all models, which may be due to the fact that most Islamic banks in Pakistan have been losing money in recent years. Additionally, as the State Bank of Pakistan tightens its prudential regulations, capital sufficiency is found to have significant correlations in both models. This study provides new information to scholars and practitioners to improve the financial and economic literature on Islamic bank profitability.

Downloads