Determinants of Devidend Policy : Evidence from Indonesian Stock Exchange

DOI:

https://doi.org/10.23917/reaksi.v9i1.2886Keywords:

Dividend policy, tax avoidance, related party transactions, intellectual capital and managerial ownershipAbstract

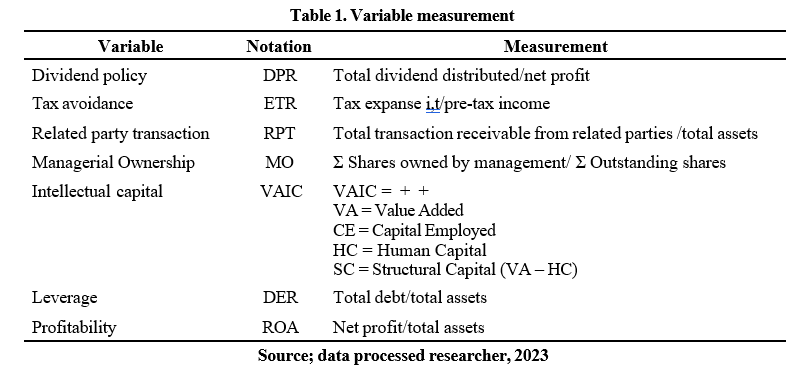

This research aims to empirically test the relationship between tax avoidance, related party transactions and intellectual capital on dividend policy. Furthermore, this research also tests managerial ownership in moderating tax avoidance, related party transactions and intellectual capital on dividend policy. This type of research is a type of quantitative research using secondary data. The population in this study are real estate companies listed on the Indonesian Stock Exchange (BEI) during 2018-2022. The sampling technique in this research used a purposive sampling technique. Analysis of research data uses moderate regression analysis. The results of this research show that (1) tax avoidance influences dividend policy, (2) related party transactions have a positive influence on dividend policy, (3) intellectual capital influences dividend policy, (4) managerial ownership weakens the relationship between tax avoidance and policy. dividends, (5) Good corporate governance can moderate and strengthen the influence of related party transactions on cash dividends, (6) moderate managerial ownership and strengthen intellectual capital on dividend policy

Submitted

Accepted

Published

Issue

Section

License

Copyright (c) 2024 Riset Akuntansi dan Keuangan Indonesia

This work is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike 4.0 International License.