Integration of Cangkal Cultural Values in Financial Literacy Education: Its Impact on Financial Attitudes, Knowledge, and Skills of Junior High School Students

DOI:

https://doi.org/10.23917/varidika.v37i2.11679Keywords:

Cangkal Cultural Values, Financial Literacy, Knowledge, Attitudes, SkillsAbstract

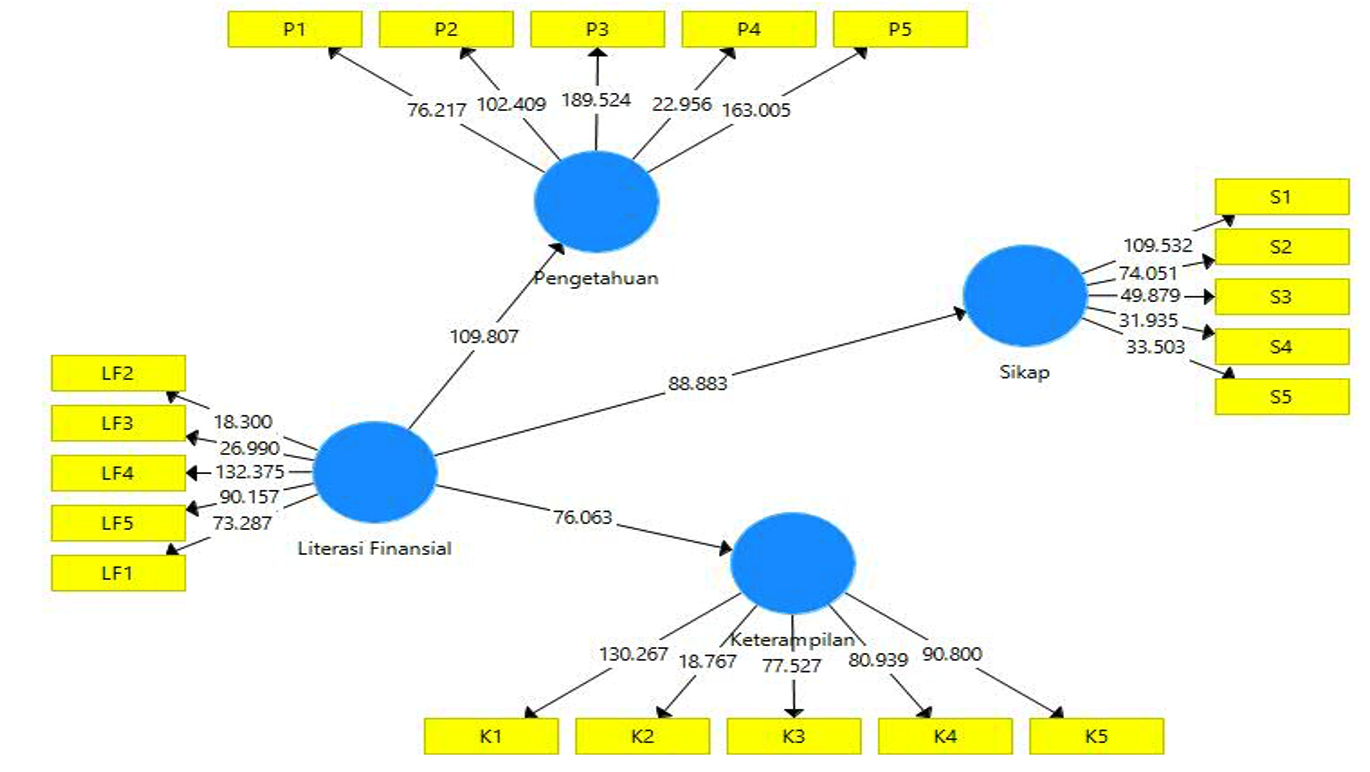

Financial literacy among students is at 23.4% and is categorized as low. This has led to increasingly high levels of consumerism and even stress. The Banjar community has a work culture known as cangkal. Cangkal refers to a persistent and diligent work ethic. Financial literacy education has an impact on students' attitudes, knowledge, and financial skills. This study aims to analyze the influence of integrating the cultural values of cangkal into financial literacy education on attitudes, knowledge, and skills. This is a quantitative study using Structural Equation Modeling-Partial Least Squares (SEM-PLS). This study was conducted in the city of Banjarmasin and Barito Kuala Regency, involving seven junior high schools with a sample size of 422 respondents from grade VII. The findings of this study are: (1) Cangkal culture has cultural values such as trust, hard work, and preference; (2) The integration of Cangkal cultural values in financial literacy education has a positive influence on attitudes, knowledge, and skills. This can be seen from the path coefficient values that are close to +1, indicating a positive and increasingly strong relationship between these variables, with results of 0.932 for knowledge, 0.921 for attitude, and 0.909 for financial skills. The conclusion of this study is that the integration of Cangkal cultural values into financial literacy has a positive influence on financial knowledge, financial attitudes, and financial skills. Further research with a different focus is expected to strengthen this study.

Downloads

References

Ahunov, M., & Van Hove, L. (2020). National Culture and Financial Literacy: International Evidence. Appl. Econ, 52(21), 2261–2279.

Akben-Selcuk, E. (2015). Factors influencing college students’ financial behaviors in Turkey: Evidence from a national survey. International Journal of Economics and Finance, 76, 87–94. https://doi.org/10.5539/ijef.v7n6p87

Ali, S. A., Aslam, S., Majeed, M. U., & Usman, M. (2024). The interplay of mental budgeting, self-control, and financial behavior: Implications for individual financial well-being. Pakistan Journal of Humanities and Social Sciences, 12(2), 1038–1049.

Anderloni, L., Bacchiocchi, E., & Vandone, D. (2012). Household financial vulnerability: An empirical analysis. Research in Economics. https://doi.org/10.1016/j.rie.2012.03.001

Bialowolski, P., Weziak-Bialowolska, D., & McNeely, E. (2021). The Role of Financial Fragility and Financial Control for Well-Being. Social Indicators Research, 155(3). https://doi.org/10.1007/s11205-021-02627-5

Böhm, P., Böhmová, G., Gazdíková, J., & Šimková, V. (2023). Determinants of Financial Literacy: Analysis of the Impact of Family and Socioeconomic Variables on Undergraduate Students in the Slovak Republic. Journal of Risk and Financial Management, 16(4), 1–20. https://doi.org/10.3390/jrfm16040252

Bosire, M., Owuor, G., Asienga, I., & Kalui, F. (2019). Personal Financial Management Practices of Secondary School Teachers in Kisii County: Kenya. Research Journal of Finance and Accounting, 10(6), 70.

Brown, M., Henchoz, C., & Spycher, T. (2018). Culture and financial literacy: Evidence from a within-country language border. Journal of Economic Behavior & Organization, 150, 62–85.

Callis, Z., Gerrans, P., Walker, D. L., & Gignac, G. E. (2023). The association between intelligence and financial literacy: A conceptual and meta-analytic review. Intelligence, 100, 101781. https://doi.org/https://doi.org/10.1016/j.intell.2023.101781

Costantini, O., & Seccareccia, M. (2020). Income Distribution, Household Debt and Growth in Modern Financialized Economies. Journal of Economic Issues. https://doi.org/10.1080/00213624.2020.1752537

Cucinelli, D., Trivellato, P., & Zenga, M. (2019). Financial Literacy: The Role of the Local Context. Journal of Consumer Affairs, 53(4), 1874–1919. https://doi.org/10.1111/joca.12270

De Los Santos-Gutiérrez, A. R. A. C. E. L. Y., Molchanova, V. S., González-Fernandez, R. O. C. Í. O., & García-Santillán, A. R. T. U. R. O. (2022). Financial Literacy, Savings Culture and Millennials Students Behavior Towards Retirement. European Journal of Contemporary Education, 11(2), 491–503.

Dewi, V. I., Febrian, E., Effendi, N., & Anwar, M. (2020). Does financial perception mediating the financial literacy on financial behavior? A study of academic community in central java island, Indonesia. ELIT–Economic Laboratory for Transition Research Dz. Washingtona, 16(4/5), 33–48.

Dwiastantii, A. (2015). Financial Literacy as the foundation for individual financial behavior. Journal of Education and Practice, 6(33), 99–105. https://eric.ed.gov/?id=EJI083664

Fachrudin, T. (n.d.). Apropriasi Budaya Suku Banjar dalam Gaya Kepemimpinan Gubernur Kalimantan Selatan Sahbirin Noor Appropriation of Banjar Ethnic Culture in Leadership Style of South Borneo Governor Named Sahbirin Noor.

Fatihah, H. C., & Anwar, M. (2023). The influence of financial attitudes on household financial behavior in labuhan village, brondong lamongan. Journal of Economics, Finance and Management Studies, 06(09). https://doi.org/10.47191/jefms/v6-i9-17

Fisch, J. E., Hasler, A., Lusardi, A., & Mottola, G. (2019). New evidence on the financial knowledge and characteristics of investors. Gflec – global financial literacy excellence center.

Hasan, A. (2014a). Prospek Pengembangan Ekonomi Syariah Di Masyarakat Banjar Kalimantan Selatan. AHKAM : Jurnal Ilmu Syariah, 14(2), 225–232. https://doi.org/10.15408/ajis.v14i2.1281

Hasan, A. (2014b). Prospek Pengembangan Ekonomi Syariah Di Masyarakat Banjar Kalimantan Selatan. AHKAM: Jurnal Ilmu Syariah, 14(2), 225–232. https://doi.org/10.15408/ajis.v14i2.1281

Hasler, A., & Lusardi, A. (2017). The gender gap in financial literacy: A global perspective. Global Financial Literacy Excellence Center. https://gflec.org/wpcontent/uploads/2017/05/The-Gender-Gap-in-Financial-Literacy-A-GlobalPerspective-Report.pdf

Holloway, K., Niazi, Z., & Rouse, R. (2017). Financial inclusion program innovations for poverty action women’s economic empowerment through financial inclusion: A review of existing evidence and remaining knowledge gaps.

Huston, S. J. (2010). Measuring financial literacy. Journal of Consumer Affairs, 44(2), 296–316.

Indefenso, E. E., & Yazon, A. D. (2020). Numeracy level, mathematics problem skills, and financial literacy. Universal Journal of Educational Research, 8(10), 4393–4399.

Julita, S., Sudarwan, & Dwi Anggoro, A. F. (2019). The Local Culture-Based Learning Model to Improve Teaching Abilities for Pre-Service Teachers. Journal of Physics: Conference Series, 1179(1), 1–5. https://doi.org/10.1088/1742-6596/1179/1/012058

Kabeer, N. (2021). Gender equality, inclusive growth, and labour markets. In Women’s Economic Empowerment: Insights from Africa and South Asia. https://doi.org/10.4324/9781003141938-3

Khalisharani, H., Johan, I. R., & Sabri, M. F. (2022). The Influence of Financial Literacy and Attitude Towards Financial Behaviour Amongst Undergraduate Students: A Cross-Country Evidence. Pertanika Journal of Social Sciences & Humanities, 30(2).

Kusumaningtyas, I. (2017). Pengaruh literasi keuangan dan gaya hidup terhadap perilaku konsumtif siswa kelas XI IPS di SMA negeri 1 Taman Sidoarjo. Jurnal Pendidikan Ekonomi (JUPE), 5(3).

Laila, V., Hadi, S., & Subanji, S. (2019). Pelaksanaan Pendidikan Literasi Finansial pada Siswa Sekolah Dasar. Jurnal Pendidikan: Teori, Penelitian, Dan Pengembangan, 4(11), 1491–1495. https://doi.org/10.17977/jptpp.v4i11.13016

Lusardi, A. (2019). Financial literacy and the need for financial education: evidence and implications. Swiss Journal of Economics and Statistics, 155(1). https://doi.org/10.1186/s41937-019-0027-5

Lusardi, A., Hasler, A., & Yakoboski, P. J. (2021). Building up financial literacy and financial resilience. Mind & Society, 20, 181–187.

Lusardi, A., Mitchell, O. S., & Oggero, N. (2020). Debt and Financial Vulnerability on the Verge of Retirement. Journal of Money, Credit and Banking, 52(5). https://doi.org/10.1111/jmcb.12671

Maslan, A., & Yaacob, N. H. (2020). Komuniti Banjar di Tanah Rantau: Ibadah haji sebagai satu dorongan tradisi Masyarakat Banjar ‘Madam Ka Banua Urang’: Banjar Community in Tanah Rantau: Hajj as a Motivation for the Banjar Community’s ‘Madam Ka Banua Urang’Tradition. Perspektif Jurnal Sains Sosial Dan Kemanusiaan, 12(1), 39–52.

Nguyen, D. T. (2017). Factors affecting financial literacy of Vietnamese adults: a case study for Hanoi and nghe an. VNU Journal of Science Economics and Business, 33(2), 59–73.

Oktaviani, R. F., Meidiyustiani, R., Qodariah, Q., & Iswati, H. (2022). Edukasi Menumbuhkan Literasi Finansial Pada Anak Usia Dini di Masa Pandemi Covid-19. ABDI MOESTOPO: Jurnal Pengabdian Pada Masyarakat, 5(2), 133–140. https://doi.org/10.32509/abdimoestopo.v5i2.1654

Parhani, I. (2016). Nilai Budaya Urang Banjar (Dalam Persfektif Teori Troompenaar). International Conference On Social and Intellectual Transformation of the Contemporary Banjarese.

Potrich, A. C., Vieira, K. M., & Paraboni, A. L. (2025). Youth financial literacy short scale: proposition and validation of a measure. Social Sciences & Humanities Open, 11, 101214.

Putro, H. P. N., Sari, R., & Handy, M. R. N. (2025). Pengembangan Bahan Ajar Berbasis Kehidupan Sosial Ekonomi Masyarakat Banjar untuk Meningkatkan Literasi Finansial Peserta Didik. Prosiding Seminar Nasional Lingkungan Lahan Basah, 10(1).

Rahayu, R., Iskandar, S., & Abidin, Y. (2022). Inovasi Pembelajaran Abad 21 Dan Penerapannya Di Indonesia. Jurnal Basicedu, 6(2), 2099–2104. https://doi.org/10.31004/Basicedu.V6i2.2082

Rahman, A., & Risman, A. (2021). Is behavior finance affected by income, learning finance and lifestyle. The EUrASEANs: Journal on Global Socio-Economic Dynamics, 4(29), 29–40.

Rahman, T., Hafidzi, A., & Hanafiah, M. (2023). Tradisi Pengurangan Harga Jual Dalam Kearifan Lokal Masyarakat Banjar (Studi Kasus Masyarakat Banjar Bumi Mas). Indonesian Journal of Islamic Jurisprudence, Economic and Legal Theory, 1(4), 823–831.

Rai, K., Dua, S., & Yadav, M. (2019). Association of financial attitude, financial behaviour and financial knowledge towards financial literacy: A structural equation modeling approach. FIIB Business Review, 8, 51–60. https://doi.org/10.1177/2319714519826651

Retnawati, H. (2016). Analisis Kuantitatif Instrumen Penelitian. Parama Publishing.

Setiawan, M., Effendi, N., Santoso, T., Dewi, V. I., & Sapulette, M. S. (2020). Digital financial literacy, current behavior of saving and spending and its future foresight. Economics of Innovation and New Technology, 31(5), 1–19.

Sleeper, M., Matthews, T., O’Leary, K., Turner, A., Woelfer, J. P., Shelton, M., Oplinger, A., Schou, A., & Consolvo, S. (2019). Tough times at transitional homeless shelters: Considering the impact of financial insecurity on digital security and privacy. Conference on Human Factors in Computing Systems - Proceedings. https://doi.org/10.1145/3290605.3300319

Sugiarto, & Farid, A. (2023). Literasi Digital Sebagai Jalan Penguatan Pendidikan Karakter Di Era Society 5.0. Cetta: Jurnal Ilmu Pendidikan, 6(3), 580–597.

Susilowati, N., Kardiyem, K., & Latifah, L. (2020). The mediating role of attitude toward money on students’ financial literacy and financial behavior. JABE - Journal of Accounting and Business Education, 4, 58–68.

Syafitri, A. A. (2024). Literasi Keuangan Sebagai Usaha Untuk Mencapai Financial Well Being: Sebuah Perspektif Dari Generasi Z. Dialektika: Jurnal Ekonomi Dan Ilmu Sosial, 9(1), 136–148.

Tejada-Peña, E., Molchanova, V. S., & García-Santillán, A. (2023a). Financial Literacy on College Students in the Context of Tuxtepec, Oax. European Journal of Contemporary Education, 12(1), 221–229. https://doi.org/10.13187/ejced.2023.1.22

Tejada-Peña, E., Molchanova, V. S., & García-Santillán, A. (2023b). Financial Literacy on College Students in the Context of Tuxtepec, Oax. European Journal of Contemporary Education, 12(1), 221–229. https://doi.org/10.13187/ejced.2023.1.221

Van Nguyen, H., Ha, G. H., Nguyen, D. N., Doan, A. H., & Phan, H. T. (2022). Understanding financial literacy and associated factors among adult population in a low-middle income country. Heliyon, 8(6).

Wagner, J., & Walstad, W. B. (2019). The effects of financial education on short-term and long-term financial behaviors. Journal of Consumer Affairs, 53(1), 234–259. https://doi.org/10.1111/joca.12210

Widada, W., Herawaty, D., & Lubis, A. N. M. T. (2018). Realistic mathematics learning based on the ethnomathematics in Bengkulu to improve students’ cognitive level. Journal of Physics: Conference Series, 1088, 1–8. https://doi.org/10.1088/1742-6596/1088/1/012028

Downloads

Submitted

Accepted

Published

Issue

Section

License

Copyright (c) 2025 Raihanah Sari, Sutarto Hadi, Ananda Setiawan, Herry Porda Nugroho Putro, Ersis Warmansyah Abbas, Rochgiyanti

This work is licensed under a Creative Commons Attribution 4.0 International License.