Mobile Payment in Overspending Behavior with Gender as a Moderating Variable: Empirical Evidence from Gen Z

DOI:

https://doi.org/10.23917/sosial.v5i1.3794Keywords:

mobile payment, gender, overspending behaviorAbstract

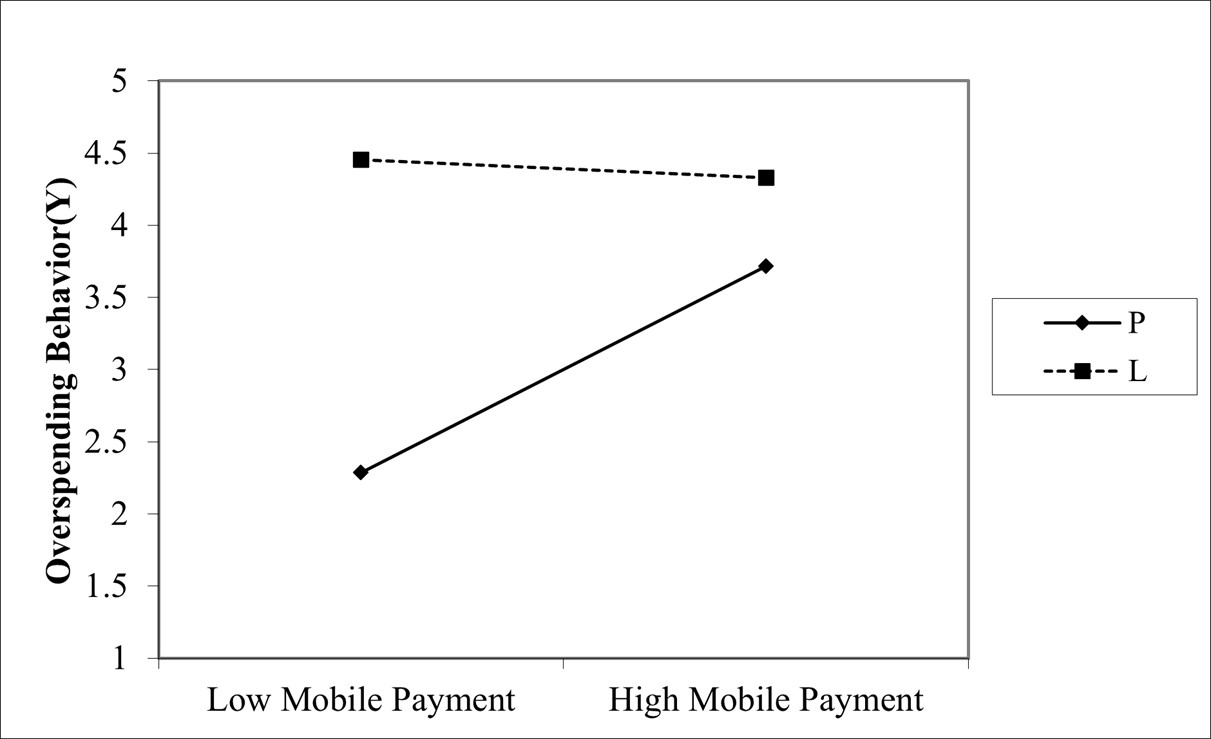

The exploration of the impact of mobile payment integration on consumer behavior represents a compelling avenue of inquiry within scholarly discourse. Despite the burgeoning adoption rates of mobile payment systems, empirical research delineating its ramifications on consumer spending tendencies, particularly in terms of propensity towards overspending, remains relatively sparse. Mobile payment platforms offer unparalleled convenience, facilitating transactions across diverse contexts, yet potentially precipitating a surge in consumer expenditure. This study endeavors to elucidate the intricate relationship between mobile payment usage and tendencies towards overspending, with a particular focus on Generation Z, a cohort known for its digital fluency and proclivity towards embracing technological innovations. Employing a quantitative research methodology, structural equation modeling (SEM) is employed to dissect the nuanced impact of mobile payment adoption on consumer behavior. Drawing upon a sample of 105 Generation Z respondents, data collection was conducted online via Google Forms disseminated through various social media platforms to ensure a diverse and representative sample. Furthermore, this inquiry investigates the moderating role of gender in shaping the nexus between mobile payment utilization and overspending behavior, seeking to discern potential gender-based disparities in consumer spending patterns engendered by mobile payment adoption. The findings underscore a significant positive association between mobile payment usage and proclivities towards overspending, indicating that heightened engagement with mobile payment platforms correlates with increased consumer expenditure tendencies. Moreover, gender emerges as a salient moderator in this relationship, with females exhibiting a heightened susceptibility to consumer behavior relative to their male counterparts.

Downloads

References

Achtziger, A. (2022). Overspending, debt, and poverty. Current Opinion in Psychology, 46, 101342.

Agarwal, S., Ghosh, P., Li, J., & Ruan, T. (2019). Digital payments induce over-spending: Evidence from the 2016 demonetization in India. Unpublished Manuscript.

Ahn, S. Y., & Nam, Y. (2022). Does mobile payment use lead to overspending? The moderating role of financial knowledge. Computers in Human Behavior, 134, 107319.

Alhaimer, R. (2022). Fluctuating attitudes and behaviors of customers toward online shopping in times of emergency: The case of Kuwait during the COVID-19 pandemic. Journal of Internet Commerce, 21(1), 26–50.

Arya, A. (2022). Gen Z: be the next thing gen Z loves. Pinterest Research. https://business.pinterest.com/ko/insights/why-gen-z-loves-new-products/

Asrori. (2020). Amil behavior utilizing productive zakat for alleviate poverty and empowerment of mustahiq to become muzakk in central java indonesia. International Journal of Business and Management Science, 10(2), 203–216. https://api.elsevier.com/content/abstract/scopus_id/85103080999

Bank Indonesia. (2021). Penggunaan Mobile Payment.

Boden, J., Maier, E., & Wilken, R. (2020). The effect of credit card versus mobile payment on convenience and consumers’ willingness to pay. Journal of Retailing and Consumer Services, 52, 101910.

Chen, C.-C. B., Chen, H., & Wang, Y.-C. (2022). Cash, credit card, or mobile? Examining customer payment preferences at chain restaurants in Taiwan. Journal of Foodservice Business Research, 25(2), 148–167.

Dahlberg, T., Guo, J., & Ondrus, J. (2015). A critical review of mobile payment research. Electronic Commerce Research and Applications, 14(5), 265–284.

Dalkilic, N., & Kirkbesoglu, E. (2015). The role of financial literacy on the development of insurance awareness. International Journal of Economics and Finance, 7(8), 272–280.

Davis, R., Lang, B., & San Diego, J. (2014). How gender affects the relationship between hedonic shopping motivation and purchase intentions? Journal of Consumer Behaviour, 13(1), 18–30.

Dian Chrisnawati, S. M. A. (2011). FAKTOR-FAKTOR YANG MEMPENGARUHI PERILAKU KONSUMTIF REMAJA TERHADAP PAKAIAN. Jurnal Spirits, 2(1), 14. https://www.bing.com/ck/a?!&&p=6e514578273491a4JmltdHM9MTY3NjMzMjgwMCZpZ3VpZD0yMWZjZTNmZi0xM2I2LTYwZWMtMTkzYi1mMmI4MTJlMDYxMmYmaW5zaWQ9NTE0Ng&ptn=3&hsh=3&fclid=21fce3ff-13b6-60ec-193b-f2b812e0612f&psq=Dian+Chrisnawati+dan+Sri+Muliati+Abdullah%2C+%22Faktor

Dittmar, H., Long, K., & Meek, R. (2004). Buying on the Internet: Gender differences in on-line and conventional buying motivations. Sex Roles, 50(5/6), 423–444.

Dzogbenuku, R. K., Amoako, G. K., Kumi, D. K., & Bonsu, G. A. (2022). Digital payments and financial wellbeing of the rural poor: The moderating role of age and gender. Journal of International Consumer Marketing, 34(2), 113–136.

Faber, R. J., & O’guinn, T. C. (1992). A clinical screener for compulsive buying. Journal of Consumer Research, 19(3), 459–469.

Faqih, K. M. S., & Jaradat, M.-I. R. M. (2015). Assessing the moderating effect of gender differences and individualism-collectivism at individual-level on the adoption of mobile commerce technology: TAM3 perspective. Journal of Retailing and Consumer Services, 22, 37–52.

Frame, W. S., Wall, L. D., & White, L. J. (2018). Technological change and financial innovation in banking: Some implications for fintech. Available at SSRN 3261732.

Gazali, H. (2021). Islam Untuk Gen Z: Mengajarkan Islam, Mendidik Muslim Generasi Z: Panduan Bagi Guru PAI.

Gosal, M. A., & Linawati, N. (2018). Pengaruh Intensitas Penggunaan Layanan Mobile Payment terhadap Spending Behavior. Petra Christian University.

Hair, J. F. (2009). Multivariate data analysis.

Humaira, I., & Sagoro, E. M. (2018). Pengaruh pengetahuan keuangan, sikap keuangan, dan kepribadian terhadap perilaku manajemen keuangan pada pelaku UMKM sentra kerajinan batik KABUPATEN BANTUL. Nominal: Barometer Riset Akuntansi Dan Manajemen, 7(1), 96–110.

Jin, H. (2022). The effect of overspending on tariff choices and customer churn: Evidence from mobile plan choices. Journal of Retailing and Consumer Services, 66, 102914.

Jung, J.-H., Kwon, E., & Kim, D. H. (2020). Mobile payment service usage: US consumers’ motivations and intentions. Computers in Human Behavior Reports, 1, 100008.

Lee, S. K. (2019). Fintech nudges: Overspending messages and personal finance management. NYU Stern School of Business.

Lee, Y.-K. (2022). Higher innovativeness, lower technostress?: comparative study of determinants on FinTech usage behavior between Korean and Chinese Gen Z consumers. Asia Pacific Journal of Marketing and Logistics, ahead-of-p(ahead-of-print). https://doi.org/10.1108/APJML-05-2022-0402

Liébana-Cabanillas, F., Sánchez-Fernández, J., & Muñoz-Leiva, F. (2014). Antecedents of the adoption of the new mobile payment systems: The moderating effect of age. Computers in Human Behavior, 35, 464–478.

Lusardi, A., de Bassa Scheresberg, C., & Avery, M. (2018). Millennial mobile payment users: a look into their personal finances and financial behaviors. GFLEC Insights Report Https://Gflec. Org/Wp-Content/Uploads/2018/04/GFLEC-Insight-Report-Millennial-Mobile-Payment-Users-Final. Pdf.

Manshad, M. S., & Brannon, D. (2021). Haptic-payment: Exploring vibration feedback as a means of reducing overspending in mobile payment. Journal of Business Research, 122, 88–96.

Meyll, T., & Walter, A. (2019). Tapping and waving to debt: Mobile payments and credit card behavior. Finance Research Letters, 28, 381–387. https://doi.org/10.1016/j.frl.2018.06.009

Mubarokah, S., & Rita, M. R. (2020). Anteseden perilaku konsumtif generasi milenial: Peran gender sebagai pemoderasi. International Journal of Social Science and Business, 4(2), 211–220.

Mueller, A., Claes, L., Mitchell, J. E., Faber, R. J., Fischer, J., & de Zwaan, M. (2011). Does compulsive buying differ between male and female students? Personality and Individual Differences, 50(8), 1309–1312.

Nazaripour, M., & Rahmani, F. (2022). The Role of Mental Accounting in Controlling the Household Overspending Behavior. New Marketing Research Journal, 12(3), 177–200.

Nguyen, Q. (2016). Linking loss aversion and present bias with overspending behavior of tourists: Insights from a lab-in-the-field experiment. Tourism Management, 54, 152–159.

Panos, G. A., & Wilson, J. O. S. (2020). Financial literacy and responsible finance in the FinTech era: capabilities and challenges. In The European Journal of Finance (Vol. 26, Issues 4–5, pp. 297–301). Taylor & Francis.

Robb, C. (2009). Effect of personal financial knowledge on college students’ credit card behavior. Journal of Financial Counseling and Planning, 20(1), 25–43. https://api.elsevier.com/content/abstract/scopus_id/78649921569

Slade, E. L., Dwivedi, Y. K., Piercy, N. C., & Williams, M. D. (2015). Modeling consumers’ adoption intentions of remote mobile payments in the United Kingdom: extending UTAUT with innovativeness, risk, and trust. Psychology & Marketing, 32(8), 860–873.

Soviati. (2022). Perilaku Konsumtif Pembawa Petaka Di Era Modern. Kementrian Keuangan Republik Indonesia. https://www.djkn.kemenkeu.go.id/kpknl-bandung/baca-artikel/15276/Perilaku-Konsumtif-Pembawa-Petaka-Di-Era-Modern.html

Sugiyono. (2013). Metode penelitian pendidikan pendekatan kuantitatif, kualitatif dan R&D.

Sui, L., Sun, L., & Geyfman, V. (2021). An assessment of the effects of mental accounting on overspending behaviour: An empirical study. International Journal of Consumer Studies, 45(2), 221–234. https://doi.org/10.1111/ijcs.12613

Taylor, E. (2016). Mobile payment technologies in retail: a review of potential benefits and risks. International Journal of Retail & Distribution Management.

Venkatesh, V., Thong, J. Y. L., & Xu, X. (2012). Consumer acceptance and use of information technology: extending the unified theory of acceptance and use of technology. MIS Quarterly, 157–178.

Wall, L. (2018). Technological Change and Financial Innovation in Banking : Some Implications for Fintech W . Scott Frame , Larry Wall , and Lawrence J . White Working Paper 2018-11 October 2018.

Widiyati, S., Listyani, T. T., & Rois, M. (2022). Studi Tentang Korelasi Antara Preferensi Pembayaran Dengan Variabel Sosial Demografi. Keunis, 10(1), 22–32.

Yang, W., Vatsa, P., Ma, W., & Zheng, H. (2023). Does mobile payment adoption really increase online shopping expenditure in China: A gender-differential analysis. Economic Analysis and Policy, 77, 99–110. https://doi.org/https://doi.org/10.1016/j.eap.2022.11.001

Yoo, J. H., & Fisher, P. J. (2017). Mobile Financial Technology and Consumers ’ Financial Capability in the United States. Journal Of Educaion & Social Policy, 7(1), 80–93.

Young, S., & Nam, Y. (2022). Computers in Human Behavior Does mobile payment use lead to overspending ? The moderating role of financial knowledge. Computers in Human Behavior, 134(September 2021), 107319. https://doi.org/10.1016/j.chb.2022.107319

Zhang, H. (2022). Where did my money go? A practical investigation towards users’ overspending behavior on online payment solution.

Downloads

Submitted

Accepted

Published

Issue

Section

License

Copyright (c) 2024 Hasbi

This work is licensed under a Creative Commons Attribution 4.0 International License.