CEO Narcissism and Corporate Tax Avoidance: Testing The Moderating Role of ESG

DOI:

https://doi.org/10.23917/reaksi.v9i2.8610Keywords:

CEO narcissism, Board gender diversity, Capital Intensity, ESG, Corporate tax avoidanceAbstract

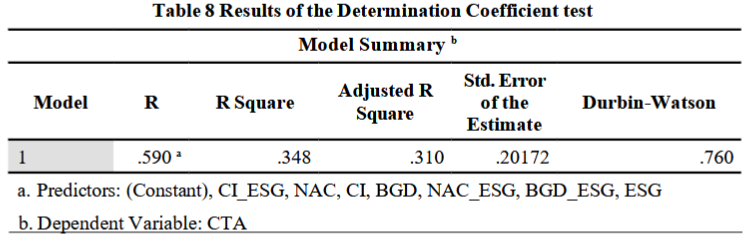

Examining the effects of capital intensity, board gender diversity, and CEO narcissism on company tax avoidance with ESG acting as a moderating factor is the aim of this study. Companies that manufacture food and beverages that are listed on the Indonesia Stock Exchange (IDX) for the years 2017–2023 make up the research population. Purposive sampling techniques were used to pick 126 companies for the sample. The research methodology used in this study is quantitative, and linear regression is used to examine the data. The findings show that CEO narcissism has a positive but insignificant effect on corporate tax avoidance, while board gender diversity has a significant positive effect. In contrast, capital intensity does not show a significant effect. However, ESG significantly moderates the relationship between CEO narcissism and board gender diversity with corporate tax avoidance, but not with capital intensity. In conclusion, ESG can reduce the tendency for tax avoidance in companies with more gender-diverse boards and those led by narcissistic CEOs.

Submitted

Accepted

Published

Issue

Section

License

Copyright (c) 2025 Riset Akuntansi dan Keuangan Indonesia

This work is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike 4.0 International License.