Extending of TAM Model in E-Filing Adoption

DOI:

https://doi.org/10.23917/reaksi.v10i1.8357Keywords:

TAM, E-Filing, Attitude, Risk, Intention, AdoptionAbstract

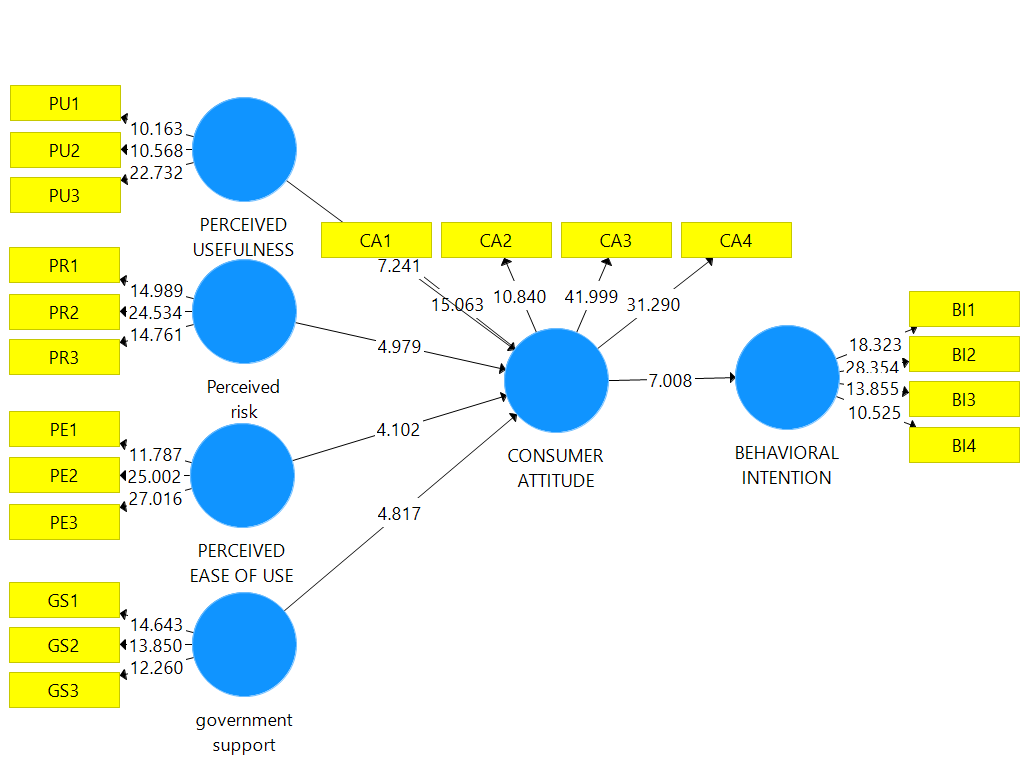

Digitalization and modernization supported by the development of the internet provide important value for the tax sector and taxpayers. This not only affects awareness and compliance but also its relevance to state revenue. Therefore, commitment to the adoption of e-filing is important. The purpose of this research is to examine the effect of taxpayer attitudes on e-filing adoption intentions using an extended TAM theoretical model by adding variables of perceived risk and government support. The novelty of this research is the expansion of the TAM model by adding these variables, especially for the government support variable which is still rarely done in poor developing countries, while government support is important to support e-filing regulations. The research involved 300 taxpayers with SEM-PLS analysis tools. The results show that all hypotheses are proven so that it is in the interest of competent parties to build a positive attitude of taxpayers towards e-filing which affects the intention to adopt e-filing. This confirms that the adoption of e-filing has an influence on tax revenue. On the one hand, limitations in the scope of respondents and observation settings are an opportunity for further research expansion so that it can provide better generalization of results.

Submitted

Accepted

Published

Issue

Section

License

Copyright (c) 2025 Riset Akuntansi dan Keuangan Indonesia

This work is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike 4.0 International License.