Potential Confusion Between Value Investing and Fundamental Analysis Explored Through Piotroski F-Score

DOI:

https://doi.org/10.23917/reaksi.v9i3.6937Keywords:

Value Investing, Fundamental Analysis, Piotroski f-score, ConfusionAbstract

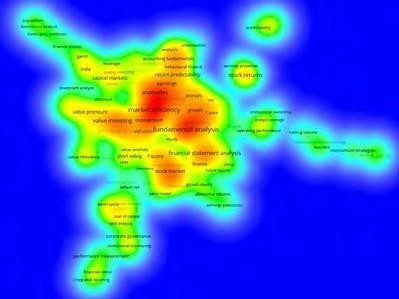

This article addresses the potential confusion between fundamental analysis (FA) and value investing (VI) in stock analysis, particularly highlighting the over-reliance on financial ratios that can obscure their distinctions. It examines the role of the f-score, developed by Piotroski (2000) as a VI indicator, which is frequently misinterpreted within the context of FA. By analyzing its utilization in academic literature, the study examines to clarify how the f-score should be understood as a value investing tool and contribute to a clearer framework distinguishing the two approaches, thereby enhancing future research and educational efforts. This article employs bibliometric analysis. Our study finds that while the f-score is frequently associated with FA metrics, its intended purpose as a measure of VI more relevant. Additionally, we categorize value investing indicators into Single Value Investing Indicators (SVII) and Combined Value Investing Indicators (CVII), building upon the foundational works of Graham & Dodd (1934) and Lakonishok et al (1994). The findings suggest that Piotroski's f-score is more appropriately classified as a CVII and more effective in predicting abnormal returns when used within the value investing framework rather than fundamental analysis.

Submitted

Accepted

Published

Issue

Section

License

Copyright (c) 2025 Riset Akuntansi dan Keuangan Indonesia

This work is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike 4.0 International License.