The Role of Digital Technology Self-Efficacy and Digital Technostress on Intention to Use FinTech: A Study on MSMEs in Surakarta City

DOI:

https://doi.org/10.23917/reaksi.v8i3.3820Keywords:

FinTech, Technostress, Digital Technology Self Efficacy, MSMEs, SurakartaAbstract

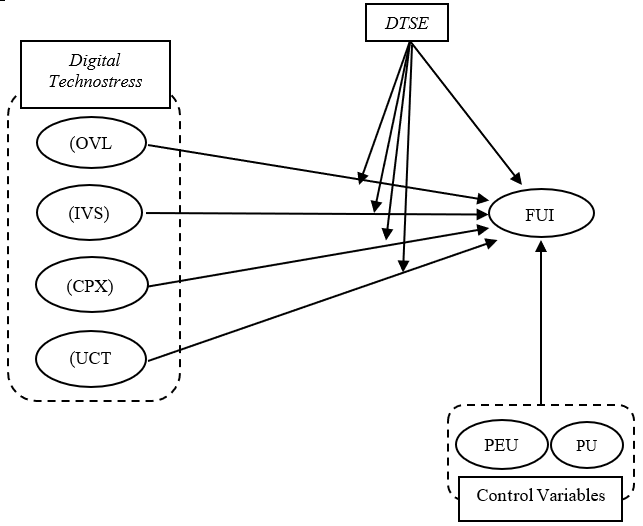

This research aims to investigate the role of Digital Technology Self Efficacy and Digital Technostress on the intention to use FinTech among Micro, Small, and Medium Enterprises (MSMEs) in Surakarta City. This research uses a questionnaire survey with the criteria for respondents being MSMEs in any field that provides FinTech options for transactions in the city of Surakarta. After obtaining a final sample of 138 MSMEs in Surakarta City, analysis was then carried out using SEM-PLS with the help of the Warp-PLS analysis tool. The research results show that even though all Technostress constructs such as overload, invasion, complexity, and uncertainty do not influence the intention to use FinTech among MSMEs in Surakarta City. However, Digital Technology Self-Efficacy can increase the intention to use FinTech among MSMEs in Surakarta City and can reduce the negative impact of the relationship between Digital Technostress and the intention to use FinTech among MSMEs in Surakarta City. The results of this research can be input for innovators and policymakers to make FinTech applications easier to use and inclusive so that MSMEs will continue to use FinTech and ultimately can participate in supporting sustainable development.

Keywords: FinTech, Technostress, Digital Technology Self Efficacy, MSMEs, Surakarta.

Submitted

Accepted

Published

Issue

Section

License

Copyright (c) 2024 Riset Akuntansi dan Keuangan Indonesia

This work is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike 4.0 International License.