Profitability As a Moderator: Assessing The Influence of Capital Structure, Investment Decision and Firm Size on Firm Value

DOI:

https://doi.org/10.23917/reaksi.v9i1.4044Keywords:

Capital Structure, Firm Size, Firm Value, Investment Decisions, ProfitabilityAbstract

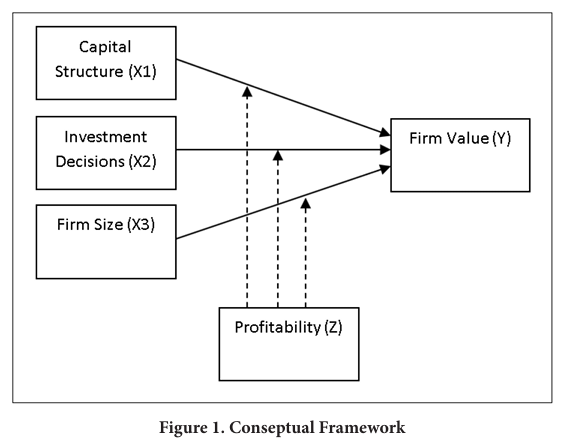

The purpose of this study is to determine whether capital structure, investment decisions, and firm size have an impact on firm value by examining profitability as a moderating factor. A quantitative methodology is used in this study. The population used in this study are companies listed on the Indonesia Stock Exchange through the website www.idx.co.id Jakarta Islamic Index 70 company in the 2019-2022 period.This study uses panel data regression model analysis.Within this research, STATA 17 version was used, also Breusch and Pagan Lagrangian is used to test the ordinary least square model versus random effect model regression.Meanwhile, Chow test is used to test ordinary least square model regression versus fixed effect model and Hausman test is used to find the most suitable panel data regression model between fixed effect model and random effect model.The results of this study indicate that capital structure affects firm value, investment decisions and firm size have no effect on firm value, profitability is able to moderate the effect of capital structure and investment decisions on firm value, while profitability is unable to moderate firm size on firm value.

Submitted

Accepted

Published

Issue

Section

License

Copyright (c) 2024 Riset Akuntansi dan Keuangan Indonesia

This work is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike 4.0 International License.