Behavioral Accounting Review For Non-Performing Customer Reporting : Case Baitul Maal Wattamwil

DOI:

https://doi.org/10.23917/reaksi.v9i1.3839Keywords:

Behavioral Accounting Research, BMT, Non-Performing Financing, Reporting, Islamic AccountingAbstract

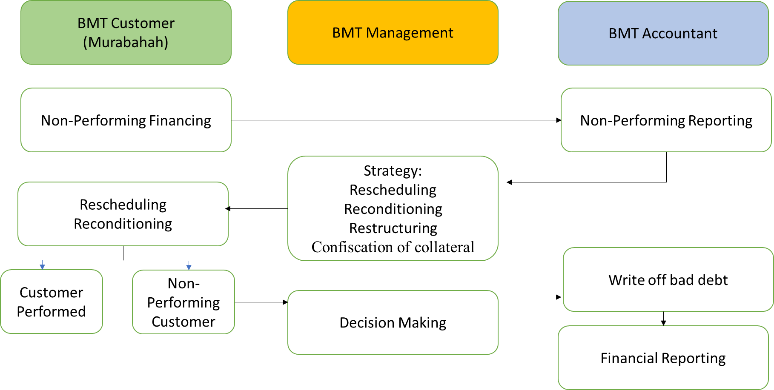

The challenge of BMT development is the elevated Non-Performing Financing (NPF) level. This study aims to investigate how BMT addresses this NPF challenge by utilizing interview techniques and conducting content analysis through qualitative methods, all from a behavioral accounting perspective. The specific BMT under examination operates within the West Java region. The research findings reveal that measures have been taken to prevent the occurrence of high Non-Performing Loans (NPLs), and the roles played by BMT's management and accountants in reporting have been instrumental, particularly in decision-making.The NPF Customer reporting is a form of BMT management responsibility to stakeholders. An intriguing discovery is that BMT must effectively leverage its social functions to mitigate the risk of high NPF.

Submitted

Accepted

Published

Issue

Section

License

Copyright (c) 2024 Riset Akuntansi dan Keuangan Indonesia

This work is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike 4.0 International License.