Tax Avoidance : Do Foreign Interests Have a Role?

DOI:

https://doi.org/10.23917/reaksi.v9i1.3636Keywords:

tax avoidance, foreign ownership, foreign board of commissioner, foreign board of directorAbstract

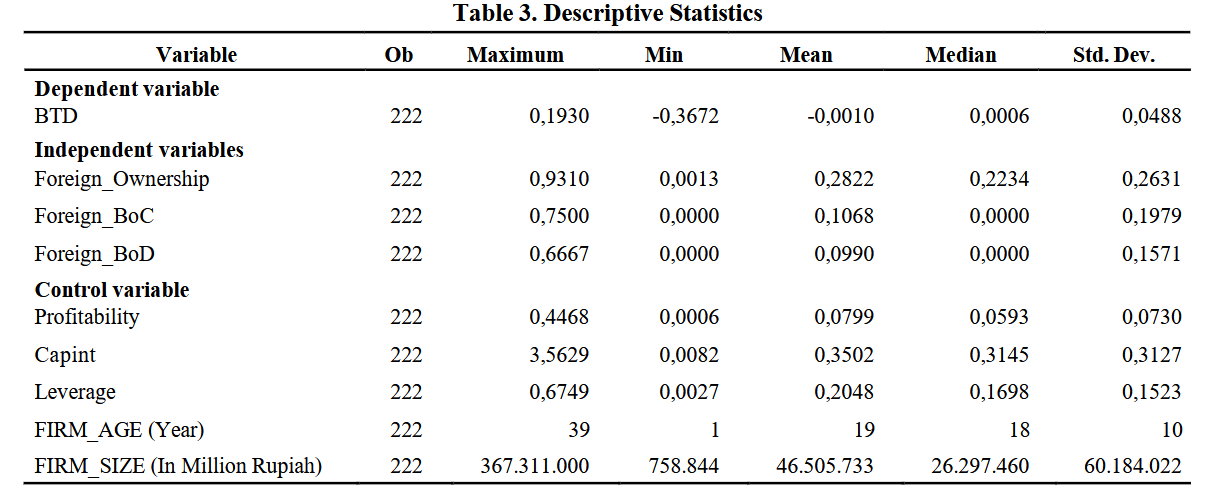

FDI may have beneficial effects on economic development. On the other hand, the presence of foreign investment leads to foreign interest, which has the potential to minimize tax burden by exploiting cross-border tax policy discretion. This study examines the influence of foreign interest on the tax avoidance practices of firms in Indonesia. This is quantitative research using a sample of firms listed in the IDX80 index with a financial reporting period of 2018-2021. The results of this study indicate that foreign ownership has a positive effect on tax avoidance. Meanwhile, the number of foreign commissioners and the number of foreign directors does not affect tax avoidance. Apart from contributing to the theory, this study is also a concern for the DGT in anticipating the risk of tax avoidance by foreign capital firms.

Keywords: tax avoidance, foreign ownership, foreign board of commissioner, foreign board of director

Submitted

Accepted

Published

Issue

Section

License

Copyright (c) 2024 Riset Akuntansi dan Keuangan Indonesia

This work is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike 4.0 International License.