Family and Politics to Related Party Transaction in Indonesia’s Mining Companies: Does Corporate Governance Matter?

DOI:

https://doi.org/10.23917/reaksi.v8i2.2902Keywords:

RPT; family ownership; political connections; corporate governance; audit quality; profitability; company age; company size.Abstract

This study discusses the influence of family ownership and political connections on related party transactions with corporate governance variables as a moderating variable in mining companies listed on the Indonesia Stock Exchange for the 2016-2020 period. This study uses audit quality, firm age, profitability and firm size as control variables. This type of research is quantitative research. The data used is secondary data using purposive sampling. This study uses the Eviews test tool and uses the random effect model and Moderated Regression Analysis (MRA). The results of the study show that family ownership and political connections have an effect on related party transactions. Furthermore, corporate governance weakens the influence of family ownership and political connections on related party transactions.

Introduction

Disclosure of financial reports regarding complete and transparent information is needed so as not to cause wrong interpretation (Agoes & Ardana, 2009). One of the information presented in the report corporate finance is information about related party transactions or related party transactions(RPT). In Indonesia, according to the statement of financial accounting standards (PSAK) number 7 of 2014 concerning disclosure of related parties. Parties are considered related when one party has the ability to control the other party or has significant influence over the other party in making financial and operational decisions. Knowledge of the entity's transactions, outstanding balances, including commitments, and relationships with related parties can influence the assessment of its operations by users of financial statements, including the assessment of risks and opportunities faced by the entity (IAS 24) .

Kang, Lee, Lee & Park (2014) stated that related party transactions are transfers of resources, services, or obligations from the reporting entity to related parties, which usually refer to executives, boards of directors, and major shareholders. Moscairello (2011) states that related party transactions are used by related parties as an efficient tool for internal transactions within the company . Kohlbeck & Mayhew (2010) stated that related party transactions can categorized as a related party transaction detrimental (abusive related party transaction) and profitable (efficient related party transaction )

In Indonesia with a concentrated ownership pattern and the main owner The dominant (ultimate control ) is family (Arifin, 2003) . Previous research in Indonesia found that related party transactions are in line with family ownership (Barokah, 2013; Dyanty et al 2013, Nuritomo, 2020; Ernawati & Aryani; 2019) and concentrated ownership (Apriani, 2015; Utama; 2015). Claessen et al. (1999) found that more than 50% of companies in Indonesia are controlled by families. According to a 2014 Price Waterhouse Cooper (PWC) survey, more than 95% of companies in Indonesia are family businesses. In family firms, greater agency conflicts occur between majority shareholders and minority shareholders (Chen, Cheung, Stouraitis, & Wong, 2005).

Sanchez (2016) stated that family ownership can add to the value of the company. Maury (2006) reports that family-owned firms increase firm profitability, and the legal environment protects the interests of minority shareholders. Cheng (2014) stated that the founding family cares about the family's reputation. Furthermore, Barokah (2013) stated that related party transactions family companies have benefits and are more transparent in disclosing related party transactions in order to maintain their reputation. Likewise, Nuritomo (2020) in his research found that the higher the family ownership, the lower the positive influence of the shareholder tax burden on related party transactions because they have to maintain a big name or avoid tax problems in the future.

Hu et al (2012) state that information is owned by family ownership as a controlling shareholder as a means carry out expropriation which is detrimental to minority shareholders. Kohlbeck et al (2018) provide evidence that family firms use their power to benefit from minority shareholders. Berto (2019) found ownership was reported to have a positive effect on tunneling. That is, the more concentrated the shareholders are in accordance with indications of expropriation. Likewise Abdullatif et al (2019) stated thatcompanies with high concentration of ownership can use RPT in tunneling activities to take over funds to dominant shareholders. Mohammed (2019) and Dyanty et al (2013) which state that related party transactions will get stronger with family ownership. Chee yoong et al (2015) examined Malaysian companies using panel data stating that related party transactions in family firms reduces the value of the firm, expropriation through related party transactions is stronger in family companies compared to non-family companies. Azim a et al (2018) examines the main shareholders of companies owned by Pakistani families who take over resources through related party transactions. The results of the study concluded that there is a relationship between the concentration of family shareholders and the exploitation of the interests of minority shareholders.

related party transaction activities with political connections to get protection in these activities. Having political connections exacerbate type II agency conflict in which the majority shareholder takes advantage position in the company for their own interests without prioritizing the shareholders minority shares (Villalonga & Amit, 2006). According to (Ling et al, 2016) stated that from the perspective of agency theory, companies that are politically connected have the potential for related party transactions. Ismail et al (2022) researched that many Egyptian companies are still connected to political boards of directors and political relations have a significant effect on related party transactions. Supatmi et al (2021) state that political connections strengthen the effect of related party transactions on company value. Habib et al. (2017) found that there was a positive effect political connections to related party transactions. Connected company politics will carry out related party transactions. In contrast, Abdullatif et al.'s research. (2019) stated Jordan found that there was no influence between political connections and related party transactions.

This study includes corporate governance variables as a moderating variable. Corporate governance will examine oversight mechanisms that can guarantee minority rights, namely by implementing corporate governancewithin the company (Lin, 2014). Utama (2015) states that good governance reduces transfer price manipulation and RPT is abusive. Fan and Wong (2002) stated one of the ways to mitigate these agency problems is by implementing a good and effective corporate governance system.

This research focuses on companies in Indonesia in the mining sector because there are several cases of related party transactions that have occurred in this sector, such as PT. Sumalindo Lestari Jaya, PT. Adaro, PT. Cakra Minerals and PT. Bumi Resources, some of which are family companies and mining companies, were chosen because a mining company is a company that manages resources and economic transactions involving many parties, namely stakeholders (suppliers, creditors, consumers, investors, etc.). Companies that carry out economic activities that involve many parties tend to pose a lot of risks so that they are expected to have a relationship with risk disclosures carried out by the company so that this becomes the motivation for researchers to make a sample of observations of mining sector companies in this study.

Literature Review and Hypothesis Development

Agency Theory

Jensen and Meckling (1976) appears when there is a work contract relationship between managers and shareholders which is described as a relationship between agent (management), principal (shareholder). In the context of related party transactions, the previous literature shows that it is consistent with agency theory that related party transactions It may be efficient or opportunistic. related party transactions from an efficient perspective, related party transactions are seen as normal business transactions that meet the economic needs of enterprises and improve efficiency company, or is a bonding mechanism between the agent (manager) and the company (Gordon & Henry, 2005). Conversely, the opportunistic perspective of related party transactions is seen as a conflict interest between management and shareholders (Gordon et al, 2004).

Related Party Transactions

Related party transactions in PSAK No.7 are defined as transactions between parties who have a special relationship or special relationship with a company and are involved in preparing the company's financial statements. According to PSAK No. 7 concerning related party transactions issued by the Indonesian Accounting Association (IAI), related party transactions that occur in a company are required to report their disclosure ( disclosure ). RPToccurs between various parties related to both thesubsidiary, partner, ultimate owner, officer or director (Gordon et al, 2004). Kang, Lee, Lee & Park (2014) stated that a related party transaction is a transfer of resources, services, or obligations from the reporting entity to related parties.

Corporate governance

Structurecorporate governance, can be interpreted as a framework within the organization to implement various governance principles so that these principles can be shared, implemented and controlled. Specifically, the governance structure must be designed to support the running of organizational activities in a responsible and controlled manner (Stoner, Freeman, and Gilbert, 1995). Corporate governance will be able to help and reduce problems that arise in agency theory including RPT.

Family Ownership

Carsrud (2004) stated that a family company is a business owned and the majority of the rules that are run by the business are made by members of the group who are emotionally attached. According to the Center for Labor Research (2005) a business where ownership and management are controlled by family members. Company impact controlled by the family in related party transactions can be explained by entrenchment or alignment effects . Fan and Wong (2002) state that the entrenchment effect is the act of controlling shareholders who are protected by their control rights to abuse of power such as expropriation. Alignment effects can provide benefits to investors and other stakeholders but in practice they are not aligned . Furthermore, corporate governance can provide oversight of controlling shareholders so as not to take expropriation and corporate governance is one way of mitigating these agency problems is by implementing a good and effective corporate governance system (Fan and Wong, 2002).

Political Connections

Companies that are politically connected are companies that in certain ways have ties politically or seek to have closeness with politicians or the government (Purwoto, 2011). According to Facio (2006), companies that have connections are at least one big shareholder or one the head of the company, be it the CEO, president, vice president or secretary, is a member of parliament, minister or person related to a politician or political party. Political connections are believed to provide more benefits for both parties. According to Sudibyo and Jianfu (2016) in (Ferdiawan & Firmansyah, 2017).

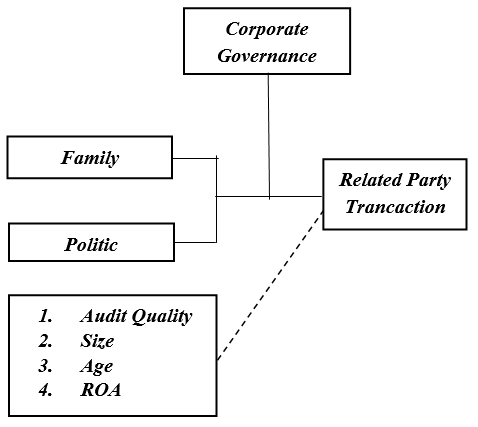

Figure 1. Research model

Literatur review

Research conducted by Dyanty et al (2013) shows that family ownership uses RPT as a tool to expropriate the wealth of minority shareholders. Azim et al (2018) examined the main shareholders of Pakistani family-owned companies. The research concludes that there is a relationship between concentration of family shareholders and the exploitation of the interests of minority shareholders. The same result was obtained by Amzaleg & Barak (2011) that there is a negative effect of family companies on the value of related party transactions, family companies tend to conduct tunneling transactions and are practically a form of personal gain from control consumption. Mohammed's research (2019) states that related party transactions will get stronger with family ownership in Turkey. Furthermore, Chee Yoong et al (2015) examined Malaysian companies using panel data stating that related party transactions in family firms reduces firm value. Kohlbeck et al (2018) examined the influence of family firms on related party transactions that family firms use their power to benefit minority shareholders. Berto's research (2019) reports that concentration of ownership has a positive effect on tunneling. That is, the more concentrated the shareholders are in accordance with indications of expropriation. Likewise Abdullatif et al (2019) stated thatcompanies with high concentration of ownership can use RPT in tunneling activities to take over funds to dominant shareholders.

On the other hand, different results have been shown by several studies, including by Hajj Abdullah & Wan Hussin (2016). The results of their research show that family-controlled companies limit the opportunistic effects of related party transactions on real earnings management, thereby supporting the alignment effect of family ownership. This study strengthens the notion that family firms in Malaysia do not experience an entrenchment effect and supports the notion of alignment. Furthermore, Bansal & Thenmozhi (2020) found that concentrated founder ownership in India is more likely to encourage related party transactions that are beneficial to minority shareholders compared to related party transactions that lead to takeovers. These results are in line with Barokah (2013) found that related party transactions in family companies have benefits and are more transparent in disclosing related party transactions in order to maintain their reputation. Likewise, Nuritomo (2020) in his research found that the higher the family ownership, the lower the positive influence of the shareholder tax burden on related party transactions because they have to maintain a big name or avoid tax problems in the future. Family companies tend not to carry out related party transactions for tax purposes because they have high tax risk considerations. These results are supported by research by Alhadab et al (2020) which shows that there is no effect of family ownership on related party transaction relationships.

Research by Hu et al (2015) found the size of related party transactions to be negatively related with corporate governance using a proxy proportion of directors indicating the need for improvement of corporate governance in China. Yeh et al (2012) examined corporate governance relationships using the CGI index. The empirical results show that good corporate governance is effective in limiting related party transactions of various related party transaction sizes. Azima et al (2018) concluded that there is a negative relationship between corporate governance and the concentration of major shareholders exploiting the interests of minority shareholders. Agnihotri & Bhattacharya (2019) show that ownership concentration negatively moderates the impact of governance variables on related party transactions. Alhadab (2020) states the weakness of the corporate governance system or the limited separation between company ownership and management in Jordan, so that the effects of related party transactions are worse, compared to the context in more developed countries. Hamid et al (2015) stated that corporate governance is a proxy for audit committees and independent directors. The higher the number of audit committees and independent directors, the lower the takeover of the interests of minority shareholders. Pebri et al (2020) stated that corporate governance with audit committee and board of commissioners proxies has an effect on related party transactions. The more independent commissioners and audit committees the better the supervision will be so that it will improve financial performance and increase compliance with related party transactions. Likewise the research of Kohlbeck and Mayhew (2004), Hwang (2010), Yeh et al. (2012), and Utama and Utama (2014) state that corporate governance influences related party transactions.

Several previous studies have examined the influence between political connections and related party transactions. Ismail et al (2022) researched that many Egyptian companies are still connected to political boards of directors and political relations have a significant effect on related party transactions. Supatmi et al (2021) state that political connections strengthen the effect of related party transactions on company value. Habib et al. (2017) found that there was a positive effect political connections to related party transactions. Connected company politics will carry out related party transactions. In contrast, Abdullatif et al.'s research. (2019) stated Jordan found that there was no influence between political connections and related party transactions.

Hypothesis Development

Family ownership and Related Party Transactions

The ownership structure will determine the nature of agency problems, namely whether the dominant conflict occurs between managers and holders shares or between controlling shareholders and minority shareholders. Berle and Means (1932) divided the types of company ownership into two, namely companies controlled by owners and companies controlled by management. With a concentrated ownership pattern and main owner The dominant (ultimate control) is the family.

Mohammed (2019) states that family companies have type II agency problems in this case the controlling shareholder uses related party transactions with the aim of transferring profits to his personal interests. Hu et al (2012) stated that there is a lot of information owned by family ownership as controlling shareholders so that it becomes a means to carry out expropriation. Munir (2011) states that related party transactions can reduce company performance and related party transactions carried out by family companies.

H1 = Family ownership has a positive effect on related party transactions

Political Connections and Related Party Transactions

Several companies in Indonesia have started carrying out related party transactions and not infrequently they also start to build political relations. Companies can do price agreement in conducting transactions with related parties (Anggala & Basana, 2020) .

According to Facio (2006), a company has connections if at least one of the shareholders is large or one Company leaders, whether CEO, president, vice president or secretary, are members of parliament, ministers or people related to politicians or political parties.

The existence of political connections can be used to carry out takeovers resources from majority shareholders towards minority shareholders (Habib et al. , 2017). Political connections can also be exploited by majority shareholders in carrying out acts of expropriation (Cheung et al., 2009; Supatmi et al. (2021) state that political connections strengthen the effect of related party transactions on company value. Habib et al. (2017) found that there is a positive influence political connections to related party transactions

H2 = Political connections have a positive effect on related party transactions

Corporate Governance, Family Ownership and Related Party Transactions

One of the reasons corporate governance mechanisms need to be implemented is that there is concentrated ownership, especially family ownership, which will have full discretion to determine the direction of the company, which can lead to conflicts of interest between controlling and non-controlling shareholders.

Dyanty et al (2012) stated that the dominance of family ownership in Indonesia is predicted to further increase entrenchment by controlling shareholders. Azim et al (2018) found that corporate governance is weaker in Pakistani family companies where major shareholders take over resources through related party transactions and have a negative tendency. Malawat et al (2018) who examined the moderating influence of corporate governance in relation to pyramid of structure and related party transactions. This creates a strong incentive for family members who serve as commissioners or directors to influence the decisions of the company's independent board of commissioners. Berto (2019) obtained empirical evidence that effective good governance can reduce the possibility of detrimental Related Party Transactions occurring. Utama (2015) shows that ownership structure acts as a governance mechanism to reduce abusive Related Party Transactions.

From the explanation above, the main question is: what mechanisms can be used effectively to reduci agency problems in family companies. The answer to this question is very relevant for efforts to establish corporate governance. With a governance mechanism to protect the interests of minority shareholders by preventing acts of expropriation carried out by majority shareholders. Strong governance is also expected to provide protection to investors and guarantee a level of fair treatment for all shareholders so with good governance mechanisms it will be possible to prevent expropriation practices by controlling shareholders.

H3 = Corporate governance weakens the influence of family ownership on related party transactions

Corporate Governance, Political Connections and Related Party Transactions

Qian et al. (2012) explain that political connections can help company in carrying out related party transactions for expropriation purposes safely. Therefore, political connections can opportunistically increase transactions related parties. To reduce opportunistic behavior, it is necessary to have mechanisms that protect this behavior.

Corporate governance mechanisms are a device to protect minority shareholders from the acts of expropriation by majority shareholders. Companies must have good corporate governance so as to reduce the controlling dominance of family parties in the company, they are required to refer to the regulations and principles. corporate governance which indirectly disciplines the company through aspects of corporate governance assessment and becomes a reference for the company to act independently and ensure justice for all shareholders and investors, as well as to gain public trust. Corporate governance acts as a mechanism to reduce abuse related party transactions (Utama, 2015).

Usman (2019) found that good corporate governance can effectively reduce the possibility of detrimental related party transactions occurring. Yodhiyanto (2016) stated that corporate governance proxied by the board of commissioners has a significant influence in monitoring to reduce the effect of entrenchment from controlling shareholders on the company's debt costs.

Based on the background explained previously, the formulation of the hypothesis in this research is as follows :

H4 = Corporate governance weakens the influence of political connections on related party transactions

Research methods

This research is a quantitative research. Quantitative research is data that is collected as secondary data in the form of numbers or qualitative data that is calculated and obtained from books, reports or websites (Sugiyono, 2003). The secondary data used in this study comes from the annual financial reports of companies listed on the Indonesia Stock Exchange (IDX) as well as secondary data obtained from the official website of the Indonesia Stock Exchange ( ) in 2016 – 2021.

The population used in this study are mining companies listed on the IDX for the 2016-2021 period. Determination of the sample in this study using a purposive sampling method in which the sample used must meet certain predetermined requirements. The criteria set are mining companies listed on the Indonesia Stock Exchange (IDX) for the 2016-2021 period, The final number of samples used in the study is presented in the following table:

Table 1 Research Sample

Operational Definition and Variable Measurement

The dependent variable or dependent variable is the main variable that is the focus of a study and in a study it is also possible to have more than one dependent variable because of differences in quality, volume, and others. There may be differences in the effect of other variables for two different dependent variables. In this study using RPT as the dependent variable, family ownership and political connections as independent variables, good corporate governance as moderating variables and audit quality, firm age, profitability and firm size as control variables.

Table 2 . Operationalization Summary

Analysis Method

Moderating Regression Analysis

According to Ghazali (2013: 229) moderated regression analysis (MRA) is an analytical approach that maintains sample integrity and provides a basis to control for the influence of the moderator variable. The test tool uses E-Views with the Random Effect model

Model 1

RPT= a + ß1FO+ ß2POL+ ß3 AQ + ß4SIZE +ß5AGE + ß6ROA + e

Model 2

RPT= a+ γ1FO+ γ2POL+ γ3 AQ + γ4SIZE + γ5AGE + γ6ROA + γ7GCG γ8 FO_GCG _ + γ9POL_GCG + e

Description :

RPT : Related Party Transactions

A : Constant

ß1,ß2,ß3 : Regression coefficient

FO : Family Ownership

POL : Political Connection

AQ : Audit Quality

SIZE : Company Size

Profitability : ROA

AGE : Company Age

GCG : Corporate Governance

FO_GCG : Multiplication between

Family Ownership and Corporate Governance

POL_GCG :Multiplication between Political Connectionsand Corporate Governance

e : error coefficient

Results and Discussion

Table 3 Descriptive Statistics

Related party transactions (RPT) as measured using the sum of related party transactions of sales, purchases, payables and receivables divided by total assets in this study have an average of 0.056 with a maximum and minimum value of 0.781 and 0, respectively. related party with a maximum value of 0.781 indicates that the level of related party transactions practiced is high, around 78%. This indicates that the sample firms In this study, the practice of related party transactions is carried out from several aspects of transactions such as debts and receivables to achieve certain goals. However, there are also those who do not conduct transactions with related parties in certain years

Family ownership (FAMILY) has an average value of 0.344 with a maximum and minimum value of 0.925 and 0 respectively because there are companies that are not owned by families . Family ownership with an average value of 34% is still high because family ownership refers to PSAK No. 15 that the majority shareholding of the company is more than 20% and minority owners have less than 20% share ownership of the company which shows that the family or the founder of the company still dominates the majority percentage of Indonesian capital ownership.

Corporate governance (GCG) has an average value of 70.407 with a maximum and minimum value of 83.00 0 and 51.312 respectively. This shows that the average value of corporate governance is 72.044%, which means that mining corporate governance in Indonesia is good.

Hypothesis testing

Table 4 Moderated Regression Analysis Test

Discussion

The effect of family ownership on RPT

Table 4.3 shows the results of panel data regression testing using a random effect research model . The first hypothesis, namely the effect of family ownership on related party transactions, is accepted. The results of statistical tests show that family ownership has a significant positive effect against related party transactions with a probability value of 0.0367 below 0.05 . The results of this study are consistent with research conducted by Azim et al (2018), Amzaleg & Barak (2011), Mohammed (2019), Cheyoong et al (2015), Kohlbeck et al (2018), Berto (2019), Abdullatif et al (2019), Ernawati & Aryani (2019).

Family ownership of the controlling shareholder has proven to strengthen motivation to engage in related party transactions. This is very reasonable because if there are several companies (company groups) in the hands of one family controller, the family's wealth is spread over many companies. These conditions will allow for expropriation through related party transactions (Dyanty et al, 2012). Family controlled companies have low motivation to disclose related party transactions. This result can be an indication that the family as the controlling shareholder takes advantage of related party transactions (Ernawati & Aryani, 2019)

The influence of political connections on the RPT

The second hypothesis is the effect of political connections on related party transactions. Statistical test results show that political connections have a significant positive effect on related party transactions with a probability value of 0.0317 below 0.05. The research results are consistent with Habib et al. (2017) which states that there is a positive influence political connections to related party transactions. Connected company will enter into related party transactions to transfer resources out company. Santosa & Nugrahanti (2022) states that there is an influence between political connections and related party transactions indicating that the company began to build political connections to carry out related party transactions in practice expropriation. Rahman & Nugrahanti (2021) states that companies with political connections can practice expropriation through related party transactions because they receive legal protection from these political connections.

Corporate governance weakens the influence of family ownership on RPT

The third hypothesis is that corporate governance weakens the effect of family ownership on related party transactions. Statistical test results show that corporate governance can weaken the effect of family ownership on related party transactions with a probability value of 0.0479 below 0.05. These results are consistent with research conducted by Hamid et al (2015) which states that corporate governance proxy audit committees and independent directors, the higher the number of audit committees and independent directors, the lower the takeover of the interests of minority shareholders. Likewise the research of Kohlbeck and Mayhew (2004), Hwang (2010), Yeh et al. (2012), and Utama and Utama (2014) state that corporate governance influences related parties.

Corporate governance weakens the influence of political connections on the RPT

fourth hypothesis, namely that GCG weakens the influence of political connections on related party transactions, is accepted. Statistical test results show that GCG can weaken the influence of political connections on related party transactions with a probability value of 0.0057 below 0.05 . In line with the research of Tariq et al (2022) showing that Egyptian companies are heavily influenced by politically connected boards of directors that corporate governance practices can reduce the effect of RPT.

Furthermore, Sari & Putri (2014) and Maharti & Nugrahanti (2022) state that good corporate governance seen from an independent board of commissioners can weaken the positive relationship of political connections to earnings management actions. This proves that agency conflicts that arise can be minimized by corporate governance with the existence of an independent board of commissioners thereby reducing opportunistic actions from management. Ali et al (2019) found that political connections were negatively associated with related party transactions. In other words, politically connected companies are less likely to engage in opportunistic behavior through related party transactions compared to other companies.

CONCLUSION

This research aims to examine the relationship between family ownership and political connections with related party transactions moderated by corporate governance and to see the relationship between family ownership levels and related party transactions in mining companies in 2016-2021. Data analysis carried out shows that the average family ownership of mining companies in Indonesia is 34.46%. As is known, according to PSAK No. 15 regarding share ownership, that investors are considered to have significant influence if they have either directly or indirectly through company share ownership 20% or more of the investee's voting rights. It can be concluded that the majority of mining companies in Indonesia are owned by families. The research results show that family ownership has a significant positive effect on related party transactions in line with research by Azima et al (2018), Amzaleg & Barak (2011), Mohammed (2019), Cheyoong et al (2015), Kohlbeck et al (2018), Munir (2011), Berto (2019), Abdullatif et al (2019), Ernawati & Aryani (2019), Yeh, Shu & Su (2012), Dyanty et al (2013). Political connections have a positive effect on related party transactions. Political connections have a positive effect on related party transactions, in line with research by Habib et al. (2017), Santosa & Nugrahanti (2022), Rahman & Nugrahanti (2021). Companies that have political connections will carry out related party transactions to transfer resources outside the company. Furthermore, the research results show that GCG in mining companies in Indonesia can weaken the influence of family ownership and political connections on related party transactions in line with research by Hamid et al (2015), Utama et al (2015), Yeh et al. (2012), Ali et al (2019), Sari & Putri (2014), Maharti & Nugrahanti (2022).

This research has several limitations. First, this research only focuses on mining companies in Indonesia. Based on this, further research needs to explore more broadly by taking samples of other corporate sectors in Indonesia. Second , future research is expected to try newer and more detailed measurements of corporate governance and follow the latest regulations regarding corporate governance, especially in more complex mining companies. Third, it is hoped that future research will focus on the sample data that will be examined, namely family ownership, because in this study the researchers did not focus on family ownership of mining companies in Indonesia, but used data on all mining companies in Indonesia. Fourth, this study only focuses on communication media in the form of annual reports. Even though the annual report is used by stakeholders as the main source of information for decision making, it is likely that management also uses other communication mechanisms for disclosure of social responsibility such as. Therefore, future research may consider disclosure in other media such as newspapers or advertisements.

References

Agnihotri, A., & Bhattacharya, S. (2019). Internationalization, Related Party Transactions, and Firm Ownership Structure: Empirical evidence from an emerging market. Research in International Business and Finance , 48 , 340–352. https://doi.org/10.1016/j.ribaf.2019.02.004

Agoes, Sukrisno, I Cenik Ardana. (2009). Business and Professional Ethics: The Challenge of Building the Whole Person. Jakarta : Salemba Empat.

Alhadab, M., Abdullatif, M., & Mansour, I. (2020). Related Party Transactions and Earnings Management in Jordan: the role of ownership structure. Journal of Financial Reporting and Accounting , 18 (3), 505–531. https://doi.org/10.1108/JFRA-01-2019-0014

Ali Jaafar Nodeh, Mehdi Safari Gerayli. (2020). Political Connections and Related-Party Transactions: Evidence from Iranian Firms. Advances in Mathematical Finance & Applications, 5(3), (2020), 319-330, DOI:

Amzaleg, Y., & Barak, R. (2012). Ownership Concentration and the Value Effect of Related Party Transactions. SSRN Electronic Journal, November. https://doi.org/10.2139/ssrn.1959557

Ancella Anitawati Hermawan. (2011). The Influence of Effective Board of Commissioners and Audit Committee on The Informativeness of Earnings: Evidence Indonesian Listed Firm, Asia Pasific Journal of Accounting and Finance, Vol.2, Issue 1.

Anderson, R. C. & Reeb, D. M. (2003). Founding-family ownership and firm performance: evidence from the S&P 500. The Journal of Finance, 58 (3),1301-1328.

Annisa Harijanto, VN (2019). The Influence of Ownership Structure and Size of Public Accounting Firms on the Level of Compliance with Disclosure of Related Transactions Based on PSAK No. 7 Concerning Accounting and Management Disclosures , 8 (1), 59–70. https://doi.org/10.21831/nominal.v8i1.24499

Arifin, Z. (2003). Agency Issues and Control Mechanisms in Companies with Concentrated Ownership Structures that are Family Controlled: Evidence from Public Companies in Indonesia. Dissertation. Depok: University of Indonesia.

Azima, F., Mustapha, MZ, & Zainir, F. (2018). Impact of Corporate Governance on Related Party Transactions in Family-Owned Firms in Pakistan. Institutions and Economies , 10 (2), 22–61.

Bansal, S., & Thenmozhi, M. (2020). Does Concentrated Founder Ownership Affect Related Party Transactions? Evidence from an Emerging Economy. Research in International Business and Finance, 53, 101206. https://doi.org/10.1016/j.ribaf.2020.101206

Barokah, Z. (2013). an Analysis of Corporate Related-Party Disclosure in the Asia-Pacific Region. Disertation, Queensland University of Technology, 1–214.

Benjamin Maury, (2006), Family ownership and firm performance: Empirical evidence from Western European corporations, Journal of Corporate Finance, 12, (2), 321-341

Bona-sánchez, C., Fernández-senra, C. L., & Pérez-alemán, J. (2016). Related-Party Transactions, Dominant Owners and Firm Value. Analytica Chimica Acta, 11–21. https://doi.org/10.1016/j.brq.2016.07.002

Chee Yoong, L., Alfan, E., & Devi, S. S. (2015). Family Firms, Expropriation and Firm Value: Evidence from Related Party Transactions in Malaysia. The Journal of Developing Areas, 49(5), 139–152. https://doi.org/10.1353/jda.2015.0048

Chen, C., & Wu, C. (2010). Related Party Transactions and Ownership Concentration: Theory and Evidence. E-Leader Conference, 57, 1–8. http://www.g-casa.com/conferences/singapore/papers_in_pdf/wed/Chen.pdf

Chen, Z., Cheung, Y.-L., Stouraitis, A., & Wong, A. W. S. (2005). Ownership concentration, firm performance, and dividend policy in Hong Kong. Pacific-Basin Finance Journal, 13(4), 431–449. doi:10.1016/j.pacfin.2004.12.001

Cheng, Q. (2014). Family Firm Research - A review. China Journal of Accounting Research, 7(3), 149–163. https://doi.org/10.1016/j.cjar.2014.03.002

Cheung, S. Y., Rau, P.R. and Stouraitis, A. 2006. Tunnelling, propping and expropriation: Evidence from connected party transactions in Hong Kong. Journal of Financial Economics, 82, 343-386.

Cheung, YL, Jing, L, Lu, T, Rau, P. R. and Stouraitis, A. 2009. Tunneling and propping up: An analysis of related party transactions by Chinese listed companies, Pacific-Basin Finance Journal, 17(3):372-393

Claessens et al (1999), The separation of ownership and control of East Asia Corporations , Wiley for the American Finance Association Stable

Claessens, S., S. Djankov, JPH Fan, and LHP Lang. ( 2002 ) . Disentangling the Incentive and Entrenchment Effects of Large Shareholdings. The Journal of Finance . 57(6). 2741-2771.

Diyanti, V., Utama, S., Rossieta, H., & Veronica, S. (2013). Effect of Ultimate Controller Ownership, Family Ownership and Corporate Governance Practices on Related Party Transactions and Profit Quality. XVI National Symposium on Accounting , I (March 2019), 213–247.

Diyanty, V. (2016). Effects of Entrenchment and Alignment of Family Final Controllers and the Role of the Board of Commissioners on Debt Costs . 1–22.

El-Helaly, M. (2018). Related-Party Transactions: A Review of the Regulation, Governance and Auditing Literature. Managerial Auditing Journal , 33 (8–9), 779–806. https://doi.org/10.1108/MAJ-07-2017-1602

Ernawati, D., & Aryani, YES (2019). Controlling Shareholders, Audit Committee Characteristics, and Related Party Transaction Disclosures : Evidence From Indonesia Article history : 23 (1), 14–28.

Fooladi, M., & Farhadi, M. (2019). Corporate Governance and Detrimental Related Party Transactions: Evidence from Malaysia. Asian Review of Accounting, 27(2), 196–227. https://doi.org/10.1108/ARA-02-2018-0029

Gordon, Elizabeth A.; Henry, Elaine; Palia, Darius (2004). Related Party Transactions: Associations with Corporate Governance and Firm Value. SSRN Electronic Journal, (), doi:10.2139/ssrn.558983

Habib, A., Muhammadi, A. H., & Jiang, H. (2017). Political Connections and Related Party Transactions: Evidence from Indonesia. International Journal of Accounting, 52(1), 45–63. https://doi.org/10.1016/j.intacc.2017.01.004

Haji-Abdullah, N. M., & Wan-Hussin, W. N. (2015). Related Party Transactions, Audit Committees and Real Earnings Management: The Moderating Impact of Family Ownership. Advanced Science Letters, 21(6), 2033–2037. https://doi.org/10.1166/asl.2015.6195

Hamid, M. A., Ting, I. W. K., & Kweh, Q. L. (2016). The Relationship between Corporate Governance and Expropriation of Minority Shareholders’ Interests. Procedia Economics and Finance, 35(16), 99–106. https://doi.org/10.1016/s2212-5671(16)00014-9

Hendratama, T. D., & Barokah, Z. (2020). Related Party Transactions and Firm Value: The Moderating Role of Corporate Social Responsibility Reporting. China Journal of Accounting Research, 13(2), 223–236. https://doi.org/10.1016/j.cjar.2020.04.002

Hu, S. H., Li, G., Xu, Y. H., & Fan, X. A. (2012). Effects of Internal Governance Factors on Cross Border Related Party Transactions of Chinese Companies. Emerging Markets Finance and Trade, 48(SUPPL. 1), 58–73. https://doi.org/10.2753/REE1540-496X4801S105

Hwang, N.-C. R., Chiou, J.-R., & Wang, Y.-C. (2013). Effect of Disclosure Regulation on Earnings Management Through Related-Party Transactions: Evidence from Taiwanese Firms Operating in China. Journal of Accounting and Public Policy, 32(4), 292–313. doi:10.1016/j.jaccpubpol.2013.04.003

Ikatan Akuntan Indonesia (IAI) Standar Akuntansi Keuangan. PSAK No.1,2018

Jensen, M., C., dan W. Meckling, (1976). Theory of the firm: Managerial Behavior,Agency Cost And Ownership Structure, Journal of Finance Economic 3:305360 http://www.nhh.no/for/courses/spring/eco420/jensenmeckling-76.pdf.

Jogiyanto, H. . 2010. Teori Portofolio dan Analisis Investasi (7th ed.). Yogyakarta: BPFE.

Johnson, Simon; La Porta, Rafael; Lopez-de-Silanes, Florencio; Shleifer, Andrei (2000). Tunneling. American Economic Review, 90(2), 22–27. doi:10.1257/aer.90.2.22

Jong, L., & Ho, P. L. (2018). Inside the family firms: The Impact of Family and Institutional Ownership on Executive Remuneration. Cogent Economics and Finance, 6(1). https://doi.org/10.1080/23322039.2018.1432095

Joseph P. H. Fan and T. J. Wong, (2002), Corporate ownership structure and the informativeness of accounting earnings in East Asia, Journal of Accounting and Economics, 33, (3), 401-425

Joseph P. H. Fan and Vidhan Goyal, (2006), On the Patterns and Wealth Effects of Vertical Mergers, The Journal of Business, 79, (2), 877-902

Kaihatu, T. S. 2006. Good Corporate Governance dan Penerapannya di Indonesia. Jurnal Manajemen dan Kewirausahaan, Vol. 8, No.1 : 1-9, Maret.

Kang, M., Lee, H. Y., Lee, M. G., & Park, J. C. (2014). The Association between Related-Party Transactions and Control-Ownership Wedge: Evidence from Korea. In Pacific Basin Finance Journal (Vol. 29). Elsevier B.V. https://doi.org/10.1016/j.pacfin.2014.04.006

Kohlbeck, M. J., Lee, H. S., Mayhew, B. W., & Salas, J. M. (2018). The Influence of Family Firms on Related Party Transactions and Associated Valuation Implications. SSRN Electronic Journal, 33431(561). https://doi.org/10.2139/ssrn.3154565

Lee, M. G., Kang, M., Lee, H. Y., & Park, J. C. (2016). Related-Party Transactions and Financial Statement Comparability: Evidence from South Korea. Asia-Pacific Journal of Accounting and Economics, 23(2), 224–252. https://doi.org/10.1080/16081625.2014.957706

Ling, L., Zhou, X., Liang, Q., Song, P., & Zeng, H. (2016). Political connections, overinvestments and firm performance: Evidence from Chinese listed real estate firms. Finance Research Letters, 18 , 328–333.

Maharti, W. & Nugrahanti, YW (2022). The Moderation Role of Corporate Governance in Political Relations, Bonus Compensation and Profit Management. E-Journal of Accounting, 32(7), 1893-1911

Mark Kohlbeck; Brian W. Mayhew (2010). Valuation of firms that disclose related party transactions. , 29(2), 0 137. doi:10.1016/j.jaccpubpol.2009.10.006

Mohammed, N. H. (2019). Related Party Transactions, Family Firm, and Firm Performance Empirical Evidence from Turkey. Accounting Analysis Journal, 8(3), 179–183. https://doi.org/10.15294/aaj.v8i3.36665

Moscariello, N. (2012). Related Party Transactions in Continental European Countries: Evidence from Italy. International Journal of Disclosure and Governance, 9(2), 126–147. https://doi.org/10.1057/jdg.2011.14

Munir, S., & Gul, R. J. (2012). Related Party Transactions, Family Firms and Firm Performance: Some Malaysian Evidence. SSRN Electronic Journal. https://doi.org/10.2139/ssrn.1705846

Munir, S., Saleh, N. M., Jaffar, R., & Yatim, P. (2013). Family Ownership, Related-Party Transactions and Earnings Quality. Asian Academy of Management Journal of Accounting and Finance, 9(1), 129–153.

Nuritomo, Utama, S., & Hermawan, A. A. (2020). Family Ownership and Tax Avoidance: An Analysis of Foreign Related Party Transactions and Dividend Payments. International Journal of Business and Society, 21(2), 643–659.

Pricewaterhouse Coopers Indonesia. 2014. “Economic crime: A threat to business globally”, di-download dari https://www.pwc.ie/ /2014_global_economic_crime_survey.pdf

Qian, M., Pan, H., & Yeung, B. Y. (2012). Expropriation of minority shareholders in politically connected firms. SSRN Electronic Journal, 1–37. https://doi.org/10.2139/ssrn.1719335

Rahman, A. F., & Nugrahanti, Y. W. (2021). The influence of related party transaction and corporate governance on firm value: An empirical study in Indonesia. Journal of Asian Finance, Economics, and Business, 8(6), 223–233. https://doi.org/10.13106/jafeb.2021.vol8.no6.0223

Richardson, G., Wang, B., & Zhang, X. (2016). Ownership Structure and Corporate Tax Avoidance: Evidence from Publicly Listed Private Firms in China. Journal of Contemporary Accounting & Economics. https://doi.org/10.1016/j.jcae.2016.06.003

Santosa, WA, & Nugrahanti, YW (2022). DO POLITICAL CONNECTIONS INCREASE RELATED PARTY TRANSACTIONS? Accuracy: Journal of Accounting and Finance Studies , 5 (1), 29-48. https://doi.org/10.29303/akurasi.v5i1.140

Santosa, Yeterina Widi Nugrahanti (2022). Do Political Connections Increase Related Party Transactions ?. Journal of Accounting and Finance Studies Vol. 5(1), 2022, Pages 29 – 48

Sari, AAIP, & Putri, IGAMAD (2014). Effect of Corporate Governance Mechanisms on Profit Management. Undayana University Accounting, 1, 94–104

Sari, et al . (2017). Tax Avoidance, Related Party Transactions, Corporate Governance and the Corporate Cash Dividend Policy. Journal of Indonesian Economy and Business , 32 (3), 190 – 208.

Sedarmayanti, 2012. Human Resource Management. Jakarta: Refika Aditama Eresco.

Su, Z., Fung, H., Huang, D., & Shen, C. (2014). Cash dividends, Expropriation, and Political Connections : Evidence from China. International Review of Economics and Finance , 29 , 260–272. https://doi.org/10.1016/j.iref.2013.05.017

Sugiyarti, L., & Purwanti, SM (2017). Effect of fixed asset intensity, growth sales and political connections to tax avoidance (Case study on the company manufacturers listed on the Indonesia Stock Exchange in 2012–2016). Research Journal Accounting and Finance , 5 (3), 1625–1642. https://doi.org/10.17509/jrak.v5i3.9225

Sugiyono. 2003. Research Methods. Bandung: Alphabet

Supatmi, S., Sutrisno, S., Saraswati, E., & Purnomosidhi, B. (2021). Abnormal related party transactions, political connections, and firm values: Evidence from Indonesian firms. International Journal of Business and Society , 22 (1), 461–478. https://doi.org/10.33736/IJBS.3189.2021

Supatmi, Sutrisno,T., Saraswati, E., & Purnomosidhi, B. (2019).The effect of related party transactions on firm performance: The moderating role of political connection in Indonesian banking. Business:Theory and Practice, 20(2003), 81–92. https://doi.org/10.3846/BTP.2019.08

Tariq H. Ismail, Mohamed El‑Deeb and Yasser Tawfik Halim. (2022). Do related party transactions affect the relationship between political connections and firm value? Evidence from Egypt, Future Business Journal (2022) 8:10 https://doi.org/10.1186/s43093-022-00123-x

Usman, B. (2019). Ownership Structures, Control Mechanism and Related Party Transaction: An Empirical Study of the Indonesian Public Listed Companies. International Journal of Economics and Management, 13(1), 1–20.

Wardhana, LI, Tandelilin, E., Lantara, IWN, & Junarsin, JE (2014). Dividend Policy in Indonesia : A Life-Cycle Explanation .

Wei, Z., Wu, S., Li, C., & Chen, W. (2011). Family Control , Institutional Environment and Cash Dividend Policy : Evidence from China. China Journal of Accounting Research, 4(1–2), 29–46. https://doi.org/10.1016/j.cjar.2011.04.001

Yeh, Y., Shu, P., & Su, Y. (2012). Related-Party Transactions and Corporate Governance : The Evidence from the Taiwan Stock Market. Pacific-Basin Finance Journal , 20 (5), 755–776. https://doi.org/10.1016/j.pacfin.2012.02.003

Yezhen Wan, Leon Wong , (2015),"Ownership, Related Party Transactions and Performance in China", Accounting Research Journal , Vol. 28 Iss 2 pp. 143 – 159, http://dx.doi.org/10.1108/ARJ-08-2013-0053

Yodhianto, A. ( 2016 ) . Entrenchment and Alignment Effects of Family and End Controlling The Role of the Board of Commissioners on Debt Costs. National Symposium on Accounting , Vol XIX.

Zhu, Z. (2015). Multiple Principal-Agent Relationships, Corporate-Control Mechanisms and Expropriation through Related Party Transactions : Evidence from China. Journal of Chinese Economics and Finance. ISSN 1450-2887 Issue 2

Submitted

Accepted

Published

Issue

Section

License

Copyright (c) 2023 Riset Akuntansi dan Keuangan Indonesia

This work is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike 4.0 International License.