Foreign Direct Investment, Institutional Quality and Economic Growth: Empirical Evidence from ASEAN

DOI:

https://doi.org/10.23917/jep.v26i1.8822Keywords:

foreign direct investment, Political Institutions, Economic Institutions, Economic GrowthAbstract

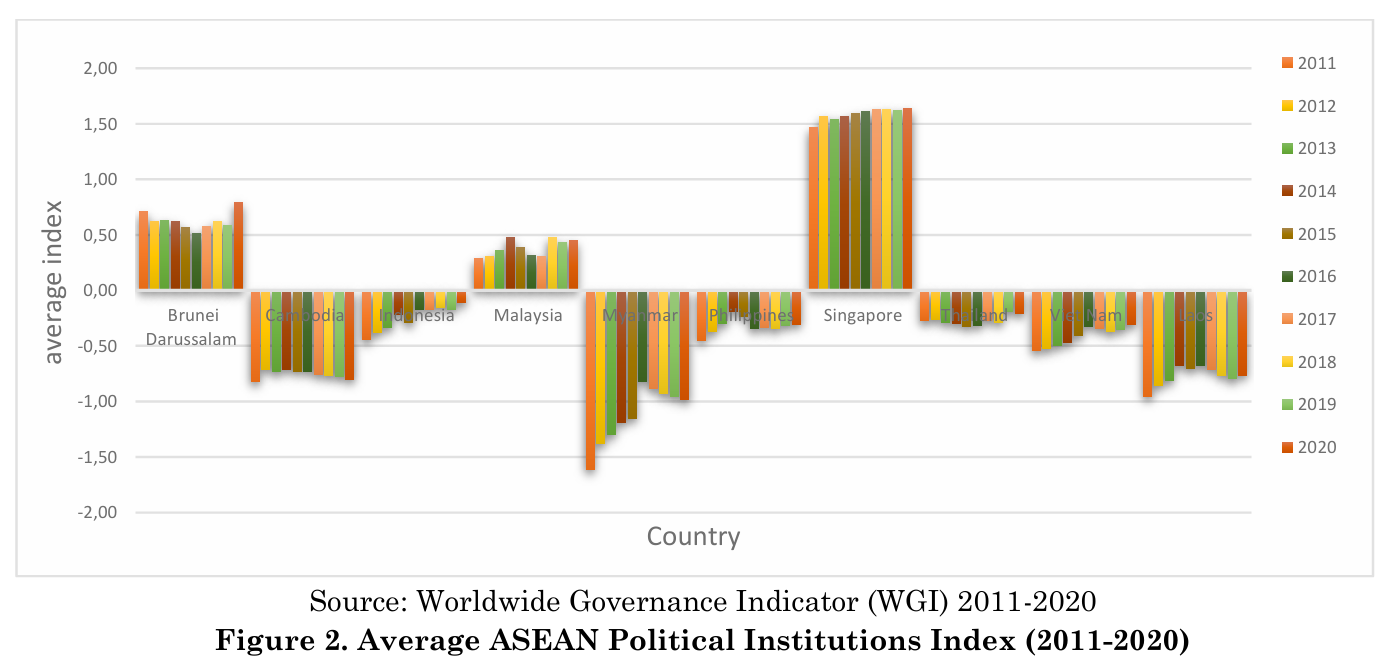

Several phenomena have occurred over the last ten years in ASEAN countries. First, foreign direct investment (FDI) inflows from ASEAN countries that are part of the East Asia and Pacific region are still low compared to East Asian countries. Second, some phenomena in ASEAN countries, such as corruption, coups, ethnic conflicts, and terrorism, are bad for political institutions. Third, the average value of economic freedom in ASEAN countries in the last ten years has yet to reach the highest average. This study aims to analyze the influence of FDI and the quality of institutions (political and economic institutions) on economic growth in ASEAN countries from 2011 to 2020. This study's panel data analysis uses fixed effect model. The analysis results show that inflows of FDI and political and economic institutions significantly and positively affect economic growth in ASEAN countries. Good quality institutions will be able to attract more foreign investment and can increase a country's economic growth.

Downloads

References

Acemoglu, D., Johnson, S., & Robinson, J. A. (2005). Institutions as a fundamental cause of long-run growth. Handbook of economic growth, 1(A).

Adams, S., & Opoku, E. E. O. (2015). Foreign direct investment, regulations and growth in sub-Saharan Africa. Economic Analysis and Policy, 47, 48–56. https://doi.org/10.1016/j.eap.2015.07.001

Aisen, A., & Veiga, F. J. (2011). How Does Political Instability Affect Economic Growth? IMF Working Papers, 11(12), 1. https://doi.org/10.5089/9781455211906.001

Akin, C. S., Cengiz, A., & Basak, G. A. (2014). The impact of economic freedom upon economic growth: An application on different income groups. Asian Economic and Financial Review, 4(8), 1024–1039.

Alexiou, C., Vogiazas, S., & Solovev, N. (2020). Economic growth and quality of institutions in 27 postsocialist economies. Journal of Economic Studies, 47(4), 769–787. https://doi.org/10.1108/JES-02-2019-0069

Asamoah, M. E., Adjasi, C. K. D., & Alhassan, A. L. (2016). Macroeconomic uncertainty, foreign direct investment and institutional quality: Evidence from Sub-Saharan Africa. Economic Systems, 40(4), 612–621. https://doi.org/10.1016/j.ecosys.2016.02.010

ASEAN Summit. (2023). Chairman's Statement of the 42nd ASEAN Summit. May, 10–11.

Asiedu, E., & Lien, D. (2011). Democracy, foreign direct investment and natural resources. Journal of International Economics, 84(1), 99–111. https://doi.org/10.1016/j.jinteco.2010.12.001

Bashier, M., & Khan, S. (2019). Effect of bilateral FDI, energy consumption, CO2 emission and capital on the economic growth of Asia countries. Energy Reports, 5, 1305–1315. https://doi.org/10.1016/j.egyr.2019.09.004

Benayed, W., Bougharriou, N., & Gabsi, F. B. (2020). The threshold effect of political institutions on the finance-growth nexus: Evidence from Sub-Saharan Africa. Economics Bulletin, 40(3), 1–11.

Bhujabal, P., Sethi, N., & Padhan, P. C. (2024). Effect of institutional quality on FDI inflows in South Asian and Southeast Asian countries. Heliyon, 10(5). https://doi.org/10.1016/j.heliyon.2024.e27060

Buchanan, B. G., Le, Q. V., & Rishi, M. (2012). Foreign direct investment and institutional quality: Some empirical evidence. International Review of Financial Analysis, 21(24), 81–89. https://doi.org/10.1016/j.irfa.2011.10.001

Burke, A., Williams, N., Barron, P., Jolliffe, K., & Carr, T. (2017). The Contested Areas of Myanmar: Subnational Conflict, Aid, and Development. Word Bank Report

Eslamloueyan, K., & Jafari, M. (2019). Do better institutions offset the adverse effect of a financial crisis on investment? Evidence from East Asia. Economic Modelling, 79, 154–172. https://doi.org/10.1016/j.econmod.2018.10.011

Fraser Institute. (2022). Economic Freedom of the World: 2022 Annual Report. In Economic Freedom of the World: 2022 Annual Report. https://doi.org/10.53095/88975001

Global Terrorism Database. (2018). Global Terrorism in 2017. National Consortium for the Study of Terrorism and Responses to Terrorism (START), August, 1–3.

Gurgul, H., & Lach, Ł. (2013). Political instability and economic growth: Evidence from two decades of transition in CEE. Communist and Post-Communist Studies, 46(2), 189–202. https://doi.org/10.1016/j.postcomstud.2013.03.008

Haini, H. (2019). Examining the relationship between finance, institutions and economic growth: evidence from the ASEAN economies. Economic Change and Restructuring, 53(4), 519–542. https://doi.org/10.1007/s10644-019-09257-5

Jude, C., & Levieuge, G. (2017). Growth Effect of Foreign Direct Investment in Developing Economies: The Role of Institutional Quality. World Economy, 40(4), 715–742. https://doi.org/10.1111/twec.12402

Kaufmann, D., Kraay, A., & Mastruzzi, M. (2009). Governance matters VII: Aggregate and individual governance indicators 1996-2007. Non-State Actors as Standard Setters, 146–188. https://doi.org/10.1017/CBO9780511635519.007

Kawaura, A. (2018). Generals in defense of allocation: Coups and military budgets in Thailand. Journal of Asian Economics, 58, 72–78. https://doi.org/10.1016/j.asieco.2018.07.004

Kelechi, A. C. (2012). Regression and Principal Component Analyses: a Comparison Using Few Regressors. American Journal of Mathematics and Statistics, 2(1), 1–5. https://doi.org/10.5923/j.ajms.20120201.01

Khan, M. H. (2018). Institutions and Asia’s development: The role of norms and organizational power. WIDER Working Paper 2018/132

Klomp, J., & de Haan, J. (2009). Political institutions and economic volatility. European Journal of Political Economy, 25(3), 311–326. https://doi.org/10.1016/j.ejpoleco.2009.02.006

Mahaini, M. G., Noordin, K., & Mohamad, M. T. (2019). The Impact of Political, Legal and Economic Institutions on Family Takaful/Life Insurance Consumption in OIC Countries. UMRAN - International Journal of Islamic and Civilizational Studies, 6(3), 97–114. https://doi.org/10.11113/umran2019.6n3.357

Mankiw, N. G. (2007). Makroekonomi (6th ed.). Erlangga.

Masron, T. A. (2013). Promoting intra-ASEAN FDI: The role of AFTA and AIA. Economic Modelling, 31(1), 43–48. https://doi.org/10.1016/j.econmod.2012.11.050

Mauro, P. (1995). Corruption and Growth. The Quarterly Journal of Economics, 110, 681–712. https://doi.org/10.2298/fid1301021m

McNulty, Y., De Cieri, H., & Hutchings, K. (2013). Expatriate return on investment in the Asia Pacific: An empirical study of individual ROI versus corporate ROI. Journal of World Business, 48(2), 209–221. https://doi.org/10.1016/j.jwb.2012.07.005

Muja, A., & Gunar, S. (2019). Institutions and economic performance: Evidence from Western Balkans 1996-2016. IFAC-PapersOnLine, 52(25), 287–292. https://doi.org/10.1016/j.ifacol.2019.12.497

Nawaz, S. (2015). Growth effects of institutions: A disaggregated analysis. Economic Modelling, 45, 118–126. https://doi.org/10.1016/j.econmod.2014.11.017

Nguyen, C. P., Su, T. D., & Nguyen, T. V. H. (2018). Institutional Quality and Economic Growth: The Case of Emerging Economies. Theoretical Economics Letters, 08(11), 1943–1956. https://doi.org/10.4236/tel.2018.811127

Nisa, E., & Farah, A. (2021). Institusi dan pertumbuhan ekonomi. Jurnal Dinamika Ekonomi Pembangunan, 4(2), 7–16.

North, D. C. (2016). Institutions and Economic Theory. American Economist, 61(1), 72–76. https://doi.org/10.1177/0569434516630194

Olaoye, O., & Aderajo, O. (2020). Institutions and economic growth in ECOWAS: an investigation into the hierarchy of institution hypothesis (HIH). International Journal of Social Economics, 47(9), 1081–1108. https://doi.org/10.1108/IJSE-10-2019-0630

Panahi, H., Assadzadeh, A., & Refaei, R. (2014). Economic Freedom and Economic Growth in Mena Countries. Asian Economic and Financial Review, 4(1), 105–116.

Parks, J. J., Champagne, A. R., Costi, T. A., Shum, W. W., Pasupathy, A. N., Neuscamman, E., Flores-Torres, S., Cornaglia, P. S., Aligia, A. A., Balseiro, C. A., Chan, G. K. L., Abruña, H. D., & Ralph, D. C. (2010). Mechanical control of Spin States in Spin-1 molecules and the underscreened kondo effect. In Science (Vol. 328, Issue 5984). The McGraw-Hill Companies. https://doi.org/10.1126/science.1186874

Petri, P. A. (2012). The Determinants of Bilateral FDI: Is Asia Different? SSRN Electronic Journal. https://doi.org/10.2139/ssrn.1577923

Prakasa, S. U. W. (2019). Garuda Indonesia-rolls royce corruption, transnational crime, and Eradication Measures. Lentera Hukum, 6(3), 409. https://doi.org/10.19184/ejlh.v6i3.14112

Rao, D. T., Sethi, N., Dash, D. P., & Bhujabal, P. (2020). Foreign aid, FDI and Economic Growth in South-East Asia and South Asia. Global Business Review. https://doi.org/10.1177/0972150919890957

Rousseeuw, P. J., & Leroy, A. M. (1987). Robust Regression and Outlier Detection. In Journal of the American Statistical Association (Vol. 84, Issue 406). https://doi.org/10.2307/2289958

Sabir, S. (2019). Fiscal policy, institutions and inclusive growth: evidence from the developing Asian countries. International Journal of Social Economics, 46(6), 822–837. https://doi.org/10.1108/IJSE-08-2018-0419

Saha, S., & Zhang, Z. (2017). Democracy-growth nexus and its interaction effect on human development: A cross-national analysis. Economic Modelling, 63, 304–310. https://doi.org/10.1016/j.econmod.2017.02.021

Santiso, C. (2001). Good Governance and Aid Effectiveness : The World Bank and Conditionality Good Governance and Aid Effectiveness : The World Bank and Conditionality Paul H Nitze School of Advanced International Studies. The Georgetown Public Policy Review, 7(1), 1–22.

Uddin, M. A., Ali, M. H., & Masih, M. (2017). Political stability and growth: An application of dynamic GMM and quantile regression. Economic Modelling, 64(April), 610–625. https://doi.org/10.1016/j.econmod.2017.04.028

Uddin, M. A., Ali, M. H., & Masih, M. (2020). Institutions, human capital and economic growth in developing countries. Studies in Economics and Finance, 38(2), 361–383. https://doi.org/10.1108/SEF-10-2019-0407

Wanjuu, L. Z., & Roux, P. le. (2017). Economic institutions and Economic Growth : Empirical Evidence From The Economic Community of West African States. South African Journal of Economic and Management Sciences, 20(1), 1–10. https://doi.org/https://doi.org/10.4102/sajems.v20i1.1607

Wooldridge, J. M. (2013). Introductory Econometrics A Modern Approach (5th ed.). Cengage Learning, South-Western.

World Bank. (2021). The World by Income and Region.

Yerrabati, S., & Hawkes, D. (2014). FDI and Economic Growth in South and East Asia & Pacific Region: Evidence from Meta-Analysis. Oxford Journal: An International Journal of Business & Economics, 9(2), 97–131.

Submitted

Accepted

Published

How to Cite

Issue

Section

License

Copyright (c) 2025 Bayu Kharisma, Sutyastie Soemitro Remi, Adhitya Wardhana, Francius Ricardo Silalahi

This work is licensed under a Creative Commons Attribution 4.0 International License.