The Impact of Coal Power Plant Emissions on Indonesia's Carbon Tax Rates

DOI:

https://doi.org/10.23917/jep.v26i1.10686Keywords:

Carbon Tax, Coal-Fired Power Plants, Emissions, System ThinkingAbstract

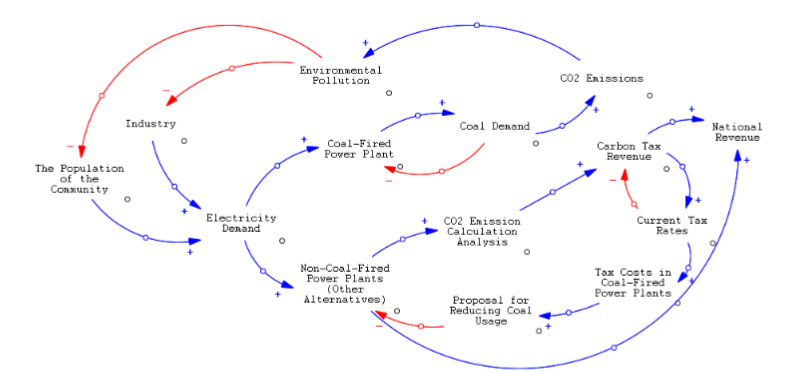

Indonesia, as one of the top ten global carbon emitters, largely due to its heavy reliance on coal-fired power plants, has introduced a carbon tax policy to address the environmental impacts and mitigate carbon emissions. This study investigates the dynamic effects of coal power plant emissions on Indonesia's carbon tax rates by applying a system thinking approach utilizing a Causal Loop Diagram (CLD). The CLD is used to map the complex interactions between carbon emissions, economic factors, and regulatory policies, focusing on Indonesia’s carbon tax policy framework from its inception in 2021 through its early implementation stage in 2022, with projections extending to 2025. The CLD analysis identifies three key feedback loops : a reinforcing loop where economic growth and electricity demand increase coal consumption and CO2 emissions, a balancing loop where carbon tax revenues stimulate renewable energy investments to reduce fossil fuel dependency, and a policy feedback loop that strengthens fiscal capacity for climate mitigation efforts. Scenario analysis suggests that increasing the carbon tax rate from IDR 30/kg CO2e to IDR 150/kg CO2e could significantly reduce emissions while maintaining economic stability, particularly in the energy sector, if accompanied by targeted subsidies and incentives for renewable energy. The findings contribute new policy insights on how carbon taxes can be optimized to achieve environmental conservation goals while minimizing negative economic impacts and promoting a sustainable energy transition in Indonesia.

Downloads

References

Abeydeera, U., Mesthrige, J. W., & Samarasinghe, T. (2019). Global Research on Carbon

Emissions: A Scientometric Review. Sustainability, 11(14), 3972.

https://doi.org/10.3390/su11143972

Acaroglu, L. (2017). Tools for Systems Thinkers: The 6 Fundamental Concepts of Systems

Thinking. Disruptive Design. https://medium.com/disruptive-design/tools-forsystems-thinkers-the-6-fundamental-concepts-of-systems-thinking-9b4d8a0b3c8e

Aditama, R. (2022). Kebijakan Ketenagalistrikan di Bidang Perlindungan dan Pengelolaan

Lingkungan Hidup Sejak Berlakunya Undang-Undang Cipta Kerja: Studi pada

PLTU Batubara Tarahan. Universitas Lampung.

Azis, R., Nurhayati, N., & Nurleli. (2023). The Contribution of Carbon Taxes to Economic

Progress in Indonesia. JRB - Jurnal Riset Bisnis, 7(1), 78–92.

https://doi.org/10.35814/jrb.v7i1.5536

Baskoro, F. R., Takahashi, K., Morikawa, K., & Nagasawa, K. (2022). Multi-objective

optimization on total cost and carbon dioxide emission of coal supply for coal-fired

power plants in Indonesia. Socio-Economic Planning Sciences, 81, 101185.

https://doi.org/10.1016/j.seps.2021.101185

Cahyono, W. E., Parikesit, Joy, B., Setyawati, W., & Mahdi, R. (2022). Projection of CO2

emissions in Indonesia. Materials Today: Proceedings, 63(Supplement 1), S438–

S444. https://doi.org/10.1016/j.matpr.2022.04.091

Cornot-Gandolphe, S. (2016). Indonesia’s Electricity Demand and the Coal Sector: Export

or meet domestic demand? https://doi.org/10.26889/9781784670795

Dat, N. D., Hoang, N., Huyen, M. T., Huy, D. T. N., & Lan, L. M. (2020). Energy

Consumption and Economic Growth in Indonesia. International Journal of Energy

Economics and Policy, 10(5), 601–607. https://doi.org/10.32479/ijeep.10243

Forster, P., Ramaswamy, V., Artaxo, P., Berntsen, T., Betts, R., Fahey, D. W., Haywood, J.,

Lean, J., Lowe, D. C., Myhre, G., Nganga, J., Prinn, R., Raga, G., Schulz, M., & Van

Dorland, R. (2007). Changes in Atmospheric Constituents and in Radiative Forcing.

Chapter 2. In S. Solomon, D. Qin, M. Manning, Z. Chen, M. Marquis, K. B. Averyt,

M. Tignor, & H. L. Miller (Eds.), Climate Change 2007: The Physical Science Basis

(pp. 129–234). Cambridge University Press.

Global Carbon Atlas Team. (2023). Global Carbon Budget, 2023 Edition.

https://www.globalcarbonatlas.org

Hidayatno, A., Dhamayanti, R., & Destyanto, A. R. (2019). Model conceptualization for

policy analysis in renewable energy development in Indonesia by using system

dynamics. International Journal of Smart Grid and Clean Energy, 8(1), 54–58.

https://doi.org/10.12720/sgce.8.1.54-58

International Energy Agency. (2020). Global CO2 Emissions in 2019. International Energy

Agency. https://www.iea.org/reports/global-co2-emissions-in-2019

Investor Daily. (2021). Pajak Karbon. Investor Daily. https://investor.id/

Irama, A. B. (2020). Perdagangan Karbon di Indonesia: Kajian Kelembagaan dan

Keuangan Negara. Jurnal Ilmu Administrasi, 4(1).

https://doi.org/10.31092/jia.v4i1.741

Kuziboev, B., Rajabov, A., Ibadullaev, E., Matkarimov, F., & Ataev, J. (2024). The role of

renewable energy, tax revenue and women governance in environmental degradation

for developing Asian countries. Energy Nexus, 13, 100262.

https://doi.org/10.1016/j.nexus.2023.100262

Lin, B., & Li, X. (2011). The effect of carbon tax on per capita CO2 emissions. Energy Policy,

39(9), 5137–5146. https://doi.org/10.1016/j.enpol.2011.05.050

Lismiyah, E., Marselina, M., Taher, A. R., Gunarto, T., & Aida, N. (2024). The Causality

Between Energy Consumption and Carbon Emission in Indonesia. Jurnal Riset Ilmu

Ekonomi, 4(1), 27–38. https://doi.org/10.23969/jrie.v4i1.83

Mutia, A. (2022). 10 Negara Penyumbang Emisi Karbon Terbesar di Dunia, Ada Indonesia!

Katadata Media Network. https://www.katadata.co.id/

NASA. (2024). The Causes of Climate Change. https://science.nasa.gov/climatechange/causes/

National Centers for Environmental Information (NCEI). (2022). Annual 2022 Global

Climate Report. https://www.ncei.noaa.gov/access/monitoring/monthlyreport/global/202213

Oktavilia, S., Puspita, D. W., Firmansyah, & Sugiyanto, F. (2018). The Relationship

Between Environmental Degradation, Poverty and Human Quality in Indonesia. E3S

Web of Conferences, 73(1), 10020. https://doi.org/10.1051/e3sconf/20187310020

Organisation for Economic Co-operation, & (OECD), D. (2023). Environment at a Glance

Indicators. OECD Publishing. https://www.oecd.org/en/publications/environment-ata-glance-indicators_ac4b8b89-en.html

Pamungkas, B. N., & Haptari, V. D. (2022). Analisis Skema Pengenaan Pajak Karbon Di

Indonesia Berdasarkan United Nations Handbook Mengenai Penerapan Pajak

Karbon Oleh Negara Berkembang. JURNAL PAJAK INDONESIA (Indonesian Tax

Review), 6(2), 357–367. https://doi.org/10.31092/jpi.v6i2.1843

Prahasta, E. (2018). Systems Thinking & Pemodelan Sistem Dinamis (Cet. 1). Informatika

Bandung.

Pujiati, A., Yanto, H., Dwi Handayani, B., Ridzuan, A. R., Borhan, H., & Shaari, M. S.

(2023). The Detrimental Effects of Dirty Energy, Foreign Investment, and Corruption

on Environmental Quality: New Evidence from Indonesia. Frontiers in

Environmental Science, 10, 1074172. https://doi.org/10.3389/fenvs.2022.1074172

Putra, J. J. H., Nabilla, N., & Jabanto, F. Y. (2021). Comparing “Carbon Tax” and “Cap and

Trade” as Mechanism to Reduce Emission in Indonesia. International Journal of

Energy Economics and Policy, 11(5), 106–111. https://doi.org/10.32479/ijeep.11375

Ramadhani, D. P., & Koo, Y. (2022). Comparative Analysis of Carbon Border Tax

Adjustment and Domestic Carbon Tax Under General Equilibrium Model: Focusing

on the Indonesian Economy. Journal of Cleaner Production, 377, 134288.

https://doi.org/10.1016/j.jclepro.2022.134288

Ratnawati, D. (2016). Carbon Tax Sebagai Alternatif Kebijakan Untuk Mengatasi

Eksternalitas Negatif Emisi Karbon di Indonesia. Indonesian Treasury Review:

Jurnal Perbendaharaan, Keuangan Negara dan Kebijakan Publik, 1(2), 53–67.

https://doi.org/10.33105/itrev.v1i2.51

Sabubu, T. A. W. (2020). Pengaturan Pembangkit Listrik Tenaga Uap Batubara Di

Indonesia Prespektif Hak Atas Lingkungan Yang Baik Dan Sehat. Lex Renaissance,

5(1), 72–90. https://doi.org/10.20885/JLR.vol5.iss1.art5

Sapta, L. T., Junaidi, J., & Umiyati, E. (2024). Determinants of electricity demand in the

industrial and commercial sector in Indonesia. Jurnal Paradigma Ekonomika, 19(1),

60–67. https://doi.org/10.22437/jpe.v19i1.34640

Saputra, A. I., Limpato, J., & Kuswantoro, H. (2022). Carbon Pricing and its Monitoring

System as a State Revenue. Indonesian Treasury Review: Jurnal Perbendaharaan,

Keuangan Negara Dan Kebijakan Publik, 7(3), 207–223.

https://doi.org/10.33105/itrev.v7i3.456

Sarasi, V., Yulianti, D., & Farras, J. I. (2021). Berpikir Sistem dan Dinamika Sistem.

Penerbit Yayasan Sahabat Alam Rafflesia.

Stern, N. (2007). The Economics of Climate Change: The Stern Review. Cambridge

University Press.

Sumarno, T. B., & Laan, T. (2021). Taxing Coal to Hit the Goals: A simple way for Indonesia

to reduce carbon emissions. https://www.iisd.org/system/files/2021-08/taxing-coalindonesia-reduce-carbon-emissions.pdf

Suryani, E., Hendrawan, R. A., Adipraja, P. F. E., & Widodo, B. (2022). Dynamic scenario

to mitigate carbon emissions of transportation system: A system thinking approach.

Procedia Computer Science, 197(1), 635–641.

https://doi.org/10.1016/j.procs.2021.12.184

Thwink.org. (2014). Systems Thinking.

https://www.thwink.org/sustain/glossary/SystemsThinking.htm

Wafiq, A. N., & Suryanto, S. (2021). The Impact of Population Density and Economic

Growth on Environmental Quality: Study in Indonesia. Jurnal Ekonomi & Studi

Pembangunan, 22(2), 301–312. https://doi.org/10.18196/jesp.v22i2.10533

Wang, H., Li, L., Sun, J., & Shen, M. (2023). Carbon emissions abatement with duopoly

generators and eco-conscious consumers: Carbon tax vs carbon allowance. Economic

Analysis and Policy, 80, 786–804. https://doi.org/10.1016/j.eap.2023.09.022

Zhang, Z., Qu, J., & Zeng, J. (2008). A quantitative comparison and analysis on the

assessment indicators of greenhouse gases emission. Journal of Geographical

Sciences, 18, 387–399. https://doi.org/10.1007/s11442-008-0387-8

Submitted

Accepted

Published

How to Cite

Issue

Section

License

Copyright (c) 2025 Arif Rahman Hakim, Vita Sarasi, Eddy Prahasta

This work is licensed under a Creative Commons Attribution 4.0 International License.