Sharia Financial Literacy: Research Trends and Directions for Future Inquiry

DOI:

https://doi.org/10.23917/jisel.v6i2.22396Keywords:

Islamic financial literacy, financial products, financial services, financial sector, society, economic inclusion indexAbstract

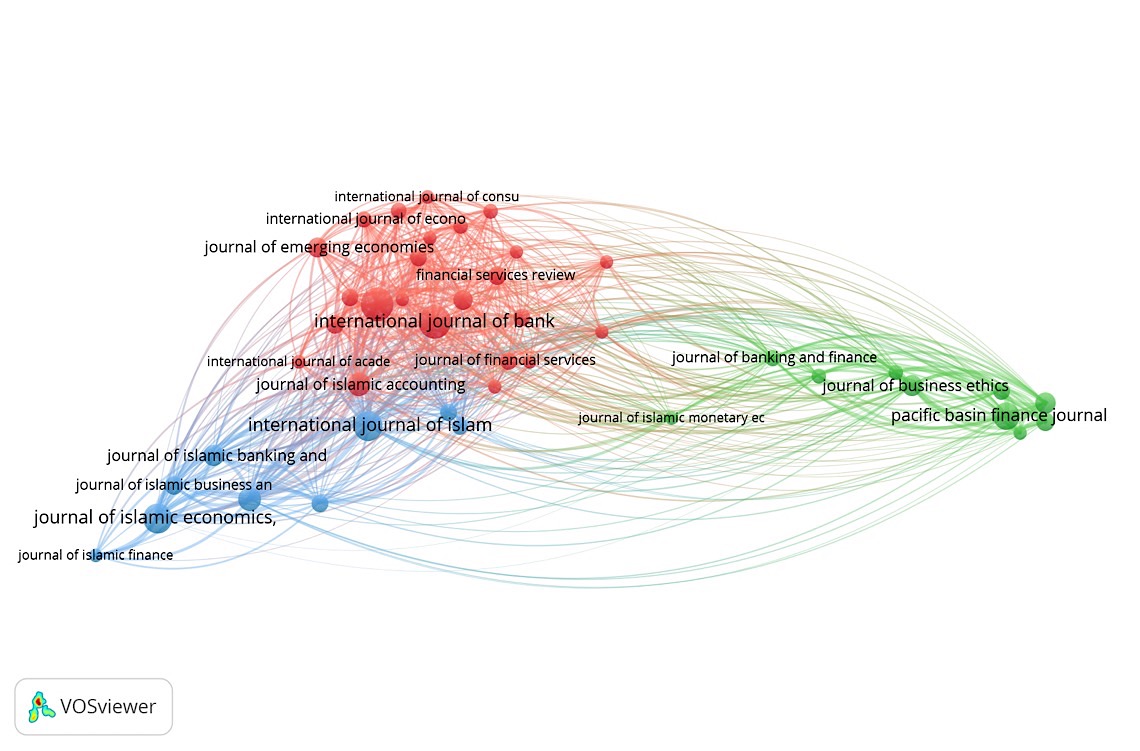

Sharia financial literacy refers to understanding the advantages and disadvantages of financial products and services, which can benefit the financial sector and society. However, research on this topic has needed to be faster to develop, with the Islamic financial literacy index lagging far behind the conventional financial inclusion index. Therefore, it is essential to conduct research that can inform future studies. This study aims to explore the direction of research on Islamic financial literacy by analyzing publications related to Islamic finance using bibliometric methods, VOSviewers, and R-studio applications. This analysis identifies core journals in international publications, researcher productivity, institutional collaboration, and keyword/author development. This finding indicates that Widyastuti, U. has the most publications, while Universiti Teknologi MARA and Universiti Malaya are the most productive universities. Indonesia and Malaysia are the nations with the most published works.

Downloads

Submitted

Published

How to Cite

Issue

Section

License

Copyright (c) 2023 Journal of Islamic Economic Laws

This work is licensed under a Creative Commons Attribution-ShareAlike 4.0 International License.