Determinants of Muzakki Decision-Making to Pay Zakat in Baitulmaal Muamalat DKI Jakarta

DOI:

https://doi.org/10.23917/jisel.v6i1.21184Keywords:

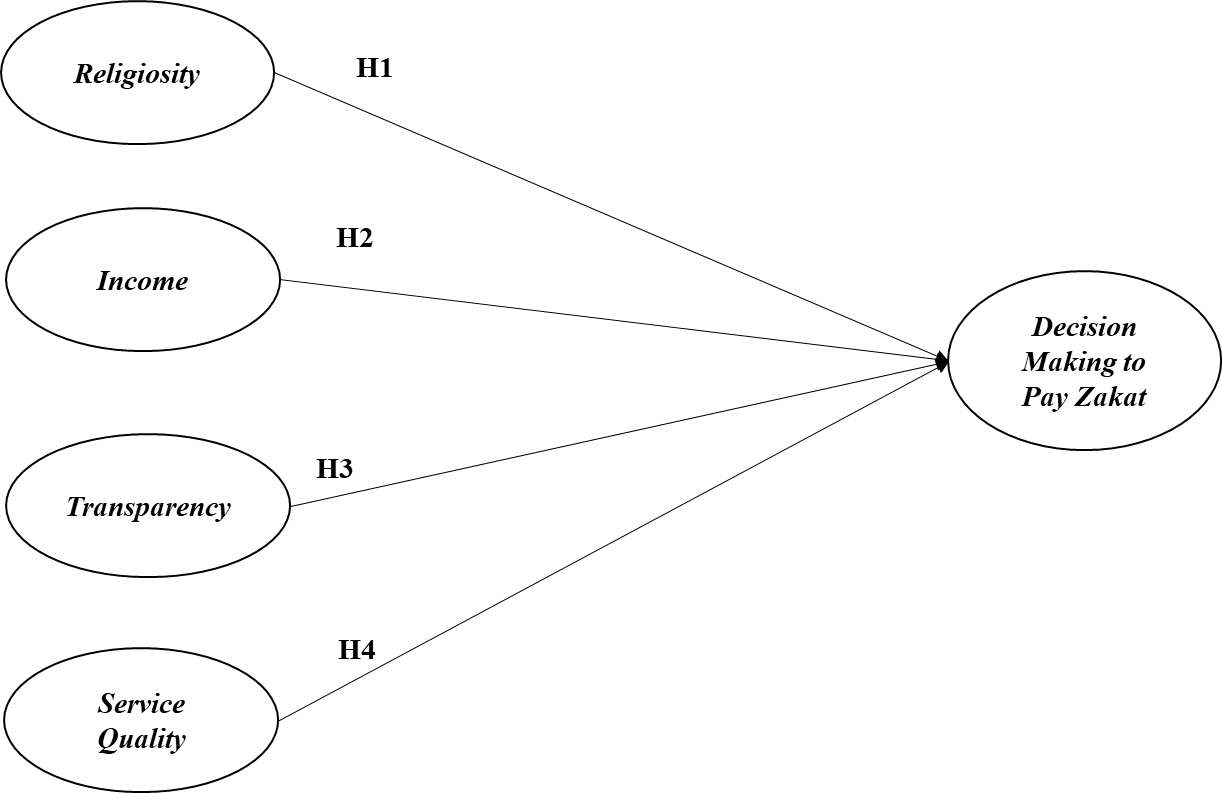

religiosity, income, transparency, quality of services, decision to pay zakatAbstract

Zakat is part of the five pillars of Islam, which is legally obligatory to do when one's property has touched the nishab and haul. Zakat has considerable potential to overcome economic problems, especially poverty. DKI Jakarta is the sixth largest city in Indonesia, with a majority Muslim population. So DKI Jakarta also has considerable zakat potential. However, there is a difference between the potential amount of zakat receipts in DKI Jakarta and the realization of zakat fund collection. This research aims to see the effect of religiosity, income, transparency, and service quality on the decisionmaking of muzakki to pay zakat in Baitulmaal Muamalat (a case study in DKI Jakarta). This research is the descriptive quantitative approach with multiple linear analysis methods. The sampling technique chosen in this research is probability sampling, Simple random sampling. The sample from this study amounted to 217 muzakki in DKI Jakarta, who distributed their zakat in Baitulmaal Muamalat. The analysis results show how the variables of religiosity, income, transparency, and service quality partially or simultaneously impact the decision-making of muzakki to pay zakat through baitulmaal muamalat in DKI Jakarta.

Downloads

Submitted

Published

How to Cite

Issue

Section

License

Copyright (c) 2023 Journal of Islamic Economic Laws

This work is licensed under a Creative Commons Attribution-ShareAlike 4.0 International License.