Creative Accounting: Viewed from Risk and Sharia Compliance Perspective

DOI:

https://doi.org/10.23917/jisel.v6i1.21164Keywords:

earnings management, firm risk, tax risk, sharia complianceAbstract

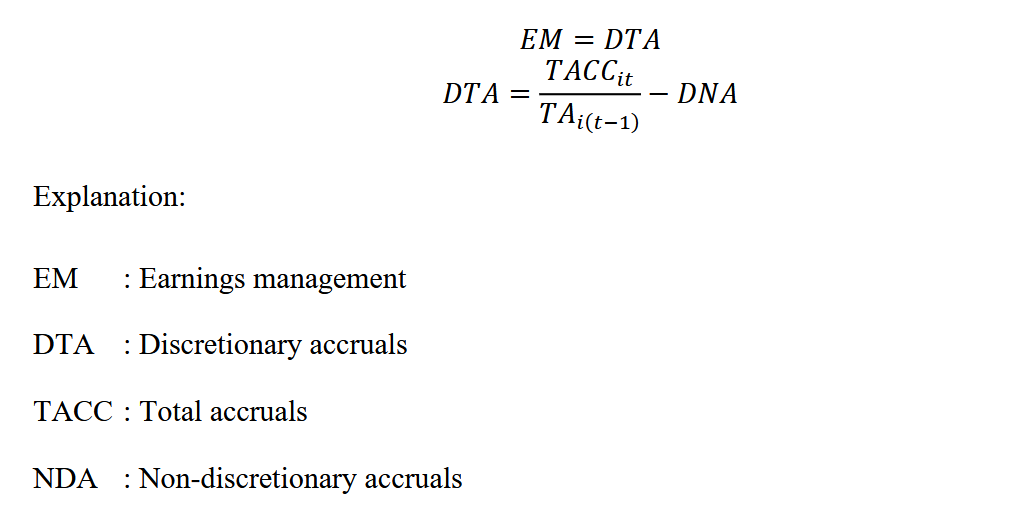

A company with a corporate form resulting from the industrial revolution raises a principal and agent relationship. The separation between the company's owner and the people who run the company makes accounting needs more crucial. However, accounting, a solution for communication between owners and management, is often exploited by managers through creative accounting, also known as earnings management. This study aims to determine the effect of firm risk, tax risk, and sharia compliance on earnings management. The research was conducted on manufacturing sector companies listed on Indonesia Stock Exchange (IDX) in 2016-2019. Using the purposive sampling method, the number of samples used is 69 companies, with 276 observations. The hypothesis examination used in this research is the multiple linear regression analysis of pooled data. The result shows that firm risk from the perspective of debtholders has a positive effect on earnings management. On the other hand, firm risk from equity holders' perspective, tax risk, and sharia compliance has no effect on earnings management.

Downloads

Submitted

Published

How to Cite

Issue

Section

License

Copyright (c) 2023 Journal of Islamic Economic Laws

This work is licensed under a Creative Commons Attribution-ShareAlike 4.0 International License.