The Influence and Contribution of Macroeconomics to The Indonesian Sharia Stock Index for The Period 2011-2021

DOI:

https://doi.org/10.23917/jisel.v6i1.21073Keywords:

ISSI, Macroeconomics, VECMAbstract

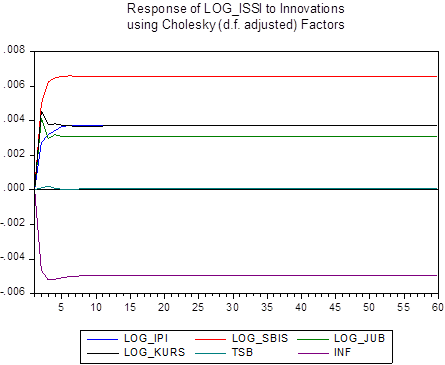

This study aims to determine the impact of macroeconomic variables on the Indonesian Sharia Stock Index (ISSI). The macroeconomic variables used are Industrial Production Index (IPI), Indonesian Sharia Bank Certificate (ISBC), Money Supply (MS), Exchange Rates (ER), Interest Rates (IR), and inflation. The observed data is in the form of monthly data for the period 2011 to 2021. The method used is to test the impact and contribution of VECM. The test results with the VECM model found that in the short term, all variables had no effect on the Indonesian Sharia Stock Index, whereas, in the long term, IPI, ISBC, and inflation had a negative effect, and MS, ER, and IR had a positive effect, based on the IRF test showed that ISSI responding to fluctuations from all positive macroeconomic variables except inflation which responded negatively and the contribution of each macroeconomic variable was IPI (0.64), ISBC (2.01), MS (0.45), ER (0.64), IR (0.01), and inflation (1.16) against the Indonesian Sharia Stock Index.

Downloads

Submitted

Published

How to Cite

Issue

Section

License

Copyright (c) 2023 Journal of Islamic Economic Laws

This work is licensed under a Creative Commons Attribution-ShareAlike 4.0 International License.