The Effect of The Characteristics of the Board of Directors and Sharia Supervisory Board on The Distribution of Zakat of Islamic Banks In Indonesia

DOI:

https://doi.org/10.23917/jisel.v8i02.9059Keywords:

Zakat, Islamic banks, Board of directors, Sharia supervisory boardAbstract

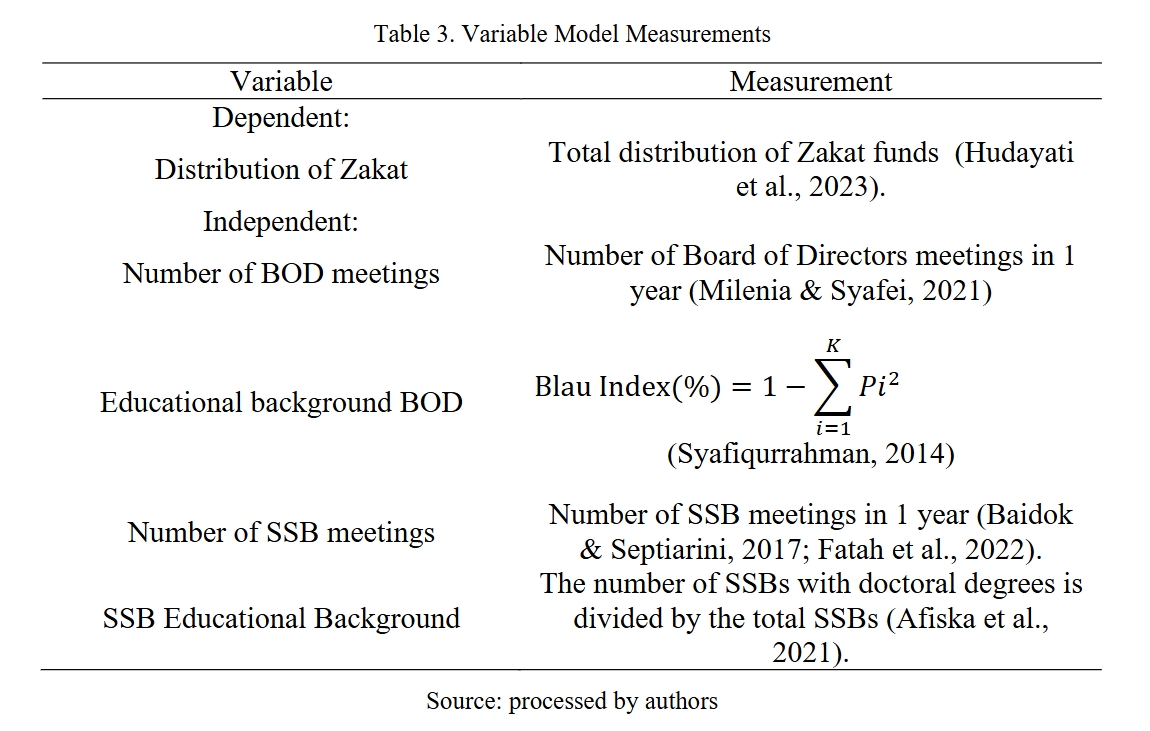

This study aims to test the effect of the characteristics of the Board of Directors and the Sharia Supervisory Board on the distribution of Zakat to third parties by Islamic banks in Indonesia. This research uses an associative quantitative approach using panel data regression. The data is secondary from Islamic banks' annual reports in Indonesia registered with OJK for 2021-2023. The sampling method used was purposive sampling, and a sample of 11 Islamic banks with 33 annual reports. The results showed that the number of meetings of the Board of Directors and the number of meetings of the Sharia Supervisory Board did not affect the distribution of Zakat. Meanwhile, the educational background of the Board of Directors has a negative effect on the distribution of Zakat, and the educational background of the Sharia Supervisory Board has a positive effect on the distribution of Zakat. The implications of this research can theoretically be used as a reference for further research. Practically, this research can be used as a reference material for Islamic banks in Indonesia and similar countries in optimizing social performance and evaluation material, especially for distributing Zakat to third parties.

Downloads

References

Abdallah, & Bahloul. (2021). Disclosure, Shariah governance and financial performance in Islamic banks. Asian Journal of Economics and Banking, 5(3), 234–254. https://doi.org/10.1108/ajeb-03-2021-0038

Afiska, L., Handayani, D. F., & Serly, V. (2021). Pengaruh Karakteristik Dewan Pengawas Syariah (DPS) Terhadap Kinerja Keuangan Bank Umum Syariah Yang Terdaftar pada Otoritas Jasa Keuangan (OJK) Indonesia. Jurnal Eksplorasi Akuntansi, 3(4), 784–798. https://doi.org/10.24036/jea.v3i4.429

Alsartawi, A. (2019). Performance of Islamic banks: Do the frequency of Sharīʿah supervisory board meetings and independence matter? ISRA International Journal of Islamic Finance, 11(2), 303–321. https://doi.org/10.1108/IJIF-05-2018-0054

Amine, B. (2018). Contribution of Governance to Ensure the Stability of Islamic Banks: A Panel Data Analysis. International Journal of Accounting and Financial Reporting, 8(3), 140. https://doi.org/10.5296/ijafr.v8i3.13333

Asutay, M., & Harningtyas, A. F. (2015). Developing Maqasid al-Shari'ah Index to Evaluate Social Performance of Islamic Banks: A Conceptual and Empirical Attempt. International Journal of Islamic Economics and Finance Studies, 1(1), 5–64. https://durham-repository.worktribe.com/OutputFile/1393301

Baidok, W., & Septiarini, D. F. (2017). Pengaruh Dewan Komisaris, Komposisi Dewan Komisaris Independen, Dewan Pengawas Syariah, Frekuensi Rapat Dewan Komisaris Syariah, Dan Frekuensi Rapat Komite Audit Terhadap Pengungkapan Indeks Islamic Social Reporting Pada Bank Umum Syariah Periode 2010-201. Jurnal Ekonomi Syariah Teori Dan Terapan, 3(12), 1020. https://doi.org/10.20473/vol3iss201612pp1020-1034

Fatah, A. N., Pratama, B. C., Fitriati, A., & Hapsari, I. (2022). Pengaruh Intellectual Capital dan Karakteristik Dewan Pengawas Syariah Terhadap Kinerja Sosial Pada Perbankan Syariah. Jurnal Ilmiah Ekonomi Islam, 8(1), 730. https://doi.org/10.29040/jiei.v8i1.3749

Firdaus, R., Sumiati, S., Djazuli, A., & Indrawati, N. K. (2025). The Role of Zakat Disclosure as a Mediating Variable in the Effect of Functional Diversity of the Board of Commissioners and Sharia Supervisory Board on ROE (Study on Islamic Commercial Banks in Indonesia for the 2013-2020 Period). Proceedings of the 3rd Warmadewa International Conference on Science, Technology, and Humanity, WICSTH 2023, 1–14. https://doi.org/10.4108/eai.27-10-2023.2353551

Haddad, A., & Bouri, A. (2022). The impact of Shariah Advisory Board characteristics on the financial performance of Islamic banks. Cogent Economics and Finance, 10(1), 1–38. https://doi.org/10.1080/23322039.2022.2062911

Hudayati, A., Muhamad, I., & Marfuah, M. (2023). The effect of board of directors and Sharia supervisory board on Zakat funds at Islamic banks in indonesia. Cogent Business and Management, 10(2), 1–19. https://doi.org/10.1080/23311975.2023.2231206

Intia, L. C., & Azizah, S. N. (2021). Pengaruh Dewan Direksi, Dewan Komisaris Independen, Dan Dewan Pengawas Syariah Terhadap Kinerja Keuangan Perbankan Syariah Di Indonesia. Jurnal Riset Keuangan Dan Akuntansi, 7(2), 46–59. https://doi.org/10.25134/jrka.v7i2.4860

Iryani, D., & Wahyudiono, B. (2020). Quality of Sharia Governance Structure on Social Performance in Indonesian Islamic Banking. Jhss (Journal of Humanities and Social Studies), 4(1), 57–61. https://doi.org/10.33751/jhss.v4i1.2042

Khalid, A. A., & Sarea, A. M. (2021). Independence and effectiveness in internal Shariah audit with insights drawn from Islamic agency theory. International Journal of Law and Management, 63(3), 332–346. https://doi.org/10.1108/IJLMA-02-2020-0056

Milenia, H. F., & Syafei, A. W. (2021). Analisis Pengaruh Islamic Governance terhadap Pengungkapan ISR pada Bank Syariah di Indonesia. Jurnal Al Azhar Indonesia Seri Ilmu Sosial, 2(2), 110. https://doi.org/10.36722/jaiss.v2i2.706

Mughni, S. &. (2022). Menyingkap fungsi sosial perbankan syariah dan pengaruhnya terhadap kinerja keuangan. JPS (Jurnal Perbankan Syariah), 3(2), 85–186.

Mukhibad, H., Jayanto, P. Y., Jati, K. W., & Khafid, M. (2022). Attributes of Shariah Supervisory Board and Shariah Compliance. Corporate Governance and Organizational Behavior Review, 6(3), 173–180. https://doi.org/10.22495/cgobrv6i3p16

Mukhibad, H., Rochmatullah, M. R., Warsina, W., Rahmawati, R., & Setiawan, D. (2020). Islamic corporate governance and performance based on maqasid Sharia index– study in Indonesia. Jurnal Siasat Bisnis, 24(2), 114–126. https://doi.org/10.20885/jsb.vol24.iss2.art2

Ningrum, R. A., & Umiyati. (2024). Sharia Compliance And Intellectual Capital Toward Protability Of Islamic Commercial Banks In Indonesia. JPS (Jurnal Perbankan Syariah), 5(2), 286–303. https://doi.org/https://doi.org/10.46367/jps.v5i2.1998

Nomran, N. M., & Haron, R. (2022). Validity of Zakat ratios as Islamic performance indicators in Islamic banking: a congeneric model and confirmatory factor analysis. ISRA International Journal of Islamic Finance, 14(1), 41–62. https://doi.org/10.1108/IJIF-08-2018-0088

Nugraheni, P. (2018). Sharia supervisory board and social performance of Indonesian Islamic banks. Jurnal Akuntansi & Auditing Indonesia, 22(2), 137–147. https://doi.org/10.20885/jaai.vol22.iss2.art6

Ponirah, A., Oktariyani, S., Sakinah, G., & Sari, Y. T. P. (2023). Efek moderasi Islamic Social Reporting pada pengarus Islamicity Performance Index terhadap Financial Performance perbankan syariah. JPS (Jurnal Perbankan Syariah), 4(1), 98–115. https://doi.org/10.46367/jps.v4i1.1056

Prihantono, Sukardi, B., Riyani, & Kurniati, P. (2024). Linkage Islamicity Performance Index and Islamic Corporate Governance throught Financial Health Performance of Indonesian Islamic Banks. International Journal of Islamic Business and Economics (IJIBEC), 8(1), 57–77. https://doi.org/10.28918/ijibec.v8i1.6872

Rahman, N. A., & Jusoh, M. A. (2018). A Review of Board of Director, Shariah Supervisory Board and Zakat Distribution Performance in Malaysia. International Journal of Academic Research in Business and Social Sciences, 8(2), 770–779. https://doi.org/10.6007/ijarbss/v8-i2/3985

Rinta. (2021). Ukuran Dewan Direksi, Aktivitas Komite Audit Dan Ukuran Komite Audit Terhadap Manajemen Laba. Journal of Accounting Science, 5(1), 89–103. https://doi.org/10.21070/jas.v5i1.1336

Sari, W. R., Pratama, B. C., Fakhruddin, I., & Wibowo, H. (2023). Do the characteristics of Sharia supervisory board affect the disclosure of Islamic social reporting? JIFA (Journal of Islamic Finance and Accounting), 6(1), 1–20. https://doi.org/10.22515/jifa.v6i1.5684

Sawmar, A. A., & Mohammed, M. O. (2021). Enhancing Zakat compliance through good governance: a conceptual framework. ISRA International Journal of Islamic Finance, 13(1), 136–154. https://doi.org/10.1108/IJIF-10-2018-0116

Setiawan, F. (2020). Pengaruh Karakteristik Dewan Pengawas Syari’ah dan Ukuran Dewan Komisaris terhadap Pengungkapan Islamic Social Reporting. Al Maal: Journal of Islamic Economics and Banking, 2(1), 25. https://doi.org/10.31000/almaal.v2i1.2718

Sidik, A. (2023). Analysis of Zakat Literacy, Zakat Transparency, and Sharia Compliance OPZ Performance with Puskasbaznas Index. Jurnal Syntax Transformation, 4(8), 104–117. https://doi.org/10.46799/jst.v4i8.792

Syafiqurrahman, A. & S. (2014). Analisis pengaruh corporate governance dan pengaruh keputusan pendanaan terhadap kinerja perusahaan perbankan di indonesia. Finance and Banking Journal, 16(1), 1–16. https://doi.org/https://doi.org/10.24912/ja.v18i1.548

Wardati, S. D., Shofiyah, S., & Ariani, K. R. (2021). Pengaruh Dewan Komisaris, Dewan Direksi, Komite Audit, Dan Ukuran Perusahaan Terhadap Kinerja Keuangan. Inspirasi Ekonomi Jurnal Ekonomi Manajemen, 3(4), 1–10. https://doi.org/10.32938/ie.v3i4.2015

Yadiati, W., Prasojo, P., Listyorini, I., Rofiqah, I., & Putra, R. N. A. (2022). Human Capital, Quality of Sharia Supervisory Board and Maqasid Shariah Based Performance: Cross Country Evidence. Jurnal Dinamika Akuntansi Dan Bisnis, 9(2), 261–280. https://doi.org/10.24815/jdab.v9i2.26740

Yanto, T., & Juliana, C. (2019). Pengaruh gender dan latar belakang pendidikan direksi dan komisaris terhadap tanggung jawab sosial dan dampaknya terhadap nilai perusahaan. Prosiding Working Papers Series In Management, 11(2), 134–154. https://doi.org/https://doi.org/10.25170/wpm.v11i2.4524

Zakiy, F. S., Falikhatun, F., & Fauziah, N. N. (2023). Sharia governance and organizational performance in Zakat management organization: evidence from Indonesia. Journal of Islamic Accounting and Business Research, ahead-of-p(ahead-of-print). https://doi.org/10.1108/JIABR-06-2023-0188

Downloads

Submitted

Accepted

Published

How to Cite

Issue

Section

License

Copyright (c) 2025 Journal of Islamic Economic Laws

This work is licensed under a Creative Commons Attribution-ShareAlike 4.0 International License.