Accounting and Legal Disputes in Islamic Banking and Finance

DOI:

https://doi.org/10.23917/jisel.v8i01.6915Keywords:

Accounting for Islamic finance, Islamic banking and Finance, Disputes resolution, Accounting principles, Islamic finance reporting practices, Accounting regulationAbstract

This paper explores the role of accounting for Islamic finance in dispute settlements in the Islamic banking and finance (IBF) industry. This study adopts a legal approach, using an analysis design to investigate the main principles and processes of dispute resolution in Islamic finance. The study involves a comprehensive review of relevant legal sources, including Islamic law, national laws and regulations, court judgments, legal opinions, and industry standards. The study shows that the promotion of legal certainty will require a strong base of legal and Islamic finance professionals and the competence and awareness of accountants, lawyers, and judges. The study also shows that financial records, statements, and documentation have a significant role in resolving disputes. Accounting records can provide evidence of transactions and terms agreed upon. Properly documented and transparent accounting practices can help clarify the nature of the dispute and contribute to finding a fair and efficient resolution in the context of Islamic financial activities. This study provides practical implications for IBF stakeholders in managing legal disputes, such as helping Islamic financial practitioners recognize the importance of integrating robust accounting practices, clear financial reporting, and transparent disclosure mechanisms. These practices are pivotal not only for the industry’s credibility but also for effective disputes resolution.

Downloads

References

AAOIFI. (n.d.). Accounting and Auditing Organization for Islamic Financial Institutions. Retrieved February 18, 2023, from https://aaoifi.com/about-aaoifi/?lang=en

Aboul-Dahab, K. M. A. (2023). The Contribution of the Islamic and Social Banks to the Concept of Sustainable Development. European Journal of Islamic Finance, 10(2), 13–25. https://doi.org/10.13135/2421-2172/7178

Akbar, M., Akbar, A., Yaqoob, H. S., Hussain, A., Svobodová, L., & Yasmin, F. (2023). Islamic finance education: Current state and challenges for Pakistan. Cogent Economics & Finance, 11(1), 1–29. https://doi.org/10.1080/23322039.2022.2164665

Al Rahahleh, N., Bhatti, M. I, & Misman, F. N. (2019). Developments in Risk Management in Islamic Finance: A Review. Journal of Risk and Financial Management, 12(37), 1–22. https://doi.org/10.3390/jrfm12010037

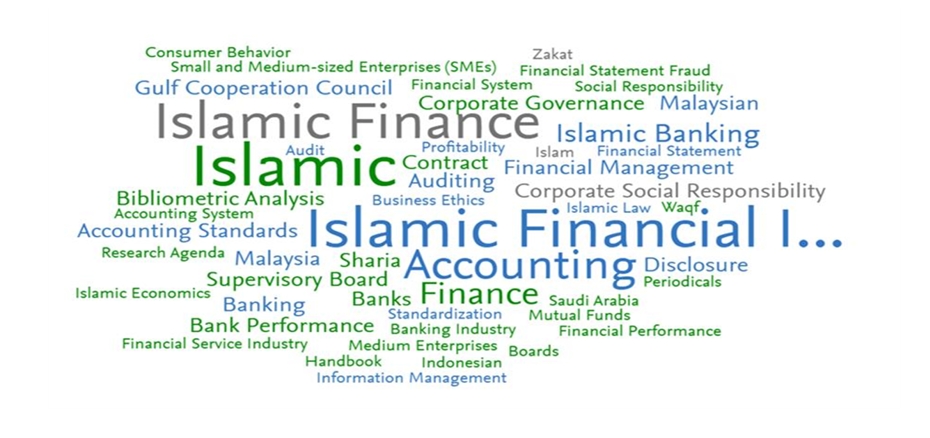

Alshater, M. M., Hassan, M. K., Khan, A., & Saba, I. (2021). Influential and Intellectual Structure of Islamic Finance: A Bibliometric Review. International Journal of Islamic and Middle Eastern Finance and Management, 14(2), 339–365. https://doi.org/10.1108/IMEFM-08-2020-0419

Alshater, M. M., Khan, A., Hassan, M. K., & Paltrinieri, A. (2022). Islamic Banking: Past, Present and Future. Journal of College of Sharia & Islamic Studies, 41(1), 193–221. https://doi.org/10.29117/jcsis.2023.0351

Aqib Ali, M. (2023). An Assessment of Islamic Banking in Asia, Europe, USA, and Australia. European Journal of Islamic Finance, 10(1), 1–15. https://doi.org/10.13135/2421-2172/7345

Asl, G. M., & Doudkanlou, M. G. (2022). How do Islamic banks manage earnings? Application of various measurement models in the Iranian Islamic banking system. ISRA International Journal of Islamic Finance, 274–288. https://doi.org/10.1108/IJIF-02-2021-0040

Bälz, K. (2008). Sharia Risk? How Islamic Finance Has Transformed Islamic Contract Law. Islamic Legal Studies Program, Harvard Law School. http://www.law.harvard.edu/programs/ilsp

Bellalah, M., & Masood, O. (2013). Islamic Banking and Finance. Cambridge Scholars Publisher.

Berrahlia, B. (2024). Islamic Finance Dispute Resolutions in the English Courts: Past Experience and an Outlook for the Future. Journal of International Trade Law and Policy, 23(1), 14–36. https://doi.org/10.1108/JITLP-04-2023-0014

Biancone, P. P., Saiti, B., Petricean, D., & Chmet, F. (2020). The bibliometric analysis of Islamic banking and finance. Journal of Islamic Accounting and Business Research, 11(9), 2069–2086. https://doi.org/10.1108/JIABR-08-2020-0235

BIS. (2021). Annual Report 2021/22. www.bis.org

Blanke, G. (2019, April 4). Islamic Banking and Finance Disputes: The Case for Semi-Secular Arbitration (Part 1). Practical Law, Arbitration Blog, Thomson Reuters. Islamic banking and finance disputes: the case for semi-secular arbitration (Part 1). Retrieved March 13, 2023, from http://arbitrationblog.practicallaw.com/islamic-banking-and-finance-disputes-the-case-for-semi-secular-arbitration-part-1/

Brescia, V., Sa’ad, A. A., Alhabshi, S. M. B. S. J., Hassan, R. B., & Lanzalonga, F. (2021). Exploring Sustainability from the Islamic Finance Perspective. European Journal of Islamic Finance, 19, 45–53. https://doi.org/10.13135/2421-2172/6107

Calandra, D., Marseglia, R., Vaccaro, V., & Chmet, F. (2022). Mapping Islamic finance and new technologies: research and managerial perspectives. European Journal of Islamic Finance, 9(1), 39–47. https://doi.org/10.13135/2421-2172/6257

Dahlan, N. K. (2018). Alternative Dispute Resolution for Islamic Finance in Malaysia. MATEC Web of Conferences, 150, 05077. https://doi.org/10.1051/matecconf/201815005077

di Mauro, F., Caristi, P., Couderc, S., Di Maria, A., Ho, L., Kaur Grewal, B., Masciantonio, S., Ongena, S., & Zaher, S. (2013). Occasional Paper Series No 146 / June 2013 Islamic Finance in Europe. https://www.ecb.europa.eu/pub/pdf/scpops/ecbocp146.pdf

El-Gamal, M. A. (2001). An Economic Explication of the Prohibition of Gharar in Classical Islamic Jurisprudence. Islamic Economic Studies, 8(2), 29–58. Retrieved from, https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3164769

El-Halaby, S., Aboul-Dahab, S., & Bin Qoud, N. (2020). A Systematic Literature Review on AAOIFI Standards. Journal of Financial Reporting and Accounting, 19(2), 133–183. https://doi.org/10.1108/JFRA-06-2020-0170

Ercanbrack, J. (2019). The Standardization of Islamic Financial Law: Lawmaking in Modern Financial Markets. The American Journal of Comparative Law, 67(4), 825–860. https://doi.org/10.1093/ajcl/avz010

Ghaffour, A. R. (2017). Practical Aspects of Dispute Resolution in Islamic Finance Facilities “Past, present and future: Legal certainty and Islamic finance in Malaysia.” https://www.bis.org/review/r171120f.pdf

Hamour, M., Shakil, M. H., Akinlaso, I. M., & Tasnia, M. (2019). Contemporary Issues of Form and Substance: An Islamic law perspective. ISRA International Journal of Islamic Finance, 11(1), 124–136. https://doi.org/10.1108/IJIF-01-2018-0006

Hasan, Z., & Asutay, M. (2011). An Analysis of the Courts’ Decisions on Islamic Finance Disputes. ISRA International Journal of Islamic Finance, 3(2), 41–71. https://doi.org/https://doi.org/10.55188/ijif.v3i2.131

Hasanuzzaman, S. M. (1991). Review, Nabil A. Salih, Unlawful Gain and Legitimate Profit in Islamic Law: Riba, Gharar and Islamic Banking. Cambridge University Press, 118. p, 1986. Journal of King Abdulaziz University: Islamic Economics, 3, 115–124. https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3126111

Hassan, M. K. (2022). Introduction to Special Issues on Islamic Economics and Finance. The Singapore Economic Review, 67(01), 1–6. https://doi.org/10.1142/S0217590822030011

Hassan, M. K., & Aliyu, S. (2018). A Contemporary Survey of Islamic Banking Literature. Journal of Financial Stability, 34, 12–43. https://doi.org/10.1016/j.jfs.2017.11.006

Hassan, M. K., Hudaefi, F. A., & Agung, A. (2022). Evaluating Indonesian Islamic Banking Scholarly Publications: A Data Analytics. Journal of Islamic Monetary Economics and Finance, 8(3), 341–370. https://doi.org/10.21098/jimf.v8i3.1560

Hassan, M. K., & Rabbani, M. R. (2023). Sharia Governance Standards and the Role of AAOIFI: A Comprehensive Literature Review and Future Research Agenda. Journal of Islamic Accounting and Business Research, 14(5), 677–698. https://doi.org/10.1108/JIABR-04-2022-0111

Hassanein, A., & Mostafa, M. M. (2022). Bibliometric Network Analysis of Thirty Years of Islamic Banking and Finance Scholarly Research. Quality & Quantity. https://doi.org/10.1007/s11135-022-01453-2

Islamic Accounting. (n.d.). Topics in Financial Reporting. Retrieved October 9, 2023, from https://www.iasplus.com/en/resources/topics/islamic-accounting

Jackson-Moore, E. (2009). The International Handbook of Islamic Banking and Finance. Global Professional Publishing.

Jirvaj, H. (2022, January 20). Outlook 2022 UK Islamic Finance-Sector Navigates COVID-19 and the Post-Brexit Era. Salaam Gateway. https://www.salaamgateway.com/story/outlook-2022-uk-islamic-finance-sector-navigates-covid-19-and-the-post-brexit-era

Jobst, A. A., & Solé, J. (2012). IMF WP 12/63 Operative Principles of Islamic Derivatives-Towards a Coherent Theory. Retrieved February 26, 2023, from https://www.imf.org/en/Publications/WP/Issues/2016/12/31/Operative-Principles-of-Islamic-Derivatives-Towards-a-Coherent-Theory-25752

Kamla, R., & Haque, F. (2019). Islamic Accounting, Neo-Imperialism and Identity Staging: The Accounting and Auditing Organization for Islamic Financial Institutions. Critical Perspectives on Accounting, 63, 1–20. https://doi.org/10.1016/j.cpa.2017.06.001

Khavarinezhad, S., Biancone, P. P., & Jafari-Sadeghi, V. (2021). Financing in the Islamic System and Sustainable Economic Development of Selected Islamic Countries. European Journal of Islamic Finance, 19, 18–23. https://doi.org/10.13135/2421-2172/6158

Lanzara, F. (2021). Islamic Finance as Social Finance: A Bibliometric Analysis from 2000 to 2021. International Journal of Business and Management, 16(9), 107–128. https://doi.org/10.5539/ijbm.v16n9p107

Lewis, M. K. (2001). Islam and Accounting. Accounting Forum, 25(2), 103–127. https://doi.org/10.1111/1467-6303.00058

Lewis, M. K. (2014). Principles of Islamic corporate governance. In M. K. Hassan & M. K. Lewis (Eds.), Handbook on Islam and Economic Life (pp. 243–267). Edward Elgar Publishing. https://doi.org/10.4337/9781783479825.00021

Masood, O., & Bellalah, M. (2013). Iran’s Islamic Banking Experience and Future. In M. Bellalah & O. Masood (Eds.), Islamic Banking and Finance (pp. 159–168). Cambridge Scholars Publishing.

Mergaliyev, A., Asutay, M., Avdukic, A., & Karbhari, Y. (2019). Higher Ethical Objective (Maqasid al-Shari’ah) Augmented Framework for Islamic Banks: Assessing Ethical Performance and Exploring Its Determinants. Journal of Business Ethics, 170(4), 797–834. https://doi.org/10.1007/s10551-019-04331-4

Meskovic, A., Kozarevic, E., & Avdukic, A. (2021). Social Performance of Islamic Banks ˗ Theoretical and Practical Insights. European Journal of Islamic Finance, 19, 1–17. https://doi.org/10.13135/2421-2172/6199

Muryanto, Y. T. (2022). The Urgency of Sharia Compliance Regulations for Islamic Fintechs: A Comparative Study of Indonesia, Malaysia and the United Kingdom. Journal of Financial Crime. https://doi.org/10.1108/JFC-05-2022-0099

Nomran, N. M., & Haron, R. (2019). Dual Board Governance Structure and Multi-bank Performance: A Comparative Analysis between Islamic Banks in Southeast Asia and GCC Countries. Corporate Governance (Bingley), 19(6), 1377–1402. https://doi.org/10.1108/CG-10-2018-0329

Oseni, U. A., Adewale, A., & Mohd Zain, N. R. B. (2016). Customers’ perceptions on the dispute resolution clauses in Islamic finance contracts in Malaysia. Review of Financial Economics, 31(1), 89–98. https://doi.org/10.1016/j.rfe.2016.05.004

Oseni, U. A., & Ahmad, A. U. F. (2015). Dispute resolution in Islamic finance: A case analysis of Malaysia. In Developing Inclusive and Sustainable Economic and Financial System (Vol. 4, pp. 125–134). https://irevieu.com/wp-content/uploads/2019/07/Islamic-Finance-Book_Volume_4.pdf#page=140

Oseni, U. A., Ayob, M. F., & Rashid, K. A. (2019). Legal Issues in Sharīʿah-compliant Home Financing in Malaysia: A Case Study of a Bai Bithaman Ājil Contract. In Emerging Issues in Islamic Finance Law and Practice in Malaysia (pp. 171–192). Emerald Publishing Limited. https://doi.org/10.1108/978-1-78973-545-120191016

Oseni, U. A., Hassan, M. K., & Hassan, R. (2019). Introduction: Revisiting the Confines and Significance of Islamic Finance Law. In Emerging Issues in Islamic Finance Law and Practice in Malaysia (1st ed., pp. 3–11). Emerald Group Publishing Ltd. https://doi.org/10.1108/978-1-78973-545-120191007

Paltrinieri, A., Dreassi, A., Rossi, S., & Khan, A. (2021). Risk-Adjusted Profitability and Stability of Islamic and Conventional Banks: Does Revenue Diversification Matter? Global Finance Journal, 50, 1–15. https://doi.org/10.1016/j.gfj.2020.100517

Puneri, A. (2021). Dispute Resolution for Islamic Banks in Indonesia. International Journal of Islamic Economics and Finance (IJIEF), 4(SI). https://doi.org/10.18196/ijief.v4i0.10084

Rasyid, A. (2013). Relevance of Islamic Dispute Resolution Processes in Islamic Banking and Finance. Arab Law Quarterly, 27(4), 343–369. https://doi.org/10.1163/15730255-12341267

Rehman, Z. U., Zahid, M., Rahman, H. U., Asif, M., Alharthi, M., Irfan, M., & Glowacz, A. (2020). Do Corporate Social Responsibility Disclosures Improve Financial Performance? A Perspective of the Islamic Banking Industry in Pakistan. Sustainability (Switzerland), 12(8), 1–18. https://doi.org/10.3390/SU12083302

Salami, M. A., Tanrivermiş, H., & Abubakar, M. (2022). Challenges Faced in Adopting Standard Methodologies for Research in Islamic Finance and the Way Out. In M. M. Billah (Ed.), Teaching and Research Methods for Islamic Economics and Finance (First Edition). Routledge.

Siddiqui, S., & Rizvi, Z. B. (2022). Understanding Volatility dependence between MENA Sukuk, GCC Sukuk and Nifty Shariah Index during Covid-19: A C-vine Copula Approach. European Journal of Islamic Finance, 9(1), 1–14. https://doi.org/10.13135/2421-2172/6067

Slimene, N., Makni, S., & ben Rejeb, J. (2014). Ethical Performance of Islamic Banks: The Case of the Tunisian Banking “Zaytuna” Journal of Islamic Banking and Finance. Journal of Islamic Banking and Finance, 2(1), 107–122. https://www.researchgate.net/publication/321849551

Suryanto, T., & Ridwansyah, R. (2016). The Shariah Financial Accounting Standards: How they Prevent Fraud in Islamic Banking. European Research Studies Journal, XIX(4), 140–157. https://doi.org/10.35808/ersj/587

Susilowati, E., Sulistyowati, E., Pujiati, D., Andayani, S., & Aliyyah, W. N. (2023). Cultural Application of Accounting and Economic Systems: An Islamic Perspective. Journal of Intercultural Communication, 23(2), 66–74. https://doi.org/10.36923/jicc.v23i2.139

Tasnia, M., Alhabshi, S. M. S. J., & Rosman, R. (2023). Corporate social responsibility and Islamic and conventional banks performance: a systematic review and future research agenda. Journal of Sustainable Finance & Investment, 13(4), 1711–1731. https://doi.org/10.1080/20430795.2021.1922063

The Basel Committee Charter. (2018, June 5). Retrieved September 11, 2023, from https://www.bis.org/bcbs/charter.htm

Viitanen, K., & Wilhelmsson, T. (2014a). Kuluttajaoikeus: Kuluttajaoikeuden Pääpiirteet. In Yritysoikeus (pp. 999–1039). Talentum.

Viitanen, K., & Wilhelmsson, T. (2014b). Kuluttajaoikeus: Markkinoinnin ja Sopimusehtojen Sääntely. In Yritysoikeus (3rd ed., pp. 1041–1076).

Zucchelli, D. (2022). Recent trend of deposits in Islamic banks. European Journal of Islamic Finance, 9(1), 56–64. https://doi.org/10.13135/2421-2172/6260

Submitted

Accepted

Published

How to Cite

Issue

Section

License

Copyright (c) 2024 Journal of Islamic Economic Laws

This work is licensed under a Creative Commons Attribution-ShareAlike 4.0 International License.