Dispute Resolution in Islamic Economic Transactions: The Role and Function of Sharia Arbitration

DOI:

https://doi.org/10.23917/jisel.v8i01.6340Keywords:

Dispute Resolution, Transactions, Islamic Economics, Sharia Arbitration, ADRAbstract

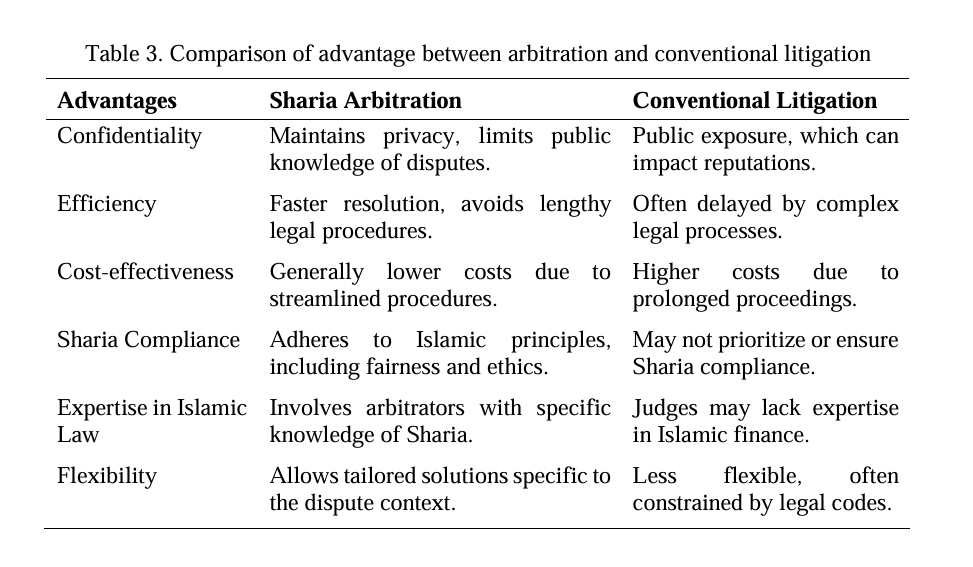

Dispute resolution in Sharia economic transactions is essential to align settlement processes with Islamic legal principles. This study examines the function and role of Sharia-based arbitration, focusing on its alignment with the values of justice, efficiency, and confidentiality within Islamic law. Using a literature-based methodology, the research analyzes secondary data from legal sources and previous studies on Sharia arbitration in Indonesia, particularly the practices of the Sharia Arbitration Body (BASYARNAS-MUI). The findings indicate that Sharia arbitration offers a streamlined, confidential, and fair dispute resolution method, fostering outcomes based on Islamic values such as justice (adl), truth (haqq), and public good (maslahat). Unlike conventional court procedures, Sharia arbitration provides faster and more effective resolutions, while ensuring privacy and protecting the involved parties' reputations. The study also reveals that Sharia arbitration strengthens the application of Islamic law across various sectors, including finance and inheritance, by embedding ethical considerations into modern economic dispute resolutions. This research underscores the practicality and moral alignment of Sharia arbitration as a robust alternative to conventional litigation, offering readers insights into the benefits of a Sharia-compliant approach to economic dispute resolution.

Downloads

References

Abdullah, H., Mohd Zain, F. A., Sheikh Ahmad Tajuddin, S. A. F., A Rahim, N. A. A., Che Haron, H. I., & Abdul Ghani, M. T. (2024). Whistleblowing likelihood scale in the lights of Kohlberg and Maqasid Shariah. International Journal of Islamic and Middle Eastern Finance and Management, 17(5), 974–990. Scopus. https://doi.org/10.1108/IMEFM-12-2023-0462

Abubakar, L., & Handayani, T. (2021). Integrated Alternative Dispute Resolution Institutions in the Financial Services Sector: Dispute Resolution Efforts in Consumer Protection Framework. Yustisia Jurnal Hukum, 10(1), 32.

Ahmad, M. (2020). Critical Study of the Role of Sharia Public Policy in the Recognition and Enforcement of Foreign Arbitral Awards in UAE [PhD Thesis]. University of East Anglia.

Allie, S. (2020). Exploring the concept of conciliation (ṣulḥ) as a method of alternative dispute resolution in Islamic law. Publisher: University of the Western Cape.

Al-Mheiri, A. E. A.-S., & Ahmed, S. A. M. (2021). Electronic arbitration ruling and its effects under the legal system of arbitration in the United Arab Emirates: An original study. Turkish Online Journal of Qualitative Inquiry, 12(10).

Al-Shibli, F. S. (2018). Litigation or arbitration for resolving Islamic banking disputes. Arab Law Quarterly, 32(4), 413–438.

Berrahlia, B. (2024). Islamic finance dispute resolutions in the English courts: Past experience and an outlook for the future. Journal of International Trade Law and Policy, 23(1), 14–36.

Bhatti, M. (2019). Managing Shariah non-compliance risk via Islamic dispute resolution. Journal of Risk and Financial Management, 13(1), 2.

Daud, M. R., Azizah, A., & others. (2024). Implementation of Online Dispute Resolution Sharia Arbitration in the New Normal Era (Basyarnas-Indonesia). KnE Social Sciences, 236–249.

Dzatihanani, R. S., & Rosyadi, I. (2019). Murabaha dispute settelement in a Sharia Rural Bank of Klaten. Journal of Islamic Economic Laws, 2(2), 212–233.

El Daouk, M. (2021). English case law on Islamic finance: Interpretation and application of shariah principles. Journal of Islamic Finance, 10(2), 53–66.

El Maknouzi, M. E. H., Jadalhaq, I. M., Abdulhay, I. E., & Alqodsi, E. M. (2023). Islamic commercial arbitration and private international law: Mapping controversies and exploring pathways towards greater coordination. Humanities and Social Sciences Communications, 10(1), 1–8.

Elhag, S. E. T., Omer, A. E.-M. S., Dganni, K. M., Hasim, N. A., Adnan, N. I. M., & Kashim, M. I. A. M. (2024). Arbitration Bases for Settling Commercial Disputes in Accordance with The Provisions of The Code of Judgments (JUSTICE) Comparative Study International Trade Law (UNCITRAL) In Light of The Emirati Arbitration Law. International Journal of Religion, 5(11), 242–252.

Firdaus, M. I., Aziz, M. A., Sukoco, D., & Alafianta, N. F. (2021). Investment Cooperation Agreement on Equity Crowdfunding Platform from the Perspective of Sharia Economic Law. Al-Iktisab: Journal of Islamic Economic Law, 5(1), 65–81.

Firmanto, T., Ridwan, R., & Lestari, S. (2020). Analysis Of Dispute Types And Dispute Settlement Models In Banking. The Indonesian Journal of Legal Thought (IJLETH), 2(1), 48–57.

Freddy, S. P., & Mohamad, N. A. (2024). DISPUTE IN CROSS-BORDER WAQF: MITIGATION, RESOLUTION, AND THE ROLE OF WAQF AUTHORITY. IIUM Law Journal, 32(1), 261–308.

Hasyim, A. D. (2021). Extra-Judicial Dispute Resolution and the Realization of Justice in the Indonesia Legal System. Asy-Syir’ah: Jurnal Ilmu Syari’ah Dan Hukum, 55(1), 1–24.

Hayati, R. F., & Mujib, A. (2022). Dispute Resolution on Muḍārabah Musytarakah Contract on Sharia Insurance in Indonesia: Between Regulation and Practice. El-Ma’arif: Jurnal Pendidikan, Hukum Dan Ekonomi Islam, 12(1), 1–15.

Huda, M. N. (2020). Activities of Islamic Sharī’ah Council and Muslim Arbitration Tribunal to Apply Islamic Law in England and Wales. Al-Milal: Journal of Religion and Thought, 2(2), 1–16.

Irina, G. (2024). ARBITRATION AND INTERNATIONAL COMMERCIAL ARBITRATION IN THE UNITED ARAB EMIRATES: EMERGENCE, ESTABLISHMENT, REFORMS IN THE CONTEXT OF DIGITALISATION. Russian Law Journal, 12(02).

Islam, S. (2021). Doctrine of Alternative Dispute Resolution in Commercial Contract Particularly Mediation Clauses. Available at SSRN 3892022.

Judijanto, L., Harsya, R. M. K., Prananingrum, D. K., Saryanto, S., & Retnaningsih, R. (2024). Analysis of Challenges and Prospects for Dispute Resolution through the National Sharia Arbitration Board in the Indonesian Legal Context. West Science Islamic Studies, 2(01), 8–14.

Karimah, I. (2022). Between Legal Risk and Sharia Risk in Islamic Banking: How Shariah Governance Address the Problem. Diponegoro Law Review, 7(1), 88–105.

Khan, H. A., Khan, F., & Barua, S. J. (2022). Alternative Dispute Resolution and Sustainability of Economic Development for the Consumer’s Benefit: An Islamic Moral Economy Perspective. Asian Journal of Law and Policy, 2(2), 99–111.

Larosa, W., Wahid, E., & Djajaputra, G. (2023). Application of Online Arbitration to Dispute Resolution E-Commerce Business in Indonesia (in Academic Discourse and Practice). Asian Journal of Engineering, Social and Health, 2(3), 228–246.

Muhammad, A. A., Idriss, I. D., Ardo, A. M., & Mohammed, Y. Z. (2023). A Literature Review of Islamic Mediation (As-Sulh) As Mechanism for Settling Marital Dispute among Muslim Couples in Northeastern Nigeria. Jurnal Al-Irsyad: Jurnal Bimbingan Konseling Islam, 5(2), 175–190.

Musadad, A., Zahro, U. I., & others. (2024). Indigenousization of Sharia Economics in Indonesia: Thought Study of KH. Ma’ruf Amin. Proceeding International Conference on Law, Economy, Social and Sharia (ICLESS), 2, 643–662.

Nafees, S. M. M., & Ahmad, M. H. (2020). Alternative dispute resolution in Islamic banking and finance. The Malaysian Current Law Journal Sdn Bhd (‘CLJ’).

Norrahman, R. A., & Mariani, M. (2023). Murabaha Contract Dispute Resolution Procedure. Sharia Oikonomia Law Journal, 1(4), 241–254.

Oseni, U. A., Hassan, M. K., & Ali, S. N. (2020). Judicial support for the islamic financial services industry: Towards reform-oriented interpretive approaches. Arab Law Quarterly, 35(4), 421–443. Scopus. https://doi.org/10.1163/15730255-BJA10009

Robbani, H. (2022). Permodelan Koding pada Penelitian Kualitatif-Studi Kasus. Nucleus, 3(1), 37–40.

Rusgianto, S., Sridadi, A. R., Aryatie, I. R., & Ahmad, N. (2020). Dispute Resolution in the Restructuring of Defaulted Sukuk?: An Empirical Investigation in Malaysia. International Journal of Innovation Creativity and Change, 11.

Salh, S. (2023). Dispute Resolution in Islamic Banking Industry Under The Iraqi Judiciary System. Academic Journal of Nawroz University.

Setyowati, R., Musjtari, D. N., & Susilowati, I. (2020). EFFECTIVENESS OF MEDIATION IN THE DISPUTE RESOLUTION OF ISLAMIC ECONOMICS IN INDONESIAN RELIGIOUS COURTS. Journal of Islamic Law Studies, 2(3), 7.

Shehata, I. (2021). Arbitration in Egypt: A Practitioner’s Guide. Kluwer Law International BV.

Sidik, J., Orlov, O., Rozali, A., & Sulistianingsih, D. (2024). Choice of Arbitrators Regarding Dispute Settlement (Comparing Indonesia and Russia). Journal of Law and Legal Reform, 5(1), 109–136.

Spagnolo, L., & Bhatti, M. (2023). Conflicts of interest between sharia and international sale of goods: Does CISG interest fit with Islamic law? Monash University Law Review, 49(1), 151–196.

Suadi, A. (2020). Judicial Authority and the Role of the Religious Courts in the Settlement of Sharia Economic Disputes. Lex Publica, 7(2), 1–14.

Suryadi, S., Marwa, M. H. M., Muhammadi, F., Zuliyah, S., & Megawati, M. (2024). Inconsistency in freedom of contract for banking dispute resolution in Indonesia. Legality: Jurnal Ilmiah Hukum, 32(2), 221–237.

Syaifuddin, S. (2023). Dispute Settlement in Sharia Banking in Indonesia. Randwick International of Social Science Journal, 4(2), 297–309.

Syawie, M. (2005). Persoalan metode Kuantitatif Dan Kualitatif. Sosio Informa: Kajian Permasalahan Sosial Dan Usaha Kesejahteraan Sosial, 10(2).

Vanni, K. M., & Wijayanti, R. (2020). Comparative Study of Development and Performance Evaluation Sharia Microfinance Institutions in Indonesia. AL-ARBAH: Journal of Islamic Finance and Banking, 2(2), 119–138.

Zubair, A. (2020). An Analysis of Dispute Resolution Mechanisms in the Islamic Banking and Finance Industry in Malaysia. Jurnal Hukum Novelty, 11(2), 164–178.

Submitted

Accepted

Published

How to Cite

Issue

Section

License

Copyright (c) 2024 Journal of Islamic Economic Laws

This work is licensed under a Creative Commons Attribution-ShareAlike 4.0 International License.