How Does the Performance of Islamic Microfinance Institutions Affect the Welfare of SMEs?: Empirical study of BTM Mulia Babat

DOI:

https://doi.org/10.23917/jisel.v7i02.6148Keywords:

Islamic microfinance, Baitul Tamwil Muhammadiyah, SMEs welfareAbstract

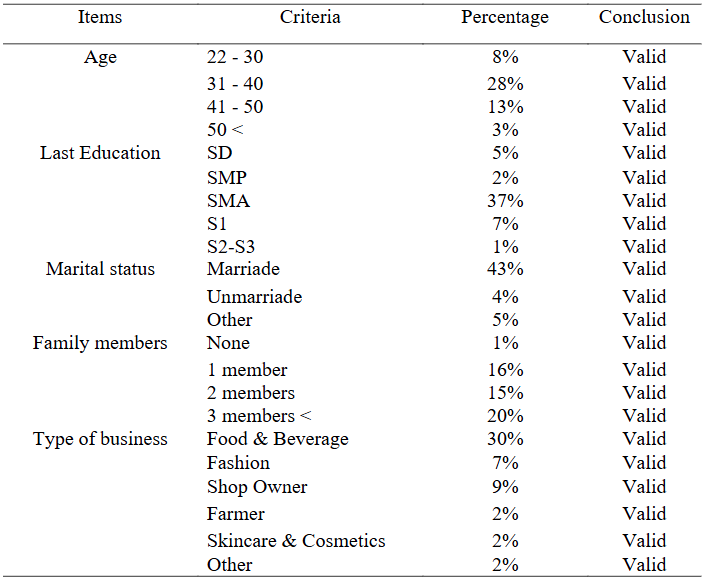

This study aims to assess the direct and indirect effectiveness of Islamic microfinance services, particularly financing products, in enhancing the welfare of small and medium-sized entrepreneurs (SMEs) in Lamongan, with Baitul Tamwil Muhammadiyah (BTM) Mulia Babat as the case study. The partial least square-structural equation modeling method is used in this quantitative study, examining data from 52 respondents, where the respondent data are BTM Mulia Babat business financing customers. The findings of this study found that Islamic microfinance services and business assistance directly have a positive impact on SMEs' increase in income. However, Islamic microfinance services and business assistance indirectly do not impact SMEs' welfare. Despite the increase in SMEs' income, it directly impacts SMEs' welfare. The novelty of this study is to identify the effectiveness of Islamic microfinance institutions in improving the welfare of SMEs. This study presents evidence of the impact of Islamic microfinance institutions on the welfare of micro and medium entrepreneurs. It can encourage more Islamic microfinance programs to offer feasible Islamic microfinance services as an alternative to boosting SMEs in the regions. This study's empirical implications and findings highlight the importance of business assistance from Islamic MIFs as business financing providers to support businesses.

Downloads

References

Ab Hamid, M. R., Sami, W., & Mohmad Sidek, M. H. (2017). Discriminant Validity Assessment: Use of Fornell & Larcker criterion versus HTMT Criterion. Journal of Physics: Conference Series, 890(1), 0–5. https://doi.org/10.1088/1742-6596/890/1/012163

Abdillah, W., & Jogiyanto. (2016). Partial Least Square (PLS) Alternantif Structural Equation Modeling (SEM) dalam Penelitian Bisnis. ANDI.

Ahmad, S., Siddiqui, K. A., & AboAlsamh, H. M. (2020). Family SMEs’ Survival: The Role of Owner Family and Corporate Social Responsibility. Journal of Small Business and Enterprise Development, 27(2), 281–297. https://doi.org/10.1108/JSBED-12-2019-0406

Al-Mamun, A., & Mazumder, M. N. H. (2015). Impact of Microcredit on Income, Poverty, and Economic Vulnerability In Peninsular Malaysia. Development in Practice, 25(3), 333–346. https://doi.org/10.1080/09614524.2015.1019339

Al-Shami, S. S. A., Razali, M. M., Majid, I., Rozelan, A., & Rashid, N. (2016). The Effect of Microfinance on Women’s Empowerment: Evidence from Malaysia. Asian Journal of Women’s Studies, 22(3), 318–337. https://doi.org/10.1080/12259276.2016.1205378

Ali, I., Hatta, Z. A., Azman, A., & Islam, S. (2017). Microfinance as a Development and Poverty Alleviation Tool in Rural Bangladesh: A Critical Assessment. Asian Social Work and Policy Review, 11(1), 4–15. https://doi.org/10.1111/aswp.12106

Arif, I. (2023). BTM Mulia Hadir di Musycab Paciran. PWMU.Co - PT. Surya Media Jatim. https://pwmu.co/304064/07/10/btm-mulia-hadir-di-musycab-paciran/

Arifin, R., Ningsih, A. A. T., & Putri, A. K. (2021). The Important Role of MSMEs in Improving The Economy. South East Asia Journal of Contemporary Business, Economics and Law, 24(6), 52–59.

Aristina, P., & Widiastuti, T. (2020). Peran Penyaluran Dana Pihak Ketiga Bmt Muda Jatim Pada Peningkatan Kesejahterraan Pelaku Umkm Perspektif Maqashid Syariah. Jurnal Ekonomi Syariah Teori Dan Terapan, 6(11), 2198. https://doi.org/10.20473/vol6iss201911pp2198-2215

As-Salafiyah, A., & Ratna Kartikawati, D. (2022). Islamic Microfinance as Social Finance in Indonesia. Islamic Social Finance, 2(1). https://doi.org/10.58968/isf.v2i1.118

Badan Pusat Statistik. (2022a). Jumlah Koperasi Aktif Menurut Provinsi (Unit), 2019-2021. https://www.bps.go.id/indicator/13/760/1/jumlah-koperasi-aktif-menurut-provinsi.html

Badan Pusat Statistik. (2022b). Profil Kemiskinan di Indonesia September 2022. Berita Resmi Statistik, 01(05), 1–8.

Chapra, M. U. (1985). Towards a Just Monetary System (Vol. 8). International Institute of Islamic Thought (IIIT).

Databoks. (2023). Jumlah UMKM di Indonesia Sepanjang 2022, Provinsi Mana Terbanyak? Databoks.Katadata.Co.Id. https://databoks.katadata.co.id/datapublish/2023/02/02/jumlah-umkm-di-indonesia-sepanjang-2022-provinsi-mana-terbanyak#:~:text=Ini terlihat dari data yang,Pulau Jawa mendominasi sektor ini.

Elsafi, M. H., Ahmed, E. M., & Ramanathan, S. (2020). The Impact of Microfinance Programs on Monetary Poverty Reduction: Evidence from Sudan. World Journal of Entrepreneurship, Management and Sustainable Development, 16(1), 30–43. https://doi.org/10.1108/WJEMSD-05-2019-0036

Fadhilah, E., Purwanto, M. R., Mukharrom, T., Dewantoro, M. H., & Supriadi. (2020). A Perspective of Maqasid Al-Syariah Towards Women’s Particular Needs in Disaster. International Journal of Advanced Science and Technology, 29(2), 2070–2075.

Fianto, B. A., Gan, C., Hu, B., & Roudaki, J. (2018). Equity Financing and Debt-Based Financing: Evidence from Islamic Microfinance Institutions in Indonesia. Pacific Basin Finance Journal, 52(July), 163–172. https://doi.org/10.1016/j.pacfin.2017.09.010

Fornell, C., & f. larcke, D. (1981). Fornell, C., & Larcker, D. F. (1981). Evaluating Structural Equation Models with Unobservable Variables and Measurement Error. Journal of Marketing Research, 18(1), 39–50.

Friedlander, W. (1980). Pengantar Kesejahteraan Sosial. Gema Insani Press.

Gebru, B., & Paul, I. (2011). Role of Micro Finance in Alleviating Urban Poverty in Ethiopia. Journal of Sustainable Development in Africa, 13(6), 246–257.

Ghozali, I. (2008). Structural Equation Modeling: Teori, Konsep, dan Aplikasi.

Ghozali, I. (2014). Structural Equation Modelling, Edisi II. Universitas Semarang.

Gina, W., & Effendi, J. (2015). Program Pembiayaan Lembaga Keuangan Mikro Syariah (LKMS) dalam Peningkatan Kesejahteraan Pelaku Usaha Mikro (Studi Kasus BMT Baitul Karim Bekasi). Al-Muzara’ah, 3(1), 34–43. https://doi.org/10.29244/jam.3.1.34-43

Ginanjar, A., & Kassim, S. (2020). Can Islamic Microfinance Alleviates Poverty in Indonesia? an Investigation From the Perspective of the Microfinance Institutions. Journal of Islamic Monetary Economics and Finance, 6(1), 77–94. https://doi.org/10.21098/jimf.v6i1.1203

Hadisumarto, W. bin M. C., & B. Ismail, A. G. B. (2010). Improving the Effectiveness of Islamic Micro-Financing: Learning from BMT Experience. Humanomics, 26(1), 65–75. https://doi.org/10.1108/08288661011025002

Hair, J. F., Ringle, G. T. M., & Sarstedt, C. M. (2014). A Primer On Partial Least Squares Structural Equation Modeling (PLS-SEM). SAGE Publications.

Hair, J. F., Black, W. C., Babin, B. J., Anderson, R. E., & Tatham, R. L. (2010). Cluster Analysis. Multivariate Data Analysis. In Hair JF (Ed.), Volume 7th ed. Pearson Education.

Hair, J., Hollingsworth, C. L., Randolph, A. B., & Chong, A. Y. L. (2017). An Updated and Expanded Assessment of PLS-SEM in Information Systems Research. Industrial Management and Data Systems, 117(3), 442–458. https://doi.org/10.1108/IMDS-04-2016-0130

Hair, Joe F., Ringle, C. M., & Sarstedt, M. (2011). PLS-SEM: Indeed a Silver Bullet. Journal of Marketing Theory and Practice, 19(2), 139–152. https://doi.org/10.2753/MTP1069-6679190202

Hair, Joe F., Sarstedt, M., Ringle, C. M., & Mena, J. A. (2012). An Assessment of the Use of Partial Least Squares Structural Equation Modeling in Marketing Research. Journal of the Academy of Marketing Science, 40(3), 414–433. https://doi.org/10.1007/s11747-011-0261-6

Hair, Joseph F., Risher, J. J., Sarstedt, M., & Ringle, C. M. (2019). When to Use and How to Report the Results of PLS-SEM. In European Business Review. https://doi.org/10.1108/EBR-11-2018-0203

Hair, Joseph F., Sarstedt, M., & Ringle, C. M. (2019). Rethinking Some of the Rethinking of Partial Least Squares. European Journal of Marketing, 53(4), 566–584. https://doi.org/10.1108/EJM-10-2018-0665

Hair Jr, J. F., Hult, G. T. M., Ringle, C. M., & & Sarstedt, M. (2021). A Primer on Partial Least Squares Structural Equation Modeling (PLS-SEM). Sage publications.

Hamdan, H., Othman, P., Sabri, W., & Hussin, W. (2012). Is Microfinance Program in Malaysia Really Effective in Helping the Poor ? World Review of Business Research, 2(1), 79–97. http://www.wbiaus.org/6. Hamdino.pdf

Harahap, I., Nawawi, Z. M., & Syahputra, A. (2023). Signifikansi Peranan UMKM dalam Pembangunan Ekonomi di Kota Medan dalam Prespektif Syariah. Jurnal Tabarru’ : Islamic Banking and Finance, 6(2), 718–728.

Henseler, J., Ringle, C. M., & Sarstedt, M. (2015). A New Criterion for Assessing Discriminant Validity in Variance-Based Structural Equation Modeling. Journal of the Academy of Marketing Science, 43(1), 115–135. https://doi.org/10.1007/s11747-014-0403-8

Ibrahim, D., & RuziahGhazali, D. (2014). Zakah as an Islamic Micro-Financing Mechanism to Productive Zakah Recipients. Asian Economic and Financial Review, 4(1), 117-125., 4(1), 117–125. http://www.pakinsight.com/pdf-files/aefr 4(1), 117-125.pdf

KEMENKOMUKM.RI. (2023). Data Lembaga Koperasi di Kementerian Koperasi dan Usaha Kecil dan Menengah Republik Indonesia (KEMENKOPUKM RI). KEMENKOPUKM RO. http://nik.depkop.go.id/

KEMENKOPUKM.RI. (2022). Satu Data KUMKM Terintegrasi. Kementerian Koperasi dan UKM. https://satudata.kemenkopukm.go.id/

Kireti, G. W., & Sakwa, M. (2014). Socio-Economic Effects of Microfinance Services on Women: The Case of Rosewo Microfinance, Nakuru County, Kenya. International Journal of Academic Research in Economics and Management Sciences, 3(3), 43–59. https://doi.org/10.6007/ijarems/v3-i3/902

KSPPS BTM MULIA BABAT. (2021). Laporan Pertanggung Jawaban Pengurus dan Pengawas Rapat Anggota Tahunan (RAT) Tahun 2021.

Kusuma, K. A., & Ryandono, M. N. H. (2016). Zakah Index: Islamic Economics’ Welfare Measurement. Indonesian Journal of Islam and Muslim Societies, 6(2), 273–301. https://doi.org/10.18326/ijims.v6i1.273-301

Loke, K. H., Adebola, S. S., Ramasamy, S., & Dahalan, J. (2020). The Effects of Services by Microfinance Institutions on the Welfare of Urban Households in Malaysia. Jurnal Pengurusan, 58, 105–118. https://doi.org/10.17576/pengurusan-2020-58-09

Malhotra, N. K. (2009). Riset Pemasaran, Edisi keempat, Jilid 1. Jakarta: PT Indeks. https://doi.org/10.1163/_q3_SIM_00374

Maulana, H., & Umam, K. (2018). Identifying Financial Exclusion and Islamic Microfinance as An Alternative to Enhance Financial Inclusion. International Journal of Islamic Business and Economics (IJIBEC), 99–106. https://doi.org/10.28918/ijibec.v1i2.1004

Maulidia, S., & Nur, M. (2022). Syariah Microfinance Institutions and Women-Based MSME Empowerment in an Efforts to Reducing Poverty (Study at KSPPS Baytul Ikhtiar Bogor). FOCUS Journal of Social Studies, 3(1), 27–47.

Mawardi, I., Widiastuti, T., Al Mustofa, M. U., & Hakimi, F. (2022). Analyzing the Impact of Productive Zakat on the Welfare of Zakat Recipients. Journal of Islamic Accounting and Business Research. https://doi.org/10.1108/JIABR-05-2021-0145

Memon, M. A., Ting, H., Ramayah, T., Chuah, F., & Cheah, J.-H. (2017). A Review of the Methodological Misconceptions and Guidelines Related to the Application of Structural Equation Modeling: a Malaysian Scenario. Journal of Applied Structural Equation Modeling, 1(June), i–xiii. https://doi.org/10.47263/jasem.1(1)01

Mohammad A. Asharaf. (2010). The Effectiveness of Microcredit Programs and Prospects of Islamic Microfinance Institutes ( IMFIs ) in Muslim Countries : A Case Study in Bangladesh. Journal of Islamic Economics, Banking and Finance, 6(604), 69–85. http://ibtra.com/pdf/journal/v6_n4_article4.pdf

Mohd Thas Thaker, M. A. Bin, Kassim, S., Amin, M. F. Bin, Salleh, M. C. M., Othman, N., & Kassim, S. N. (2022). Modeling the Demand for Islamic Microfinance Services: An Application of PLS-SEM Approach. International Journal of Islamic Economics and Finance (IJIEF), 5(1), 89–106. https://doi.org/10.18196/ijief.v5i1.11776

Nawaz, S., Sheikh, M. R., & Zahra, K. A. (2021). Islamic Microfinance and Women Entrepreneurship Performance during COVID-19 Pandemic. Journal of Accounting and Finance in Emerging Economies, 7(3), 727–738. https://doi.org/10.26710/jafee.v7i3.1943

OJK. (2021). Laporan Perkembangan Keuangan Syariah Indonesia 2021. Ketahanan Dan Daya Saing Keuangan Syariah, 148. https://www.ojk.go.id/id/kanal/syariah/data-dan-statistik/laporan-perkembangan-keuangan-syariah-indonesia/Pages/Laporan-Perkembangan-Keuangan-Syariah-Indonesia-2020.aspx

Purwanti, A. (2024). Manajer BTM Mulia Babat. Informant.

Purwanto, P., Abdullah, I., Ghofur, A., Abdullah, S., & Elizabeth, M. Z. (2022). Adoption of Islamic Microfinance in Indonesia an Empirical Investigation: An Extension of the Theory of Planned Behaviour. Cogent Business and Management, 9(1). https://doi.org/10.1080/23311975.2022.2087466

Putu Ayu Sita Laksmi, & I Gde Wedana Arjawa. (2023). Peran Pemerintah dan Modal Sosial dalam Meningkatkan Kesejahteraan Pelaku Usaha. JOURNAL SCIENTIFIC OF MANDALIKA (JSM) e-ISSN 2745-5955 | p-ISSN 2809-0543, 4(3), 12–21. https://doi.org/10.36312/10.36312/vol4iss3pp12-21

Rahayu, N. S. (2020). The Intersection of Islamic Microfinance and Women’s Empowerment: A Case Study of Baitul Maal Wat Tamwil in Indonesia. International Journal of Financial Studies, 8(2), 1–13. https://doi.org/10.3390/ijfs8020037

Rahman, F. K., Tareq, M. A., Yunanda, R. A., & Mahdzir, A. (2017). Maqashid Al-Shari’ah-Based Performance Measurement for the Halal Industry. Humanomics, 33(3), 357–370.

Rohman, P. S., Fianto, B. A., Ali Shah, S. A., Kayani, U. N., Suprayogi, N., & Supriani, I. (2021). A Review on Literature of Islamic Microfinance from 2010-2020: Lesson for Practitioners and Future Directions. Heliyon, 7(12), e08549. https://doi.org/10.1016/j.heliyon.2021.e08549

Rokhman, W., & Abduh, M. (2020). Antecedents of Smes’ Satisfaction and Loyalty Towards Islamic Microfinance: Evidence from Central Java, Indonesia. Journal of Islamic Marketing, 11(6), 1327–1338. https://doi.org/10.1108/JIMA-05-2018-0090

Santoso, D. B., Gan, C., Revindo, M. D., & Massie, N. W. G. (2020). The Impact of Microfinance on Indonesian Rural Households’ Welfare. Agricultural Finance Review, 80(4), 491–506. https://doi.org/10.1108/AFR-11-2018-0098

Sekaran, U. and Bougie, R. (2013). Research Methods for Business (Sons, J. Wiley, & Atrium (eds.); 6th ed.). Southern Gate, Chichester, West Sussex.

Sinkovics, R. R., Jean, R.-J. B., & Kim, D. (2016). Advancing the International Marketing Research Agenda with Innovative Methodologies – An Introduction. International Marketing Review. https://doi.org/10.1108/IMR-03-2016-0071

Suharti, F. (2018). SINERGITAS ISLAMIC MICROFINANCE INSTITUTION (IMFI): Pemberdayaan dan Peningkatan Kesejahteraan Usaha Mikro Kecil dan Menengah (UMKM). El-Jizya : Jurnal Ekonomi Islam, 5(1), 52–80. https://doi.org/10.24090/ej.v5i1.1626

Taufiq, M. (2020). Optimalisasi Peran Dewan Pengawas Syariah di Lembaga Keuangan Mikro Syariah. Al-Huquq: Journal of Indonesian Islamic Economic Law, 2(1), 74. https://doi.org/10.19105/alhuquq.v2i1.3350

Uddin, H., & Barai, M. K. (2016). Islamic Microcredit: The Case of Bangladesh. Journal of Accounting, Finance and Economics, 6(1), 49–64.

Ülev, S., Savaşan, F., & Özdemir, M. (2022). Do Islamic Microfinance Institutions Affect the Socio-Economic Development of the Beneficiaries? The Evidence from Turkey. International Journal of Ethics and Systems. https://doi.org/https://doi.org/10.1108/IJOES-09-2021-0179

Wibowo, K. A., Ismail, A. G., Tohirin, A., & Sriyana, J. (2020). Factors Determining Intention to Use Banking Technology in Indonesian Islamic Microfinance. Journal of Asian Finance, Economics and Business. Vol. 7 (12), 1053–1064. https://doi.org/10.13106/jafeb.2020.vol7.no12.1053

Widiastuti, T., Auwalin, I., Rani, L. N., & Ubaidillah Al Mustofa, M. (2021). A Mediating Effect of Business Growth on Zakat Empowerment Program and Mustahiq’s Welfare. Cogent Business and Management, 8(1). https://doi.org/10.1080/23311975.2021.1882039

Wulandari, P., & Kassim, S. (2016). Issues and Challenges in Financing the Poor: Case of Baitul Maal Wa Tamwil in Indonesia. International Journal of Bank Marketing, 34(2), 216–234. https://doi.org/10.1108/IJBM-01-2015-0007

Zitouni, T., & Ben Jedidia, K. (2022). Does Islamic Microfinance Contribute to Economic Empowerment in Tunisia?: A Case Study Of Zitouna Tamkeen. Journal of Business and Socio-Economic Development, 2(1), 67–81. https://doi.org/10.1108/jbsed-10-2021-0143

Submitted

Accepted

Published

How to Cite

Issue

Section

License

Copyright (c) 2024 Journal of Islamic Economic Laws

This work is licensed under a Creative Commons Attribution-ShareAlike 4.0 International License.