The Impact of Financial Technology on Advancing Banking Services and Promoting Financial Inclusion in Libya

DOI:

https://doi.org/10.23917/jisel.v8i02.10073Keywords:

Financial Technology, Alternative Payment Methods, Automation, Service Quality, Financial InclusionAbstract

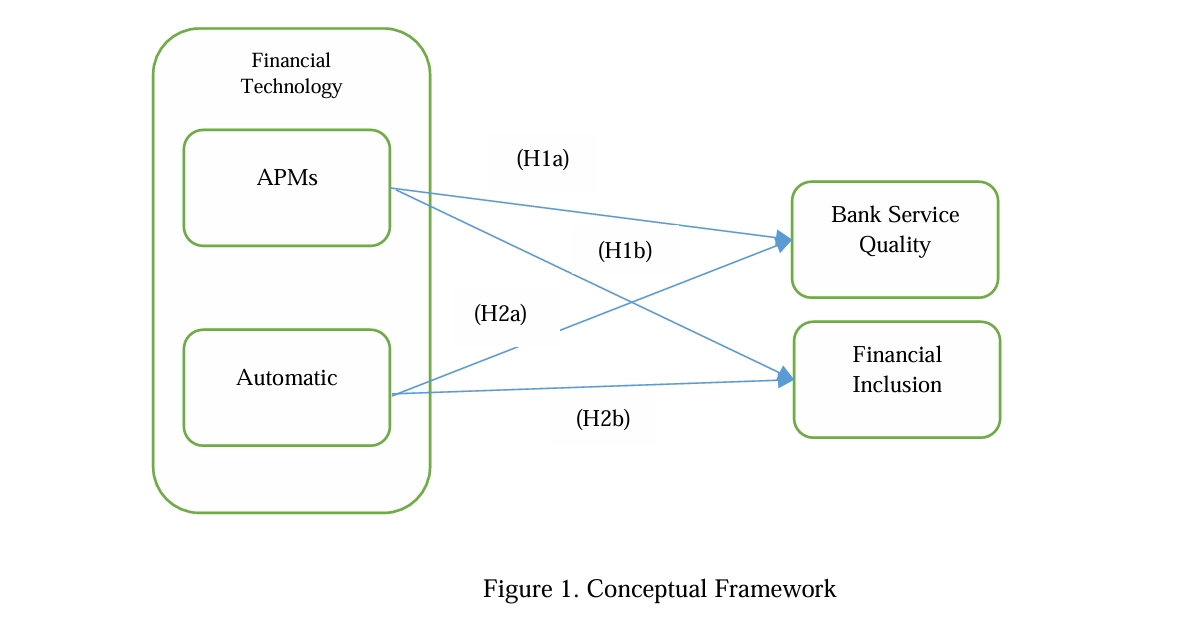

This research examines the impact of Financial Technology (FinTech) on advancing banking services and financial inclusion in Libya. The study aims to foster financial inclusivity and advance fintech development in Libya, relying on the Innovation Diffusion Theory. Utilizing a quantitative approach in this research, data is collected from Libyan bank customers through structured questionnaires and is analyzed using the Statistical Package for Social Sciences (SPSS). The findings of this research support the hypothesis that the adoption of Alternative Payment Methods (APMs) and automation by banks positively impacts financial inclusion and service quality. The results of this study intend to assist policymakers and financial institutions in devising targeted plans to support Libya’s recovery through FinTech, modernizing its banking system, and improving the quality of services offered to citizens. This study informs the debate on developing technology-based mechanisms to tackle the specific banking problems in Libya, improve financial inclusion and assists the key stakeholders by providing them with an elaborate roadmap on enhancing service delivery.

Downloads

References

Adelaja, A. O., Umeorah, S. C., Abikoye, B. E., & Nezianya, M. C. (2024). Advancing financial inclusion through fintech: Solutions for unbanked and underbanked populations. World Journal of Advanced Research and Reviews, 23(01), 427-438. https://doi.org/10.30574/wjarr.2024.23.2.2379

Adewumi, A., Ewim, S. E., Sam-Bulya, N. J., & Ajani, O. B. (2024). Advancing business performance through data-driven process automation: A case study of digital transformation in the banking sector. International Journal of Multidisciplinary Research Updates, 8(02). https://doi.org/10.53430/ijmru.2024.8.2.0049

Almansour, B., & Elkrghli, S. (2023). Factors influencing customer satisfaction on e-banking services: a study of Libyan banks. International Journal of Technology Innovation and Management (IJTIM), 3(1), 34-42. https://doi.org/10.54489/ijtim.v3i1.211

Alnaas, H. (2021). The barriers of adoption the e-banking in the Libyan Banks—A case study of commercial banks in Tobruk city. Open Journal of Business and Management, 10(1), 501-524. https://doi.org/10.4236/ojbm.2022.101028

Al-Sowaidi, A., & Faour, A. (2022). Fintech revolution: how established banks are embracing innovation to stay competitive. Journal of Business and Management Studies, 5(5), 166-172. https://doi.org/10.32996/jbms.2023.5.5.14

Amnas, M. B., Selvam, M., & Parayitam, S. (2024). FinTech and Financial Inclusion: Exploring the Mediating Role of Digital Financial Literacy and the Moderating Influence of Perceived Regulatory Support. Journal of Risk and Financial Management, 17(3), 108. https://doi.org/10.3390/jrfm17030108

Arner, D., Buckley, R., Charamba, K., Sergeev, A., & Zetzsche, D. (2022). Governing FinTech 4.0: BigTech, platform finance, and sustainable development. Fordham J. Corp. & Fin. L., 27, 1. "Governing FinTech 4.0: BigTech, Platform Finance, and Sustainable Deve" by Douglas Arner, Ross Buckley et al.

Ashenafi, B. B., & Dong, Y. (2022). Financial inclusion, Fintech, and income inequality in Africa. FinTech, 1(4), 376-387. https://doi.org/10.3390/fintech1040028

Baker, H., Kaddumi, T. A., Nassar, M. D., & Muqattash, R. S. (2023). Impact of financial technology on improvement of banks’ financial performance. Journal of Risk and Financial Management, 16(4), 230. https://doi.org/10.3390/jrfm16040230

Bhatia, M. (2022). Banking 4.0. Springer Books.

Boubaker, R., & Zammel, M. (2025). Exploring FinTech Market Landscape in the MENA Region. In The Palgrave Handbook of FinTech in Africa and Middle East: Connecting the Dots of a Rapidly Emerging Ecosystem (pp. 1-29). Singapore: Springer Nature Singapore. https://doi.org/10.3390/jrfm16040230

Bouthahaba, I. E., & Khaled, M. H. (2021). The mediating role of socio-economy on the relationship between customer lifestyles and the awareness of MobiCash banking services of Wahda Bank in Libya. Journal of Emerging Economies & Islamic Research, 9(1), 88-107. https://doi.org/10.24191/jeeir.v9i1.11210

Brydan, R. N., & Abdulnabi, M. H. (2021). Factors Affecting Customers' Acceptance of Wahda Bank E-Service in Libya. Finance and Business Economies Review, 5(4), 340-355. https://doi.org/10.58205/fber.v5i4.741

Brydan, R. N., & Abdulnabi, M. H. (2021). Factors Affecting Customers' Acceptance of Wahda Bank E-Service in Libya. Finance and Business Economies Review, 5(4), 340-355. https://doi.org/10.58205/fber.v5i4.741

Chen, F., Du, X., & Wang, W. (2023). Can fintech applied to payments improve consumer financial satisfaction? Evidence from the USA. Mathematics, 11(2), 363. https://doi.org/10.3390/math11020363

Chen, M. A., Wu, Q., & Yang, B. (2019). How valuable is FinTech innovation?. The Review of financial studies, 32(5), 2062-2106. https://doi.org/10.1093/rfs/hhy130

Dakduk, S., Van der Woude, D., & Nieto, C. A. (2023). Technological adoption in emerging economies: Insights from Latin America and the Caribbean with a focus on low-income consumers.

Danladi, S., Prasad, M. S. V., Modibbo, U. M., Ahmadi, S. A., & Ghasemi, P. (2023). Attaining sustainable development goals through financial inclusion: exploring collaborative approaches to Fintech adoption in developing economies. Sustainability, 15(17), 13039. https://doi.org/10.3390/su151713039

Danladi, S., Prasad, M. S. V., Modibbo, U. M., Ahmadi, S. A., & Ghasemi, P. (2023). Attaining sustainable development goals through financial inclusion: exploring collaborative approaches to Fintech adoption in developing economies. Sustainability, 15(17), 13039. https://doi.org/10.3390/su151713039

David, D., & Williams, S. B. (2022). Financial innovations and Fintech solutions for migrant workers in the MENA region. In Innovative Finance for Technological Progress (pp. 257-287). Routledge. https://doi.org/10.4324/9781003220220-16?urlappend=%3Futm_source%3Dresearchgate.net%26medium%3Darticle

David-West, O., Oni, O., & Ashiru, F. (2022). Diffusion of innovations: Mobile money utility and financial inclusion in Nigeria. Insights from agents and unbanked poor end users. Information Systems Frontiers, 24(6), 1753-1773.

Dewantoko, T. A. (2025). Banking and Fintech in the Digital Financial Ecosystem for the Unbankable Population. Journal of Banks and Financial Institutions, 1(1/2), 14-25. https://doi.org/10.70764/gdpu-jbfi.2025.1(1)-02

Dufera, A. G., Liu, T., & Xu, J. (2023). Regression models of Pearson correlation coefficient. Statistical Theory and Related Fields, 7(2), 97-106. https://doi.org/10.1080/24754269.2023.2164970

Elghwail, I. K. M., Ngah, B. B., Obad, F. M., & Ateik, A.-H. A. M. (2023). A Conceptual Framework for Adopting Islamic Banking and Finance in Libya. International Journal of Research and Innovation in Applied Science, VIII(IV), 01–10.

EU (2025). EU-funded E-nable Project Concludes with Remarkable Achievements for Libya’s Economic Growth. Retrieved from: https://innovation-africa.org/2025/eu-funded-e-nable-project-concludes-with-remarkable-achievements-for-libyas-economic-growth/

Ghanad, A. (2023). An overview of quantitative research methods. International journal of multidisciplinary research and analysis, 6(08), 3794-3803. https://doi.org/10.47191/ijmra/v6-i8-52

Gomber, P., Kauffman, R. J., Parker, C., & Weber, B. W. (2018). On the fintech revolution: Interpreting the forces of innovation, disruption, and transformation in financial services. Journal of management information systems, 35(1), 220-265. https://doi.org/10.1080/07421222.2018.1440766

Hussainey, K., & Dalwai, T. (Eds.). (2024). Handbook of Banking and Finance in the MENA Region (Vol. 13). World scientific. https://doi.org/10.1142/q0435?urlappend=%3Futm_source%3Dresearchgate.net%26medium%3Darticle

Iddrisu, K., Yakubu, I. N., & Asongu, S. A. (2025). FinTech Innovations for Sustainable Banking. In Strategic Approaches to Banking Business and Sustainable Development Goals (pp. 63-86). Cham: Springer Nature Switzerland.

Izah, S. C., Sylva, L., & Hait, M. (2023). Cronbach's alpha: A cornerstone in ensuring reliability and validity in environmental health assessment. ES Energy & Environment, 23, 1057. http://dx.doi.org/10.30919/esee1057

Josyula, H. P., & Expert, F. P. T. (2021). The role of fintech in shaping the future of banking services. The International Journal of Interdisciplinary Organizational Studies, 16(1), 187-201.

Kadaba, D. M. K., Aithal, P. S., & KRS, S. (2023). Impact of Digital Financial Inclusion (DFI) initiatives on the self-help group: For sustainable development. International Journal of Management, Technology, and Social Sciences (IJMTS), 8(4), 20-39. https://dx.doi.org/10.2139/ssrn.4674709

Lal, T. (2021). Impact of financial inclusion on economic development of marginalized communities through the mediation of social and economic empowerment. International Journal of Social Economics, 48(12), 1768-1793.

Mohammad, S. S., Prajanti, S. D. W., & Setyadharma, A. (2021). The analysis of financial banks in Libya and their role in providing liquidity. Journal of Economic Education, 10(1), 1-13.

Morgan, P. J. (2022). Fintech and financial inclusion in Southeast Asia and India. Asian Economic Policy Review, 17(2), 183-208.

Mukherjee, A., Nath, P., & Pal, M. (2003). Resource, service quality and performance triad: a framework for measuring efficiency of banking services. Journal of the Operational Research Society, 54(7), 723-735.

Murinde, V., Rizopoulos, E., & Zachariadis, M. (2022). The impact of the FinTech revolution on the future of banking: Opportunities and risks. International review of financial analysis, 81, 102103.

Nguyen, Q. K. (2022). The impact of risk governance structure on bank risk management effectiveness: evidence from ASEAN countries. Heliyon, 8(10).

Polishchuk, V., & Ishchuk, L. (2022, May). The essence of financial inclusion and accessibility to financial products. In Economic Forum (Vol. 1, No. 12, pp. 135-143).

Rogers, E. M., Singhal, A., & Quinlan, M. M. (2014). Diffusion of innovations. In An integrated approach to communication theory and research (pp. 432-448). Routledge.

Santhosh Kumar, K., & Aithal, P. S. (2024). From Access to Empowerment: The Role of Digital Microfinance–ABCD Evaluation. International Journal of Management, Technology and Social Sciences (IJMTS), 9(2), 267-282.

Selmi, N. (2025). Libya in transition: governance challenges and civil society’s prospects in political and economic reforms. Global Security: Health, Science and Policy, 10(1), 2449614.

Sharma, V., Jangir, K., Gupta, M., & Rupeika-Apoga, R. (2024). Does service quality matter in FinTech payment services? An integrated SERVQUAL and TAM approach. International Journal of Information Management Data Insights, 4(2), 100252.

Tavakol, M., & Wetzel, A. (2020). Factor Analysis: a means for theory and instrument development in support of construct validity. International journal of medical education, 11, 245.

Verma, J. (2023). Embracing fintech applications in the banking sector Vis-á-Vis service quality. In Contemporary Studies of Risks in Emerging Technology, Part B (pp. 207-219). Emerald Publishing Limited.

Wachira, G., & Njuguna, A. (2023). Enhancing growth and productivity through mobile money financial technology services: the case of m-pesa in kenya. International Journal of Economics and Finance, 15(12), 1-91.

Zhao, Q., Tsai, P. H., & Wang, J. L. (2019). Improving financial service innovation strategies for enhancing china’s banking industry competitive advantage during the fintech revolution: A Hybrid MCDM model. Sustainability, 11(5), 1419.

Zhao, Y., Goodell, J. W., Wang, Y., & Abedin, M. Z. (2023). Fintech, macroprudential policies and bank risk: Evidence from China. International Review of Financial Analysis, 87, 102648.

Downloads

Submitted

Accepted

Published

How to Cite

Issue

Section

License

Copyright (c) 2025 Journal of Islamic Economic Laws

This work is licensed under a Creative Commons Attribution-ShareAlike 4.0 International License.